Victoria d’Este

Revealed: March 31, 2025 at 3:32 am Up to date: April 01, 2025 at 3:35 am

Edited and fact-checked:

March 31, 2025 at 3:32 am

In Temporary

Bitcoin stumbles, Ethereum struggles, however Toncoin shines as markets chop sideways, with macro uncertainty retaining merchants on edge forward of April’s key occasions.

Alright, we’re wrapping up March with a market that feels… itchy. Prefer it desires to maneuver, however doesn’t fairly know the place. Bitcoin’s taken a spill, Ethereum’s barely retaining it collectively, and Toncoin – weirdly – is simply doing its personal factor. There’s no clear development, no euphoric prime, no panic capitulation. Simply chop, tariffs, and quite a lot of scorching takes.

Let’s break it down.

Bitcoin (BTC): ~$81.9K and clinging on

BTC dropped from $88K to a low of $81.5K, and whereas it bounced a bit, it’s nonetheless hovering close to the lows like a boxer hanging off the ropes. Not knocked out, however undoubtedly winded.

BTC/USDT 4H Chart, Coinbase. Supply: TradingView

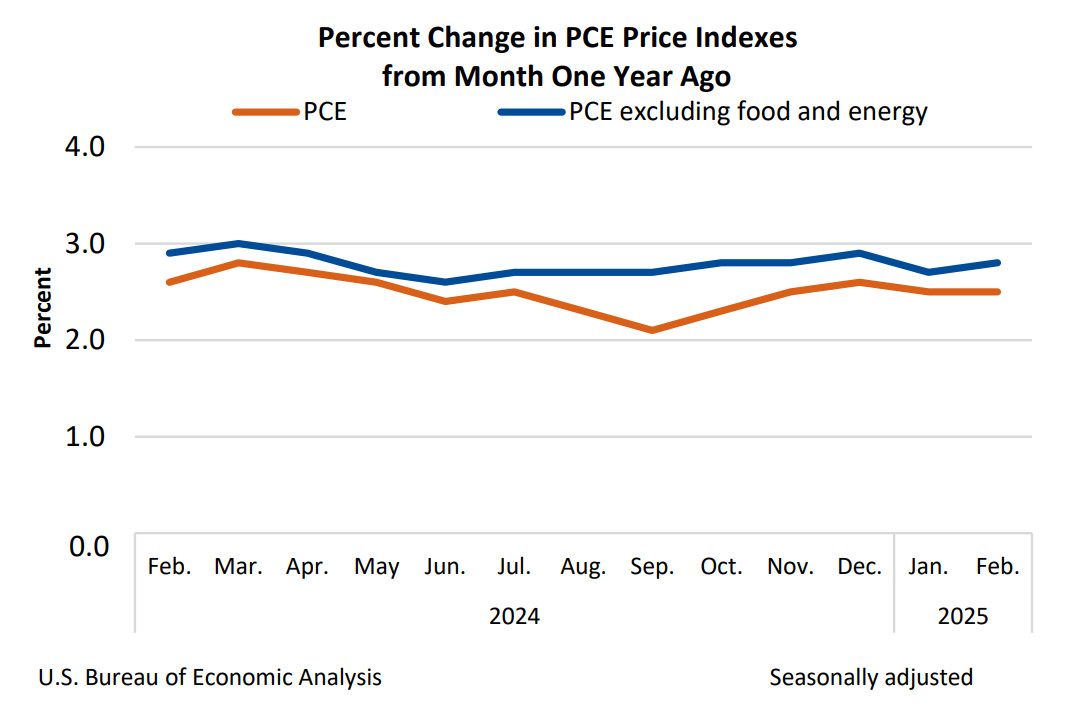

So what occurred? Principally, macro threw a wrench into the works – once more. Trump’s “Liberation Day” tariffs at the moment are looming over April 2 like an enormous stormcloud. That’s obtained merchants spooked throughout equities and crypto alike, particularly with the PCE inflation knowledge coming in scorching. A lot for early charge cuts, huh?

US PCE % change (screenshot). Supply: Bureau of Financial Evaluation

However right here’s the trick: it seems to be like nobody’s panicking. In actual fact, MARA’s gearing as much as elevate $2B to purchase extra BTC (as a result of apparently we’re within the period of Bitcoin-powered treasury methods).

Supply: MARA Holdings

In the meantime, Arthur Hayes is out right here saying $110K is subsequent as soon as the liquidity is again. So yeah, short-term ache, however structurally? Nonetheless bullish.

So, what now? It seems to be like if $80K holds, cool – we chop sideways, possibly bounce. If it breaks, $78K or $72K are in play, however truthfully… that sort of flush would most likely get purchased sooner than Taylor Swift tickets.

Ethereum (ETH): $1,796 and tripping

In the meantime, ETH is having a a lot more durable time. Down from $2,115 to sub-$1,800, underperforming BTC by a landslide. RSI’s in oversold territory (round 21), and ETH/BTC simply hit a five-year low – yep, 5 years. That’s an entire halving cycle in the past.

ETH/USDT 4H Chart, Coinbase. Supply: TradingView

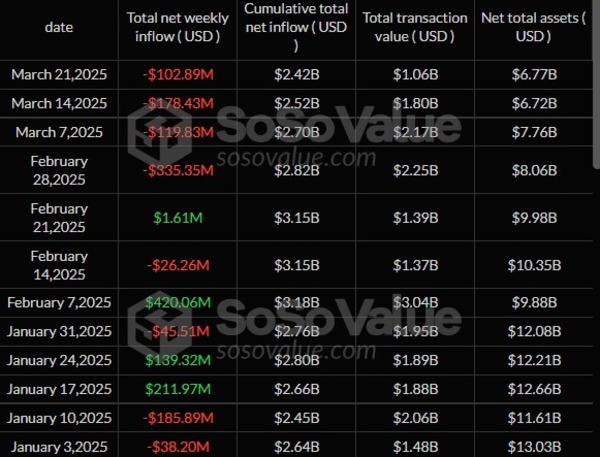

However the ache isn’t about jus one factor – there are a number of causes at play. For one, ETH funds are bleeding out – feels virtually regular at this level, doesn’t it?

Ethereum ETF web inflows proceed slumping. Supply: SoSoValue

Publish-Dencun, we had the SIR.buying and selling hack, which doesn’t assist with belief.

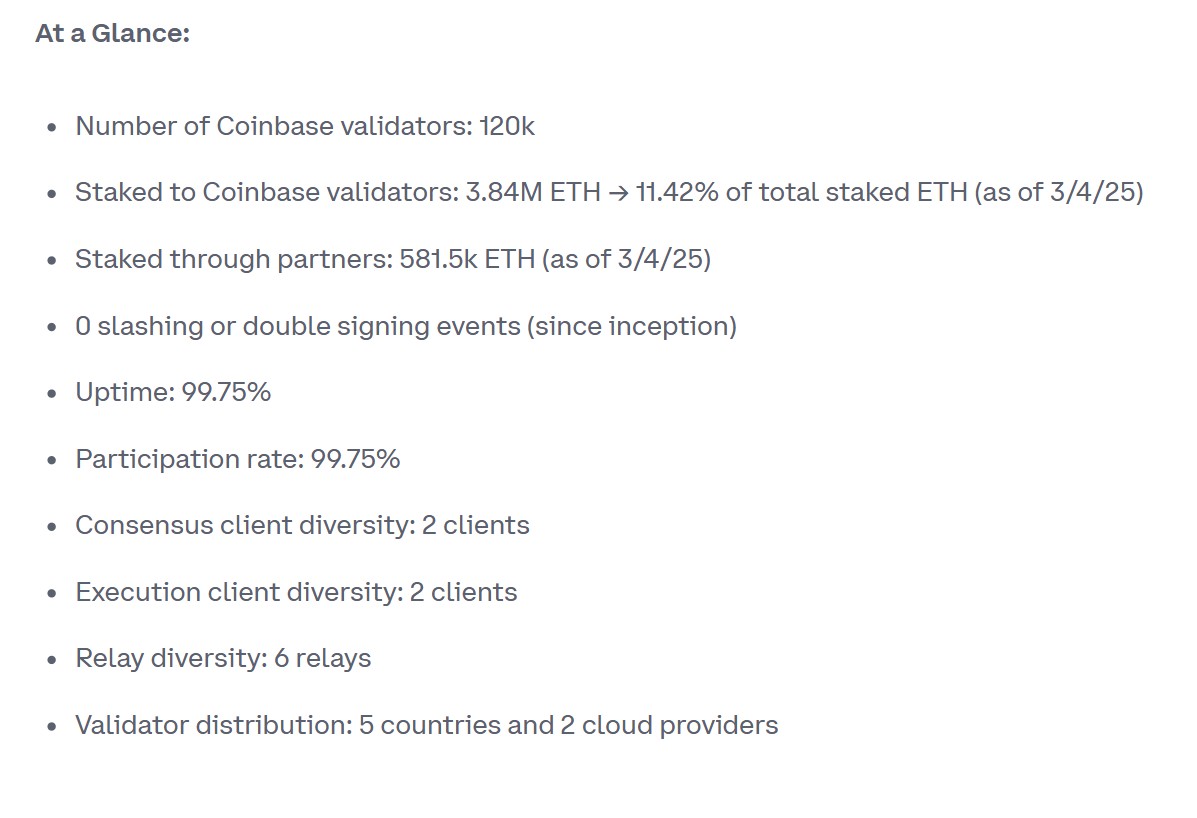

Additionally, it’s come to the floor that Coinbase is holding 11%+ of staked ETH, at the moment being its largest node operator. This expectedly has some of us yelling about centralization once more.

Coinbase is the most important Ethereum node operator. Supply: Coinbase

Some VCs are calling ETH “a lifeless funding.” Overdramatic, certain – but it surely tells you simply the place the sentiment is heading.

Proper now, ETH’s principally ready on BTC to cease bleeding. If Bitcoin finds a flooring, possibly we get a aid bounce. If not, ETH may break beneath $1,750 and begin knocking on $1,700’s door. However at this level, it’s much less about TA and extra about who nonetheless believes within the long-term thesis – which, let’s be trustworthy, is kinda shaky if the one bullish narrative is “BlackRock would possibly file an ETH ETF.”

Toncoin (TON): $3.89 and doing its personal factor

Whereas Bitcoin stumbled and Ethereum faceplanted, TON someway managed to bop to its personal rhythm. It climbed from $3.55 to over $4 early within the week, held above key ranges even because the majors bled out, and is now coasting close to $3.89 – nonetheless above its 50-SMA, nonetheless wanting sturdy.

TON/USD 4H Chart. Supply: TradingView

However this wasn’t simply one other altcoin defying gravity – TON truly had causes to maneuver.

First got here Elon. Musk confirmed that his Grok AI bot is now dwell inside Telegram, immediately tying TON to the most popular narrative in tech. And now the comedy: the bot crashed underneath the load of customers inside hours. However hey, the roof is on hearth, proper?

Then, in a really on-brand flex, TON’s official account claimed a Tesla Cybertruck in a promo photograph might be purchased with TON. Whether or not it’s symbolic or an actual take a look at of utility doesn’t even matter – it obtained consideration.

So yeah, TON’s power wasn’t simply technical – it had narrative gasoline. If BTC can keep above $80K, TON may simply retest the $4.10–$4.20 zone. But when the market takes one other dive, even TON’s stable week gained’t reserve it from gravity. Nonetheless, it’s been one of many few brilliant spots – and that counts.

So… what’s the temper?

On edge. The market feels prefer it’s caught in a ready room. Everybody’s watching macro headlines looking for out clues and spoilers for the subsequent Fed assembly. No person desires to be the primary to purchase the dip – or the final.

There’s no actual conviction proper now. Quantity’s thinning, volatility’s up, and merchants are break up between “we’re going to $65K” and “that is only a fakeout earlier than ATH.” Appears like we’re one narrative away from both situation.

However right here’s the silver lining: institutionals haven’t flinched. Whales are nibbling. And traditionally, these sorts of fake-outs and chop zones have resulted in explosive strikes – normally up, particularly when the broader monetary system is leaking weirdness from each seam.

April’s going to be spicy. If the market likes what it hears from the Fed or if Trump softens the tariff tone, we may see risk-on come roaring again. If not? Effectively, buckle up. Both method, its lookes just like the boring days are over.

Disclaimer

In keeping with the Belief Venture tips, please notice that the knowledge offered on this web page will not be meant to be and shouldn’t be interpreted as authorized, tax, funding, monetary, or another type of recommendation. You will need to solely make investments what you may afford to lose and to hunt unbiased monetary recommendation if in case you have any doubts. For additional info, we propose referring to the phrases and circumstances in addition to the assistance and help pages offered by the issuer or advertiser. MetaversePost is dedicated to correct, unbiased reporting, however market circumstances are topic to alter with out discover.

About The Creator

Victoria is a author on quite a lot of know-how subjects together with Web3.0, AI and cryptocurrencies. Her intensive expertise permits her to put in writing insightful articles for the broader viewers.

Extra articles

Victoria d’Este

Victoria is a author on quite a lot of know-how subjects together with Web3.0, AI and cryptocurrencies. Her intensive expertise permits her to put in writing insightful articles for the broader viewers.