Purpose to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade specialists and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

Bitcoin continues to commerce above the $85,000 mark, signaling a slight upward motion after weeks of value consolidation. As of at the moment, the asset is up 2.2% on the day by day chart, giving some merchants a purpose to anticipate a stronger rally forward. Nevertheless, broader timeframes paint a unique image.

During the last month, Bitcoin is down over 8%, and from its January 2025 all-time excessive above $109,000, the decline stands at greater than 20%.

Associated Studying

Public Firms Accumulate BTC Whereas Lengthy-Time period Holders Promote

Regardless of this underperformance, blockchain information supplier CryptoQuant has revealed a breakdown of company Bitcoin accumulation within the first quarter of 2025.

The information highlights an aggressive accumulation pattern amongst public firms. In complete, these corporations added 91,781 BTC to their stability sheets between January and March, suggesting continued confidence in Bitcoin’s long-term worth proposition.

Among the many most notable patrons, Tether added 8,888 BTC in Q1 2025, bringing its complete holdings to 92,646 BTC. MicroStrategy remained essentially the most aggressive acquirer, buying 81,785 BTC value over $8 billion.

Different contributors included Semler Scientific (+1,108 BTC), Metaplanet (+2,285 BTC), and The Blockchain Firm (+605 BTC).

CryptoQuant additionally talked about that Marathon Digital is planning a $2 billion inventory sale to fund future Bitcoin purchases, whereas GameStop is exploring a $1.3 billion convertible notice providing to help its entry into Bitcoin investing.

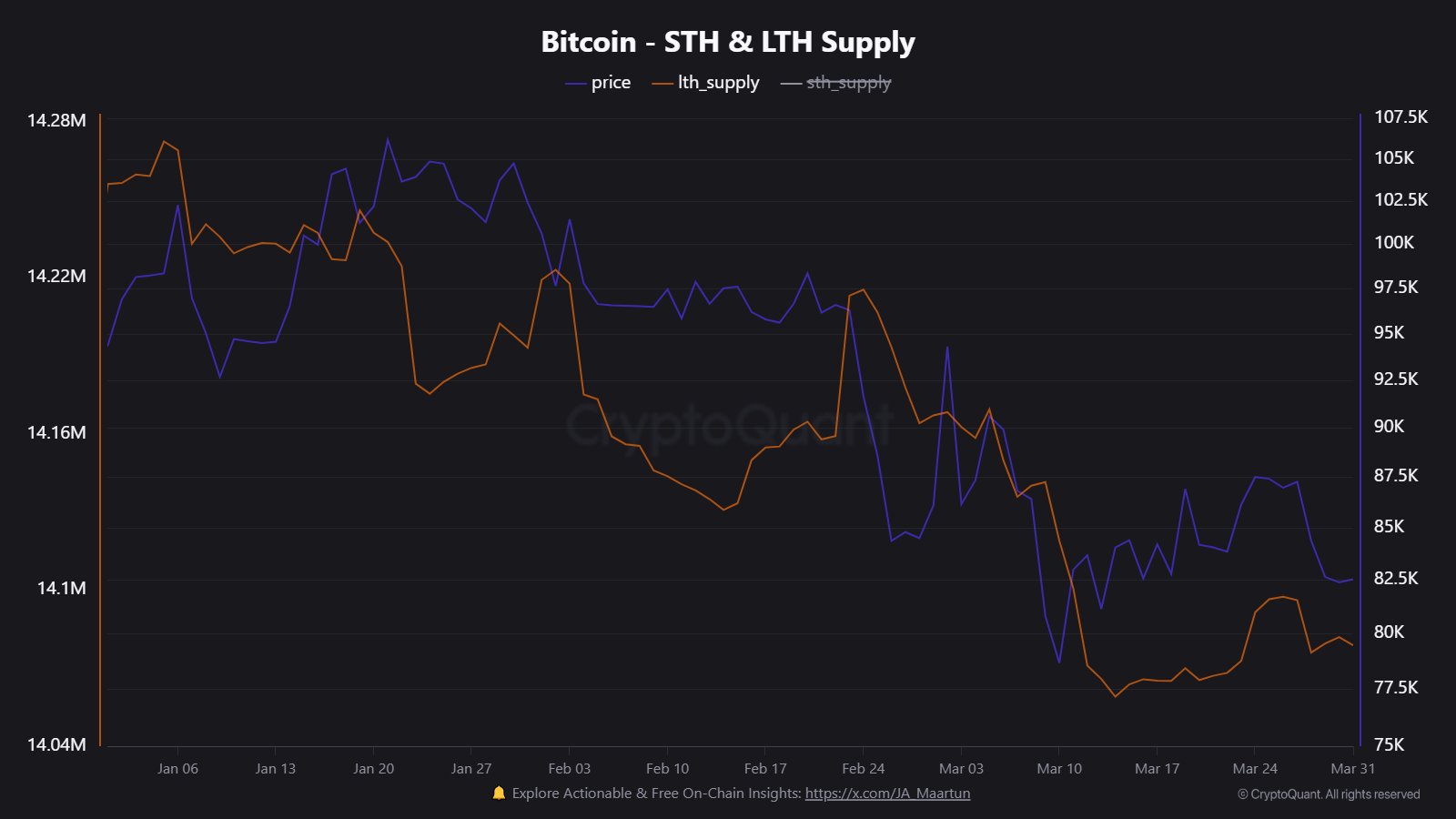

Nevertheless, this sturdy demand was not sufficient to maintain Bitcoin’s value. CryptoQuant reported that long-term holders offloaded round 178,000 BTC throughout the identical interval, including important promote strain.

The scenario was exacerbated by outflows of roughly $4.8 billion from spot Bitcoin ETFs, which additional weighed on value motion.

Including to the promote strain: $4.8 billion flowed out of Bitcoin ETFs in Q1.

Regardless of company shopping for, this wave of outflows seemingly weighed closely on value. pic.twitter.com/gZZz5RJxdK

— CryptoQuant.com (@cryptoquant_com) April 2, 2025

Key Assist Ranges for Bitcoin Recognized by Analyst

In the meantime, CryptoQuant analyst BorisVest recognized an vital help zone between $65,000 and $71,000. This vary is derived from two particular metrics: the Energetic Realized Value and the True Market Imply Value.

The Energetic Realized Value, at present round $71,000, filters out long-dormant cash to raised replicate the habits of extra energetic market contributors. Alternatively, the True Market Imply Value at $65,000 represents a broader common based mostly on latest transaction historical past.

Associated Studying

BorisVest famous that if Bitcoin’s value falls into this zone, it may see sturdy demand from long-term holders and institutional patrons alike. He prompt that this space could function a basis for additional accumulation and doubtlessly act as a springboard for a brand new upward section.

Regardless, whereas some market contributors proceed to exit their positions, others look like benefiting from the consolidation to build up.

Featured picture created with DALL-E, Chart from TradingView