Knowledge reveals Bitcoin has misplaced curiosity to Ethereum and altcoins lately as their mixed futures quantity has damaged previous the 85% mark.

Ethereum & Altcoins Have Seen Their Futures Quantity Rise Just lately

In a brand new submit on X, CryptoQuant neighborhood analyst Maartunn has talked concerning the newest pattern within the futures buying and selling quantity share of Ethereum and the altcoins. The futures buying and selling quantity right here naturally refers back to the quantity that’s changing into concerned in futures-related trades on the varied derivatives exchanges.

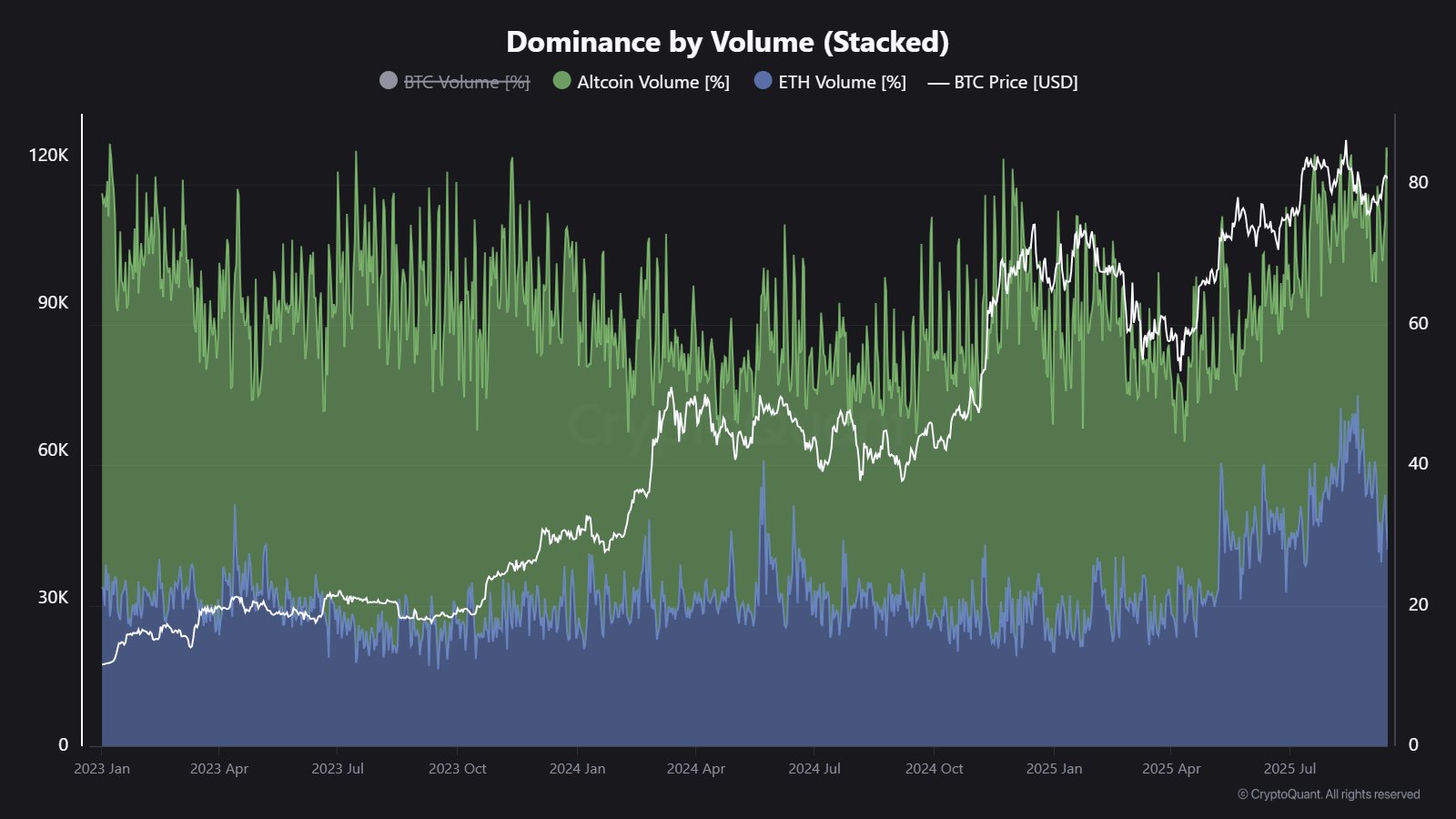

Under is the chart shared by Maartunn that reveals the pattern within the dominance on this metric for ETH and the alts over the past couple of years:

The worth of the indicator seems to have gone up for each of those belongings in current days | Supply: @JA_Maartun on X

As is seen within the graph, the futures buying and selling quantity dominance has seen a pointy enhance for the altcoins lately, implying that speculative curiosity in these cash has gone up.

The metric continues to be considerably down for Ethereum in comparison with its earlier excessive, nevertheless it has nonetheless additionally loved an uptick similtaneously the altcoin development.

Mixed, ETH and the alts occupy round 85.2% of the full cryptocurrency futures buying and selling quantity following the rise. Which means that the remaining portion, Bitcoin, has gone under 15% in dominance.

Traditionally, intervals like these have been a nasty omen for not simply BTC, however the market as an entire. Examples of those are seen within the chart throughout each the late 2024 and Summer time 2025 worth tops.

Thus, contemplating that Ethereum and the altcoins are as soon as once more dominating futures buying and selling exercise, it’s potential that Bitcoin and different belongings could also be in for some volatility.

In another information, on-chain analytics agency Santiment has shared in an X submit an replace on how the varied initiatives within the digital asset sector rank up when it comes to the Improvement Exercise. This indicator measures the full quantity of labor that the builders of a given undertaking are doing on its public GitHub repositories.

The metric makes its measurement in items of “occasions,” the place one occasion is any motion taken by the developer on the repository, just like the push of a commit or creation of a fork.

Right here is the desk posted by Santiment that reveals the rating for cryptocurrency initiatives on the premise of their 30-day Improvement Exercise:

Appears like ICP has maintained its place on the prime | Supply: Santiment on X

As displayed above, Ethereum is just the tenth largest undertaking when it comes to 30-day Improvement Exercise, regardless of its market cap being second solely to Bitcoin. The undertaking that’s seeing its builders work the toughest proper now’s Web Pc (ICP), which has the metric sitting at a price practically 3 times that of ETH’s.

ETH Worth

Ethereum recovered above $4,750 earlier, nevertheless it appears the asset’s worth has as soon as once more confronted a pullback because it’s now again at $4,450.

The pattern within the worth of the coin over the past 5 days | Supply: ETHUSDT on TradingView

Featured picture from Dall-E, Santiment.web, CryptoQuant.com, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent assessment by our group of prime expertise consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.