India: The World’s Progress Champion Whilst Progress Slows

For the previous few years, India has been hailed because the darling of world buyers. As soon as thought of a protected and apparent wager, Indian inventory markets skilled meteoric rises, pushed by spectacular financial development and a wave of worldwide capital. But, latest developments have launched uncertainty. Inventory indices within the nation have retreated, main many to query India’s prospects. This paradox captures the complexity of a nation touted because the “Subsequent China.”

The Subsequent China: India’s Emergence as a Progress Engine

India has typically been known as the “Subsequent China,” a moniker that underscores its potential to drive world development at a time when China’s financial engine is dropping steam. With annual GDP development charges exceeding 7% in recent times, the Indian financial system appeared poised to imagine the mantle of the world’s main development driver. This optimism was mirrored in Indian inventory markets, which posted spectacular features over the previous two years. For buyers, India seemed to be a positive and apparent alternative, providing alternatives in burgeoning industries, a rising client base, and an financial system ripe for improvement.

Nevertheless, as 2024 drew to a detailed, cracks started to kind on this rosy narrative.

Under is a comparability between the FTSE India Index and the DJI China Index, highlighting the placing distinction in efficiency since 2012.

A Market Slip: India’s Inventory Indices Tumble

In a stunning flip of occasions, Indian inventory markets have shed 11% of their worth from historic highs, and this decline occurred inside just some weeks. Such a fast retreat has sparked doubt amongst world buyers. The ultimate quarter of 2024 witnessed a big exodus of international capital from India—a development that rattled markets and undermined confidence within the nation’s development story.

What precipitated this sudden shift?

Sky-Excessive Valuations: A Bubble Ready to Burst

One main issue behind the market downturn is valuation. Over the previous few years, the passion for “taking part in the India story” led to exuberant market habits. Inventory costs soared to stratospheric ranges, creating valuations that always defied logic. Buyers clamored to take part in what they believed was a bulletproof development trajectory, however many did not account for the dangers of a bubble-like state of affairs. By late 2024, the unsustainable nature of those valuations turned obvious, triggering a correction within the markets.

Macro-Financial Woes: A Sobering Actuality Verify

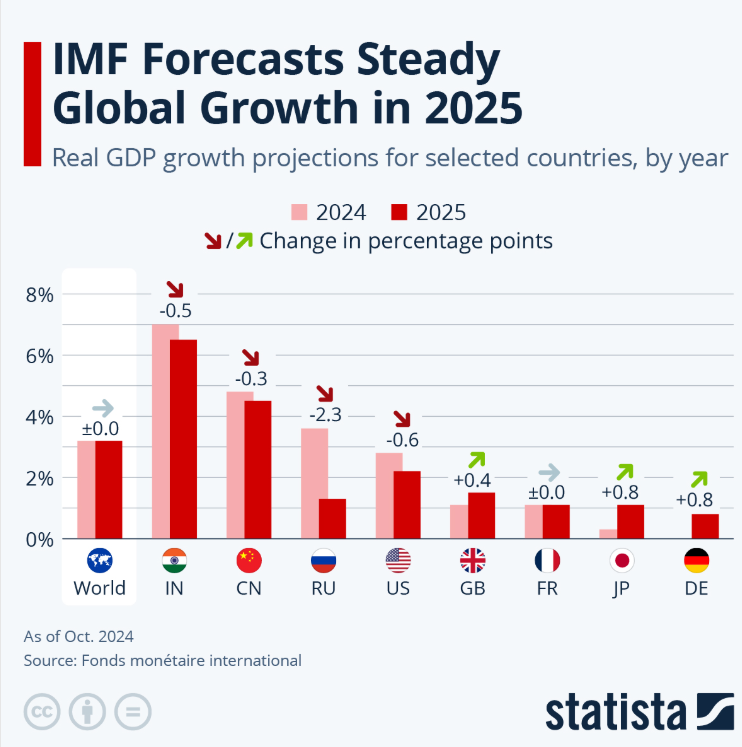

Past market valuations, the broader macroeconomic setting started to deteriorate. India’s GDP development, whereas nonetheless strong by world requirements, fell beneath 7%, edging nearer to five% by the top of the 12 months. Whereas 2024 noticed an general development fee of 6.6%, projections for 2025 have been much less optimistic. This slowdown marks a stark distinction to the double-digit development charges many had hoped India would maintain.

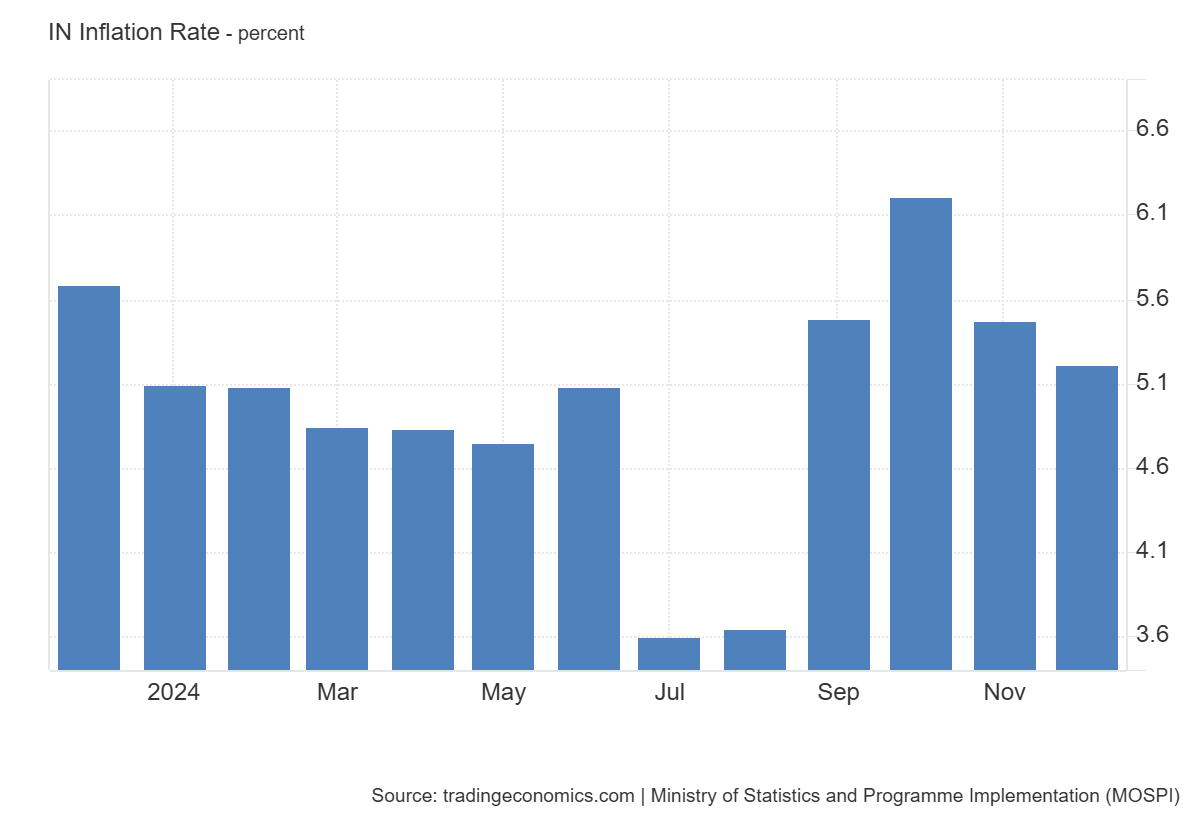

Inflation has additionally emerged as a persistent problem. With worth will increase hovering above 6%, Indian households have seen their buying energy eroded. Family debt has risen to regarding ranges, additional straining client confidence. Compounding these points, enterprise investments a essential driver of future development have slowed significantly.

The consequence? A dampening of the bullish sentiment that when surrounded the Indian financial system.

A Interval of Normalization

Whereas the latest market correction and financial slowdown could seem alarming, it is very important view these developments in context. India’s development just isn’t collapsing; relatively, it’s normalizing. Double-digit development is tough to maintain indefinitely, and even a 6.6% development fee locations India among the many fastest-growing main economies on the earth.

Regardless of the challenges, India stays an important engine of world development. Its financial system could account for simply 4% of world GDP at the moment, however its strategic significance is way better. With a younger and rising inhabitants, rising urbanization, and a burgeoning center class, India has immense long-term potential.

Furthermore, India occupies a positive geopolitical place. As tensions rise between China and america, India stands to profit from its standing as a strategic accomplice for Western nations. The worldwide diversification of provide chains partly pushed by the will to scale back dependence on China has additionally created alternatives for India to emerge as a producing and expertise hub.

What’s Subsequent for Buyers?

For these contemplating their subsequent strikes, it’s essential to not “throw the newborn out with the bathwater,” because the saying goes. The latest market correction, whereas painful, might current alternatives for buyers prepared to undertake a long-term perspective. Indian equities, after their pullback, could now provide extra cheap valuations, making them a sexy possibility for individuals who consider within the nation’s development story.

Nevertheless, a cautious strategy is warranted. Inflation have to be intently monitored, because it has the potential to stifle client spending and hinder financial restoration. Moreover, structural reforms and coverage initiatives might be essential in addressing a number of the deeper challenges going through the financial system, similar to revenue inequality, infrastructure deficits, and regulatory bottlenecks.

India stays a significant participant on the worldwide stage, and its potential as a development driver is simple. The latest turbulence, whereas unsettling, is a part of the rising pains of an financial system transitioning from emerging-market darling to a extra mature and secure development engine. Buyers ought to keep watch over the horizon alternatives in India are more likely to re-emerge sooner relatively than later.

Dangers of Investing within the Indian Inventory Index

Investing in an Indian inventory index just like the Nifty 50 or BSE Sensex gives alternatives resulting from India’s fast development, nevertheless it comes with dangers:

Rising Market Volatility: Indian markets are extra unstable, as seen with a 5.15% Nifty drop post-2024 elections.

Excessive Valuations: Elevated price-to-earnings ratios sign potential overvaluation, risking corrections like the ten% drop in late 2024.

Political and Regulatory Dangers: Coverage shifts or governance points (e.g., the 2023 Adani scandal) can impression markets.

World Financial Publicity: Slowdowns or commodity worth spikes (e.g., oil) have an effect on development and indices.

Foreign money Danger: Rupee depreciation (e.g., 83.48 vs. USD in 2024) can erode returns for international buyers.

Mitigation: Diversify by way of ETFs, undertake a long-term view (6-7% annual development), and enter after corrections.

Regardless of development potential, volatility and exterior dangers require warning.

Conclusion

In conclusion, India’s development story is way from over. Whereas the journey forward could also be marked by occasional setbacks, the nation’s fundamentals stay robust. The “Subsequent China” nonetheless holds promise, even when the highway is bumpier than initially anticipated. For these with endurance and conviction, the Indian development narrative is one price watching and investing in.

This communication is for info and training functions solely and shouldn’t be taken as funding recommendation, a private suggestion, or a proposal of, or solicitation to purchase or promote, any monetary devices. This materials has been ready with out bearing in mind any specific recipient’s funding aims or monetary state of affairs, and has not been ready in accordance with the authorized and regulatory necessities to advertise impartial analysis. Any references to previous or future efficiency of a monetary instrument, index or a packaged funding product will not be, and shouldn’t be taken as, a dependable indicator of future outcomes. eToro makes no illustration and assumes no legal responsibility as to the accuracy or completeness of the content material of this publication.