Alisa Davidson

Revealed: August 25, 2025 at 6:59 am Up to date: August 25, 2025 at 6:59 am

Edited and fact-checked:

August 25, 2025 at 6:59 am

In Temporary

Ethereum has outpaced Bitcoin in latest months, pushed by rising institutional curiosity and liquidity inflows whereas retail participation stays restricted.

Cryptocurrency market analyst CryptoMe from analysis agency CryptoQuant launched an replace noting that Ethereum has not too long ago outperformed Bitcoin. In keeping with the evaluation, over the previous three months, Ethereum’s positive factors have outpaced BTC, and this development could persist for a while.

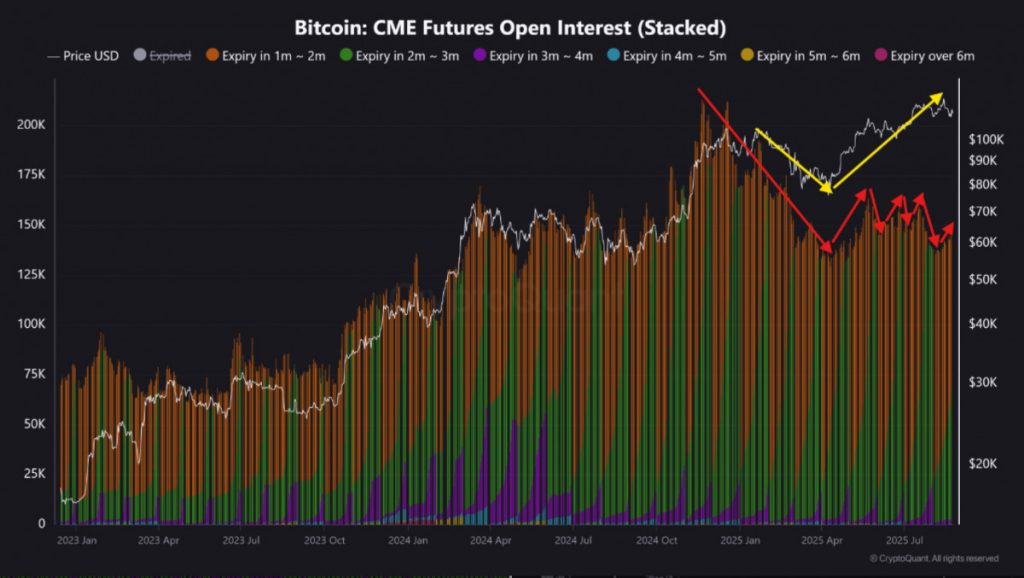

A comparability of Open Curiosity (OI) in Bitcoin and Ethereum futures on the CME, which incorporates hedge funds, institutional buyers, and enormous speculators, helps illustrate the distinction. For Bitcoin, regardless of reaching new all-time highs of $110,000 in January and $124,000 later within the yr, OI didn’t recuperate to earlier ranges, indicating that rising BTC costs haven’t attracted the identical degree of institutional curiosity in CME derivatives.

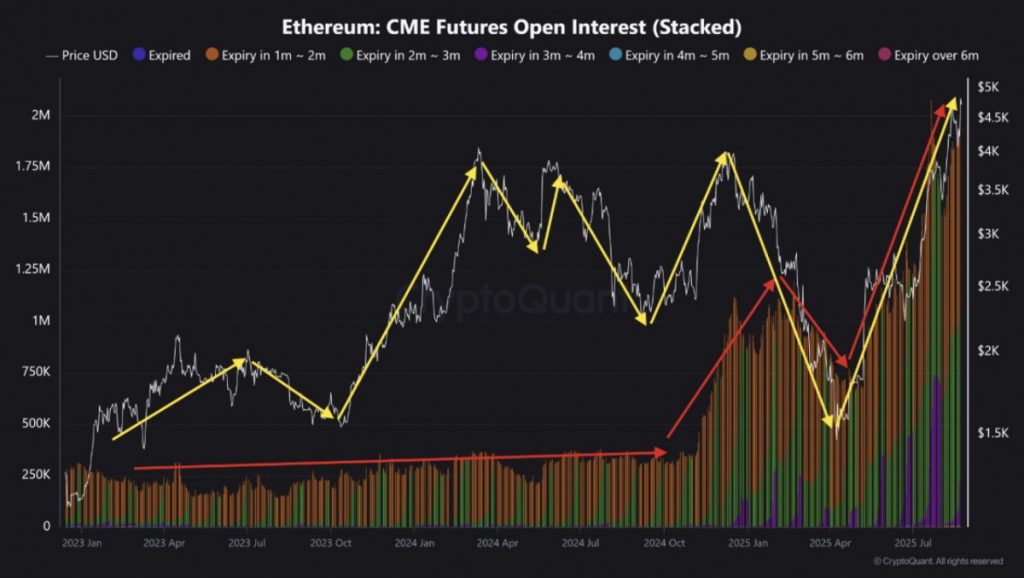

In distinction, Ethereum’s latest value enhance has been accompanied by a transparent rise in OI, signaling that its upward motion is supported by recent liquidity inflows. This means that Ethereum is starting to decouple from Bitcoin when it comes to market participation and institutional assist.

CryptoMe highlighted that CME Open Curiosity knowledge must be thought-about alongside CFTC Dedication of Merchants (CoT) experiences, with explicit consideration to filtering the positions of huge speculators. Even with out this adjustment, the general Open Curiosity presents a transparent image of market dynamics.

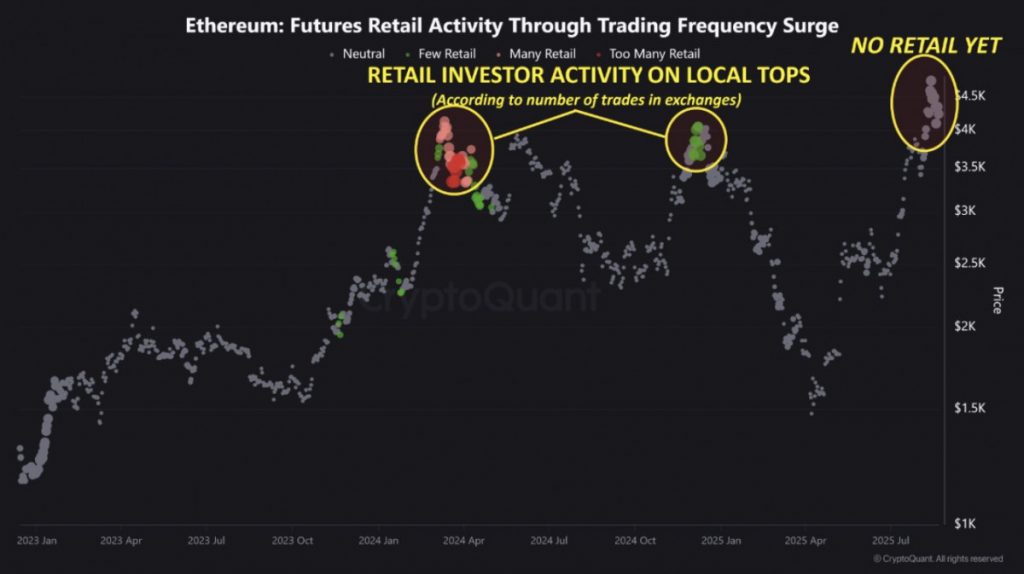

Moreover, knowledge from centralized exchanges signifies that retail buyers haven’t but considerably entered the market. Sometimes, retail exercise peaks close to market tops, offering exit liquidity for bigger individuals. Within the present rally, the absence of considerable retail involvement means that Ethereum’s upward motion is supported by stronger fundamentals and could also be thought-about extra sustainable.

Ethereum Surges 7% As Institutional Flows Shift From Bitcoin

As of this writing, Ethereum is buying and selling at $4,607, marking a 7.15% enhance over the previous 24 hours, with a excessive of $4,947 and a low of $4,080. In distinction, Bitcoin is buying and selling at $111,685, down 3.02% over the identical interval, reaching a excessive of $117,370 and a low of $111,479.

Bitcoin skilled a decline over the weekend following a quick rally, with analysts noting that enormous holders look like reallocating positions from Bitcoin to Ethereum. The latest drop comes after Bitcoin surged above $117,000 final Friday, a motion partially influenced by US Federal Reserve Chair Jerome Powell’s feedback at Jackson Gap concerning a possible rate of interest reduce in September.

Moreover, in latest weeks, institutional buyers have additionally proven a desire for Ethereum, with spot Ether ETFs seeing bigger inflows in comparison with Bitcoin ETFs, reflecting a broader development of capital shifting towards Ethereum.

Disclaimer

In step with the Belief Venture pointers, please observe that the knowledge offered on this web page will not be meant to be and shouldn’t be interpreted as authorized, tax, funding, monetary, or another type of recommendation. It is very important solely make investments what you may afford to lose and to hunt unbiased monetary recommendation if in case you have any doubts. For additional data, we recommend referring to the phrases and circumstances in addition to the assistance and assist pages offered by the issuer or advertiser. MetaversePost is dedicated to correct, unbiased reporting, however market circumstances are topic to alter with out discover.

About The Creator

Alisa, a devoted journalist on the MPost, focuses on cryptocurrency, zero-knowledge proofs, investments, and the expansive realm of Web3. With a eager eye for rising traits and applied sciences, she delivers complete protection to tell and have interaction readers within the ever-evolving panorama of digital finance.

Extra articles

Alisa Davidson

Alisa, a devoted journalist on the MPost, focuses on cryptocurrency, zero-knowledge proofs, investments, and the expansive realm of Web3. With a eager eye for rising traits and applied sciences, she delivers complete protection to tell and have interaction readers within the ever-evolving panorama of digital finance.