Be a part of Our Telegram channel to remain updated on breaking information protection

Following the success of its spot Bitcoin and spot Ethereum ETFs (exchange-traded funds), asset administration large BlackRock is reportedly trying to tokenize its ETFs on the blockchain.

In keeping with a Bloomberg report that cited sources conversant in the matter, the agency is contemplating tokenizing funds that supply publicity to real-world property (RWA). Nonetheless, this transfer can be topic to “regulatory concerns,” the report added.

BlackRock Crypto ETFs Entice Billions Of {Dollars} At Document Tempo

BlackRock already affords a number of crypto-related merchandise. These embody ETFs that monitor the digital asset market leaders Bitcoin (BTC) and Ethereum (ETH), the iShares Bitcoin Belief and the iShares Ethereum Belief.

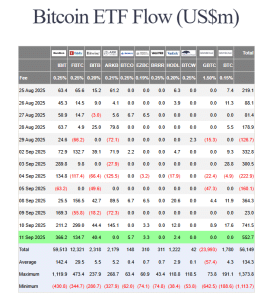

Information from Farside Buyers exhibits that BlackRock’s spot Bitcoin ETF leads the market by way of cumulative inflows, with its complete flows thus far standing at $59.513 billion. That is significantly greater than the second-largest fund by way of this metric, which is Constancy’s FBTC with its $12.321 billion in cumulative inflows.

US BTC ETF flows (Supply: Farside Buyers)

Whereas BlackRock’s spot Ethereum ETF has been one of the best performer of all US spot ETH ETFs, it hasn’t gained as a lot traction because the asset supervisor’s BTC product. So far, the ETH ETF has seen $12.721 billion in cumulative inflows.

Each BlackRock’s spot Bitcoin and spot Ethereum ETFs reached $10 billion in property beneath administration in a single yr or much less. This makes them two of solely three such merchandise to hit this milestone.

Along with these ETFs, BlackRock additionally affords lesser-known “thematic” funds just like the iShares Blockchain and Tech ETF, which invests in an index of crypto-related firms.

BlackRock Already In The Nascent Tokenization House

The reported plans to tokenize its ETFs comes as BlackRock already manages the world’s largest tokenized cash market fund referred to as the BlackRock USD Institutional Digital Liquidity Fund (BUIDL).

That fund crossed the $1 billion mark In March, and now accounts for over $2 billion in managed property.

Tokenized equities, together with shares and ETFs, are nonetheless a nascent market regardless of a current uptick in curiosity. Whereas a number of main gamers akin to Robinhood and Kraken are at the moment available in the market, there’s lower than $500 million value of those property in circulation, information from RWA.xyz exhibits.

Previously 30 days, there has additionally been a greater than 40% drop within the variety of month-to-month energetic addresses to round 23,940. Month-to-month switch volumes have slid over 22% throughout this era as nicely.

Whereas the reported transfer by BlackRock to tokenize its ETFs will deliver the funds on-chain, Bloomberg Intelligence ETF analyst Eric Balchunas questions the “worth add” for customers.

In an X submit, he stated that tokenization may assist make the “again workplace (plumbing)” within the conventional finance (TradFi) area “extra environment friendly” by means of the utilization of blockchain know-how.

We have to outline the pattern higher: If by ‘tokenization’ you imply the again workplace (plumbing) of TradFi will likely be barely extra environment friendly by using blockchain know-how? Then positive, tremendous, in all probability will however zzzz. What’s implied tho by the hype is getting precise traders to promote… https://t.co/SzXROTB9oi

— Eric Balchunas (@EricBalchunas) September 11, 2025

“What’s implied tho by the hype is getting precise traders to promote $VOO et al and purchase a token a la the way in which ETFs stole from MFs,” he wrote.

“I don’t see the worth add for the patron,” Balchunas added.

In a follow-up remark, he stated BlackRock’s transfer to tokenize its ETFs remains to be “a giant raise,” including that it is sensible to tokenize stuff for those who are already on-chain.

“However the on chain ppl are such a small fraction of the worldwide cash which is why the hype generally feels too heavy for the influence (at the very least medium time period),” he wrote.

TradFi Companies Transfer To Safe Dominance Amid Stablecoin Growth, Liquidity Shift

BlackRock will not be the one conventional finance agency that’s rising its presence within the blockchain area.

In April, the Depository Belief & Clearing Company (DTCC) introduced an revolutionary new platform for tokenized collateral administration utilizing its AppChain infrastructure.

A few months after that in July, Goldman Sachs and BNY Mellon partnered to launch a tokenized cash market funds resolution.

Earlier this month, the Nasdaq additionally filed a proposal with the US Securities and Trade Fee (SEC) to permit buying and selling of listed securities on its essential market in tokenized kind.

The push into the tokenization area is a part of a broader effort by tradFi companies to keep up their dominance because the adoption of stablecoins grows and liquidity begins shifting on-chain.

Associated Articles:

Finest Pockets – Diversify Your Crypto Portfolio

Simple to Use, Characteristic-Pushed Crypto Pockets

Get Early Entry to Upcoming Token ICOs

Multi-Chain, Multi-Pockets, Non-Custodial

Now On App Retailer, Google Play

Stake To Earn Native Token $BEST

250,000+ Month-to-month Energetic Customers

Be a part of Our Telegram channel to remain updated on breaking information protection