The convergence of conventional finance (TradFi) and decentralized infrastructure simply hit a brand new gear. ING, certainly one of Europe’s banking heavyweights, is reportedly deepening its publicity to the crypto ecosystem via a strategic alignment with Bitwise.

This isn’t simply a normal steadiness sheet adjustment. It alerts a basic shift in how institutional capital views digital asset custody and yield era.

For years, banks sat on their fingers, paralyzed by regulatory fog. Now, with Bitwise offering the regulated rails, establishments like ING are successfully bypassing the technical friction of direct possession whereas capturing the upside. That validates the ‘Bitcoin as collateral’ thesis in a giant method. When a world systemically essential financial institution (G-SIB) strikes into the area, it forces rivals to re-evaluate their danger fashions.

The circulation of capital is not simply speculative retail quantity, it’s sticky, long-term institutional allocation.

However right here’s the catch: merely holding Bitcoin is turning into inadequate for classy actors. The market is demanding utility. As trillions of {dollars} in potential liquidity search entry, the restrictions of the Bitcoin Layer 1 (L1), particularly its lack of native good contract functionality and sluggish transaction occasions, have grow to be the ecosystem’s major bottleneck.

That infrastructure hole has triggered a capital rotation into Layer 2 options able to dealing with institutional throughput. Bitcoin Hyper ($HYPER) has emerged as a major beneficiary of this development, positioning itself to resolve the scalability trilemma proper because the institutional gates swing open.

Purchase your $HYPER right here.

Bitcoin Hyper Brings Solana Speeds to Bitcoin Liquidity

Whereas the market obsesses over ETF inflows, builders are targeted on the execution layer. The core innovation driving curiosity in Bitcoin Hyper ($HYPER) is its integration of the Solana Digital Machine (SVM). Traditionally, Bitcoin Layer 2s have confronted a brutal trade-off: inherit Bitcoin’s safety however endure from sluggish block occasions, or construct a sidechain that sacrifices safety for pace.

Bitcoin Hyper dismantles this dichotomy. By using the SVM for execution whereas anchoring state to Bitcoin L1, it permits for transaction speeds that rival Solana, sub-second finality and negligible prices, whereas using Bitcoin as the last word settlement layer.

For builders, this can be a large unlock. It allows the creation of high-frequency buying and selling platforms, gaming dApps, and complicated DeFi protocols utilizing Rust (a language most well-liked for high-performance functions), all inside the Bitcoin ecosystem.

The implications for DeFi are profound. Frankly, billions in BTC are presently sitting idle. By providing a high-performance execution atmosphere, Bitcoin Hyper permits that capital to be mobilized in methods beforehand restricted to Ethereum or Solana. Plus, the protocol’s Decentralized Canonical Bridge facilitates trustless transfers, fixing the fragmentation concern that has plagued earlier bridging makes an attempt.

Take a look at the technical breakdown within the Bitcoin Hyper whitepaper.

You should buy $HYPER right here.

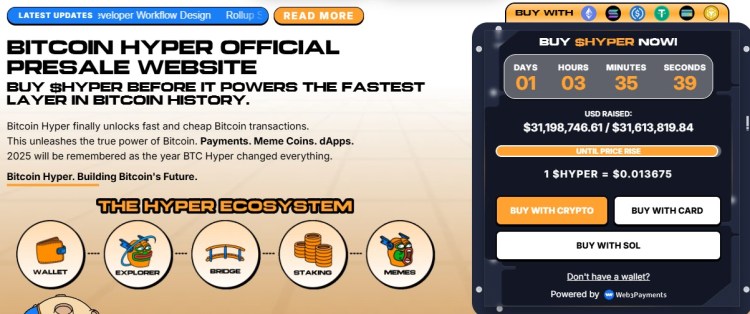

Whales Accumulate $HYPER as Presale Crosses $31 Million

It seems like good cash is front-running the general public launch of this SVM-integrated Layer 2.

In keeping with the official presale dashboard, Bitcoin Hyper has raised a powerful $31.2M thus far. That stage of capital dedication throughout a presale section suggests excessive conviction from early backers relating to the undertaking’s skill to seize L2 market share.

Presently priced at $0.013675, the token presents an entry level that stands in stark distinction to the valuations of established L2s.Past the uncooked capital inflows, the undertaking’s staking incentives are driving retention. Buyers can stake instantly after the Token Technology Occasion (TGE), with a brief 7-day vesting interval for presale contributors.

This construction incentivizes long-term alignment somewhat than mercenary capital rotation. With the roadmap together with a mainnet launch that prompts the SVM capabilities, the window for early accumulation is narrowing.

View the official Bitcoin Hyper presale.

The content material offered on this article is for informational functions solely and doesn’t represent monetary recommendation. Cryptocurrency markets are risky; conduct your individual due diligence earlier than investing.