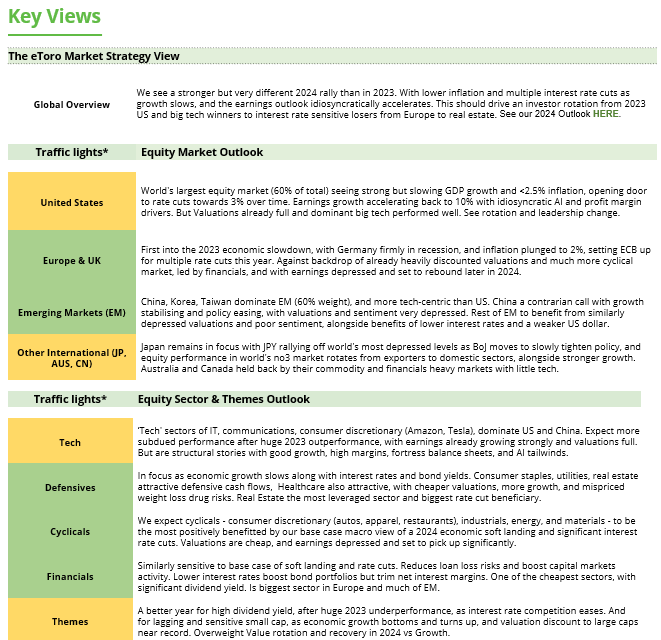

Please see this week’s market overview from eToro’s world analyst workforce, which incorporates the most recent market information and the home funding view.

Threat urge for food continues amid market beneficial properties

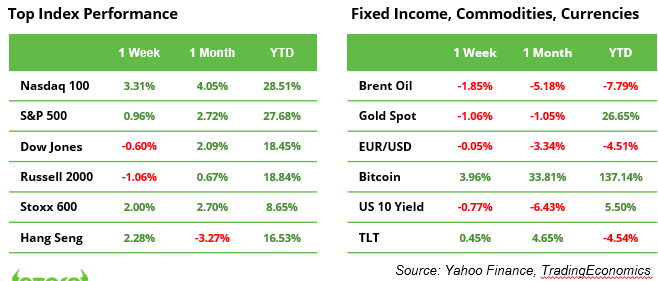

Final week noticed a continued urge for food for threat, with the Nasdaq 100 rising 3.3%, the S&P 500 hitting a file excessive of 6,090, and Bitcoin lastly surpassing the $100,000 mark. Investor sentiment was bolstered by a powerful November jobs report, which confirmed the U.S. added 227K jobs (October: 36K) and unemployment fell to 4.2%. The market’s main focus this week would be the ECB charge resolution on Thursday. Analysts are divided between a 25 or 50 foundation level reduce. In the meantime, within the U.S., the inflation report (CPI) will present the ultimate information level earlier than the Fed’s assembly subsequent week, the place markets are pricing in an 83% probability of a 25 foundation level reduce.

Regardless of elevated fairness valuations and hovering cryptocurrency costs, promoting stress within the present market seems restricted. Many anticipated dangers haven’t materialised, together with chaos across the U.S. elections, escalating geopolitical tensions, main cybersecurity breaches, vital local weather disasters, or a client spending slowdown. Nevertheless, dangers stay. Essentially the most speedy concern seems to be the potential for an additional European debt disaster.

Santa rally: buyers really feel validated

December is historically a powerful month for inventory markets, with the so-called “Santa rally“, a seasonal rise in costs, changing into a globally recognised phenomenon. In line with our evaluation, Hong Kong and the UK (see chart) current one of the best alternatives for above-average beneficial properties.

Notably, December accounts for a good portion of annual returns in some areas. Italy leads the pack, with the month contributing a formidable 39% of yearly beneficial properties. The UK follows intently at 36%, whereas Japan information 32%. Europe additionally performs effectively, averaging 29%, although the US lags behind, with December including simply 16% to annual returns.

Though previous efficiency isn’t any assure of future outcomes, the info means that investing throughout December will be rewarding. Traders who keep their positions in the course of the vacation season might profit from these seasonal tendencies, at the same time as annually brings distinctive challenges.

Present uncertainties embrace Trump’s unpredictable commerce insurance policies, sluggish financial progress in Europe and China, and political turmoil in international locations like France and Germany. But, the rally continues regardless of these dangers. Investor confidence stays excessive: the S&P 500 volatility index dropped to just about 13, whereas the DAX climbed a formidable 4% final week.

ECB charge resolution: Trump provides uncertainty to the combo

So the year-end rally is gaining momentum, with the DAX posting its strongest beneficial properties since September. This week, the European Central Financial institution (ECB) holds the important thing to figuring out the market’s subsequent strikes. Its resolution may both lengthen the rally or carry it to a sudden halt.

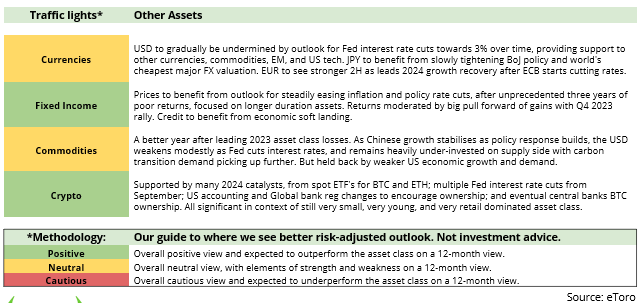

Because the ECB continues its rate-cutting cycle, the first query stays: how a lot decrease will charges go? A transparent roadmap is unlikely to emerge from this assembly, as ECB President Christine Lagarde is anticipated to sidestep addressing essentially the most urgent points. Traders ought to mood their expectations for concrete steerage.

Including additional complexity is the unpredictable issue of Donald Trump. Doubtlessly greater tariffs may have an inflationary impact, creating extra challenges for policymakers. Trump’s commerce insurance policies stay a major wildcard in an already unsure financial panorama. In consequence, the ECB might decide to purchase extra time to evaluate the broader financial influence earlier than committing to additional actions.

A 25 foundation level charge reduce appears probably, with markets anticipating a drop within the benchmark charge to 1.75% by the tip of 2025. Such a transfer may ignite a virtuous cycle: elevated lending, greater funding, and rising consumption might present a sustainable enhance to financial progress, even amid persistent uncertainties.

Upcoming: eToro’s annual funding outlook 2025

This week, eToro’s workforce of market analysts will launch its annual funding outlook. As a part of the Digest & Make investments collection, an in depth YouTube video (additionally obtainable as a podcast) will spotlight key takeaways for 2024, main market drivers anticipated in 2025, and in-depth analyses of Europe and the U.S. The report will even embrace an up to date funding outlook for all main asset courses and have insights from a world ballot of over 3,000 retail buyers. Don’t miss this complete information to navigating the markets within the yr forward!

Information releases and earnings studies

Macro information:

U.S. CPI (11/12), ECB financial coverage assembly + speech Lagarde (12/12)

Earnings:

Oracle (9/12), Gamestop (10/12), Adobe (11/12), Broadcom, Costco (12/12)

This communication is for info and schooling functions solely and shouldn’t be taken as funding recommendation, a private suggestion, or a proposal of, or solicitation to purchase or promote, any monetary devices. This materials has been ready with out considering any specific recipient’s funding aims or monetary scenario and has not been ready in accordance with the authorized and regulatory necessities to advertise unbiased analysis. Any references to previous or future efficiency of a monetary instrument, index or a packaged funding product aren’t, and shouldn’t be taken as, a dependable indicator of future outcomes. eToro makes no illustration and assumes no legal responsibility as to the accuracy or completeness of the content material of this publication.