Gregory Pudovsky

Printed: September 08, 2025 at 9:50 am Up to date: September 08, 2025 at 9:50 am

In Transient

Hybrid crypto exchanges are rising as the way forward for digital buying and selling, combining the liquidity and effectivity of centralized platforms with the transparency, self-custody, and compliance options of decentralized techniques to rebuild belief and meet rising institutional and retail calls for.

A Market Turnaround within the Midst of Enlargement

Crypto Change Platform fashions are not simply centralized gateways for buying and selling digital belongings—they’re quickly evolving into hybrid ecosystems mixing effectivity, transparency, and person management. In July 2025, the cryptocurrency market crossed the $4 trillion valuation mark, pushed by institutional adoption and new regulatory readability. As Reuters stories, this milestone “displays its transformation right into a core element of world finance”.

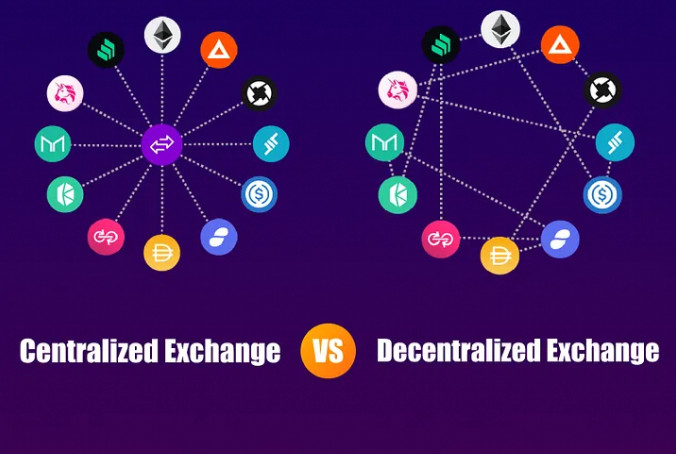

However amid this development, centralized exchanges (CEXs)—as soon as unchallenged—are dropping momentum. In Q2 2025, the quantity of spot buying and selling on CEX plummeted greater than 28 % to three.9 trillion. In the meantime, decentralized exchanges (DEXs) have surged, reaching a excessive of $876.3 billion in spot volumes and an unprecedented ratio of DEX to CEX of 0.23.

This shift is a sign of the emergence of hybrid models- platforms that mix each centralized liquidity and pace with decentralized custody and transparency.

From Centralized to Hybrid: Why the Shift Issues

The Reign and Repercussions of Centralized Exchanges

Because the inception of Bitcoin, centralized change platforms akin to Binance, Coinbase, and MEXC have primarily dominated when it comes to affordability, liquidity, and fiat gateways. Binance ranked virtually first on the earth in July 2025 with about 40 % of the social change collected, adopted by MEXC with 8.6 % and Gate at 7.8 %.

Nevertheless, this hegemony got here at a value; fixed hacks, murky reserve mannequin, and notorious FTX collapse in 2022 killed investor confidence. Merchants started demanding fashions the place belief is earned by means of transparency, not guarantees.

The Attraction of Decentralization and its Limits

Decentralized exchanges akin to Uniswap and PancakeSwap offered that belief by enabling peer-to-peer trades instantly from wallets. With censorship resistance and self-custody, DEXs picked up a brand new crowd of privacy-minded and security-focused customers.

Nevertheless, that they had their share of drawbacks: steep entry boundaries, extremely unstable liquidity, and simply minimal quantities of compliance. For mass adoption, buyers wanted one thing in between.

Hybrid Crypto Change Platform: Better of Each Worlds

Hybrid platforms fill this hole. They combine ordered books, liquidity depth, and the custodial and governance benefits of decentralized design.

The mannequin allows a retail person expertise with intuitive buying and selling paired with institutional regulatory-grade compliance and non-disclosure, and auditability of reserves. We will say that, by utilizing hybrids, it’s doable to make crypto exchanges environment friendly and trusted on the identical time.

Driving Forces Behind Hybrid Adoption

1. Rebuilding Belief after FTX

The failure of FTX restructured the mentalities of customers/merchants by demanding verifiable solvency and extra management over their cash. Through the use of on-chain proof-of-reserves and optionally available non-custodial buying and selling wallets, the hybrid platforms restore confidence with out relinquishing liquidity.

A survey by Glassnode in 2025 revealed that 62 % of buyers now need to use exchanges which have built-in self-custody options, and this illustrates how person demand is shifting to hybrid options.

2. Knowledge Reveals DEX Momentum

CoinGecko’s Q2 2025 report highlights DEXs rising 25.3% quarter-on-quarter, in comparison with a 27.7% decline in CEX quantity. PancakeSwap alone expanded buying and selling exercise by 539% due to hybrid routing linked to Binance Alpha.

This isn’t a passing pattern—it’s proof that platforms providing hybrid architectures outperform these locked in legacy fashions.

3. Institutional and Regulatory Push

Establishments are not sidelined in crypto—they now drive a lot of the quantity. However they demand compliance, stability, and threat administration instruments. Pure DEXs can’t provide that, whereas conventional CEXs generally fail transparency exams.

Hybrid exchanges meet within the center: integrating KYC/AML compliance, institutional custody options, and governance tokens that permit communities form decision-making.

Core Options of Subsequent-Gen Hybrid Exchanges

A profitable hybrid Crypto Change Platform should examine a number of bins:

Safety and Custody: Employment of non-custodial wallets, chilly storage, and multi-sig.

Transparency: dwell on-chain auditing and solvency certifications verifiable by anybody.

Liquidity Depth: a centralized market-making mixed with a decentralized liquidity pool.

DeFi Integration: lending, staking, cross-chain swaps, and automatic yield methods.

Compliance Layer: standardized modules in KYC/AML that establishments can declare with out an assault on retail privateness.

By combining these traits, the exchanges will be capable to please not solely regulators but in addition retail merchants and establishments.

The Street Forward: Hybrids because the Dominant Future

Inside the subsequent 5 years, hybrid platforms could fully reshape how folks commerce crypto. Improvements already on the horizon embody:

Decentralized identification (DID) techniques give customers possession of non-public knowledge.

Tokenized insurance coverage funds routinely defend deposits in opposition to hacks.

Cross-chain interoperability mitigates dangers of bridging.

AI-driven compliance engines maintain a stability between safety, privateness, and regulation.

These improvements will lead to hybrid exchanges changing into the trade commonplace moderately than an choice.

Conclusion

The world of crypto buying and selling is basically at a turning level. what? Centralized exchanges have opened the doorways for tens of millions to entry a number of digital belongings, which offer liquidity and an ideal manner for institutional buyers to leap in. Nevertheless, a sequence of hacks, custodial dangers, and an absence of transparency are nonetheless there. Then again, if we discuss decentralized platforms, they’re working fairly good and offering a buying and selling expertise with out belief points. They’re offering extra management for customers. However nonetheless must work on their scalability, fragmented liquidity, and regulatory compliance.

This persistent battle has given technique to the emergence of the hybrid Crypto Change Platforms, a mixture of the 2 worlds. Hybrid exchanges are discovering a center floor that lets customers select to self-custody, use the centralized liquidity swimming pools, and likewise adhere to compliance necessities to maintain regulators a cheerful bunch, with out dropping the core property; decentralization.

This isn’t a change solely in expertise however actually across the rebuilding of belief, which has now turn into essentially the most helpful asset within the crypto world as 2025 approaches. Traders are actually looking out for safety, effectivity, and transparency multi functional package deal, and solely the platforms that may ship on these expectations will survive.

The stress is intense with a market capitalization of greater than 4 trillion {dollars}. The hybrid exchanges aren’t merely a pattern; as an alternative, they’re the brand new basis of the post-pandemic age in digital finance. Within the subsequent a number of years, platforms that mix the deal with innovation with being delicate to person wants and regulatory necessities is not going to solely succeed but in addition turn into the important thing to the way forward for finance.

Disclaimer

According to the Belief Challenge tips, please word that the knowledge offered on this web page will not be supposed to be and shouldn’t be interpreted as authorized, tax, funding, monetary, or every other type of recommendation. You will need to solely make investments what you possibly can afford to lose and to hunt impartial monetary recommendation when you have any doubts. For additional data, we recommend referring to the phrases and situations in addition to the assistance and help pages offered by the issuer or advertiser. MetaversePost is dedicated to correct, unbiased reporting, however market situations are topic to alter with out discover.

About The Writer

Gregory, a digital nomad hailing from Poland, will not be solely a monetary analyst but in addition a helpful contributor to varied on-line magazines. With a wealth of expertise within the monetary trade, his insights and experience have earned him recognition in quite a few publications. Utilising his spare time successfully, Gregory is presently devoted to writing a ebook about cryptocurrency and blockchain.

Extra articles

Gregory, a digital nomad hailing from Poland, will not be solely a monetary analyst but in addition a helpful contributor to varied on-line magazines. With a wealth of expertise within the monetary trade, his insights and experience have earned him recognition in quite a few publications. Utilising his spare time successfully, Gregory is presently devoted to writing a ebook about cryptocurrency and blockchain.