Victoria d’Este

Printed: February 17, 2025 at 12:01 pm Up to date: February 17, 2025 at 12:01 pm

Bitcoin (BTC)

Effectively, right here we’re once more – Bitcoin spent the previous week trapped in a decent $95K–$98K vary. It teased merchants with fairly a couple of potential breakouts however by no means delivered one. So, what’s been maintaining BTC caught in a limbo? Let’s discover out.

BTC/USD 4H Chart, Coinbase. Supply: TradingView

First up, ETF outflows. A cool $651 million left spot Bitcoin ETFs, marking one other tough week for institutional flows. However, in fact, Bitcoin’s largest believers weren’t rattled – whales stored accumulating, maintaining the market from taking a deeper dive.

Bitcoin provide held by addresses with 0.1 to 1 BTC. Supply: Glassnode

The macro backdrop isn’t precisely serving to both. CPI and PPI knowledge got here out a lot hotter than anticipated, which had merchants bracing for impression. It’s turning into clear that the Fed isn’t slicing charges anytime quickly, which is dangerous information for danger property like BTC.

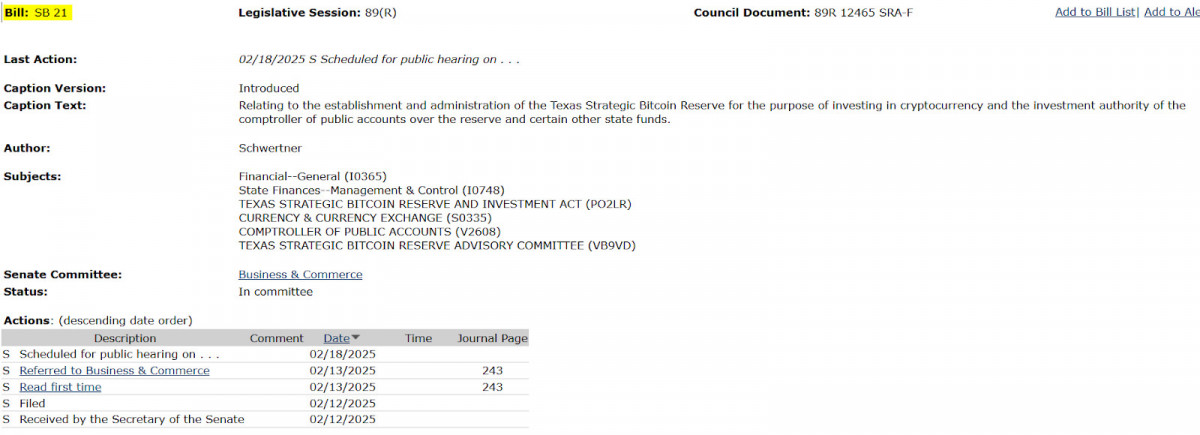

Invoice SB21. Supply: Capitol.texas.gov

After which it’s again to laws once more. A number of U.S. states, together with Texas, launched Bitcoin reserve payments, adoption on the state stage may be very a lot on the desk. In the meantime, the SEC did what the SEC does finest – delayed selections on extra ETF filings, so traders are nonetheless stored guessing.

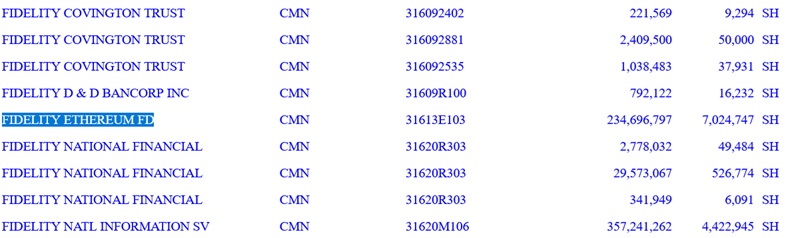

Goldman’s 13F submitting reveals holdings of $234.7 million price of Constancy’s Ethereum ETF. Supply: SEC

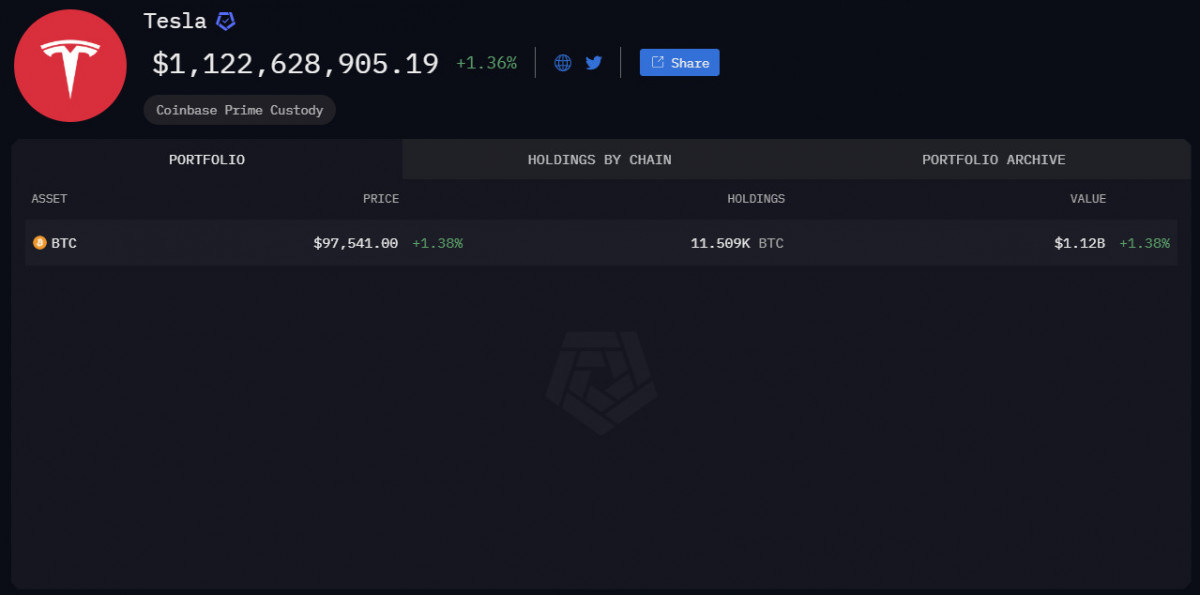

However let’s discuss establishments, as a result of regardless of the ETF exodus, massive cash isn’t precisely working for the exits. Goldman Sachs doubled its Bitcoin ETF holdings to $1.5 billion, and Tesla reaffirmed BTC’s place on its steadiness sheet in its This autumn report – not dangerous for an asset Wall Road as soon as dismissed as a “fad.” Over within the company world, MicroStrategy (now simply “Technique”) continued stacking BTC, and even GameStop noticed an 18% inventory pump on whispers that the corporate would possibly make a Bitcoin transfer.

The worth of Tesla’s cumulative Bitcoin holdings. Supply: Arkham Intelligence

On-chain, we’re seeing indicators of a traditional provide squeeze. Bitcoin trade reserves hit a three-year low (~2.5M BTC), which means fewer cash can be found for quick sale. If demand picks up, effectively… you recognize what occurs subsequent.

Bitcoin trade reserves, all exchanges. Supply: CryptoQuant

Value-wise, it’s nonetheless uncertainty.

BTC/USD 4H Chart, Coinbase. Supply: TradingView

The 4-hour chart reveals repeated checks of each assist and resistance, however no actual momentum in both course. The 50-period SMA (orange line) has been serving as dynamic resistance, capping upside makes an attempt, whereas RSI sits at 40.71, dipping under impartial. That alerts weakening bullish momentum, which might arrange a retest of $95K and even $93K if sellers push decrease. On the flip aspect, if Bitcoin reclaims the 50-SMA and breaks above $98.5K, the trail to $100K+ is again on the desk.

Ethereum (ETH)

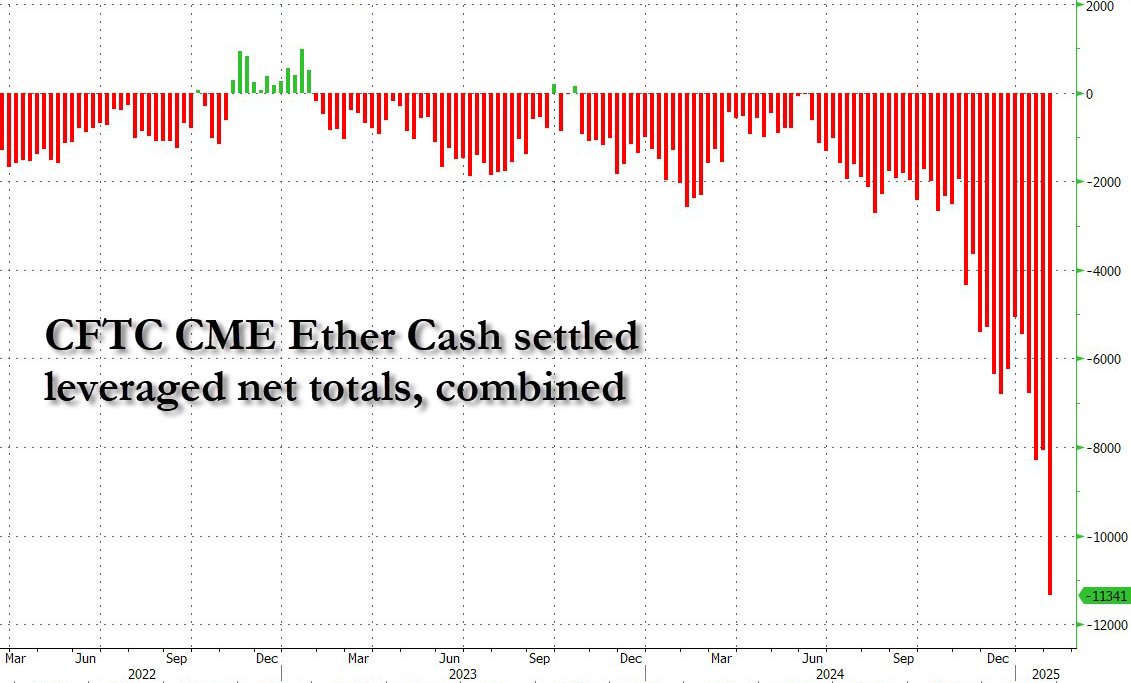

Ethereum didn’t fare a lot better final week. ETH bounced between $2,600 and $2,800, underperforming Bitcoin whereas the market wrestled with a flood of quick curiosity.

ETH/USD 4H Chart, Coinbase. Supply: TradingView

The large story got here from hedge funds who went all-in on shorting ETH, pushing quick positions up 500%. That’s a heavy short-term guess towards Ethereum’s power, and thus far, it’s working.

Ether cash-settled leveraged internet quick totals. Supply: Zerohedge

However not every part appears misplaced. The NYSE made a transfer to permit staking for Grayscale’s spot Ether ETF, which might pull in recent institutional curiosity.

NYSE proposes to amend the Grayscale Ethereum Belief ETF and Grayscale Mini Belief ETF to allow staking. Supply: NYSE

In the meantime, the Ethereum Basis deployed $120 million into DeFi initiatives, so there’s no cause to doubt ETH’s dominance within the area. And, as a uncommon win for merchants, Ethereum’s gasoline charges dropped under $1 million for the primary time since September 2024, which means community congestion is low.

Supply: Ethereum Basis

Ethereum builders, as at all times, stored constructing. This time, they agreed to hurry up the timeline for exhausting fork deployments to maintain Ethereum aggressive. However even with these upgrades, short-sellers nonetheless have the higher hand, and Ethereum wants stronger momentum to interrupt out of its rut.

ETH/USD 4H Chart, Coinbase. Supply: TradingView

For now, Ethereum is caught in range-bound consolidation between $2,500 and $2,800, mirroring Bitcoin’s lack of clear course. The 50-period SMA (orange line) at $2,673 has been performing as a pivot level, with ETH oscillating round it however failing to ascertain robust momentum.

On the 4-hour RSI, ETH sits at 48.82, just under the impartial 50 stage, suggesting an absence of bullish conviction. Value motion has been comparatively weak, with no clear breakout makes an attempt, however on the identical time, sellers haven’t managed to push it decrease both.

If ETH can break above $2,800, it might set off a transfer towards the $3,000 resistance zone. But when sellers take management and push ETH under $2,500, a retest of decrease assist round $2,350–$2,400 could possibly be in play. For now, ETH stays in wait-and-see mode.

Toncoin (TON)

TON won’t have made main waves in worth motion, however behind the scenes, the community has been busy. For one, TON built-in with Tether’s USDt ecosystem through LayerZero, so now it’s related to Ethereum, Tron, Solana, and 9 different blockchains. This can be a large step for liquidity and interoperability for the community.

Supply: the TON weblog

However TON isn’t nearly DeFi – there’s some actual traction on the dApp entrance. The TON Mini App Migration Grantwas introduced, designed to draw builders from different blockchains emigrate their mini-apps to TON. If this features momentum, TON might begin carving out an even bigger area of interest in Web3 functions.

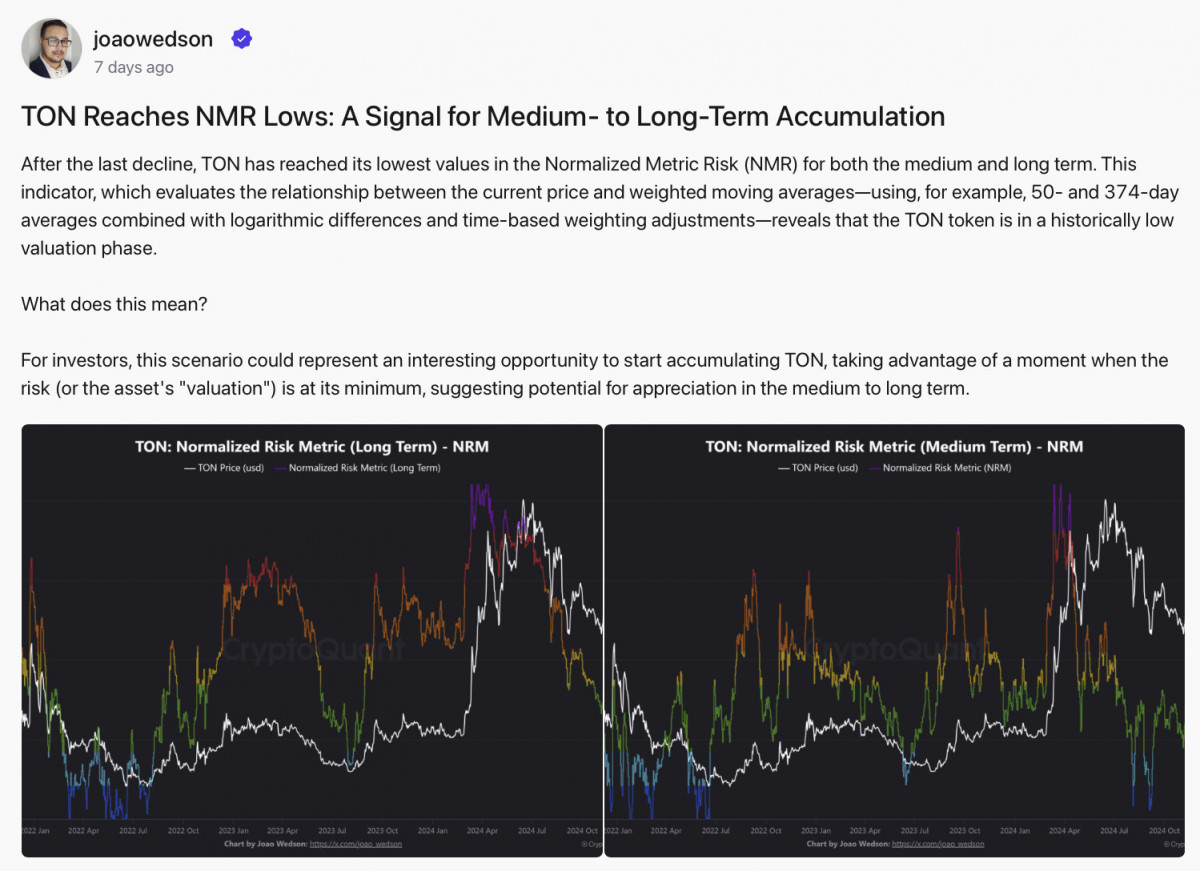

From an funding perspective, CryptoQuant analysts flagged TON as considerably oversold, pointing to its NMR indicator flashing historic accumulation alerts. In different phrases, they see this as a stable shopping for zone for medium-to-long-term traders.

Supply: CryptoQuant

However whereas all this was occurring, TON’s worth stayed locked in a decent vary between $3.60 and $3.90. In contrast to Bitcoin and Ethereum, which noticed some volatility, TON has been flatlining, barely hovering across the 50-period SMA at $3.78.

TON/USD 4H Chart. Supply: TradingView

The RSI sits at 48.41, reflecting the dearth of robust shopping for or promoting strain. Proper now, TON is in ready mode, on the lookout for a catalyst – whether or not it’s a Bitcoin breakout, extra stablecoin demand, or an inflow of dApps from the brand new migration program.

If TON can break previous $3.90, it might begin pushing towards $4.20 and past. But when sellers take management and it drops under $3.60, the following key assist is round $3.40. For now, TON is positioning itself effectively for the long run – however merchants should be affected person.

Disclaimer

In step with the Belief Mission pointers, please notice that the data supplied on this web page shouldn’t be supposed to be and shouldn’t be interpreted as authorized, tax, funding, monetary, or some other type of recommendation. It is very important solely make investments what you possibly can afford to lose and to hunt unbiased monetary recommendation when you’ve got any doubts. For additional data, we propose referring to the phrases and circumstances in addition to the assistance and assist pages supplied by the issuer or advertiser. MetaversePost is dedicated to correct, unbiased reporting, however market circumstances are topic to vary with out discover.

About The Creator

Victoria is a author on quite a lot of know-how subjects together with Web3.0, AI and cryptocurrencies. Her intensive expertise permits her to jot down insightful articles for the broader viewers.

Extra articles

Victoria d’Este

Victoria is a author on quite a lot of know-how subjects together with Web3.0, AI and cryptocurrencies. Her intensive expertise permits her to jot down insightful articles for the broader viewers.