Victoria d’Este

Printed: March 10, 2025 at 12:27 pm Up to date: March 10, 2025 at 12:27 pm

Edited and fact-checked:

March 10, 2025 at 12:27 pm

In Temporary

Bitcoin tumbles to $82K on Fed fears and ETF outflows, Ethereum dips beneath $2.1K amid weak demand, and Toncoin struggles close to $2.7 with no aid in sight.

Bitcoin (BTC)

Over the previous week, Bitcoin’s been on a tough journey, sliding from over $90,000 right down to round $82,500. On the 4-hour chart, it’s damaged clear via its 50-SMA at $87,406 and is now flirting with oversold RSI ranges (36.9). Let’s discover out what’s been behind this slide.

BTC/USD 4H Chart, Coinbase. Supply: TradingView

One of many largest blows got here from the much-hyped Trump “Strategic Bitcoin Reserve” announcement — which, ultimately, turned out to be an entire lot of nothing.

Souce: The White Home

Positive, the federal government stated it could maintain onto current Bitcoin, however there was no actual plan to purchase extra. Markets didn’t like that — cue a pointy “sell-the-news” transfer.

Supply: Yahoo! Finance

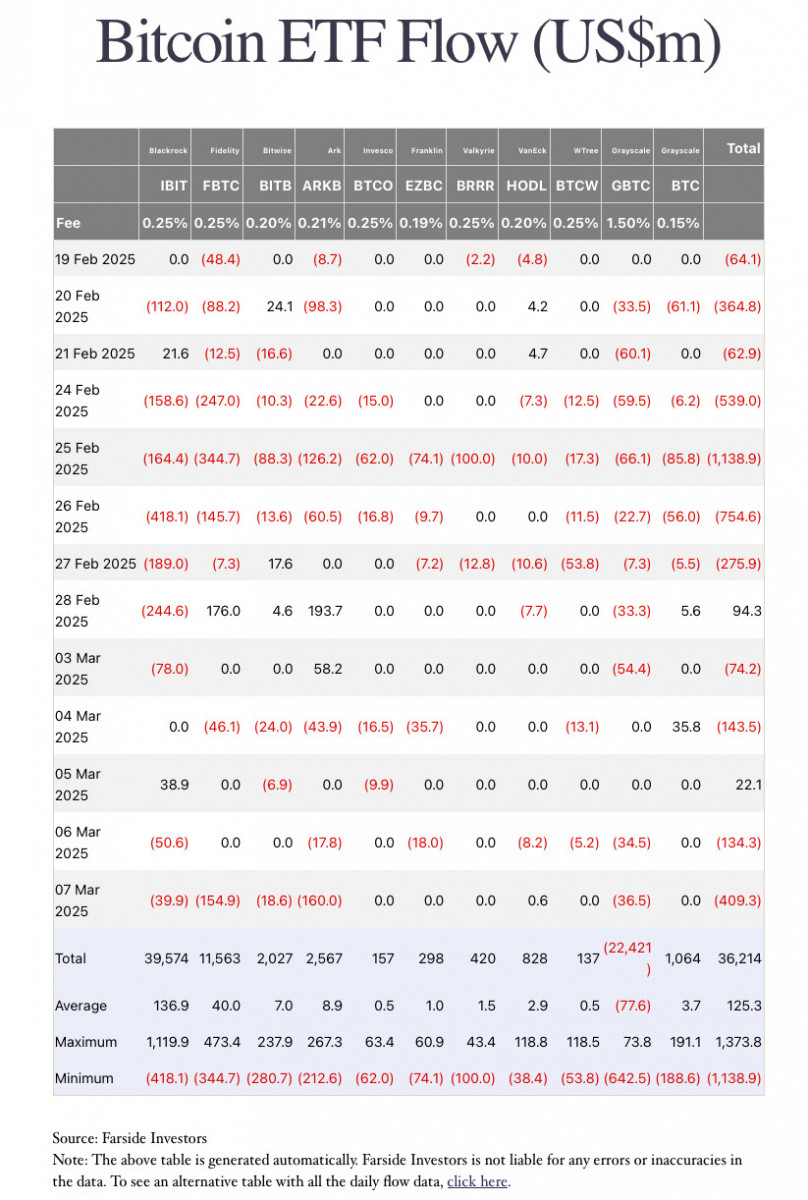

On the identical time, robust US jobs information and chronic inflation indicators have just about crushed hopes for fast Fed charge cuts, which is placing threat belongings like Bitcoin beneath much more stress. To make issues worse, ETFs noticed over $370 million in outflows following Trump’s speech, and now there are whispers concerning the authorities doubtlessly offloading a few of its Bitcoin stash — all of which has merchants spooked a couple of provide glut.

Supply: Farside Buyers

Bitcoin did take a fast dip to $80,000, however for now, that degree is performing as a fragile flooring. Nonetheless, if broader sentiment retains souring, we might simply see that flooring give method. Merchants at the moment are laser-focused on the $78,000 to $82,000 vary — if Bitcoin breaks beneath that, issues might get rather a lot messier.

Ethereum

Ethereum hasn’t fared a lot better than Bitcoin — it’s been dragged down from over $2,400 to round $2,070, as proven within the chart you shared. RSI is limping alongside close to 39, and value motion remains to be caught beneath its 50-SMA at $2,199, displaying little signal of energy.

ETH/USD 4H Chart, Coinbase. Supply: TradingView

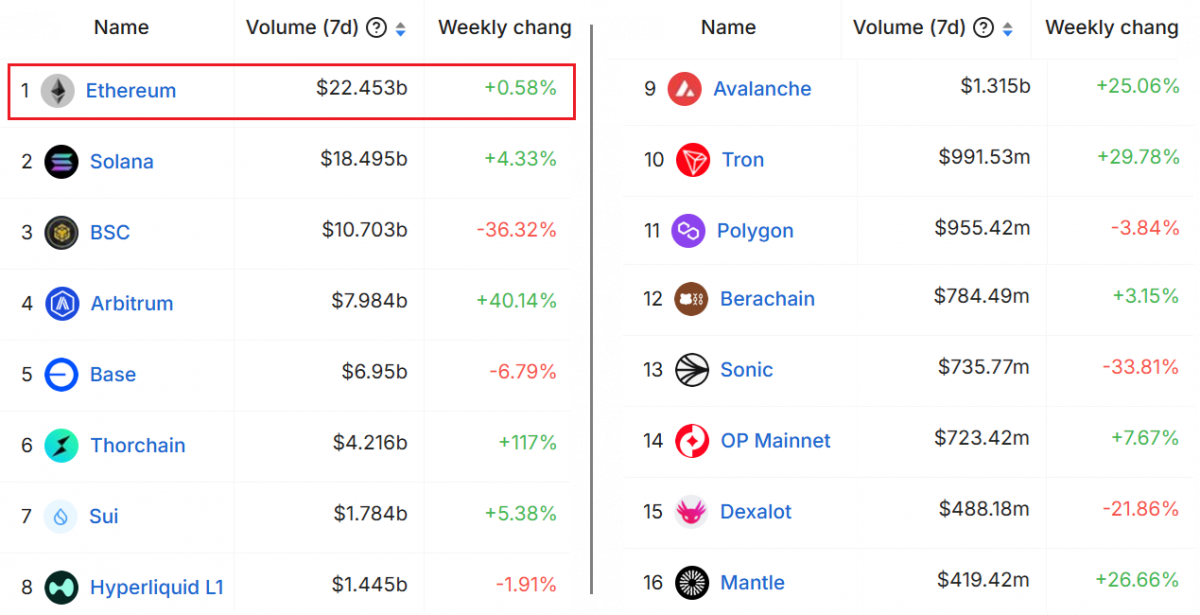

An enormous a part of ETH’s droop is tied to the broader market’s response to the underwhelming Trump Bitcoin reserve information — however Ethereum’s additionally obtained its personal baggage. DeFi and staking exercise have been sluggish this week, elevating questions on on-chain demand. Plus, there’s rising chatter about delays to the Pectra improve, which isn’t serving to confidence.

7-day decentralized exchanges volumes, USD. Supply: DefiLlama

One other blow: Trump’s Bitcoin reserve pitch made zero point out of Ethereum, dashing hopes that ETH would get a slice of the “strategic asset” narrative. For ETH holders who have been relying on some institutional nod, that was a chilly shoulder.

Proper now, Ethereum remains to be shifting in lockstep with Bitcoin, so except BTC finds its footing, ETH seems to be prefer it might take one other run at that $2,000 psychological degree. On the flip aspect, if macro situations shift — say, if charge lower hopes return — Ethereum’s shut proximity to long-term help might set it up for a pointy bounce. However for now, merchants are eyeing $2,000 as the road within the sand.

Toncoin (TON)

Toncoin (TON) has been having a fair harder time than the majors, sliding steadily from round $3.40 right down to $2.68 — and with RSI crushed right down to 24.0, it’s deep in oversold territory. However to date, there’s no actual signal of a bounce. The drop mirrors the broader risk-off vibe throughout crypto, however TON’s slide is sharper, partly as a result of it was neglected of the US reserve speak that, no less than for a second, propped up Bitcoin — and to a lesser extent, Ethereum.

TON/USD 4H Chart. Supply: TradingView

In contrast to BTC and ETH, TON doesn’t have that large institutional cash behind it, so when the entire market begins de-risking, TON tends to get hit tougher. If Bitcoin can’t maintain regular, TON might simply slide additional, with merchants eyeing the $2.50–$2.60 zone as the following doubtless touchdown spot. Nonetheless, with RSI this crushed down, even a small aid rally in Bitcoin or Ethereum might set off a pointy, quick bounce in TON — however that will doubtless be extra of a tactical commerce than a longer-term restoration sign.

Supply: TON Weblog

In the meantime, there’s rather a lot occurring beneath the hood within the TON ecosystem. TON Core simply rolled out its Accelerator improve, pushing community capability previous 100,000 TPS — and now engaged on slicing transaction latency to enhance person expertise. However whereas these are strong technical milestones, they haven’t translated into value energy — no less than not but.

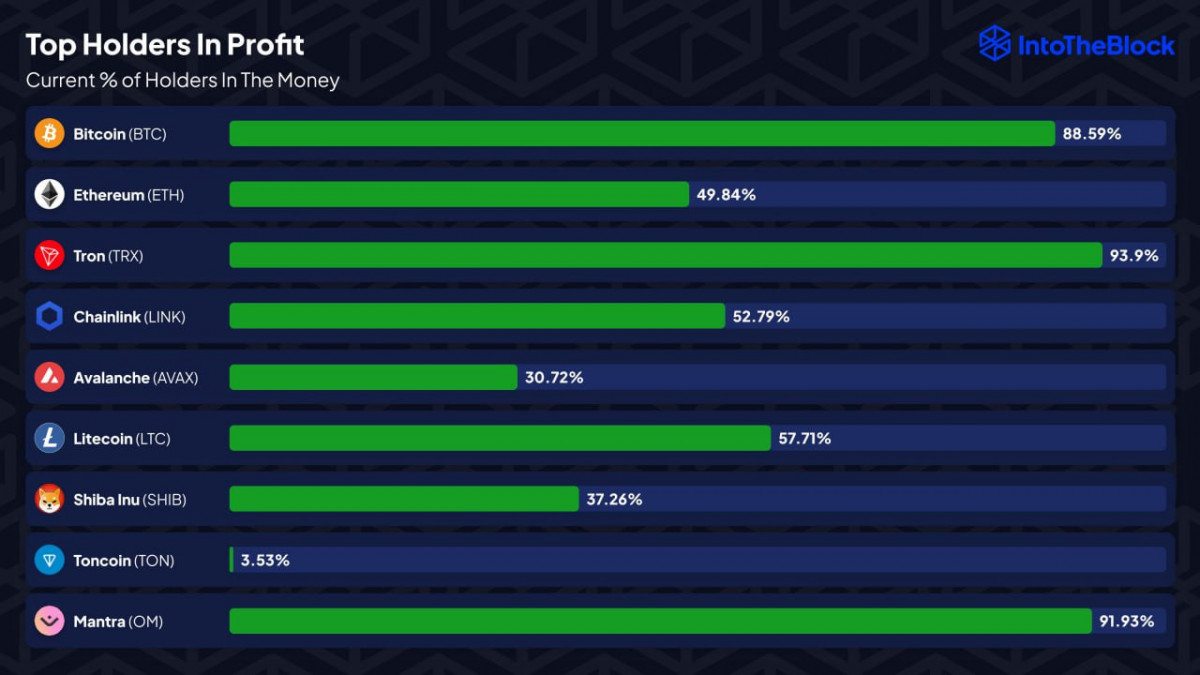

Supply: IntoTheBlock

Including to the bearish temper, solely about 3.5% of TON holders are at the moment in revenue — making it one of the vital underwater amongst main blockchains.

Lastly, there are some long-term performs brewing, like TON Ventures’ new AI and crypto analysis initiative, and even Telegram including paid DMs, which might tie again into the TON ecosystem. However proper now, the chart’s telling the actual story — and except Bitcoin finds its footing quickly, TON seems to be set to remain beneath stress, even when it’s primed for a short-term bounce on any broader market aid.

Disclaimer

In step with the Belief Undertaking pointers, please be aware that the knowledge supplied on this web page will not be supposed to be and shouldn’t be interpreted as authorized, tax, funding, monetary, or another type of recommendation. It is very important solely make investments what you’ll be able to afford to lose and to hunt impartial monetary recommendation in case you have any doubts. For additional data, we propose referring to the phrases and situations in addition to the assistance and help pages supplied by the issuer or advertiser. MetaversePost is dedicated to correct, unbiased reporting, however market situations are topic to alter with out discover.

About The Writer

Victoria is a author on a wide range of expertise matters together with Web3.0, AI and cryptocurrencies. Her intensive expertise permits her to jot down insightful articles for the broader viewers.

Extra articles

Victoria d’Este

Victoria is a author on a wide range of expertise matters together with Web3.0, AI and cryptocurrencies. Her intensive expertise permits her to jot down insightful articles for the broader viewers.