Victoria d’Este

Revealed: Could 26, 2025 at 10:32 am Up to date: Could 26, 2025 at 10:32 am

Edited and fact-checked:

Could 26, 2025 at 10:32 am

In Transient

Final week’s market surge was accompanied by bullish headlines, however this week’s volatility was marked by political noise, regulatory stalls, and macro jitters, affecting confidence.

Final week felt just like the market had one hand on the throttle – Bitcoin blasting previous all-time highs, ETF flows pumping, Ethereum attempting to maintain up. This week, although, felit much more like second-guessing. The charts didn’t crumble, however momentum had clearly hit a wall. Each bullish headline obtained met with one thing bitter, be it political noise, regulatory stalls, or macro jitters and such. Worth motion throughout majors largely remained rangebound, and confidence clearly took a step again. Let’s break down what occurred – and why it issues in the event you’re buying and selling these items.

Bitcoin (BTC)

First issues first: Bitcoin did set a brand new ATH final Monday by breaking above $111K. And for a second, it felt like the following leg up was on, didn’t it? However inside 48 hours, it was already again down close to $107K, and that transfer down clearly wasn’t a random pullback.

BTC/USDT 4H Chart, Coinbase. Supply: TradingView

It got here proper as Trump reignited EU tariff speak, and spooked world markets once more (managed chaos a lot?). Then over $300 million in BTC longs obtained flushed as merchants rotated to safer floor. So, for anybody who thought Bitcoin would act like a “chaos hedge” – this week was a actuality test.

Reality Social

However what made all that worse was leverage. Open curiosity in BTC futures hit file highs midweek, as per Coinglass. That’s high quality in a clear uptrend, however lethal when sentiment flips. And with everybody loaded up, even a modest drop turned sharp actual quick.

Supply: Coinglass

On the upside, ETF inflows didn’t let up – with greater than $2.75 billion pouring into spot Bitcoin funds over simply seven days, as per Fairside. That form of quantity often units a robust tone for the week.

Supply: Fairside Traders

Then there was Michael Saylor, who dropped a not-so-subtle trace that MicroStrategy would possibly purchase extra BTC on this dip. That form of speak, particularly from somebody along with his monitor file, tends to present the market a little bit spine.

In the meantime, Texas handed a invoice supporting a Bitcoin reserve, signaling state-level political backing that’s nonetheless uncommon within the U.S. It didn’t get a lot airtime, however it added gas to the longer-term institutional case.

Supply: Bitcoin Legal guidelines

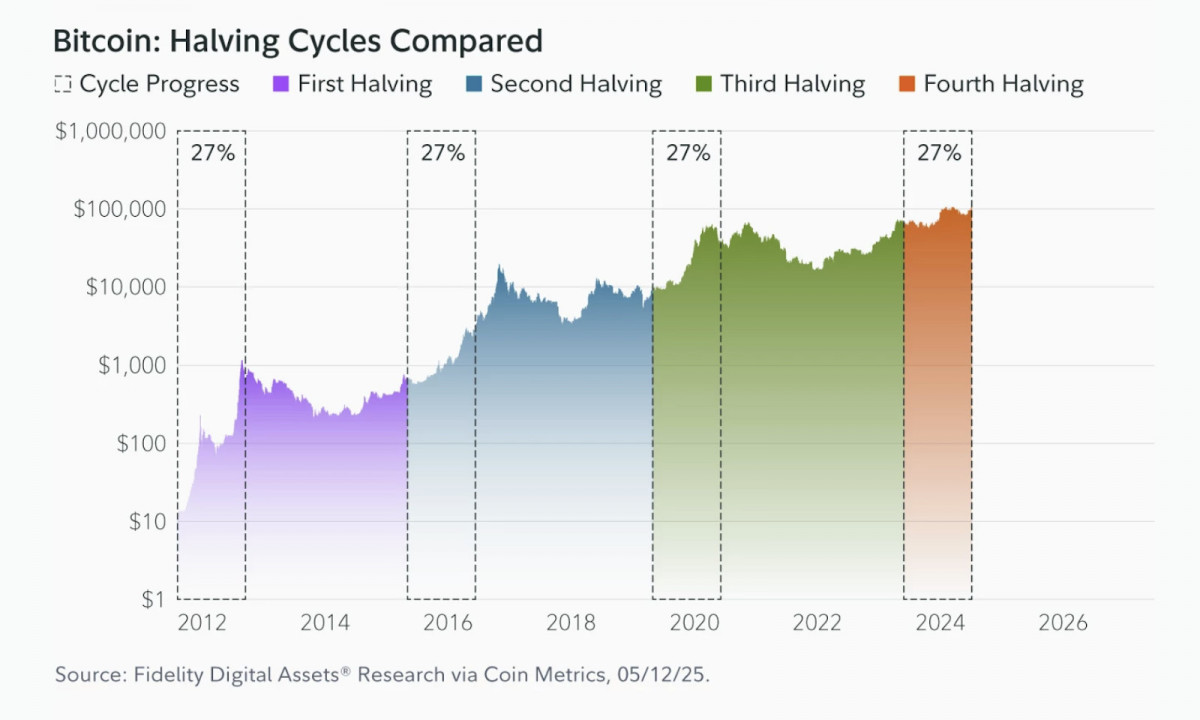

And on prime of all that, Constancy got here out with analysis reaffirming Bitcoin’s place as a core piece of a contemporary funding portfolio. Nothing flashy, however the form of validation that tends to stay with slow-moving capital.

Supply: Constancy Digital Property

When you’re buying and selling BTC, the message right here is easy: the long-term development nonetheless appears to be like strong, however for now it’s not a clear trending setting. Whipsaws are again. Keep nimble, particularly heading into choices expiry and extra tariff speak. A decisive reclaim of $112K might flip the swap once more – however we wouldn’t count on clean crusing.

Ethereum (ETH)

ETH adopted BTC larger early within the week, tapping $2,725, then slipped again underneath $2,600 by Wednesday and… just about stayed there till additional discover.

ETH/USDT 4H Chart, Coinbase. Supply: TradingView

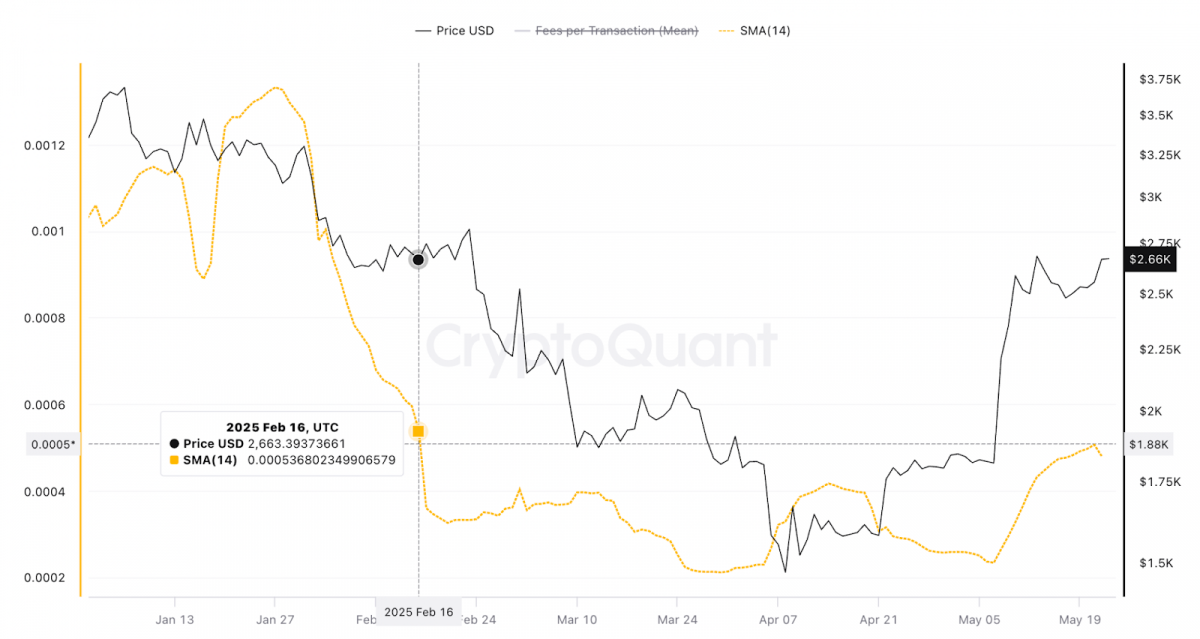

There was a quiet uptick in community exercise – fuel charges hit a three-month excessive. EthCC[8] introduced it’s headed to Cannes, which was a pleasant nod to Ethereum’s builder tradition. However that stuff didn’t appear to maneuver the charts a lot.

Supply: CryptoQuant

Then got here the SEC delay on ETH ETFs – not shocking, however ever a buzzkill. Each pushback now makes it tougher to consider Ethereum’s going to experience the identical institutional wave BTC did.

James Seyffart

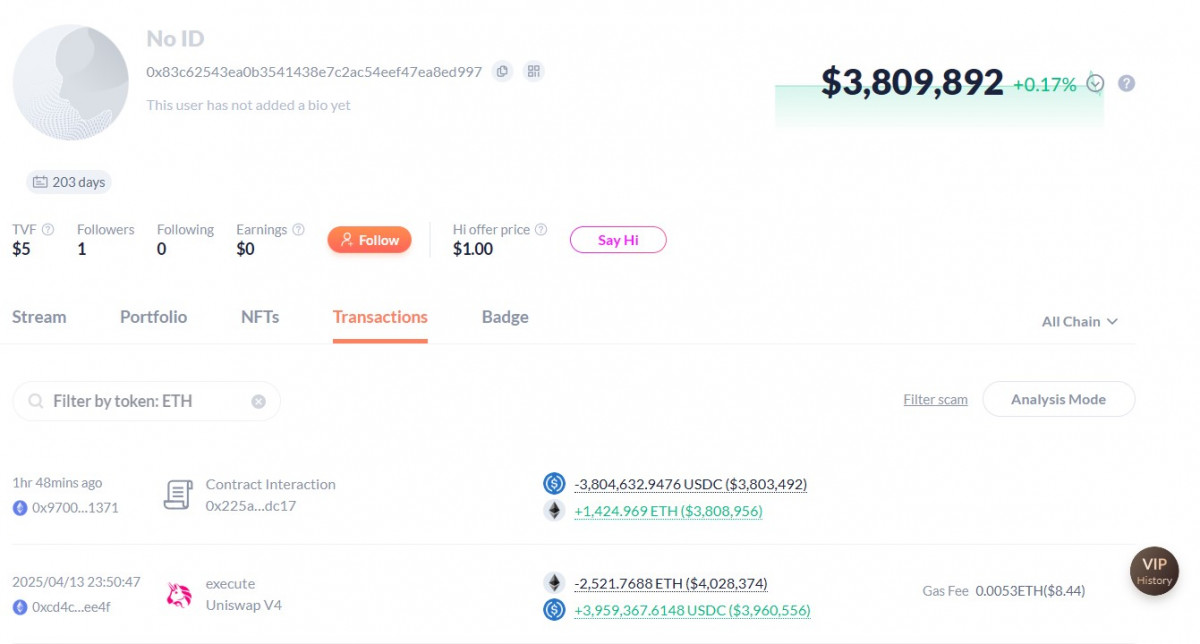

What did catch some consideration this week was a whale buyback of two,500 ETH midweek, at a worth larger than the earlier promote. Possibly it was conviction, perhaps remorse (or each?). Both approach, there was no follow-through.

Whale buys ETH after promoting over a month in the past. Supply: DeBank

And, for sure, Trump’s tariff kerfuffle shook the entire market, ETH included. Ether did comply with BTC decrease, however did so with a lot much less drama. Most likely as a result of leverage is lighter right here. But it surely additionally confirmed ETH isn’t transferring by itself information – it’s simply reacting to the massive canine.

When you’re buying and selling ETH, it’s nonetheless range-bound and reactive. If BTC stabilizes, ETH would possibly take one other shot at $2,800, however with out its personal spark – like ETF momentum or a killer DeFi/L2 breakout – ETH is simply… drifting.

Toncoin (TON)

In the meantime, TON had a little bit of a pulse this week. Early on, it made a pointy transfer from $2.85 to $3.25 – not explosive, however sufficient to snap some merchants out of their boredom and get them eyeing the chart once more. After weeks of quiet, that form of worth motion felt prefer it is likely to be the beginning of one thing.

TON/USD 4H Chart. Supply: TradingView

However to date it looks like one other vibe-based rally that couldn’t maintain. However this time, the TON ecosystem really had some issues happening behind the scenes. For one, Telegram reported $540M in earnings, an eyebrow-raising stat given all of the authorized stress it’s underneath.

Supply: Monetary Instances

Notably, Vietnam moved to dam the app completely, and France denied Pavel Durov permission to journey to the U.S., citing nationwide issues over his ongoing authorized disputes.

Supply: Reuters

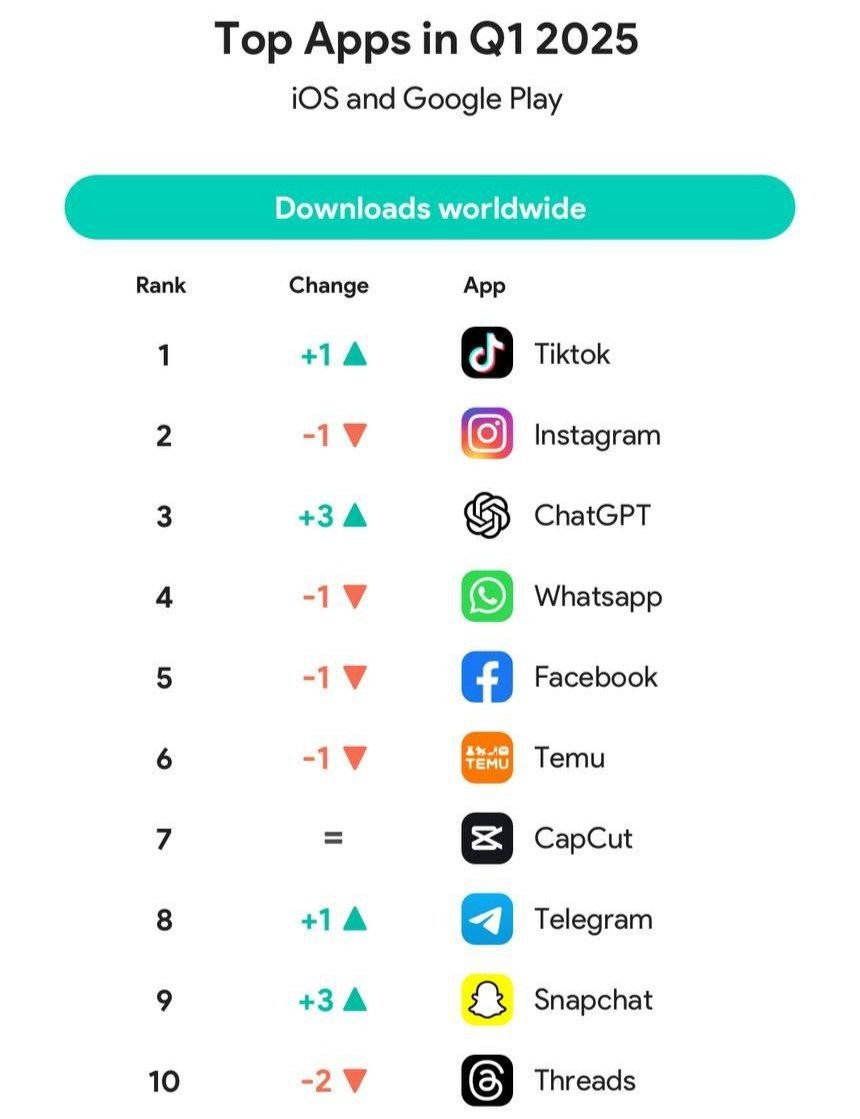

Regardless of all that, Telegram managed to jumped a spot within the 2025 world app rankings, displaying that person progress isn’t flinching.

Supply: Unknown

All this issues for TON as a result of, truthful or not, its destiny continues to be psychologically tethered to Telegram’s. When the app is flourishing, TON will get some advantage of the doubt. When authorized storms begin swirling, that profit fades.

As for worth, $2.90 held up as assist, however the bounce off it wasn’t emphatic. Consumers confirmed up – they at all times do in that zone – however they weren’t chasing. With no new catalyst, TON is again in that acquainted state: reactive, not main.

When you’re buying and selling TON, the message is fairly easy – the ecosystem isn’t useless, however headlines are steering the bus. Till TON places out a transparent, self-contained catalyst, each worth transfer goes to be tied to both Bitcoin’s path or the newest stray little bit of Telegram drama. Certain, the chart appears to be like high quality and even reveals some decisive strikes right here and there, however the conviction behind it nonetheless feels skinny.

Disclaimer

According to the Belief Undertaking tips, please be aware that the data offered on this web page is just not supposed to be and shouldn’t be interpreted as authorized, tax, funding, monetary, or some other type of recommendation. It is very important solely make investments what you may afford to lose and to hunt unbiased monetary recommendation when you’ve got any doubts. For additional info, we advise referring to the phrases and situations in addition to the assistance and assist pages offered by the issuer or advertiser. MetaversePost is dedicated to correct, unbiased reporting, however market situations are topic to vary with out discover.

About The Creator

Victoria is a author on quite a lot of expertise subjects together with Web3.0, AI and cryptocurrencies. Her in depth expertise permits her to write down insightful articles for the broader viewers.

Extra articles

Victoria d’Este

Victoria is a author on quite a lot of expertise subjects together with Web3.0, AI and cryptocurrencies. Her in depth expertise permits her to write down insightful articles for the broader viewers.