BlackRock has reportedly elevated its share within the IBIT spot Bitcoin ETF, pushing holdings to $314 million. Why is BlackRock shopping for Bitcoin? Will BTCUSDT break $100,000?

A crypto wave is sweeping via the retail and company world. Yesterday, New Hampshire turned the primary state to enact Bitcoin reserve laws. Technique, previously MicroStrategy, is actively shopping for Bitcoin, lately scooping up over $1 billion of the coin. In the meantime, establishments are actively accumulating and scrambling for the digital gold in Could 2025.

DISCOVER: 20+ Subsequent Crypto to Explode in 2025

BlackRock Reportedly Will increase Stake in IBIT

Information that BlackRock, one of many world’s largest asset managers, is reportedly rising its stake in IBIT, its flagship spot Bitcoin ETF, pushing holdings to $314 million, a 124% enhance from November, is a large sentiment enhance for holders.

BlackRock will increase its place within the iShares Bitcoin ETF by 124%, bringing its whole holdings to $314 million. pic.twitter.com/VV0paTSRCi

— Dealer T (@thepfund) Could 6, 2025

This strategic allocation, more likely to two of its mannequin portfolios, the Goal Allocation with Options and the Goal Allocation with Options Tax-Conscious portfolios, may encourage different companies to observe go well with.

Even so, regardless of relentless shopping for and “endorsement” from main gamers, the Bitcoin worth stays beneath $100,000, throttling capital move to a few of the greatest ICOs to spend money on.

One query looms giant: What does BlackRock know that the remainder of us don’t? Why are they rising their Bitcoin allocation as a substitute of shopping for Ethereum or different cash that analysts think about among the many greatest to purchase in 2025?

DISCOVER: 11 Greatest Crypto Presales to Put money into Could 2025 – High Token Presale

The Bitcoin Guess: What Does BlackRock Know?

The fast enhance in publicity by BlackRock suggests a deliberate technique. In any case, their energetic pursuit of BTC publicity by way of spot Bitcoin ETFs is just not new.

By September 2024, their Strategic Earnings Alternatives fund (BSIIX) added over 2 million shares of IBIT, bringing its whole to 2.1 million shares. In the meantime, the Strategic International Bond fund (MAWIX) elevated its IBIT holdings by 24,000 to 40,682 shares.

In a portfolio submitting at present with the SEC, BlackRock disclosed proudly owning 2,140,095 shares of IBIT in its Strategic Earnings Alternatives Portfolio as of September 30, valued at $77.3 million.

That is a rise from 88,000 shares beforehand reported as of June 30.

For those who’ve been…

— MacroScope (@MacroScope17) November 26, 2024

In a notice to traders, Michael Gates, a lead portfolio supervisor for the Goal Allocation ETF mannequin portfolio suite, revealed the rationale behind their help for Bitcoin–one of many greatest cryptos to contemplate shopping for in 2025.

Gates stated they’re including a Bitcoin place, funded from equities, as an “further different asset”, pointing to its mounted provide. Together with the asset of their portfolio permits them to diversify sources of threat and return.

He additional emphasised that they may HODL Bitcoin, because it gives “distinctive and additive sources of diversification” to portfolios.

Establishments clearly see the worth in holding Bitcoin. As of Could 2026, IBIT managed over $58 billion from traders shopping for shares from BlackRock.

(Supply)

Previously 24 hours, over $36 million in shares have been bought. IBIT ranks among the many prime 5 ETFs by inflows, trailing solely the Vanguard S&P 500 ETF.

Why Is the BTCUSDT Value Caught?

Regardless of regular inflows and aggressive shopping for from establishments, together with Technique, costs stay beneath $100,000.

Earlier at present, costs rallied to as excessive as $97,700 earlier than retracing from the resistance degree.

(BTCUSDT)

On X, one analyst questions the ” provide ” supply that retains costs low.

You are not allowed to ask the place the Bitcoin “provide” is coming from.BTC cleared $100k a number of instances. Now for the final 2 weeks It is caught at $94k with M2 exploding, shares up and gold up.

$4 billion of ETF buys, $1 billion of Saylor buys.However you are not allowed to query it.

— WhalePanda (@WhalePanda) Could 6, 2025

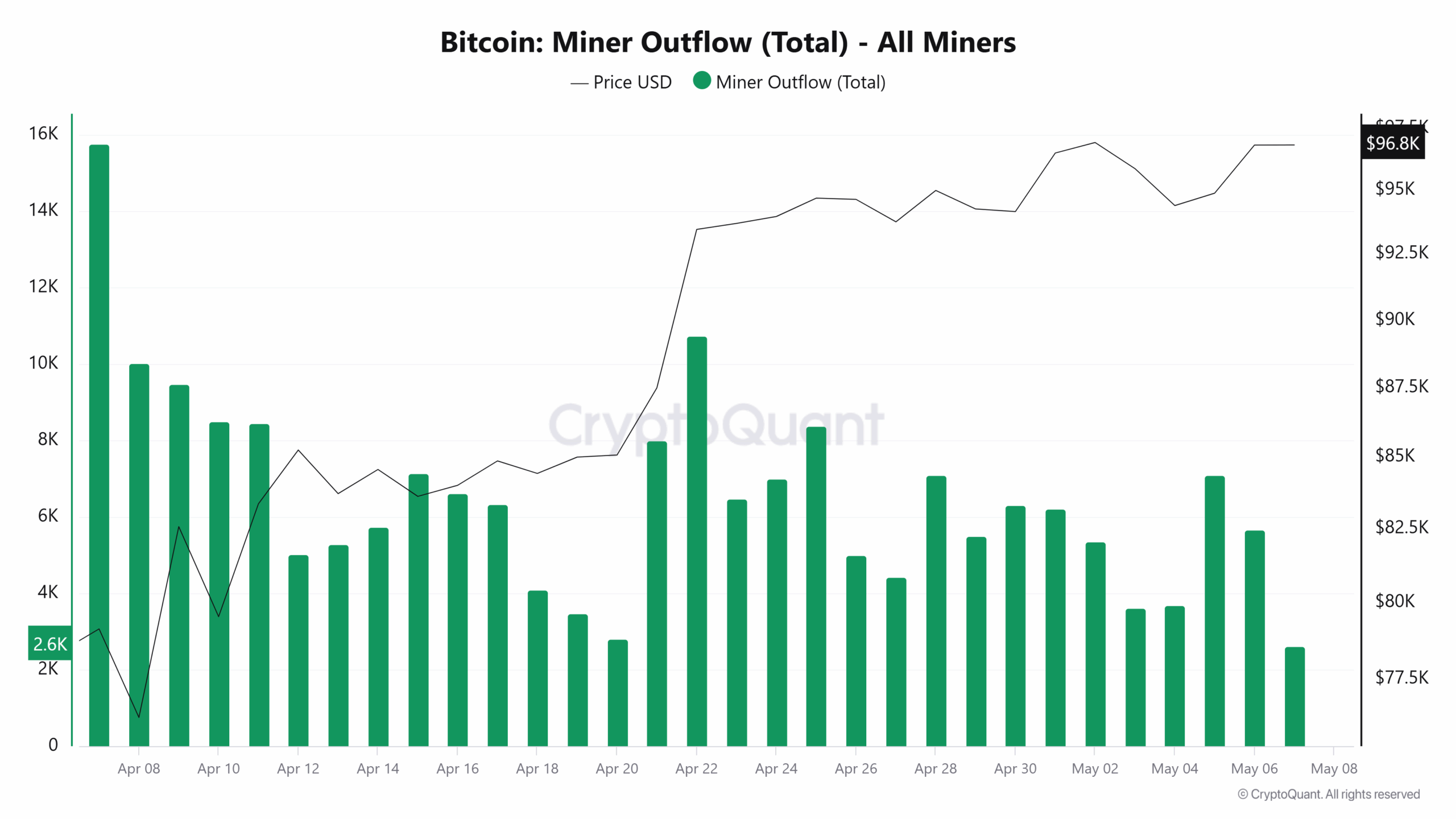

Bitcoin miners, who are inclined to promote when costs are excessive, have slowed their liquidation over the previous month. In keeping with CryptoQuant, solely 5,678 BTC have been offered on Could 6, in comparison with 15,767 BTC offered on April 7.

(Supply)

With miners holding and establishments shopping for, Bitcoin is more likely to break above $100,000 in a purchase development continuation formation.

DISCOVER: Subsequent 1000x Crypto – 12 Cash That Might 1000x in 2025

BlackRock Boosts Bitcoin ETF Stake: Why Is BTC Value Caught Beneath $100K?

BlackRock has reportedly elevated its stake in IBIT, shopping for extra shares

Establishments are actively shopping for Bitcoin, following Technique’s methods?

Miners are usually not promoting and HODL, as CryptoQuant tendencies present

Why is the Bitcoin worth caught beneath $100,000?

The submit BlackRock is Nonetheless Shopping for Bitcoin: What Do They Know That We Don’t? appeared first on 99Bitcoins.