Zora – as soon as hailed as a promising NFT infrastructure platform, has come underneath fireplace following the launch of its ZORA token airdrop. Relatively than being celebrated, the occasion rapidly drew widespread criticism attributable to its controversial tokenomics, unclear utility, and an execution course of that many customers described as poorly managed.

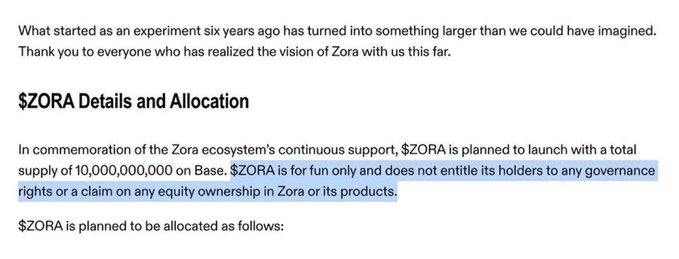

Lack of Utility, Lack of Belief in a “For Enjoyable” Token

ZORA has been described as a token with no clearly outlined advantages for holders. The challenge overtly said that the token carries no governance rights, no fairness illustration, and performs no important position within the operation of the platform. On its official channels, Zora even emphasised that the replace was a “for enjoyable” launch – a nontraditional strategy designed to spark consideration.

Nonetheless, in an surroundings the place customers more and more anticipate clear token distribution, tangible utility, and alignment with decentralized values, Zora’s positioning has backfired. Relatively than being considered as a inventive experiment, the dearth of clear use instances has led many to see the ZORA token as extra of a speculative asset than a significant contributor to the NFT ecosystem.

Supply: Zora

The state of affairs raises an vital query: if the token serves no goal, why launch it within the first place? For a model that after held a powerful status within the NFT area, launching a token with no clear operate now seems like opportunism, hypothesis disguised as “enjoyable.” Customers argue that if Zora had no intention of creating the token helpful, the least it might have carried out was to make sure a good distribution. But, that too fell brief.

Not solely does ZORA lack utility, but it surely additionally debuted at a comparatively excessive market valuation, regardless of providing no concrete advantages to holders. This has fueled additional confusion, particularly because the staff and early buyers management the vast majority of the token provide. With 65% held by insiders, ZORA’s excessive value, no utility, and skewed drop drew sharp Web3 backlash.

Some analysts counsel the choice was a authorized grey-area transfer to reduce regulatory stress. However by doing so, Zora could have harm its status, simply as Web3 shifts towards long-term, value-driven constructing.

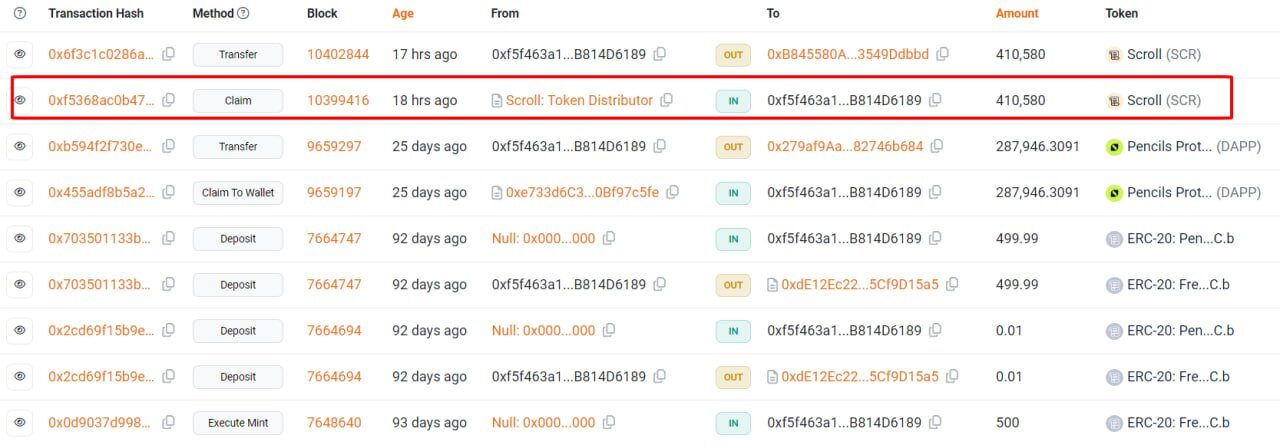

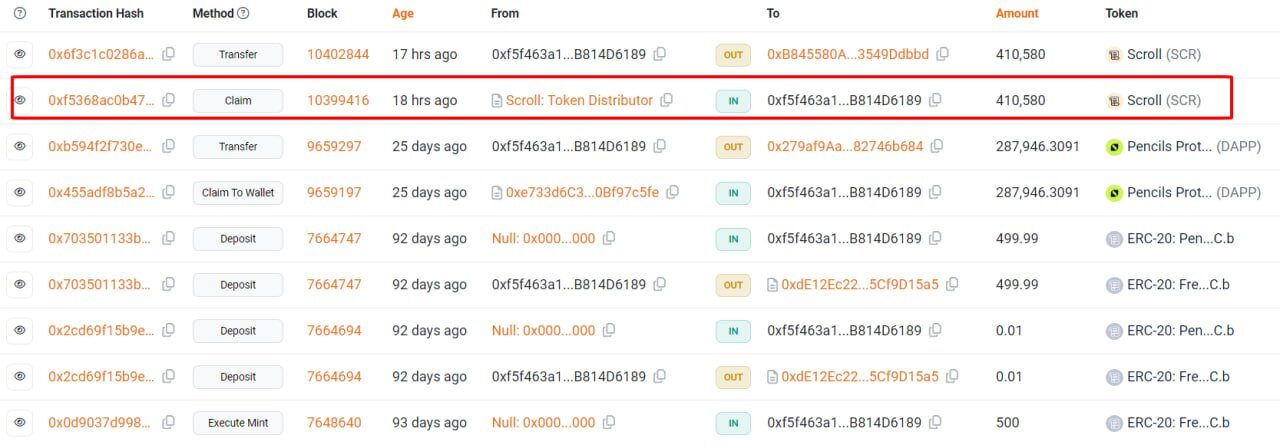

Skewed Allocation: Zora’s Belief Drawback In comparison with zkSync and Scroll

Zora gave 65% of its tokens to insiders, 18.9% to the staff, 20% to reserves, and 26.1% to buyers. That leaves simply 35% for the neighborhood, cut up into 10% for airdrops, 20% for neighborhood initiatives, and 5% for liquidity.

Supply: Zora

This uneven distribution drew backlash, particularly since ZORA was pitched as a “for enjoyable” token with no actual use. Critics argue that this launch seems to prioritize insiders somewhat than genuinely foster neighborhood participation, as many had hoped.

zkSync put aside simply 33.3% for insiders, leaving 67% for the neighborhood, way more balanced than its friends. This contains 17.5% for airdrops and broader ecosystem initiatives managed by the nonprofit ZKsync Basis. The vesting schedule spans 4 years, with a one-year cliff.

Scroll allotted 23% to the staff, 17% to buyers, and 10% to its basis about 50% to insiders. The opposite 50% goes to the neighborhood, 35% for ecosystem incentives, 15% for airdrops distributed in deliberate phases.

Each zkSync and Scroll beforehand confronted backlash for insider-friendly allocations throughout testnet or pre-TGE phases.

The neighborhood criticized zkSync for unclear airdrop guidelines that disregarded many longtime testnet customers. Scroll additionally confronted backlash after stories surfaced that some inside addresses acquired early allocation privileges.

Supply: Scroll Explorer

In distinction, Zora not solely surpasses zkSync’s insider ratio (65% vs. 33.3%) but in addition departs basically in worth proposition. Whereas zkSync and Scroll hyperlink tokens to governance and utility, ZORA presents none, regardless of greater insider allocations.

This disparity explains the wave of backlash throughout platforms like X and Discord. Many now see Zora as insider-led, not like zkSync and Scroll’s community-first strategy.

Throughout the Web3 area, it’s frequent to see insider allocations starting from 20–30%. Zora’s 65% allocation led many to name it a stealth token sale, not an airdrop.

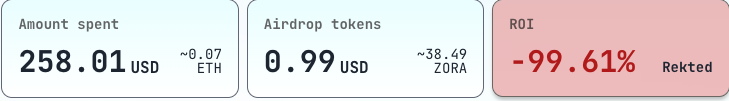

Neighborhood Backlash, On-Chain Information, and ‘Rekt’ Tales

Information exhibits that the worth of ZORA dropped over 50% inside just some hours after itemizing, signaling a powerful wave of sell-offs. Buying and selling quantity additionally plummeted – from $31 million to simply $9 million inside 48 hours, highlighting the dominance of short-term hypothesis over long-term conviction.

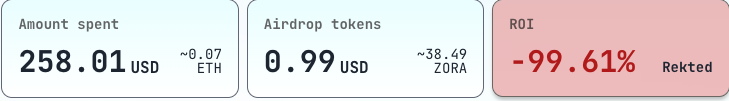

Past the market metrics, many customers have shared their private disappointments. One extensively circulated case concerned a person who spent $258 (~0.07 ETH) interacting with the platform in hopes of receiving a significant airdrop allocation. As an alternative, they acquired solely $0.99 price of ZORA, equal to simply 38.49 tokens, reflecting a brutal unfavourable ROI of 99.61%. The story rapidly unfold throughout X, stamped with the phrase “Rekted”, a logo of the collective sense of betrayal echoing all through the neighborhood.

Moreover, the neighborhood found that many wallets with little to no significant interplay with the platform nonetheless acquired substantial airdrop allocations. This raised suspicions of potential insider involvement or so-called “ghost allocations.”

A Dune Analytics dashboard monitoring recipient pockets exercise exhibits that some addresses acquired giant token quantities regardless of having no on-chain engagement. In the meantime, many extremely lively customers – together with business KOLs, acquired minimal rewards, generally not even sufficient to cowl the gasoline charges they’d spent (with common prices exceeding $1,000).

Why ZORA is being criticized proper now🤣🤣

1. ZORA non-interactive pockets handle receives airdrop– Suspected insider or staff member– https://t.co/i9hx2HOvKI (Examine potential)

2. High KOLs spend about $1000+ on gasoline, however haven’t generated even $100 in income

ZORA is the…

— Naback | Korea KOL (@Naback222) April 24, 2025

Whereas some metrics such because the variety of creators and tokens minted on Zora proceed to point out development, the prevailing sentiment on social media stays overwhelmingly unfavourable. Many customers argue that the airdrop created no sustainable worth and as a substitute served primarily as a liquidity exit for a small group of insiders.

Conclusion

Zora launched its airdrop as a lighthearted experiment – a “for enjoyable” token drop meant to energise the neighborhood. As an alternative, it has triggered widespread backlash and broken belief in a platform that was as soon as thought-about a cornerstone of the NFT infrastructure motion.

In a market that more and more rewards transparency, utility, and long-term imaginative and prescient, Zora’s strategy has raised uncomfortable questions on accountability in Web3. For customers and builders alike, the fallout serves as a stark reminder: within the age of decentralization, neighborhood belief is hard-won and simply misplaced.

Learn extra: High 5 Airdrop Farming Initiatives on Solana (Half 2)