Kraken Prompt Purchase costs 3.57% complete charges (2.57% unfold + 1% express) vs 0.25-0.40% on Kraken Professional. Our investigation discovered automated purchases price DCA traders 13x yearly in charges in comparison with handbook Professional trades. Detailed charge breakdown inside.

Key Factors

Prompt Purchase charged 3.57% complete (2.57% unfold + 1% charge) vs. 0.40% on Kraken Professional for fast orders or 0.25% for affected person restrict orders.

Kraken embeds unfold prices within the ‘Value’ discipline with out separate itemization, requiring customers to manually evaluate towards market charges.

Kraken Professional lacks recurring purchase automation whereas rivals like Binance and Bybit provide it at 0.08-0.10% commonplace charges.

Desk of Contents

Consumer Discovers Hidden Prices on Automated Bitcoin Purchases

Verification Testing: Prompt Purchase vs Kraken Professional

Price Disclosure Practices

Actual-World Value Impression

The Automation Commerce-Off

Business Comparability

Steadily Requested Questions

Kraken Consumer Discovers 3.57% Hidden Prices on Automated Bitcoin Purchases

Kraken charges for automated Bitcoin purchases can price traders 13 instances greater than handbook buying and selling, in response to a Crypto-Information.Web investigation. A Kraken person making each day $30 Bitcoin [coin_data_widget ticker=”BTC”] purchases seen one thing uncommon on Nov. 16: whereas Bitcoin traded at roughly $94,000 on spot markets, their buy executed at an efficient price of $96,106 per BTC. The discrepancy prompted the person to contact Crypto-Information.Web, resulting in an investigation that documented complete prices of roughly 3.57% for automated purchases on Kraken’s Prompt Purchase characteristic, in comparison with 0.25-0.40% for handbook trades on the trade’s Professional platform.

The Kraken charge construction forces a troublesome selection: automated recurring purchases are solely obtainable via Prompt Purchase, which costs a mixture of unfold markup and express charges. Customers in search of decrease prices should use Kraken Professional, which costs charges primarily based on present market charges however requires handbook execution for each buy. The investigation discovered no Kraken choice combines each aggressive charges and automatic execution, a spot that prices retail traders between $41 and $346 yearly relying on their funding patterns.

Verification Testing: Prompt Purchase vs Kraken Professional Price Comparability

The person’s Nov. 16 transaction receipt exhibits they paid 30.00 USDC complete (29.703 USDC plus 0.297 USDC in express charges) and obtained 0.0003121 BTC, in response to documentation reviewed by Crypto-Information.Web. With Bitcoin buying and selling between $94,000 and $94,200 on spot markets on the time, the efficient buy value of $96,106 per BTC represented a value differential of roughly $1,900 to $2,100, or roughly 2.0-2.2% above market charges. Mixed with the express 1% charge proven on the receipt, the entire transaction price reached roughly 3.0-3.2%.

Crypto-Information.Web performed verification testing the identical day at 20:51-20:52 CET, executing $10 USDT to BTC transactions throughout all three Kraken platforms. Kraken Professional Net confirmed a market value of 94,241.8 USDT with an estimated 0.04 USDT buying and selling charge (0.4%). Kraken Professional Cell confirmed comparable outcomes at 94,251.6 USDT with the identical 0.4% charge construction. In distinction, Prompt Purchase on the usual Kraken cellular app quoted roughly 0.00010321 BTC for a similar $10 funding, an efficient price of 96,891 USDT/BTC. The unfold differential between Prompt Purchase and Professional Net got here to roughly 2.81%, with testing confirming the extra 1% express charge documented within the person’s receipt, bringing complete prices to roughly 3.8%.

The testing confirmed a constant sample: Prompt Purchase transactions price roughly 3.57-3.8% in complete, whereas Kraken Professional costs 0.40% for fast market orders (referred to as “taker” charges) or 0.25% for affected person restrict orders that await the market to return to you (referred to as “maker” charges), in response to Kraken’s official charge schedule. Most retail traders execute market orders, incurring the 0.40% taker charge, leading to prices roughly 9 instances increased on Prompt Purchase. Affected person merchants utilizing restrict orders pay solely the 0.25% maker charge, widening the associated fee differential to roughly 14-fold for similar transaction quantities.

Price Disclosure Practices

The disclosure construction reveals a multi-step course of that obscures complete prices. When customers provoke an Prompt Purchase buy, the preliminary display screen exhibits solely an estimated BTC quantity (e.g., “That’s ≈0.00010321 BTC” for 10 USDC) with no value or charge breakdown. The ultimate affirmation display screen shows three fields: “Quantity” (BTC to obtain), “Value” (e.g., 96,046.6321 USDC), and “Kraken charge” (e.g., 0.099 USDC, representing 1%). The unfold, the distinction between the displayed “Value” and precise market charges, is embedded inside the “Value” discipline relatively than itemized individually. To find the markup, customers should manually bear in mind the market value proven on Kraken’s homepage and calculate the proportion distinction themselves.

Kraken’s Phrases of Service state that “Prompt Purchase consists of a displayed charge and, the place relevant, a variety which is included within the value” and that “Kraken could retain any extra unfold from a transaction.” The documentation lists elements affecting unfold however by no means tells customers the precise proportion or greenback quantity earlier than they full a purchase order.

Against this, Kraken Professional shows market value (e.g., “≈94,241.8 USDT”) and estimated buying and selling charge (e.g., “≈0.04 USDT”) as separate line gadgets earlier than commerce execution. This construction permits customers to see each the reference market price and the express charge they’ll pay.

Actual-World Value Impression

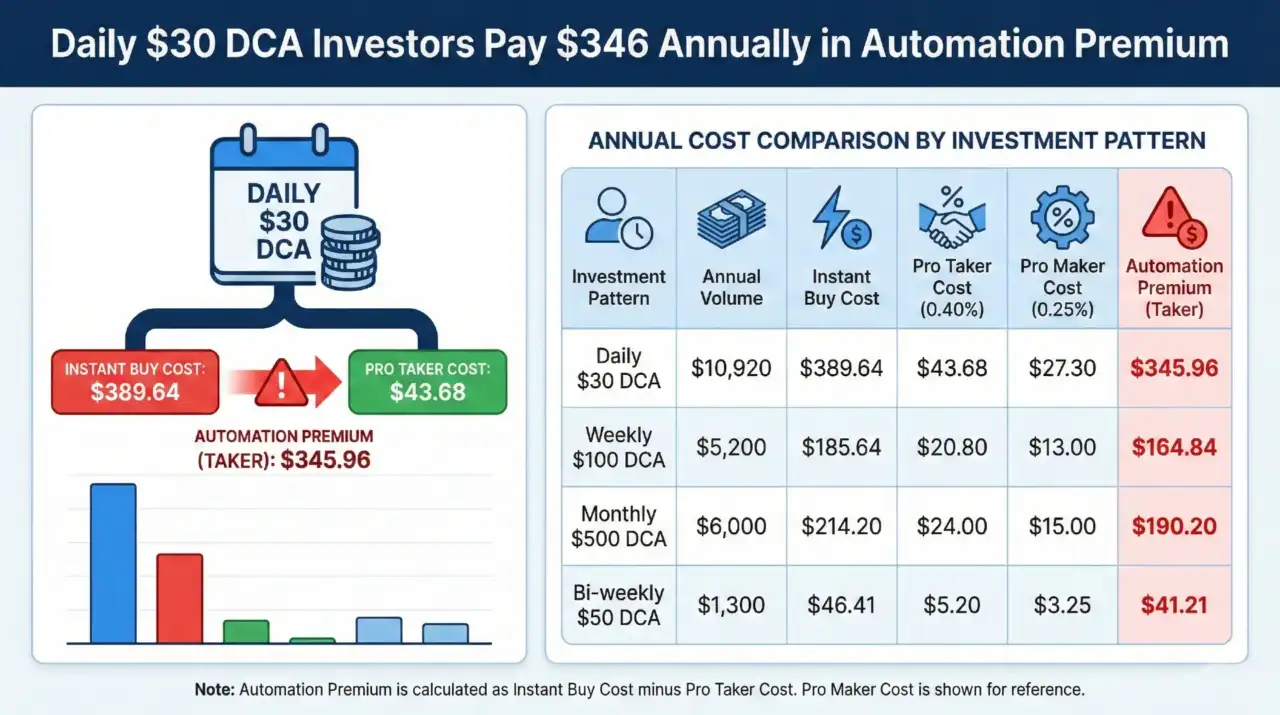

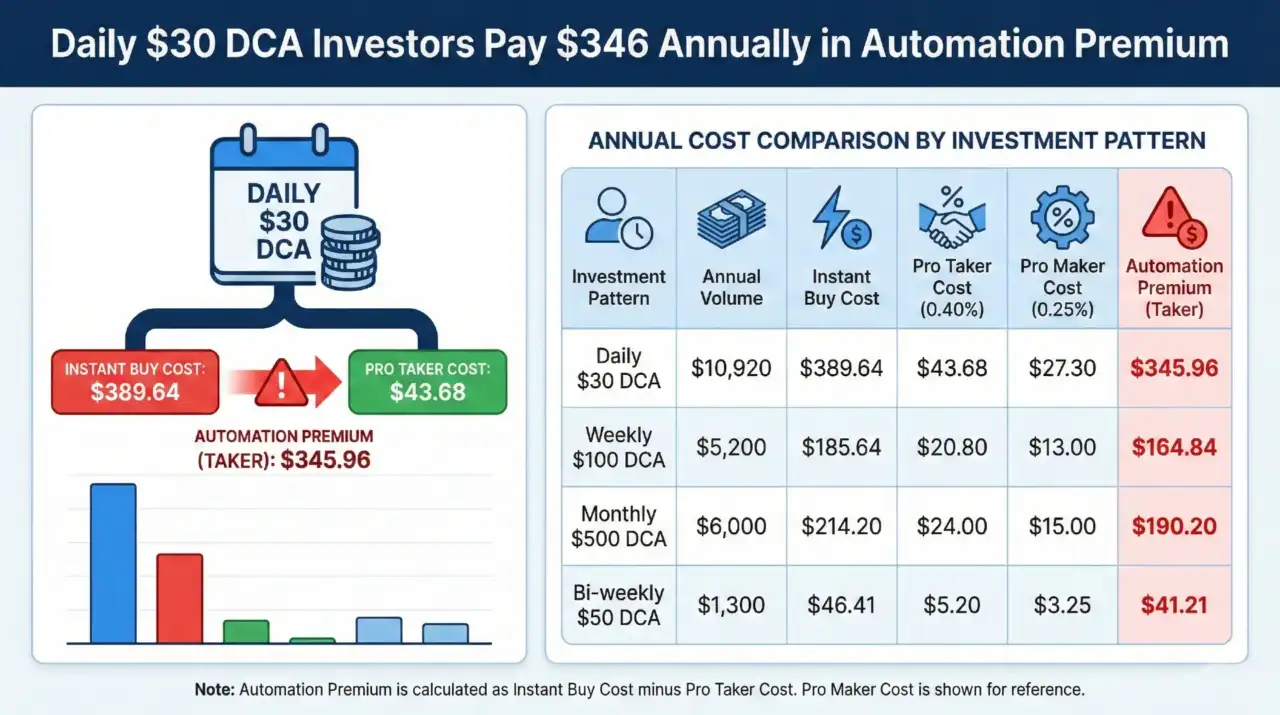

To quantify the influence on retail traders, Crypto-Information.Web calculated annual prices throughout 4 consultant funding patterns utilizing the documented 3.57% Prompt Purchase charge construction and 0.40% Professional taker charge for market order execution.

Day by day $30 DCA Traders Pay $346 Yearly in Automation Premium

Month-to-month DCA Technique: $190 Value Distinction

The automation premium, the extra annual price for utilizing Prompt Purchase as a substitute of manually executing trades on Professional, ranges from $41 to $346 compared towards market order execution (taker charges). Affected person merchants keen to make use of restrict orders and await fills would pay even much less: $27.30 yearly for each day $30 purchases versus $389.64 on Prompt Purchase, a differential of $362.34. These calculations are mathematical projections primarily based on the verified charge construction, not precise person transaction histories over full calendar years.

The Automation Commerce-Off

Kraken affords three buying pathways, every with distinct limitations. Commonplace Prompt Purchase (3.57% complete price) consists of automated recurring purchase performance and a beginner-friendly interface. Kraken+ subscription ($4.99/month) removes the 1% express charge however not the two.57% unfold, making it cost-effective just for customers investing greater than $500 month-to-month. Kraken Professional offers charges of 0.25% to 0.40% for retail volumes, plus skilled buying and selling instruments, however lacks recurring purchase automation totally.

The Kraken+ subscription presents a specific problem for smaller traders. For the bi-weekly $50 investor ($1,300 yearly), the $59.88 subscription plus 2.57% unfold totals $93.29 per 12 months, worse than the $46.41 they’d pay with commonplace Prompt Purchase. The subscription solely advantages customers investing over $500 month-to-month, the place the 1% charge financial savings offset the $4.99 month-to-month price. Even at optimum utilization, Kraken+ customers nonetheless pay considerably greater than Professional’s handbook execution prices.

Kraken’s official documentation, final up to date Aug. 9, 2025, explicitly states: “Recurring orders are presently not obtainable on Kraken Professional.” This architectural hole forces customers to decide on between comfort and cost-efficiency, a trade-off that retail crypto traders should navigate when establishing automated funding methods.

Crypto-Information.Web contacted Kraken on Nov. 16, 2025 with detailed findings and particular questions concerning the charge construction, disclosure practices, and platform structure selections. A follow-up inquiry was despatched Nov. 18 providing to debate through telephone name and condensing inquiries to deal with core disclosure considerations. Kraken didn’t reply to both request for remark by the unique Nov. 19 deadline or by publication on Nov. 25, regardless of a number of alternatives to supply perspective.

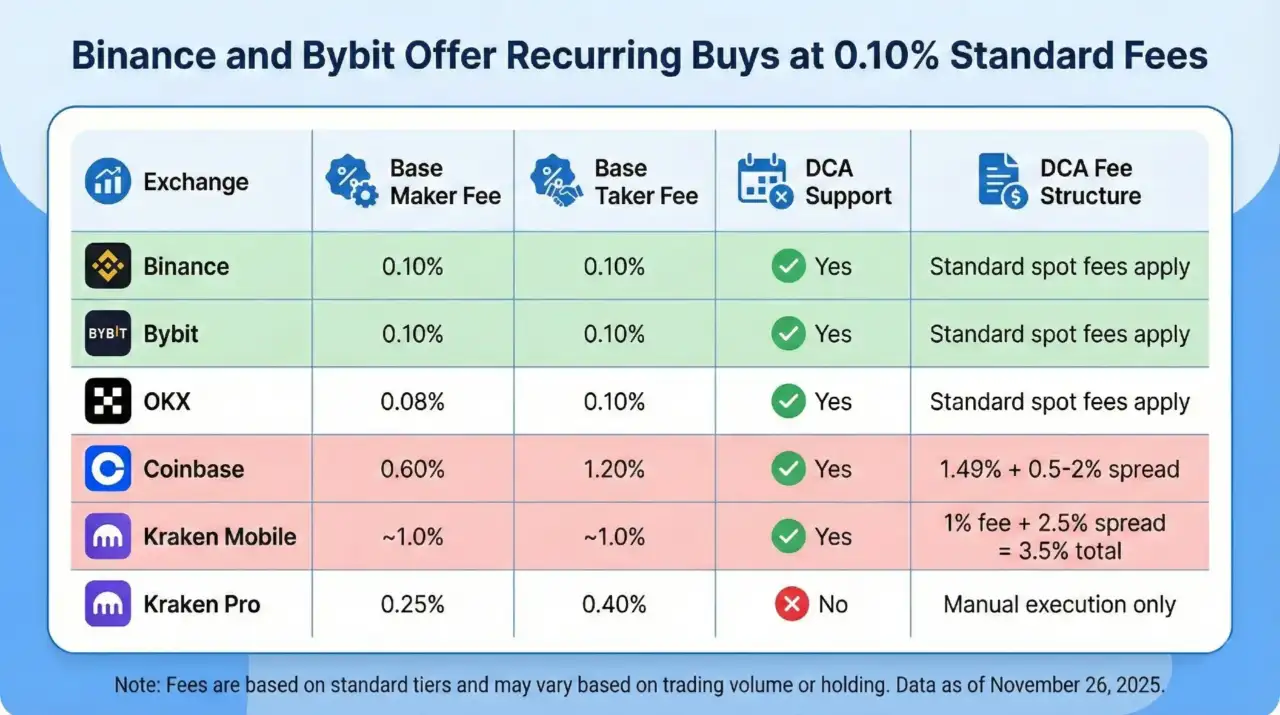

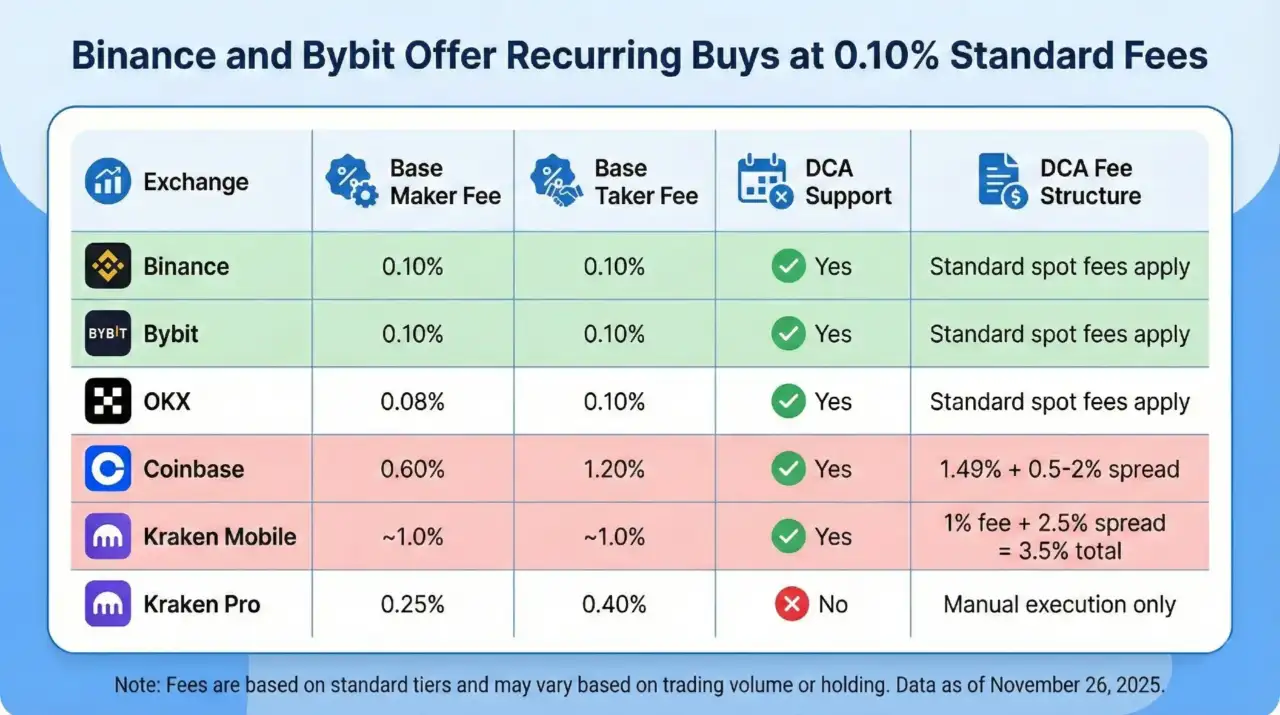

Business Comparability

Evaluation of main cryptocurrency exchanges reveals that Kraken’s restriction of automated purchases to a high-fee tier diverges from business observe. Binance affords recurring purchase performance at commonplace spot buying and selling charges of 0.10% for each maker and taker orders. Bybit equally offers automated purchases at 0.10% commonplace charges with no extra costs. OKX allows recurring buys at 0.08% maker and 0.10% taker charges, additionally utilizing commonplace spot buying and selling charges.

Binance and Bybit Supply Recurring Buys at 0.10% Commonplace Charges

Kraken’s 3.57% DCA Prices Are 35x Larger Than Opponents

The comparability exhibits Kraken Professional’s charge construction of 0.25-0.40% is aggressive with different exchanges’ superior buying and selling platforms. Nevertheless, whereas rivals provide recurring purchase performance on their low-fee platforms, Kraken restricts automation to Prompt Purchase’s 3.57% price construction. This represents prices 35-fold increased than Binance, Bybit, or OKX for similar automated funding methods.

The investigation paperwork a major price differential between Kraken’s automated and handbook buy choices, compounded by disclosure practices that embed unfold prices inside pricing fields relatively than itemizing them individually. For the rising variety of retail traders training disciplined recurring funding methods, the architectural limitation forcing a selection between automation and aggressive charges represents a fabric annual expense that diverges from business requirements the place automation is accessible at spot buying and selling charges.

Steadily Requested Questions: Kraken Charges

How a lot does Kraken Prompt Purchase price?

Kraken Prompt Purchase prices roughly 3.57% complete: a 2.57% unfold markup embedded within the buy value plus a 1% express charge. This totals $357 in annual charges for a $10,000 funding utilizing automated recurring buys.

What’s the distinction between Kraken and Kraken Professional charges?

Kraken Professional costs 0.25% for restrict orders (maker charges) or 0.40% for market orders (taker charges), in comparison with Prompt Purchase’s 3.57% complete price. This represents a 9-14x price distinction relying on order sort. Nevertheless, Kraken Professional doesn’t assist automated recurring purchases.

Does Kraken Professional assist recurring buys?

No. In keeping with Kraken’s official documentation up to date Aug. 9, 2025, “Recurring orders are presently not obtainable on Kraken Professional.” Customers should select between Prompt Purchase’s automation at 3.57% prices or Professional’s low charges with handbook execution.

Is Kraken+ price it for small traders?

No. Kraken+ ($4.99/month) solely advantages traders contributing over $500 month-to-month. For a bi-weekly $50 DCA investor, the $59.88 annual subscription plus 2.57% unfold totals $93.29, worse than commonplace Prompt Purchase’s $46.41 annual price.

How do Kraken’s automated buy charges evaluate to rivals?

Kraken’s 3.57% automated buy charges are 35 instances increased than Binance (0.10%), Bybit (0.10%), and OKX (0.08-0.10%), which provide recurring purchase performance at commonplace spot buying and selling charges with out extra markups.

Disclosure

Crypto-Information.Web editorial workers maintain positions in Bitcoin however don’t maintain positions in Kraken or Kraken-issued securities. Kraken just isn’t a present or previous advertiser with Crypto-Information.Web. This text is for informational functions solely and doesn’t represent funding recommendation. Readers ought to conduct their very own analysis earlier than making monetary selections.