Victoria d’Este

Revealed: April 07, 2025 at 2:52 pm Up to date: April 08, 2025 at 2:53 am

Edited and fact-checked:

April 07, 2025 at 2:52 pm

In Transient

A $5 trillion market crash hammered Bitcoin, Ethereum, and Toncoin as political turbulence and macroeconomic chaos despatched crypto costs plummeting.

For those who blinked this week, you in all probability missed a $5 trillion wipeout throughout international markets – and crypto didn’t get a free move. Bitcoin collapsed from $88K to beneath $75K in just a few buying and selling days. Ethereum? Down 25% in the identical stretch. Toncoin? Held out longer, however then gave up the battle too. This wasn’t simply one other dip – this was a macro-slap, and the charts appear like they bought hit with a frying pan.

Bitcoin: From “subsequent cease $100K” to “please maintain $70K” inside 5 days

Effectively, that escalated rapidly. One second, Bitcoin was teasing a breakout above $88K – the subsequent, it plunged right into a freefall that seemed like one thing out of a horror movie for bulls. By April 7, it was clinging to $74K help with RSI down within the basement at 19 on the 4H – basic “oversold,” but in addition basic “don’t attempt to catch the knife.”

BTC/USD 4H Chart, Coinbase. Supply: TradingView

So what triggered this? Not a crypto scandal, not an ETF rug-pull – however politics. Trump’s “Liberation Day” tariffs landed like a hammer, throwing international markets right into a spiral that immediately reminded merchants of 1987’s Black Monday. A ten% blanket tariff on everybody? No marvel, markets freaked out. Shares nuked. Commodities spiked. And threat belongings – together with Bitcoin – had been tossed overboard.

BTC tried to carry its personal early on. For a minute, it even seemed prefer it would possibly decouple, reciting the previous “digital gold” playbook. However macro gravity pulled it proper again. Gold rallied, bonds surged, and Bitcoin… didn’t.

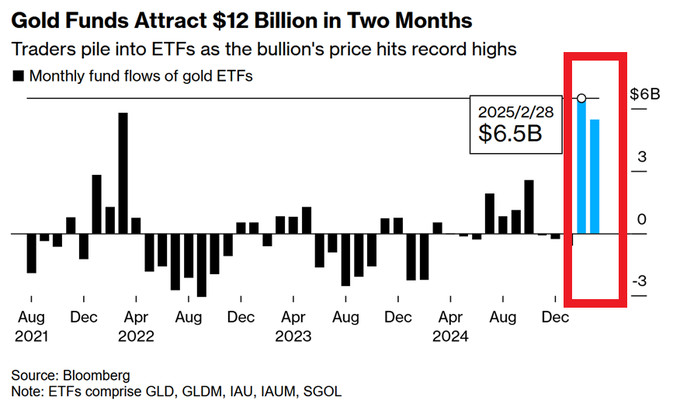

Gold funds month-to-month inflows. Supply: Bloomberg

Behind the scenes, some whales had been nonetheless shopping for – Metaplanet in Japan added to its stack, Saylor’s agency stored the religion – however retail wished none of it. Change inflows dropped to 2-year lows. Sentiment tanked. And even the “buy-the-dip” crowd stayed silent.

Simon Gerovich

Now, the million-satoshi query is: can we bounce from right here, or is that this simply the intermission earlier than a leg right down to $70K? That’s the “sensible backside” in accordance with some analysts – not as a result of it’s truthful, however as a result of that’s the place liquidity in all probability sits.

Ethereum: Similar storm, smaller boat, extra liquidations

ETH didn’t simply observe Bitcoin – it tripped over it. The worth bought pummeled down from ~$1,900 to $1,411, and with RSI beneath 15, it’s formally within the “panic zone.”

ETH/USD 4H Chart, Coinbase. Supply: TradingView

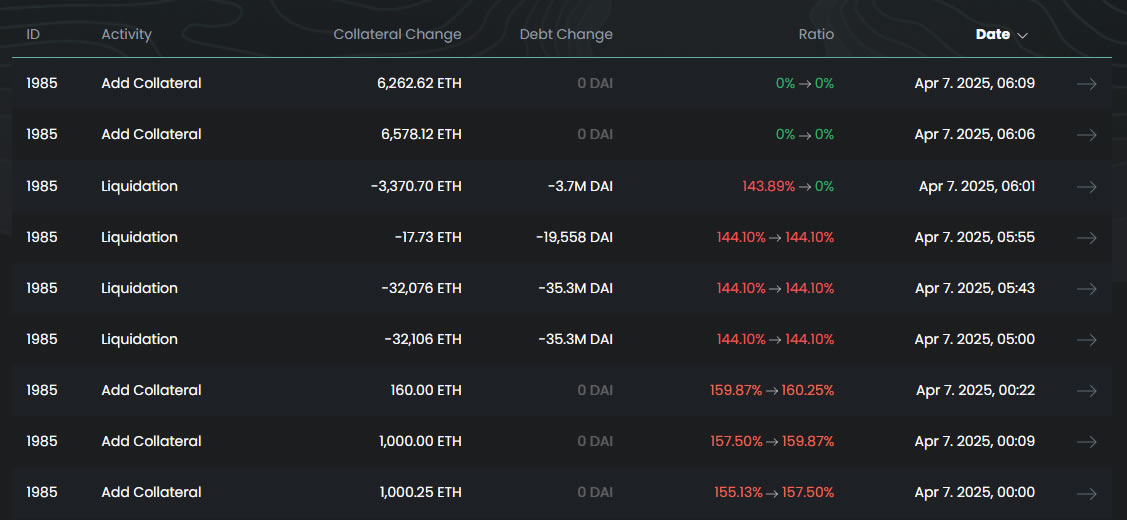

The kicker was a $106 million liquidation on DeFi protocol Sky. One whale, one huge margin name, and a path of liquidated longs in its wake.

ETH whale liquidations. Supply: DeFi Discover

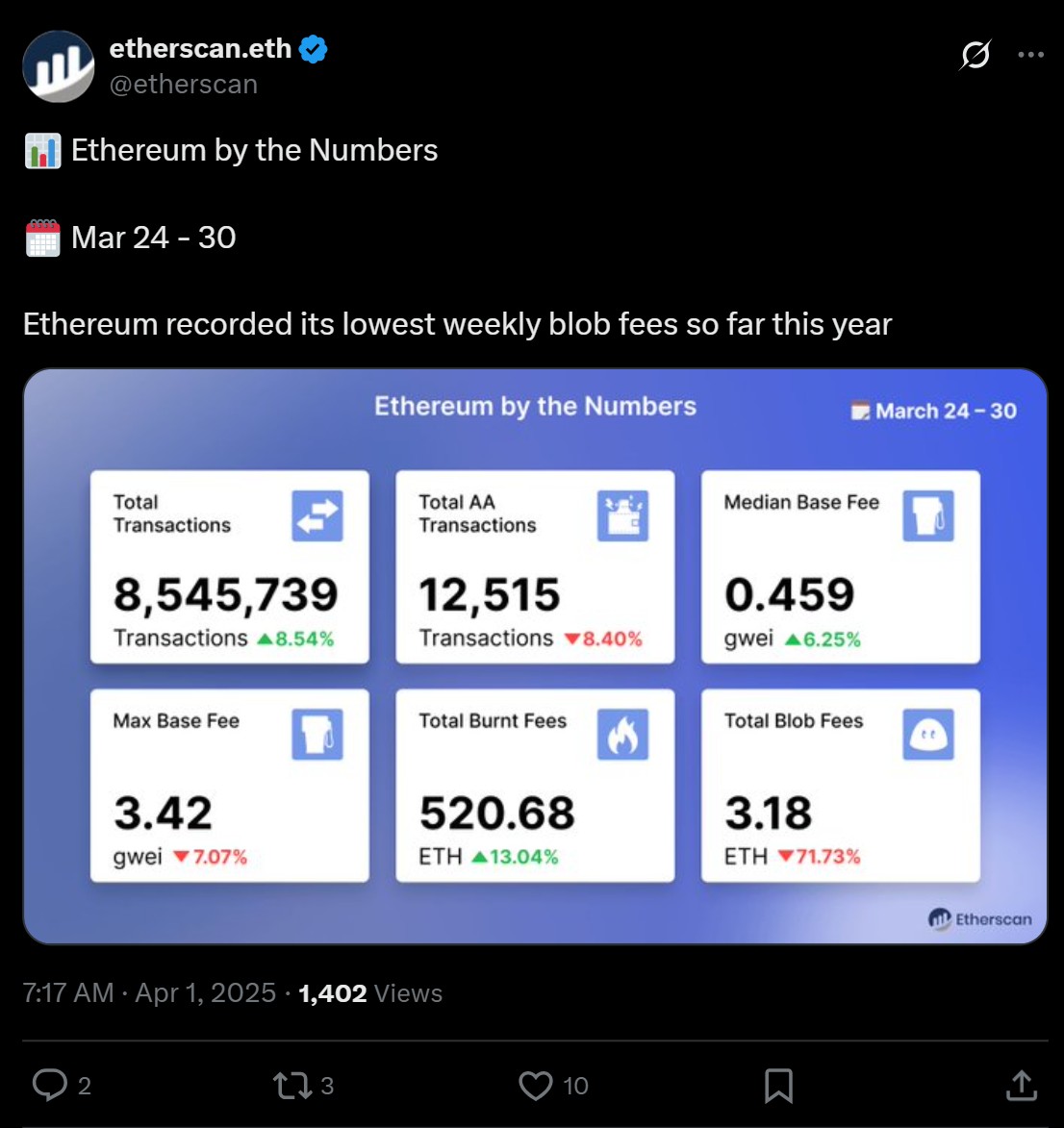

ETH’s ache wasn’t simply macro, although. Its fundamentals took successful too – weekly blob charges (the brand new stuff from the Dencun improve) collapsed to 2025 lows. L2s aren’t buzzing. Dev exercise seems stagnant. Even derivatives quantity is limp. ETH’s “ultrasound cash” narrative is beginning to sound prefer it’s enjoying on a damaged report.

Supply: Etherscan

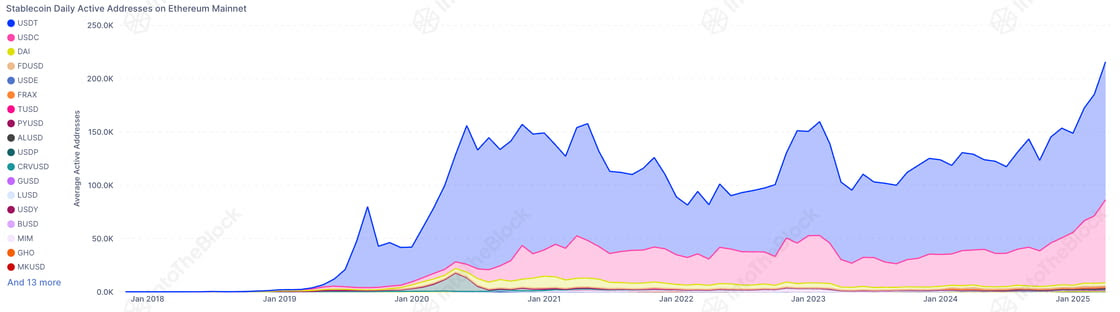

And but – ETH isn’t lifeless. Stablecoin exercise on Ethereum is up huge ($30B added in Q1), and Vitalik’s privateness push is getting traction.

Stablecoin every day energetic addresses on Ethereum mainnet. Supply: IntoTheBlock

The rails are nonetheless working. However in a market the place macro guidelines all, fundamentals don’t transfer value. Bitcoin does. So until BTC bounces, ETH is caught ready in line – probably down at $1,300 subsequent.

Toncoin: The tiger lastly flinched

…After which there’s Toncoin – which, till lately, seemed prefer it would possibly sidestep the mess fully.

TON had been one of many few large-cap tokens exhibiting relative power into late March. Whereas Bitcoin stumbled and Ethereum leaked decrease, TON was using excessive above $4, carried by Telegram-fueled optimism and a packed information cycle.

Pavel Durov was out hyping Telegram’s bond rally, citing report progress and profitability. Tonkeeper Professional rolled out on-chain 2FA with Telegram bot integration. STON.fi launched a cross-DEX liquidity aggregator. Even the bottom pockets bought an improve, and TON Core unveiled a beta of its new layer-2 fee community – tailored for Web3 microtransactions and already being utilized in TON Proxy.

What may go unsuitable? The basics appeared stacked, the vibe was coloured inexperienced, however the value completely bought wrecked.

As soon as BTC and ETH cracked, it didn’t matter how good the TON story sounded. Danger was off, and liquidity ran for canopy. TON plunged over 30%, from $4.20 to beneath $2.90, with RSI hitting the teenagers like the remainder of the market.

TON/USD 4H Chart, Coinbase. Supply: TradingView

So for now, TON’s upside will hinge much less on Telegram or tech rollouts, and extra on whether or not Bitcoin can cease the bleeding. Till then, it’s simply one other alt using the identical ugly wave down.

So now what? Lifeless cat bounce, or the beginning of one other melt-up?

Technically, we’re overdue for a aid rally. RSI on BTC and ETH is screaming oversold. Your complete market seems prefer it simply went by means of a blender. And traditionally, this type of ache often brings in opportunistic patrons – particularly if equities begin discovering their toes.

However the macro backdrop continues to be a large number. Trump’s tariffs aren’t going away, recession odds are up, and no one is aware of whether or not Bitcoin will return to performing like gold – or simply one other tech inventory with volatility points.

If BTC can claw its method again above $76–78K quickly, we would get that bounce. If not, $70K is asking. ETH at $1,300, TON at $2.5 – that’s all again on the menu.

So yeah – it’s been per week. Perhaps the worst for the reason that FTX collapse, minus the fraud. Simply pure, uncooked macro. And it’s a reminder: in crypto, you’re not simply buying and selling tokens. You’re buying and selling narratives. And proper now, the dominant one is concern.

Disclaimer

Consistent with the Belief Undertaking pointers, please be aware that the data offered on this web page isn’t meant to be and shouldn’t be interpreted as authorized, tax, funding, monetary, or some other type of recommendation. You will need to solely make investments what you’ll be able to afford to lose and to hunt impartial monetary recommendation in case you have any doubts. For additional data, we advise referring to the phrases and circumstances in addition to the assistance and help pages offered by the issuer or advertiser. MetaversePost is dedicated to correct, unbiased reporting, however market circumstances are topic to alter with out discover.

About The Creator

Victoria is a author on quite a lot of expertise matters together with Web3.0, AI and cryptocurrencies. Her in depth expertise permits her to put in writing insightful articles for the broader viewers.

Extra articles

Victoria d’Este

Victoria is a author on quite a lot of expertise matters together with Web3.0, AI and cryptocurrencies. Her in depth expertise permits her to put in writing insightful articles for the broader viewers.