Motive to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business consultants and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Ethereum is displaying spectacular resilience because it continues to carry above important ranges regardless of ongoing market volatility. Whereas Bitcoin struggles to interrupt previous its all-time highs, ETH stays secure, sustaining bullish construction and fueling hopes for a broader altcoin rally. Analysts throughout the market are eyeing a possible altseason, with Ethereum anticipated to steer the cost as soon as it clears main provide zones.

Associated Studying

Nonetheless, the highlight is shifting to a much less mentioned however extremely vital chart—ETHBTC. Based on high analyst Daan, the ETHBTC pair has been consolidating in a decent vary between 0.022 and 0.026 because the final squeeze. This consolidation suggests a interval of accumulation and diminished volatility, but it surely additionally acts as a vital sign for altcoin momentum.

If ETHBTC breaks above the 0.026 resistance stage, Daan suggests it may set off a short lived however highly effective rally in ALT/BTC pairs. Sectors intently tied to Ethereum—equivalent to DeFi protocols, ETH-based memecoins, and Layer 2 ecosystems—may gain advantage most from such a transfer. Till then, buyers are intently monitoring ETH’s efficiency relative to BTC, because it stays probably the most dependable indicators of capital rotation throughout the crypto market.

ETHBTC Chart Turns into Key to Altseason Outlook

Ethereum is presently buying and selling at a pivotal vary, with buyers intently waiting for a breakout that would result in new highs and doubtlessly ignite the long-anticipated altseason. Regardless of international tensions and continued macroeconomic uncertainty—significantly surrounding the aggressive and unstable Bond market—ETH has remained comparatively robust. Bulls are optimistic, viewing the present consolidation as a wholesome pause earlier than the subsequent leg up.

One of the vital vital alerts for altcoin momentum isn’t discovered on the USD chart, however within the ETHBTC pair. Daan factors out that Ethereum’s worth relative to Bitcoin has been consolidating between the 0.022 and 0.026 BTC vary because the latest squeeze. This vary now acts as a stress level for the market. A breakout above 0.026 would seemingly catalyze a surge in altcoin energy, particularly amongst Ethereum-related belongings like DeFi protocols, ETH-based memecoins, and Layer 2 options.

Nonetheless, Daan warns that if ETHBTC drops beneath 0.0224, it may sign weak spot for alts relative to BTC. It’s vital to keep in mind that ALT/BTC pairs can fall even when altcoin USD costs rise, significantly throughout aggressive BTC rallies. The identical applies in reverse. For now, ETH’s place on this vary stays probably the most telling indicators of the place the broader crypto market would possibly head subsequent.

Associated Studying

Ethereum Faces Resistance As Bulls Try Breakout

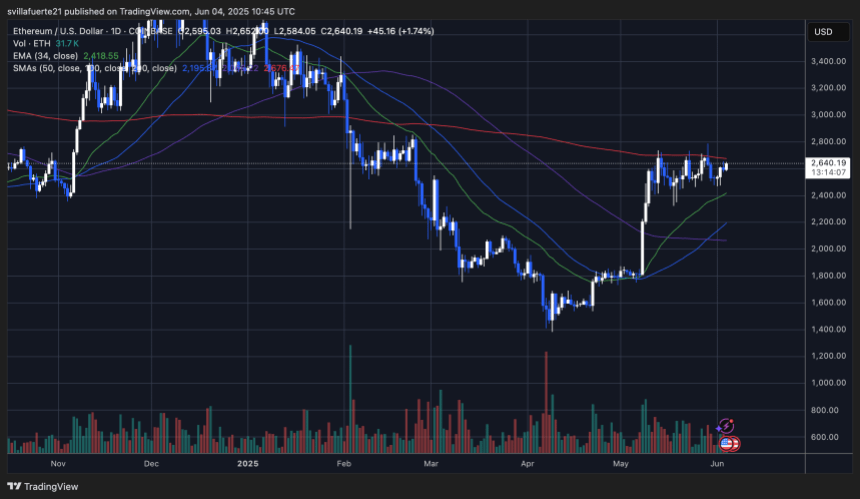

Ethereum (ETH) is presently buying and selling round $2,640, displaying indicators of energy after holding its floor above the $2,500 mark. On the each day chart, ETH is forming a transparent consolidation sample just under a key resistance zone outlined by the 200-day transferring common (presently at $2,676). This stage has repeatedly capped worth motion over the previous few weeks, signaling robust provide stress on this space.

Regardless of the dearth of a decisive breakout, Ethereum is sustaining a bullish construction with increased lows and constant quantity help. The 34-day EMA has turned upward and presently sits at $2,418, offering dynamic help and reinforcing the short-term uptrend. If ETH can reclaim the 200-day SMA and push above $2,700, a broader rally may observe, doubtlessly opening the trail towards $3,000 and past.

Associated Studying

On the draw back, if worth fails to interrupt this resistance and sellers take management, quick help lies close to $2,500, adopted by stronger demand round $2,350–$2,400 the place the 50- and 100-day SMAs converge. For now, Ethereum stays in a balanced state, displaying resilience, however nonetheless wants a powerful catalyst to beat the technical ceiling that continues to stall upward momentum.

Featured picture from Dall-E, chart from TradingView