Experiences have disclosed that centralized crypto lending climbed to roughly $25 billion in excellent loans within the third quarter, a determine that alerts renewed exercise amongst centralized platforms. Exercise has picked up this 12 months, and a few companies that survived the current shake-out are rising their mortgage books once more.

CeFi Surges

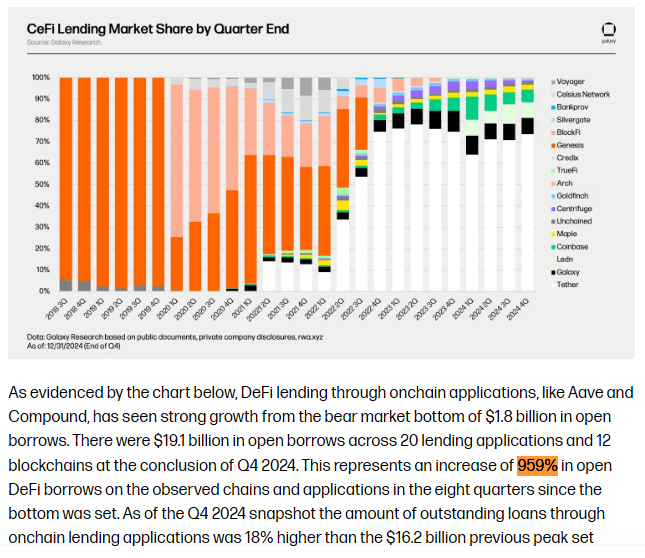

In line with Galaxy Analysis, the broader crypto lending market totaled about $36.5 billion as of This fall 2024, down from a excessive of $64.4 billion in This fall 2021. That drop displays the fallout from earlier platform failures and bankruptcies that minimize into each provide and demand.

The make-up of the market has shifted. Primarily based on studies, the most important centralized lenders — together with Tether, Galaxy and Ledn — now account for a big share of CeFi loans. These three collectively held near $10 billion of CeFi excellent loans, equal to roughly 88.6% of that section by the tip of final 12 months. Tether alone represented the most important single slice.

Supply: Galaxy Analysis

DeFi Borrowing Sees A Sturdy Comeback

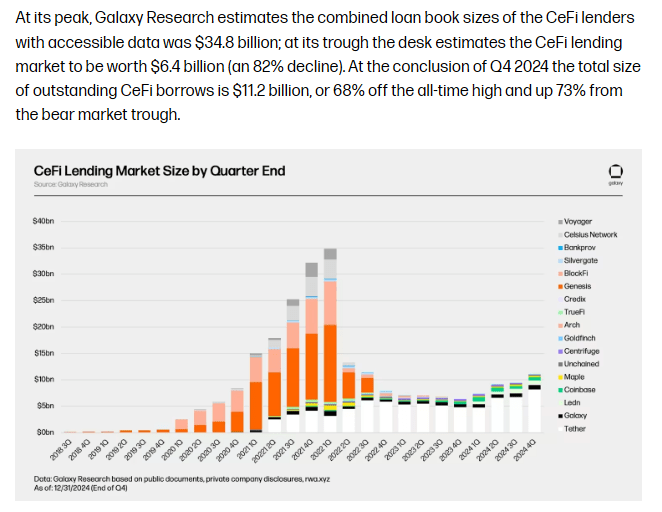

DeFi borrowing has recovered sharply from the lows of the 2022–2023 downturn. Open borrows on decentralized platforms climbed from about $1.8 billion within the trough to $19 billion by the tip of 2024, a rise of 959% over the interval. This exhibits many customers moved again to on-chain options as centralized choices contracted.

Supply: Galaxy Analysis

Why Numbers Matter Now

Market watchers say the brand new totals matter as a result of they reveal the place exercise lives at present: extra on chain, and concentrated amongst fewer centralized gamers. Some lenders look like working with greater collateral ranges and clearer reporting than a number of the failed companies of previous years. That has calmed some buyers. Nonetheless, the overall lending market is way under its 2021 dimension.

Dangers Stay

The focus of CeFi loans in a handful of companies raises questions on single-point stress. If one giant lender faces bother, contagion may unfold. Worth swings in main cryptocurrencies additionally depart loans weak to fast liquidations. Regulators are watching the sector carefully, and coverage modifications may reshape the place and the way loans are made.

What To Watch Subsequent

Observers will probably be watching quarterly mortgage books, the tempo of on-chain borrowing, and any alerts of latest capital flowing into lending desks. The market is rebuilding, however it’s rebuilding in a modified kind — smaller than the height in 2021 and extra cut up between centralized gamers and DeFi protocols.

Featured picture from Unsplash, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent overview by our staff of prime know-how consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.