Motive to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business consultants and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

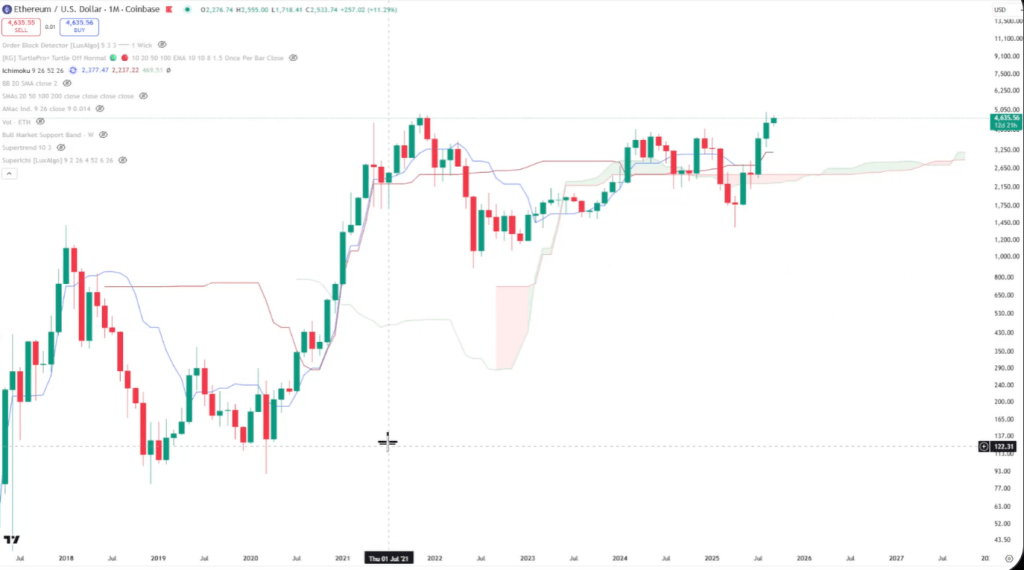

Ethereum is approaching a decisive section that would carry it into five-figure territory, in keeping with a multi-timeframe evaluation from dealer Cantonese Cat (@Cantonmeow).

Ethereum Prepared To Smash All-Time Highs

In a video printed at present, the analyst argues that ETH has cleared a cluster of late-cycle resistances and is now exhibiting a confluence of technical alerts—on month-to-month, weekly, every day, and intraday charts—that “favor a few of the greater targets to be met, possibly 1.272, 1.414, 1.618, anyplace round doubtlessly 5 figures.” These Fib ranges would put ETH at $7,752, $9,883 and $14,011 respectively.

On the month-to-month chart, the analyst facilities his case on the log-scale Fibonacci construction and volatility regime. ETH, he says, spent months stalling across the 0.886 retracement close to $4,000—the identical zone that repeatedly repelled the market in prior makes an attempt—however “final month, we had the break by that right here, convincingly.”

Associated Studying

He notes that the wick of the newest push already poked above the wick from the November 2021 peak, reinforcing the concept that provide on the former high is thinning. Concurrently, the month-to-month Bollinger Bands are increasing whereas worth “is impulsively going to the upside right here together with the higher Bollinger Band,” a backdrop he describes as in line with development acceleration quite than imply reversion. “It does favor a few of the greater targets to be met,” he stated, whereas stressing sequencing: “We have to type of break above the earlier all-time excessive right here first earlier than we will truly discuss transferring additional up.”

A second pillar of the bullish thesis is the Ichimoku profile throughout cycles—particularly the fusion of Tenkan-sen (conversion line) and Kijun-sen (final analysis). “When you may have the Tenkan and Kijin fused collectively and worth is driving up together with it, this fusion over right here is named Katana,” he defined. Traditionally, he stated, this “precipitates an enormous transfer,” and with worth now above the Katana, “the Katana is taking pictures the value up.” On the present construction: “We obtained a Katana right here being constructed up and worth is at the moment impulsively going to the upside, in order that can also be favorable for Ethereum.”

On the weekly timeframe, Cantonese Cat frames ETH’s advance by a three-cycle template outlined by a “cycle liquidity zone” appearing as a pivot. Every prior cycle noticed deviations above and under a governing development line earlier than a sustained transfer as soon as the zone was recaptured. He locations the current consolidation straight on that blueprint: after breaking the “$4,000 liquidity stage,” ETH is “consoling sideways… looking for some vitality earlier than breaking apart greater.” A back-test is feasible however not required, he stated; the “main case” stays continuation until the chart invalidates.

Decrease Timeframe Indicators

The decrease timeframes, in his view, are already aligning with that end result. On the every day chart, he highlights a growing “Adam and Eve continuation sample” nested inside a basic cup-and-handle, the place “the deal with… quantity just isn’t that nice,” which he views as textbook, adopted by “a fairly first rate quantity bullish engulfing candle.”

Measured towards log-scale retracements, worth was rejected at 0.786, discovered assist at 0.5, and is now “attempting to interrupt by 0.6… work our means again… to 0.786,” a rhythm he says “is being revered fairly decently.” He additionally factors to a short-term bottoming sequence—“you possibly can see one thing referred to as a tweezer backside… when you’ve got anyplace round two or three of those type of wick sticking down like that, that’s often a fairly first rate backside”—and a three-candle “morning star” reversal: “It’s a reversal sample and it may find yourself resulting in a reversal right here… appears to be understanding fairly nicely.”

Associated Studying

On the 12-hour chart, he reads the construction as reaccumulation in a Wyckoff sense, referencing the “rounded backside,” a strengthening secondary take a look at—“the ST is greater than the VCLX”—and the emergence of a “creek” overhead that worth seems able to vault. “It does seem like a reaccumulation kind sample… exhibiting some power… consolidating sideways… to reaccumulate earlier than [a] bullish continuation,” he stated, including that after the prior vertical leg, digestion at elevated ranges is constructive.

Relative-strength diagnostics, he argues, reinforce the ETH-led narrative. Ethereum’s market-share gauge (ETH.D) “has damaged above the Ichimoku cloud… with power,” then “back-tested the cloud for about 4 weeks,” and could also be ready for the Tenkan to “rise… as assist” earlier than the subsequent leg. On a month-to-month volatility foundation, he provides, “the 20-month transferring common was reclaimed… and we merely spent a month right here back-testing” it—proof that dominance may development greater if the back-test holds. “That’s principally that means that Ethereum desires to proceed to outperform the remainder of the cryptocurrency market right here for [the] foreseeable future,” he stated.

Breadth indicators outdoors of ETH additionally tilt risk-on in his framework. The Total3 index (complete crypto market cap excluding Bitcoin and Ethereum) is “attempting to interrupt above and kind an all-time excessive” on a month-to-month “cup and deal with” construction, whereas the “Others” index (market cap excluding the highest 10 cash) has punched by the 0.786 stage on the weekly and is “gravitat[ing]… to the subsequent stage, the 0.886.”

He emphasizes the excellence between log and linear retracements, noting a failed linear 0.886 breakout in a previous try: “If we have been to interrupt above the linear, in addition to the log 0.886 right here with fashion, then I believe Others would find yourself performing extraordinarily nicely and would find yourself following the footsteps of Ethereum.” His conclusion is unambiguous: “I’m bullish on Ethereum. I’m bullish on altcoin. I’m bullish on the cryptocurrency market area normally.”

At press time, ETH traded at $4,565.

Featured picture created with DALL.E, chart from TradingView.com