Alisa Davidson

Revealed: Could 27, 2025 at 10:30 am Up to date: Could 27, 2025 at 8:04 am

Edited and fact-checked:

Could 27, 2025 at 10:30 am

In Temporary

In 2025, the worldwide crypto market is experiencing progress pushed by growing adoption, regulatory help, memecoin reputation, and ETF enlargement, with Europe main possession good points and US coverage shifts boosting confidence and institutional curiosity.

The crypto market has entered a brand new part of worldwide progress in 2025, and Gemini’s (a world crypto and Web3 platform based in 2014 by Cameron and Tyler Winklevoss) the newest annual report confirms it. Launched below embargo and based mostly on detailed survey knowledge from six international locations, the 2025 World State of Crypto report paints an image of accelerating possession, shifting demographics, and key market drivers like pro-crypto regulation, memecoin reputation, and ETF adoption.

The findings present that almost one in 4 adults globally now personal crypto — up from one in 5 only a yr in the past. Whereas the pattern is world, the expansion isn’t evenly distributed. Europe is main, the U.S. is politically reshaping its crypto narrative, and youthful generations stay essentially the most enthusiastic members.

A Turning Level in U.S. Coverage

Within the Introduction part of the report, Gemini highlights 2025 as a yr of transformation — not simply technologically however politically. The election of President Donald Trump marked a pointy pivot in U.S. crypto coverage. In March, Trump introduced the launch of a Strategic Bitcoin Reserve. This reserve goals to build up bitcoin in a tax-neutral method whereas guaranteeing the U.S. doesn’t promote the roughly 198,000 BTC it already holds within the Treasury.

This shift indicators a extra aggressive alignment with digital property. The administration additionally restructured the SEC below a “pro-innovation” framework, selling stablecoin laws and lowering enforcement stress on crypto corporations. Because the report notes, “publicly-traded corporations have turned to bitcoin as a viable reserve asset,” betting it would outperform conventional treasury bonds.

How the Report Was Compiled

The findings are based mostly on a complete on-line survey performed between March 18 and April 10, 2025. The survey included 7,205 respondents throughout six international locations: the US, United Kingdom, France, Italy, Singapore, and Australia — about 1,200 members per nation. Gemini partnered with Knowledge Pushed Consulting Group, and the pattern represents adults aged 18 to 75 with family incomes of at the least $14,000 per yr.

The survey explored areas comparable to:

Common consciousness and attitudes towards crypto;

Possession patterns and motivations;

ETF and memecoin adoption;

Regulatory perceptions and demographic tendencies.

Europe Leads in Crypto Possession

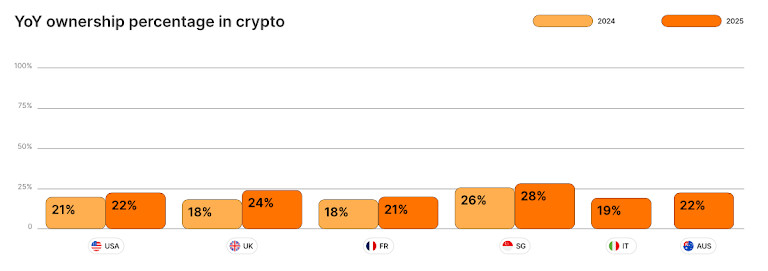

As outlined within the High Findings, possession elevated globally in 2025 — with Europe displaying the strongest progress.

Within the UK, crypto possession rose from 18% in 2024 to 24% in 2025, the sharpest bounce of any area surveyed;

In France, possession grew from 18% to 21%, whereas Singapore noticed an increase from 26% to twenty-eight%;

The U.S. additionally gained barely, from 20% to 22%.

This European momentum could also be tied to regulatory readability from the EU’s Markets in Crypto-Property (MiCA) framework, which has laid a basis for broader adoption.

Confidence Pushed by U.S. Coverage

One of the crucial mentioned takeaways within the report is how political help has affected public sentiment. Almost 23% of U.S. non-owners mentioned the creation of the Strategic Bitcoin Reserve made them really feel extra assured in crypto’s worth. The identical sentiment was shared by 21% within the UK and 19% in Singapore.

Because the report notes:

“President Trump’s insurance policies are making an influence… This sentiment was echoed by respondents within the UK and Singapore.”

This indicators that public confidence isn’t simply rising amongst present holders — it’s rising even sooner amongst those that’ve by no means owned crypto earlier than.

Memecoins: A Severe Gateway

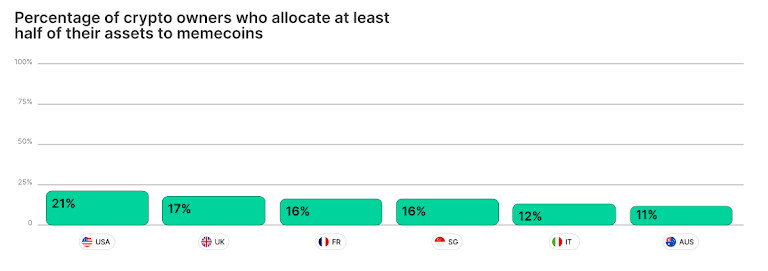

The part titled Memecoins dives into one of many report’s most eye-catching stats. It seems memecoins — lengthy thought-about dangerous or unserious — are literally driving adoption in significant methods.

Within the U.S., 31% of customers who maintain each memecoins and conventional cryptocurrencies mentioned they purchased the memecoins first;

In Australia and the UK, the determine is 28%;

It’s 23% in Singapore, 22% in Italy, and 19% in France.

The sample suggests memecoins act as onramps — sparking preliminary curiosity, then resulting in funding in additional established tokens. In actual fact, globally, 94% of memecoin holders additionally personal different forms of crypto.

France in Focus

France is the standout chief in memecoin adoption. 67% of crypto traders within the nation personal memecoins — the best amongst all surveyed nations. Singapore (59%), Italy (58%), and the UK (57%) observe intently.

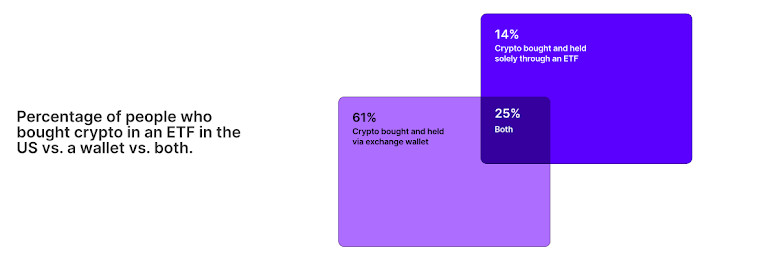

ETFs Achieve Floor

The approval of spot crypto ETFs in early 2024 proved to be a milestone. Within the U.S., 39% of crypto homeowners now say they maintain ETFs — up from 37% the earlier yr.

These merchandise are additionally turning into extra frequent in different international locations:

Italy: 47%;

UK: 41%;

Singapore: 40%;

Australia: 38%;

France: 32%.

The report describes this because the quickest progress ever recorded in ETF historical past, with giant capital inflows pushing up bitcoin costs and increasing crypto publicity to extra conventional traders.

A Dependable Retailer of Worth

Gemini dedicates a complete part of the report back to the shifting notion of crypto from a speculative asset to a reliable retailer of worth.

“The crypto market has been resilient in 2025… Many traders view crypto as a dependable retailer of worth in any market setting.”

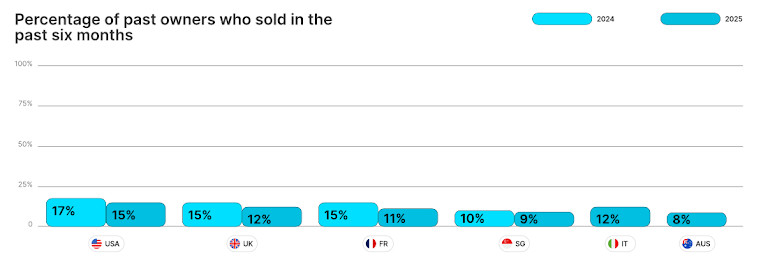

Proof for this? Promoting has declined. In 2025, solely about one in ten previous homeowners mentioned they offered their crypto within the earlier six months — down from considerably greater figures in 2024.

USA: 17% (2024) → 15% (2025);

Singapore: 11% → 9%;

Australia: 12% → 8%.

Inflation, Gender & Generational Shifts

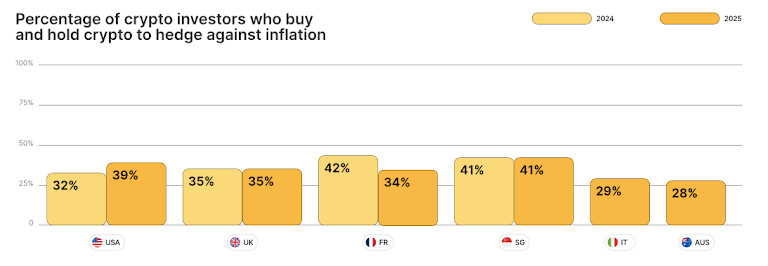

Crypto can also be being seen as a hedge in opposition to inflation — notably within the U.S., the place 39% now say they purchase and maintain crypto for that cause (up from 32% final yr). In France, the quantity is even greater at 42%, adopted by 41% in Singapore and 35% within the UK.

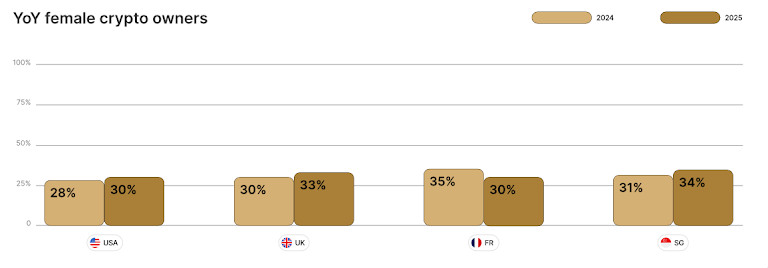

In the meantime, the gender hole in crypto is narrowing, albeit slowly:

Within the U.S., 30% of crypto homeowners in 2025 are girls (up from 28%);

Within the UK and France: 33% and 30%;

In Singapore: 34%.

In relation to age, the crypto market stays distinctly youth-driven. Almost 52% of Gen Z and 48% of Millennials globally mentioned they at present personal or have beforehand owned crypto. That compares to simply 26% of Gen X and 11% of Boomers.

Conclusion: A Market Ripe With Momentum

The Gemini 2025 report is not only a knowledge dump. It’s a sign — that crypto is turning into extra built-in with the monetary system, extra supported by governments, and extra evenly distributed throughout age teams, genders, and nations.

As Marshall Beard, Chief Working Officer at Gemini, put it:

“America has confirmed itself as a world chief in web3 and blockchain expertise with the addition of Trump’s pro-crypto insurance policies, which is a major change from the earlier Administration. With this pro-innovation method, the crypto trade is positioned for vital progress in the US and around the globe.”

With memecoins onboarding new customers, ETFs unlocking institutional cash, and authorities coverage enjoying an even bigger position than ever, the way forward for crypto could also be formed simply as a lot by laws and accessibility as by expertise itself.

Disclaimer

In step with the Belief Mission tips, please be aware that the data offered on this web page is just not meant to be and shouldn’t be interpreted as authorized, tax, funding, monetary, or some other type of recommendation. You will need to solely make investments what you may afford to lose and to hunt impartial monetary recommendation if in case you have any doubts. For additional data, we advise referring to the phrases and circumstances in addition to the assistance and help pages offered by the issuer or advertiser. MetaversePost is dedicated to correct, unbiased reporting, however market circumstances are topic to alter with out discover.

About The Writer

Alisa, a devoted journalist on the MPost, makes a speciality of cryptocurrency, zero-knowledge proofs, investments, and the expansive realm of Web3. With a eager eye for rising tendencies and applied sciences, she delivers complete protection to tell and interact readers within the ever-evolving panorama of digital finance.

Extra articles

Alisa Davidson

Alisa, a devoted journalist on the MPost, makes a speciality of cryptocurrency, zero-knowledge proofs, investments, and the expansive realm of Web3. With a eager eye for rising tendencies and applied sciences, she delivers complete protection to tell and interact readers within the ever-evolving panorama of digital finance.