China is shifting nearer to exploring stablecoins, a change that might reshape international funds and assist push the yuan onto the world stage. Studies say the State Council is reviewing a roadmap that will set targets for utilizing a yuan-backed stablecoin, assign roles to home regulators, and lay out guidelines to handle dangers. Senior leaders are anticipated to fulfill this month to debate yuan internationalisation and stablecoin coverage — a notable shift from the 2021 ban on crypto buying and selling and mining, and a growth carefully watched by initiatives like Conflux crypto, which place themselves as regulatory-compliant blockchains in China.

JUST IN: China pivots to stablecoins after US passes the GENIUS Act.

Beijing is now drafting a yuan-backed stablecoin roadmap, with pilots set offshore in

Hong Kong.This marks a serious shift: as soon as centered solely on the e-CNY CBDC (home use), China now sees stablecoins… pic.twitter.com/JLqSmbz5xD

— Jessica Gonzales (@lil_disruptor) August 28, 2025

Beijing has lengthy aspired for the yuan to rival the U.S. greenback and euro in international funds. But, regardless of China’s huge commerce surpluses, strict capital controls have capped its worldwide affect.

Stablecoins are digital tokens pegged to fiat currencies and supply immediate, low-cost, borderless transfers. For a rustic that has lengthy enforced strict capital controls, stablecoins current each a possibility and a problem: they might make cross-border yuan flows simpler, however regulators will want safeguards to forestall capital flight and monetary instability.

The yuan’s share of world funds not too long ago fell to about 2.88%, underscoring why Beijing is all in favour of instruments to spice up worldwide use of the foreign money.

EXPLORE: The 12+ Hottest Crypto Presales to Purchase Proper Now

Beijing’s Stablecoin Roadmap May Redefine Yuan Internationalisation, Problem U.S. Greenback Dominance, and Spark a New Period for China-Compliant Blockchains Like Conflux Crypto

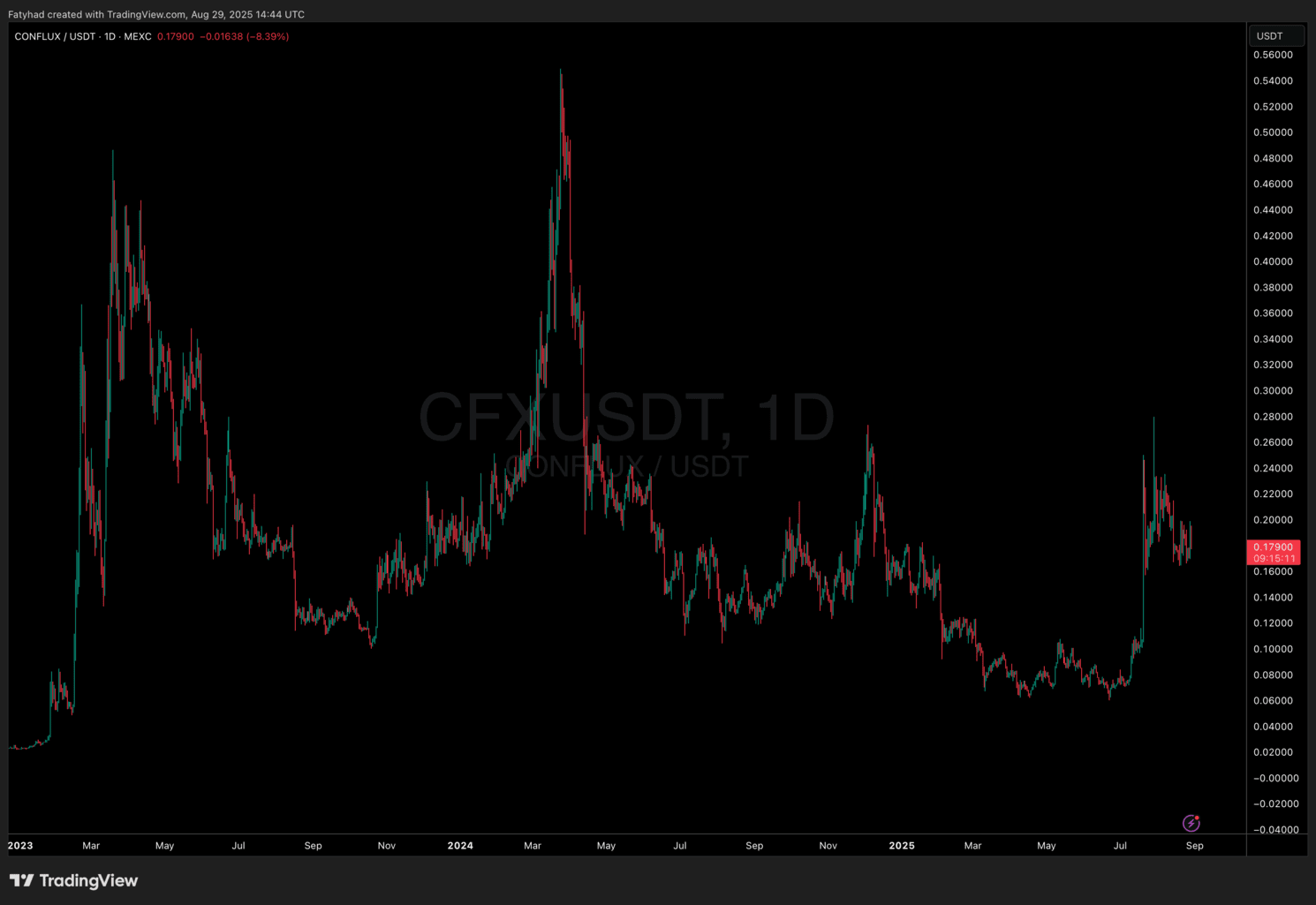

Following this variation of coronary heart, Conflux (CFX) crypto has exploded increased. Since July, CFX has climbed sharply after two headlines: a plan for an offshore yuan-pegged stablecoin constructed with fintech companions, and the rollout of Conflux 3.0, which guarantees a lot sooner throughput (as much as 15,000 TPS) and higher cross-border settlement assist.

Buying and selling quantity jumped from beneath $60 million to greater than $1.7 billion in a few days, briefly pushing CFX market cap above $1 billion.

(Supply: CFXUSDT)

Conflux can also be getting ready a crucial community improve (v3.0.1). The arduous fork is scheduled for August 31 (08:00 UTC+8); Binance has mentioned it should droop CFX deposits and withdrawals beginning September 1 as a precaution throughout the improve — a typical apply to assist guarantee a easy transition.

DISCOVER: JPMorgan Says Bitcoin Is Undervalued – Quickest Layer-2 Bitcoin Hyper May Speed up the Push to Truthful Worth

PetroChina’s Stablecoin Experiment Highlights Company Adoption and Hong Kong’s Regulatory Function

In the meantime, PetroChina is learning whether or not stablecoins can be utilized for cross-border settlement and funds, citing Hong Kong’s new stablecoin guidelines (efficient August 1) and shut monitoring of the HKMA.

China Nationwide Petroleum Company, one of many world's largest vitality firms, disclosed at its half-year outcomes convention that the corporate is carefully following the most recent developments of the Hong Kong Financial Authority concerning stablecoin issuer licenses, and can…

— Wu Blockchain (@WuBlockchain) August 29, 2025

If vitality majors like PetroChina start settling transactions in yuan-pegged tokens, the potential impression on international commerce corridors may very well be huge. For China, it might imply a direct software of stablecoin know-how to develop yuan-denominated settlement, lowering reliance on the U.S. greenback in oil and commodity markets.

May Conflux crypto change into a serious participant on this sector? The reply will rely on regulatory outcomes in Beijing and Hong Kong, how easily Conflux’s improve runs, and whether or not main companies truly transfer to settle in yuan-pegged stablecoins. For now, Conflux sits on the middle of a narrative that mixes coverage, infrastructure upgrades, and company pilots — and that mix is why merchants can’t assist however watch carefully.

Key Takeaways

China’s State Council is reviewing a roadmap for yuan-backed stablecoins. This indicators a serious coverage shift.

Conflux crypto positive factors momentum with its 3.0 improve and compliance edge, aligning with China’s blockchain ambitions.

PetroChina explores stablecoin settlements beneath Hong Kong’s new framework, highlighting broader adoption in conventional industries.

The publish China is Shifting on Chinese language Stablecoin: Is Conflux Crypto Pump Proof of Sensible Cash Accumulation? appeared first on 99Bitcoins.