Victoria d’Este

Printed: February 04, 2025 at 12:57 pm Up to date: February 04, 2025 at 12:57 pm

Edited and fact-checked:

February 04, 2025 at 12:57 pm

In Temporary

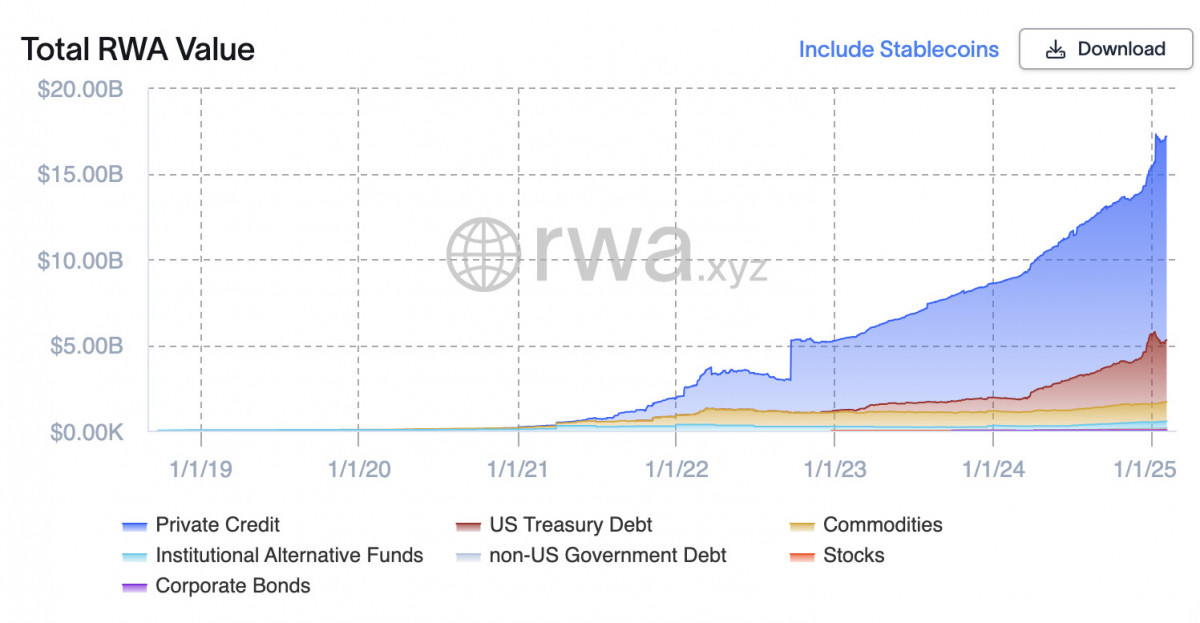

The cryptocurrency ecosystem is witnessing a big shift with the resurgence of real-world asset tokenization marketplaces, with whole worth locked on-chain now at $17.1 billion.

The revival of real-world asset tokenization marketplaces signifies an essential change within the cryptocurrency ecosystem. The business has regained its prominence, with whole worth locked on-chain now standing at $17.1 billion. This rise, which has virtually doubled within the final 12 months, demonstrates how tokenized property have gotten essential forces behind the bigger restoration of digital property.

Photograph: RWA.xyz

Main Market Positive factors for RWA Tokens

RWA-related tokens outperformed the sector as an entire within the February 3 crypto market restoration. Notably, after falling to $17, Chainlink (LINK) recovered the $21 stage with a 22% enhance. Related rises of 23% and 27% have been seen by Mantra (OM) and Ondo Finance (ONDO), respectively, indicating a resurgence of curiosity in blockchain-based asset tokenization. Singapore’s Financial Authority-regulated Chintai (CHEX) noticed a 38% enhance, indicating a requirement for authorized tokenized monetary merchandise all through the world.

This result’s per macroeconomic traits. Investor fears have eased on account of the non permanent suspension of U.S. tariffs on Canada and Mexico, making a scenario that’s favorable to dangerous property like cryptocurrencies. Digital property, particularly RWAs, are gaining from capital rotation as conventional markets reply to regulatory modifications.

Speculative buying and selling just isn’t the one issue contributing to the rise of RWA tokenization. Main monetary organizations and institutional gamers are progressively establishing themselves on this market. RWA.xyz reviews that U.S. Treasury money owed account for 21% of the sector’s TVL, whereas personal credit score accounts for about 70% of the on-chain worth of tokenized property. The remainder consists of commodities, shares, and tokenized actual property.

The rising involvement of Wall Road demonstrates a shift in the way in which that blockchain is seen by conventional finance. Monetary giants like BlackRock and Franklin Templeton are aggressively investigating blockchain-based property, and analysts level to the estimated $30 trillion market potential of asset tokenization. Based on Andrey Kuznetsov, co-founder of Haqq Community, standard banking executives are preparing for a future during which tokenized RWAs shall be essential.

Market Rotation and the Rise of Different Property

The newest cryptocurrency comeback has proven altering investing traits. RWAs have gotten increasingly more widespread as a extra dependable and utility-driven substitute for DeFi and NFTs. Pav Hundal, head analyst at Swyftx, referred to as the rise as a “speculative rotation,” implying that buyers are rediscovering the significance of tokenization initiatives that mix blockchain and conventional monetary markets.

This variation is most seen within the rising demand for tokenized US Treasuries. Ondo Finance has launched Nexus, an answer that allows the instant minting and redemption of tokenized Treasury points. Institutional buyers searching for blockchain-based publicity to fixed-income markets have proven an curiosity within the platform. Such traits recommend that RWAs are producing speculative returns and rising into functioning funding merchandise.

Regulatory Developments and International Growth

Regulation is a vital facet within the progress of RWA markets. Latest coverage strikes in the USA point out a extra permissive method to tokenized property. Centrifuge’s normal counsel, Eli Cohen, anticipates the Trump administration to loosen rules on digital asset tokenization, selling additional progress within the area.

Concurrently, legislative certainty in locations akin to Singapore and the Center East encourages new tasks. MANTRA, a layer-1 blockchain designed particularly for RWA purposes, has introduced a billion-dollar asset tokenization cooperation with Dubai’s DAMAC Group. Such agreements spotlight the rising integration of blockchain into established companies starting from actual property to institutional finance.

Bitcoin’s Affect and General Market Affect

Bitcoin’s comeback has set the bottom for renewed optimistic enthusiasm within the cryptocurrency market. Whereas BTC’s 4% enhance seems tiny compared to the double-digit positive aspects of RWA tokens, it represents a further signal of rising investor confidence. The CoinDesk 20 Index, which measures large-cap crypto property, rose 2%, including to the notion of a long-term restoration.

Photograph: CoinGecko

RWA property are making the most of the elevated optimism, with buying and selling companies like Wintermute reporting a 200% acquire in TVL final yr. The tokenization of presidency securities, specifically, has spurred this progress, indicating a larger institutional embrace of blockchain-based monetary devices.

The development of tokenized RWAs factors to a basic change in monetary markets. The sector’s quick progress, aided by legislative modifications and institutional help, is altering investing methods. Tokenization’s transformational potential has been harassed by main monetary voices akin to BlackRock CEO Larry Fink and Robinhood’s Vlad Tenev. Their requests for regulatory clarification mirror the broader recognition of blockchain as a reputable monetary infrastructure.

Tokenized RWAs would possibly develop into one of the crucial essential blockchain purposes. The potential to attach conventional property with decentralized finance makes a robust argument for long-term adoption. Whereas volatility stays an issue, the rising engagement of worldwide banks, asset managers, and governments means that the emergence of RWAs just isn’t a passing development.

The return of RWA tokenization markets is indicative of an even bigger shift in digital asset investing. Because the sector achieves recent all-time highs, its affect goes past speculative income, offering a glance into the way forward for blockchain-based banking. With institutional buyers understanding the advantages of tokenization, RWAs would possibly develop into a key part of worldwide monetary markets within the coming years. The persevering with progress of legislative frameworks and know-how breakthroughs will determine the speed of adoption, however the momentum behind tokenized property is obvious.

Disclaimer

Consistent with the Belief Challenge tips, please word that the knowledge offered on this web page just isn’t supposed to be and shouldn’t be interpreted as authorized, tax, funding, monetary, or every other type of recommendation. It is very important solely make investments what you’ll be able to afford to lose and to hunt unbiased monetary recommendation if in case you have any doubts. For additional info, we propose referring to the phrases and situations in addition to the assistance and help pages offered by the issuer or advertiser. MetaversePost is dedicated to correct, unbiased reporting, however market situations are topic to alter with out discover.

About The Creator

Victoria is a author on quite a lot of know-how matters together with Web3.0, AI and cryptocurrencies. Her intensive expertise permits her to write down insightful articles for the broader viewers.

Extra articles

Victoria d’Este

Victoria is a author on quite a lot of know-how matters together with Web3.0, AI and cryptocurrencies. Her intensive expertise permits her to write down insightful articles for the broader viewers.