Alisa Davidson

Revealed: September 29, 2025 at 9:19 am Up to date: September 29, 2025 at 9:32 am

Edited and fact-checked:

September 29, 2025 at 9:19 am

In Transient

Bitcoin and Ethereum noticed some sideways motion and bounces final week, whereas Toncoin struggled after breaking key help ranges, with the general market nonetheless bearish however poised for potential volatility relying on upcoming ETF information.

Bitcoin (BTC)

The story of final week was fairly easy: down first, then caught, and eventually a little bit bounce into the weekend. Early on, BTC flushed into the ~$109K space and simply sat there, grinding sideways between $109K and $113K for what felt like ceaselessly. And solely on Sunday did it lastly perk up towards $112K.

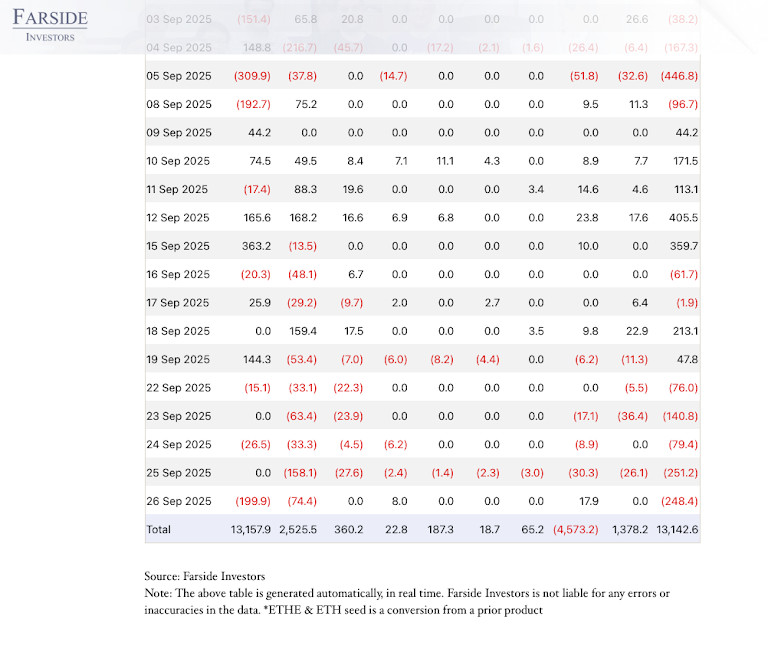

The explanations for this aren’t mysterious. ETF inflows cooled, whales have been unloading, and merchants have been leaning heavy into the large month-to-month choices expiry (talked about final week). We additionally had a robust greenback mid-week, so no marvel danger urge for food shrivelled throughout the board.

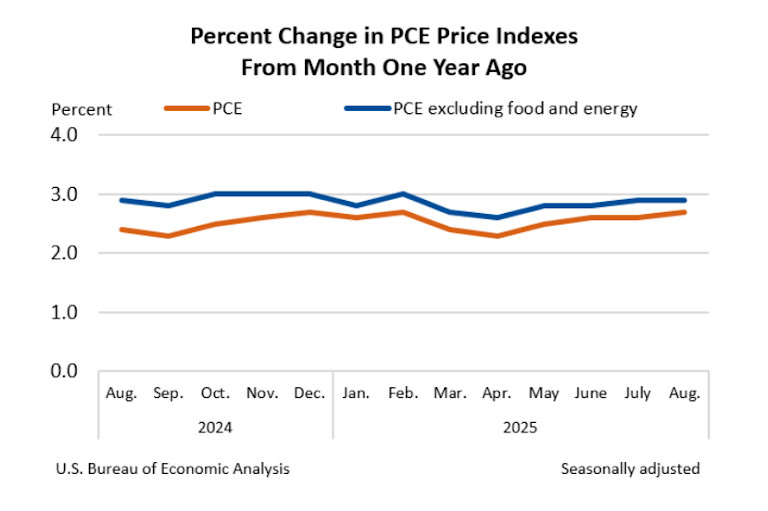

Then the tone flipped late within the week. Inflation numbers (PCE) got here in with out surprises, shares and gold pushed increased, and all of the sudden Bitcoin had room to breathe.

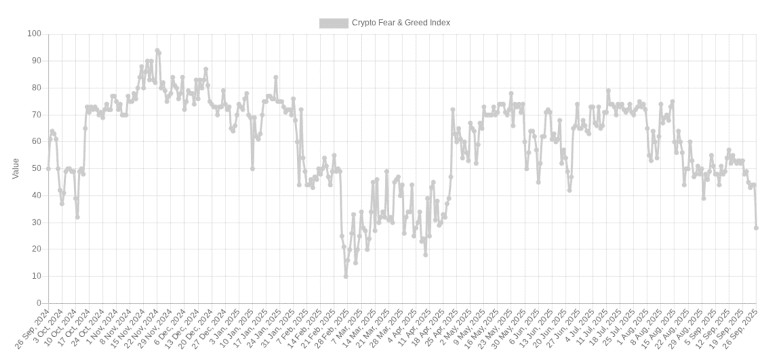

However let’s not get carried away. The weekly candle nonetheless closed purple, and concern gauges dropped to lows we haven’t seen in months.

Till BTC can climb again above that 18 September excessive close to $118K, that is only a bounce inside a bearish construction. If ETF headlines land proper in October, we would see follow-through. If not, the market may simply drag us again to $107K and even $105K.

Ethereum (ETH)

ETH principally adopted the identical script, simply with the amount turned up. It broke clear by way of the $4,064 help and slipped into the $3.9Ks earlier than bouncing again to round $4.12K on Sunday.

The additional weak point got here from 5 straight days of ETH ETF outflows, plus some large treasury strikes that made merchants nervous.

On prime of that, the entire “supercycle” hype bumped into a chilly bathe from Wall Road. However the backdrop remains to be there: change balances are at a nine-year low, and scaling upgrades like PeerDAS preserve transferring ahead.

We all know that the second Bitcoin stabilizes, ETH often pops again quicker. The important thing ranges now are fairly clear: maintain above $4,060 and push by way of $4,200, and the restoration appears actual. However fail there, and we’re most likely staring down $3.8K–$3.6K once more.

Toncoin (TON)

In the meantime, Toncoin lastly misplaced its footing. After weeks of clinging to that ~$3 ground, it broke down onerous and sank into the $2.65–2.75 vary, the place it’s now simply drifting.

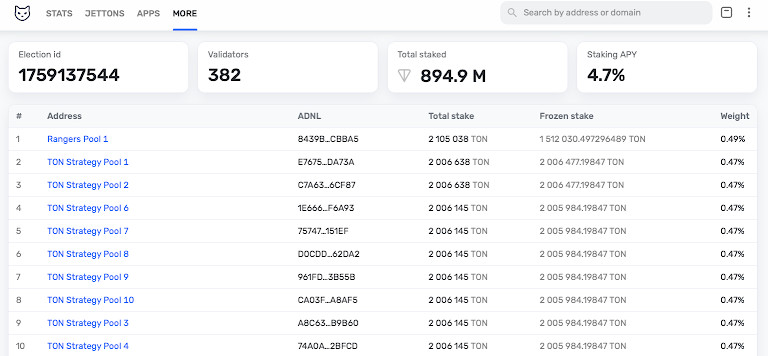

What’s placing is that this occurred regardless of a string of constructive headlines. As an example, TON Technique was added to the S&P Software program Index, which is not any small feat by way of visibility. On prime of that, the community has been quietly strengthening itself — over 30 million TON moved into staking with 20 new validators spun up in simply the previous few weeks.

In the meantime, AlphaTON Capital filed with the SEC, elevating $36 million towards a deliberate $225 million TON treasury, although with a catch: the credit score line they opened with BitGo will get liquidated if TON falls one other 25%, which might put the ache threshold someplace close to $2.20. So the draw back danger may be very actual. That’s to not point out constructing developments on the ecosystem aspect.

All of that makes TON a bizarre case proper now. Structurally it appears damaged — worth cracked a key degree and hasn’t recovered — however essentially, it’s gaining floor in indices, staking safety, and DeFi rails. All in all, TON appears caught between good long-term indicators and short-term gravity. Till it reclaims and holds above $3, it’s most likely going to stay caught in limbo, shadowing no matter Bitcoin and Ethereum resolve to do subsequent.

The large image

So the place are we now? Structurally, markets are nonetheless bearish — we’re underneath the large ranges, and the weekly candles are nonetheless purple. However what’s fascinating right here is the timing: October is full of ETF selections, and that’s the type of headline danger that may flip flows shortly. If Bitcoin pushes above $118K, the market may rip increased in a rush. If it slips again underneath $109K, then the lows from final week would possibly solely have been a pit cease. Both method, it appears like the following transfer goes to be sharp, and we’re all simply ready to see which door opens first.

Disclaimer

According to the Belief Venture pointers, please be aware that the knowledge supplied on this web page shouldn’t be meant to be and shouldn’t be interpreted as authorized, tax, funding, monetary, or another type of recommendation. It is very important solely make investments what you may afford to lose and to hunt impartial monetary recommendation if in case you have any doubts. For additional data, we recommend referring to the phrases and circumstances in addition to the assistance and help pages supplied by the issuer or advertiser. MetaversePost is dedicated to correct, unbiased reporting, however market circumstances are topic to alter with out discover.

About The Writer

Alisa, a devoted journalist on the MPost, makes a speciality of cryptocurrency, zero-knowledge proofs, investments, and the expansive realm of Web3. With a eager eye for rising tendencies and applied sciences, she delivers complete protection to tell and have interaction readers within the ever-evolving panorama of digital finance.

Extra articles

Alisa, a devoted journalist on the MPost, makes a speciality of cryptocurrency, zero-knowledge proofs, investments, and the expansive realm of Web3. With a eager eye for rising tendencies and applied sciences, she delivers complete protection to tell and have interaction readers within the ever-evolving panorama of digital finance.