BlackRock is likely one of the 4 horsemen of the US economic system, together with funding giants Vanguard, Constancy and State Avenue. And now there’s a Moody’s recession prediction terrifying all of those establishments.

All of those funding establishments are lugubrious on the US economic system - right here’s why.

Moody’s Recession Prediction: Two Extra Weeks

Recession dangers are rising, in line with Moody’s Analytics chief economist Mark Zandi. In a current publish on X, he warned that U.S. progress is faltering below mounting coverage pressures.

Zandi later clarified that he doesn’t consider the economic system is in a proper recession but, however mentioned sure sectors have already slipped into one.

In an interview with Enterprise Insider, Zandi pointed to tariffs, immigration restrictions, and Federal Reserve coverage as the principle headwinds. Collectively, he mentioned, they’ve created unusually excessive uncertainty, stalling funding and hiring.

BREAKING: Moody's Rankings warns US economic system nears recession, citing 3 key components:

— Payroll employment— Employment ranges— Constant job declines

Q: When will voters be taught? pic.twitter.com/P9wvPQurBr

—

Dr. MemeNstein votes

BLUE

(@Coste1Costello) August 12, 2025

All of this has BlackRock, which manages over $12.5 trillion in belongings below administration, about 40% of the USA’s GDP, nervous and already promoting its holdings.

September is all the time a nasty month for shares. Traditionally, September has been the graveyard for the S&P 500, with a median lack of 1.1% relationship again to 1928. Two extra weeks may very well be the beginning of it.

To not point out, in a current report, BlackRock cited these financial considerations:

Getting old scarcity: Developed nations have record-low delivery charges (Google “sperm depend 2045”). This will lead to excessive inflation over time and a shift in demand towards industries catering to seniors, corresponding to healthcare, actual property, and leisure.

A fragmenting world: In line with BlackRock, “We expect the Ukraine struggle and fraught U.S.-China relations have ushered in a brand new period of world fragmentation and competing protection and financial blocs.” BlackRock believes international financial progress shall be extra risky, however opens prospects in rising markets.

DISCOVER: 9+ Greatest Excessive-Danger, Excessive-Reward Crypto to Purchase in July 2025

Jackson Gap: Crash the Financial system With No Survivors

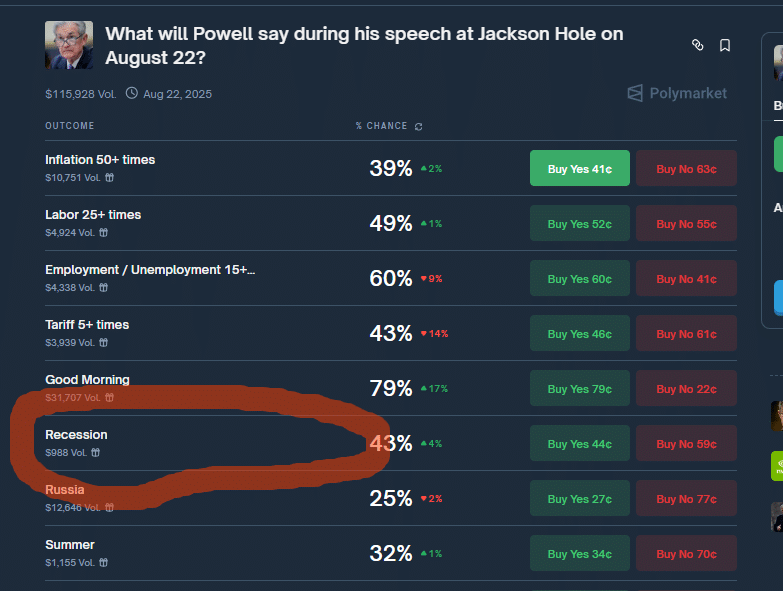

The final bit of stories terrifying traders is the Fed’s assembly in the present day in Jackson Gap, Wyoming.

Wall Avenue largely expects charge cuts from the Federal Reserve this fall, pointing to September because the almost definitely begin. But, undercutting these hopes are Tariffs launched by President Donald Trump, which have added financial pressure, and the administration has leaned arduous on the Fed to shift coverage.

Not like previous Jackson Gap conferences, many consultants consider Powell is unlikely to supply robust clues.

Inflation stays sticky above goal and has been pushed greater by tariffs, muddying the case for cuts. Some analysts argue the central financial institution will need extra proof earlier than shifting.

In actuality, the U.S. economic system feels a pinprick away from one thing unhealthy:

Scholar mortgage debt is reaching an alarming $2 trillion, whereas bank card debt is surging.

Banks are tightening on client credit score. When this occurs, client spending, which has stayed robust however shifted to credit score, will get shafted.

DISCOVER: Subsequent 1000X Crypto: 10+ Crypto Tokens That Can Hit 1000x in 2025

Are Issues That Unhealthy?

The hour attracts close to now. The bell has tolled for thee, America, in the end. Meals shall be a luxurious by early 2026. Is that how issues will pan out?

No. Whereas issues aren’t that unhealthy, all indicators level to a slowing, if not crashing, economic system after another run-up for shares and crypto that many see coming in This autumn from charge cuts. However stay calm. Issues will get higher. Drink copious quantities of Chivas Regal. Kidding. Partially.

Hold on to your long-term investments with stable foundations, promote what you should for rapid money, and belief that every part will finally end up all proper. Get some recent air, contact grass.

EXPLORE: Tether CEO Paolo Ardoino Hopes For Web Constructive From US Elections, Says Bitcoin Strategic Reserve Is A Nice Concept: 99Bitcoins Unique

Be a part of The 99Bitcoins Information Discord Right here For The Newest Market Updates

Key Takeaways

BlackRock is likely one of the 4 horsemen of the US economic system, together with funding giants Vanguard, Constancy and State Avenue – and now they’re all terrified.

All eyes are on Powell in the present day at Jackson Gap. As inflation lingers and labor metrics soften.

The publish BlackRock and Wall St. Exit US Markets, Bracing for Recession appeared first on 99Bitcoins.