Binance Coin (BNB) is gaining contemporary curiosity as traders carefully watch a possible breakout. The token is dealing with resistance round $593, with every day commerce quantity at $1.24 billion. Its market cap is $83 billion. The present pattern is being attributed to sustained shopping for curiosity and steady technical cues.

Merchants Determine Triangle Sample On BNB Chart

Technical analysts are keenly watching a triangle worth sample forming on the chart of BNB towards USDT’s 1-day chart. As analyst Andrew Griffiths explains, this formation is acknowledged for contracting worth motion, whereby the highs develop into decrease and the lows develop into increased. It sometimes signifies a big transfer within the close to future, both increased or decrease.

#BNB evaluation on the 1D chart vs USDT reveals worth motion inside a triangle sample, indicating room for the present aspect pattern. Potential targets: T1 = $599, T2 = $617, T3 = $644. For danger administration, take into account Cease-Loss ranges: SL1 = $580, SL2 = $559, SL3 = $542, SL4 = $521.… pic.twitter.com/Qku1eChZ4R

— Andrew Griffiths (@AndrewGriUK) Might 3, 2025

The graph signifies BNB trending in a narrower vary for the previous few periods. Such a setup sometimes signifies that there’s a breakout on the horizon. As BNB has been on an upward pattern previous to this sample forming, some assume it would preserve going up—if the help zones maintain. Nevertheless, a breach beneath these help ranges would possibly reverse the pattern and push the value down.

Worth Targets Established At $599, $617, And $644

If BNB retains surging, analysts have cited three potential targets. The primary is $599, which is just under the psychological barrier of $600. The second is $617, a spot the place BNB fought to maneuver above again in March.

The third is $644, which is all the vary of the triangle formation. These will seemingly be checkpoints if there may be momentum.

Though short-term bullish indications are there, the token has not but breached any of those ranges. For now, BNB is probing a big stage of help and resisting. Any such worth motion is typical earlier than greater strikes in both course.

BNB: The 32% Prediction

Despite all of the short-term hype, a unique forecast reveals BNB plummeting within the subsequent 12 months. Based mostly on a worth forecast, the token would possibly decline by 32% and hit $402 on June 4, 2025. That prediction doesn’t coincide with the prevailing chart power, creating an additional layer of uncertainty for long-term traders.

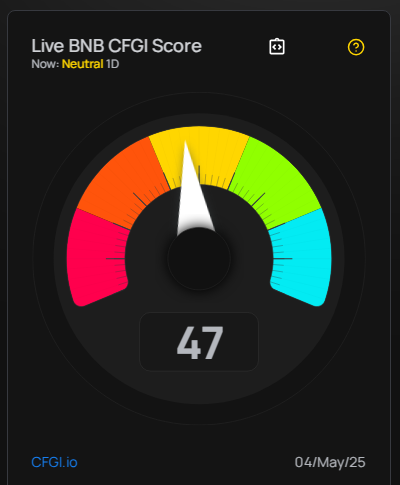

BNB has skilled 15 inexperienced days out of the previous 30, and its worth volatility has been solely 2.5%. The sentiment of the market appears to be impartial in the intervening time, with the Concern & Greed Index standing at 52. Everybody continues to be targeted on the triangle formation and if BNB will extricate itself from it.

Featured picture from Gemini Imagen, chart from TradingView