Be a part of Our Telegram channel to remain updated on breaking information protection

The Ethereum worth soared 9% within the final 24 hours to commerce at $4,175 as of 4:03 a.m. EST on buying and selling quantity that surged 29% to $56.6 billion.

With the current acquire, the ETH worth reclaimed the $4,100 degree, bouncing again after the Oct. 10 flash crash that despatched the token to as little as $3,686.

The surge occurred as retail buyers rushed to purchase the dip.

Amid the surge, Steak ‘n Shake reversed course on a possible plan to just accept Ether funds after a number of Bitcoiners balked on the concept of the quick meals chain increasing past Bitcoin.

The meals chain firm carried out a ballot on X, asking its over 468k followers whether or not it ought to settle for Ether on Saturday, promising to “abide by the outcomes of the ballot.”

Ought to Steak n Shake settle for ETH funds? We are going to abide by the outcomes of this ballot.

— Steak ‘n Shake (@SteaknShake) October 11, 2025

On the outcomes, 53% of the over 48k votes went for sure. Nevertheless, Steak ‘n Shake suspended the ballot after 4 hours as a result of backlash from the Bitcoin neighborhood.

“Ballot suspended. Our allegiance is with Bitcoiners. You’ve gotten spoken,” it mentioned on X.

Steak n’ Shake began accepting Bitcoin as fee on Might 16 in all of its places the place permitted by legislation, together with the US, France, Monaco, and Spain.

Ethereum Value Holds Assist, Goals For A Large Rally

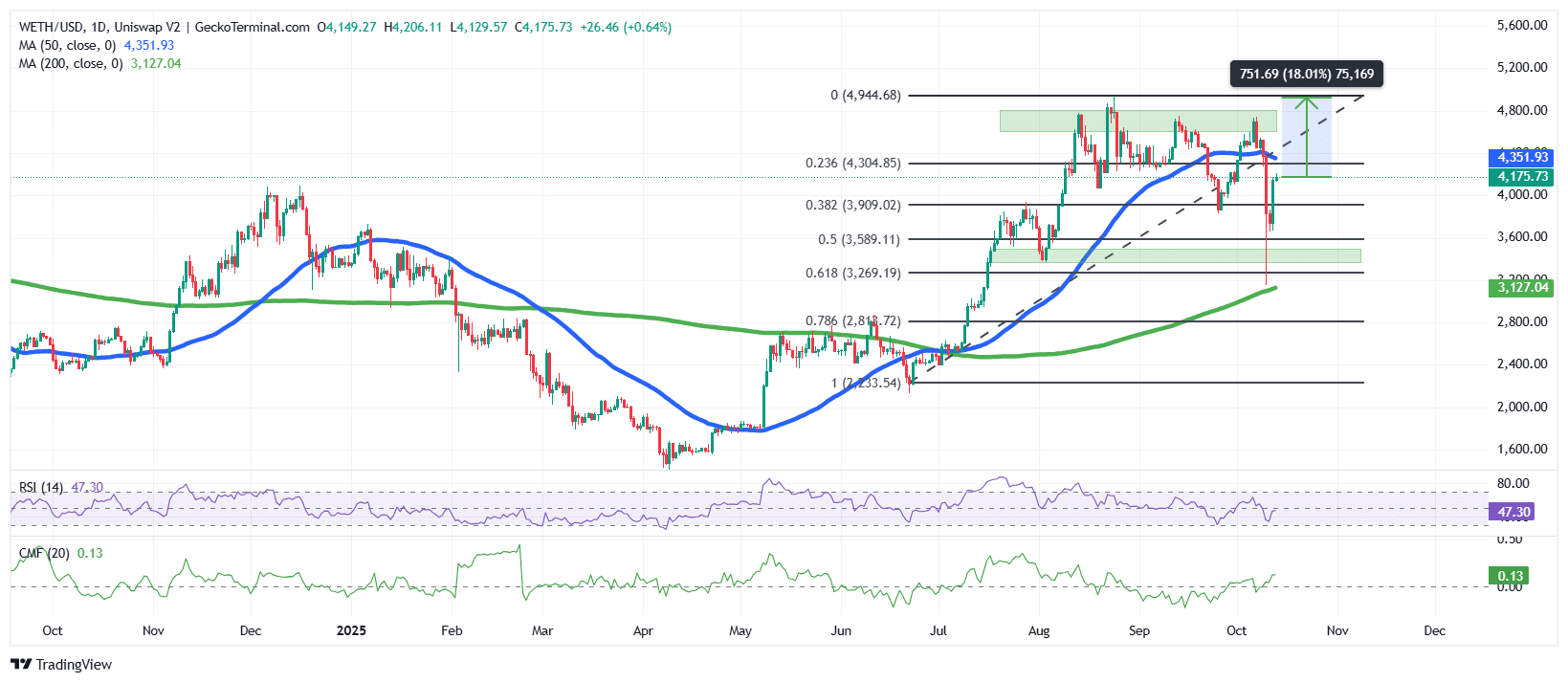

The ETH worth, after touching its all-time excessive (ATH) at $4,946 in August, has been holding properly the $4,800 resistance and the $3,909 help, as proven on the every day chart.

The current crash drove the Ethereum worth under its sustained help degree, which, in keeping with the Fibonacci retracement ranges, discovered a stronger help between the 0.5 fib degree ($3,589) and the 0.382 fib degree ($3,909). This help allowed the value of ETH to soar again above the 0.5 Fib degree, because it targets to maneuver above the 0.236 Fib degree ($4,304).

In the meantime, main indicators additionally help the bullish outlook for ETH.

Regardless of the current crash, Ethereum has held sturdy above the 200-day Easy Transferring Common (SMA), which is an indication that the bullish sentiment remains to be holding sturdy. The restoration can be pushing again the value of ETH close to the 50-day SMA, presently appearing as rapid resistance at $4,351.

Furthermore, the Relative Power Index (RSI) appears to be rebounding from the 30-oversold ranges, presently at 47 and climbing, an indication that patrons are taking management and will push it to increased ranges.

CMF Alerts Shopping for Curiosity, ETH Value Eyes ATH

In accordance with the ETH/USD every day chart evaluation, the ETH worth appears to be rebounding in direction of a powerful rally that might push the value increased.

The present CMF studying of 0.13 signifies reasonable shopping for strain, exhibiting that capital is flowing into the market after current weak spot. This means accumulation is happening, with patrons progressively regaining management.

If the bulls maintain the present momentum, the value of Ethereum may proceed surging, first clearing the 0.236 Fib degree and the 50-day SMA, because it goals to soar to the earlier ATH round $4,940.

Ali Martinez believes that the present setup may push the ETH worth to the resistance round $4,500 within the brief time period.

BULL-ive! $ETH pic.twitter.com/91T3pa0e86

— Ali (@ali_charts) October 12, 2025

Nevertheless, if the bears exert some strain right here, the 0.5 Fib degree at $3,589 nonetheless acts as a possible cushion in opposition to downward strain.

Associated Information:

Greatest Pockets – Diversify Your Crypto Portfolio

Simple to Use, Characteristic-Pushed Crypto Pockets

Get Early Entry to Upcoming Token ICOs

Multi-Chain, Multi-Pockets, Non-Custodial

Now On App Retailer, Google Play

Stake To Earn Native Token $BEST

250,000+ Month-to-month Lively Customers

Be a part of Our Telegram channel to remain updated on breaking information protection