Apple inventory has rebounded over the previous couple of months, however has lagged the Magnificent 7 leaders. The Every day Breakdown dives deep.

Earlier than we dive in, let’s be sure to’re set to obtain The Every day Breakdown every morning. To maintain getting our every day insights, all you have to do is log in to your eToro account.

Deep Dive

Down over 7% up to now this 12 months, Apple is the second-worst-performing Magnificent 7 part of 2025, trailing solely Tesla. Regardless of this, Apple is one in all simply three corporations with a market cap of $3 trillion or extra, sitting behind Nvidia and Microsoft.

Nevertheless, Apple has discovered some momentum currently, rallying greater than 12% over the previous three months. Is that this an indication that Apple is again — or only a bounce after a flailing begin to the 12 months?

Digging Into the Enterprise

We all know Apple because the iPhone maker — and the corporate behind Macs, AirPods, iPads, and extra. Because of its huge success, which actually dates again to the iPod and Apple Music (keep in mind that?), Apple has constructed a fortress stability sheet and generates immense money circulate.

One drawback although? Development.

Whereas Apple has loved robust development through the years, income and revenue development have struggled during the last a number of years. That has compelled some buyers to search for development in different areas — for example, with shares like Amazon and Nvidia — even when which means accepting extra volatility.

Dangers and Alternatives

After we have a look at the valuation, Apple trades at slightly below 30x ahead earnings. That is costlier than the general market, however bulls argue that Apple nonetheless deserves a premium. As for whether or not it’s costly or low-cost primarily based by itself historic vary, Apple inventory sits someplace in between. During the last 5 years, shares have sometimes been thought of “low-cost” at round 22x to 25x earnings and “costly” above 32x.

Buyers at the moment are turning their consideration to Apple’s merchandise, with an iPhone refresh due within the coming months and a rising concentrate on AI.

AI developments had been anticipated to raise the consumer expertise, however delays have left each buyers and clients questioning whether or not Apple can ship. Buyers can nonetheless anticipate a gradual stream of upgrades through the years — together with new iPhones, iPads, Macs, and extra — but it surely’s the AI part they’re most desirous to see take form.

The corporate is reportedly engaged on “an bold slate of recent units, together with robots, a lifelike model of Siri, a sensible speaker with a show, and home-security cameras,” in accordance to Bloomberg.

After all, there are dangers to this strategy — together with delays, merchandise that fail to launch, or disappointing buyer reactions. Buyers should weigh Apple’s traditionally robust enterprise towards their expectations for future income and revenue development.

Wish to obtain these insights straight to your inbox?

Enroll right here

Digging Deeper — Apple’s Companies Enterprise

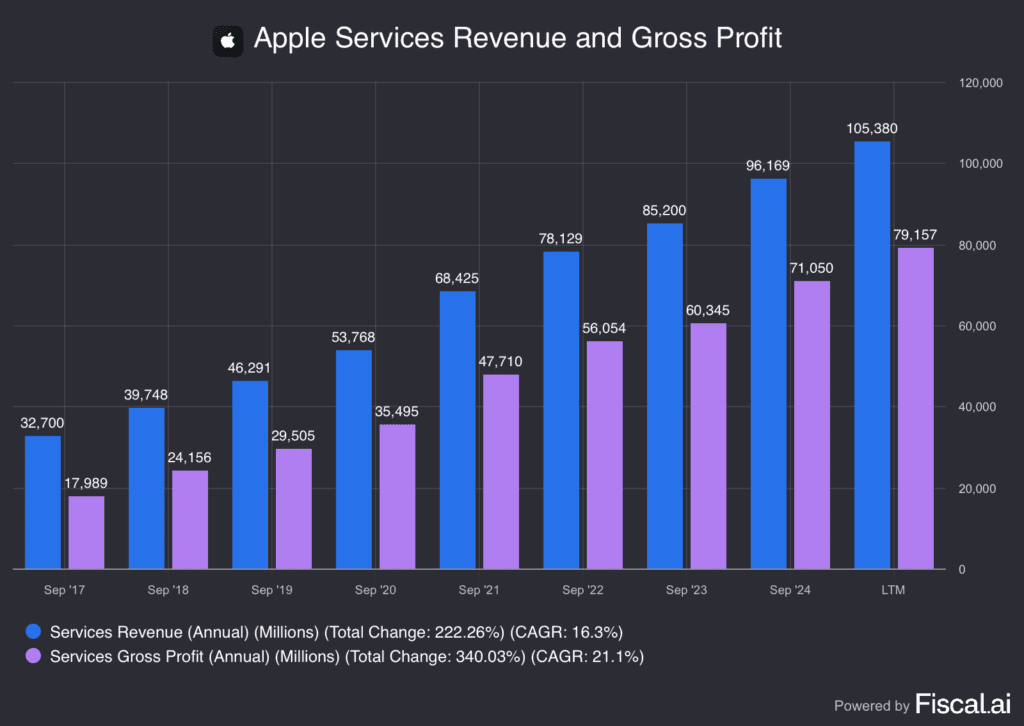

Apple’s {hardware} enterprise could also be trying to find new development shops, however its Companies enterprise — which incorporates the App Retailer, Apple Music, iCloud, Apple Pay, and extra — continues to hum alongside properly.

Income continues to develop at a stable tempo, whereas gross earnings — which command 75% gross margins and are greater than double the margins achieved with its Merchandise enterprise — additionally proceed to develop. So regardless that it’s a a lot smaller income footprint, this section makes up greater than 40% of gross revenue and continues to develop at a gradual clip.

That is one motive (of a number of) why Apple has been capable of stay so dedicated to its huge share repurchase plan, which elevates its earnings per share — (regardless of gradual revenue development, a shrinking share depend permits earnings per share to extend).

What Wall Avenue’s Watching

TGT

Shares of Goal are underneath strain this morning, down nearly 10% after the retailer reported earnings. The corporate beat on earnings and income estimates, however gross sales stay underneath strain. Additional, CEO Brian Cornell introduced he’s stepping down and being changed by COO Michael Fiddelke. Goal inventory pays a dividend yield north of 4.3%.

HTZ

Hertz inventory is rallying on experiences that it’ll promote used automobiles on-line by way of a partnership with Amazon Autos. Prospects who reside inside 75 miles of 4 main cities — Dallas, Houston, Los Angeles and Seattle — will be capable of use the brand new service. HTZ inventory is up greater than 40% 12 months to this point.

Disclaimer:

Please be aware that as a consequence of market volatility, a few of the costs might have already been reached and eventualities performed out.