Purpose to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade specialists and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

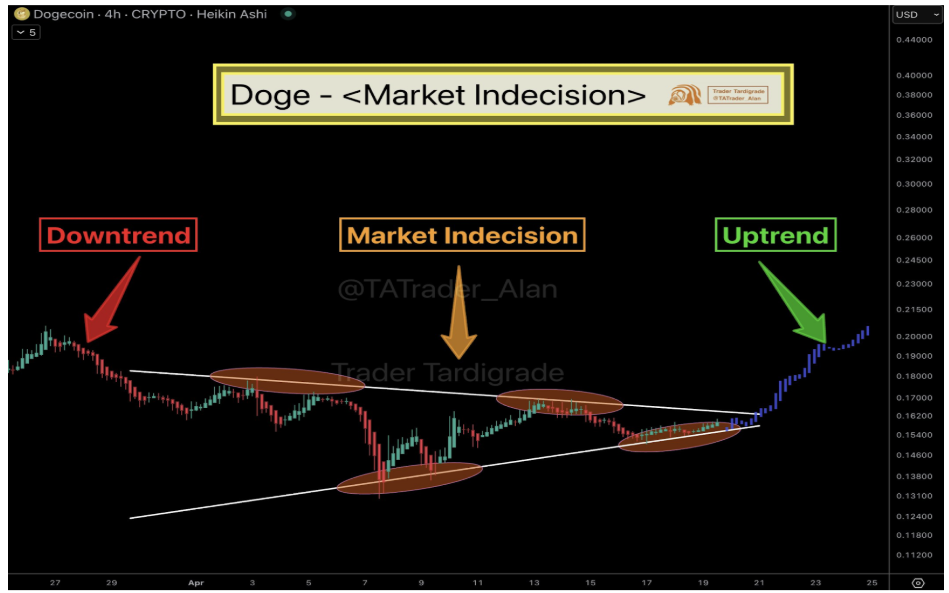

Dogecoin has been buying and selling in a decent vary currently, with its worth motion more and more narrowing over the previous few days between $0.15 and $0.16. This more and more narrowing vary comes off a wider draw back consolidation transfer for the reason that starting of April, which has led to the creation of a triangle sample on the 4-hour candlestick timeframe chart.

Associated Studying

Because it stands, Dogecoin is attempting to get better from earlier losses in April, and a current increased low factors to rising bullish exercise that would ship it pushing above the higher trendline of the triangle sample within the coming week.

Analyst Notes Traditional Market Indecision In Dogecoin Construction

Crypto analyst Dealer Tardigrade just lately introduced consideration to Dogecoin’s present worth construction in a submit shared on the social media platform X, noting a converging triangle formation that displays rising indecision available in the market.

In accordance with his evaluation, Dogecoin’s worth motion has transitioned from a transparent downtrend (seen all through late March and increasing into the primary week of April) right into a state of consolidation that has continued over the previous two weeks.

Trying on the ensuing triangle formation on the 4-hour candlestick timeframe chart, it’s simple to deduce that each patrons and sellers are exercising warning. Patrons are reluctant to enter at increased ranges, whereas sellers appear unwilling to push costs decrease, making a narrowing band of worth motion since April 15. The result’s a compression of volatility, which may get away in both path.

Picture From X: Dealer Tardigrade

Picture From X: Dealer Tardigrade

What Comes After The Indecision Section?

As proven within the Dogecoin worth chart above, the memecoin is now approaching the tip of the triangle. On this explicit case, the construction leans towards a bullish breakout, with market conduct exhibiting indicators of upward strain constructing beneath the floor by a 2.77% enhance in buying and selling quantity previously 24 hours.

Dealer Tardigrade projected an uptrend that cancels out the downtrend in late March, following the basic sample of a downtrend, indecision, and a ensuing uptrend.

A robust bullish candle that closes above the higher trendline of the triangle is essential to validate the anticipated uptrend. Dealer Tardigrade’s projection reveals that if such a transfer happens, Dogecoin may reclaim the $0.20 degree inside a comparatively quick timeframe earlier than the tip of the month.

Dogecoin opened the month of April at $0.166. As such, a clear upside breakout adopted by a sustained shut above $0.20 would mark a constructive end for Dogecoin in April.

Associated Studying

Such a constructive month-to-month shut would seemingly affect market sentiment heading into Could and presumably invite elevated shopping for exercise. It could additionally assist verify that the current interval of bearishness is over and assist reestablish a bullish construction.

On the time of writing, Dogecoin was buying and selling at $0.1573

Featured picture from 21Shares, chart from TradingView