Wouldn’t or not it’s nice if we had one all-encompassing metric to information our Bitcoin investing choices? That’s exactly what has been created, the Bitcoin All the pieces Indicator. Not too long ago added to Bitcoin Journal Professional, this indicator goals to consolidate a number of metrics right into a single framework, making Bitcoin evaluation and funding decision-making extra streamlined.

For a extra in-depth look into this matter, try a current YouTube video right here: The Official Bitcoin EVERYTHING Indicator

Why We Want a Complete Indicator

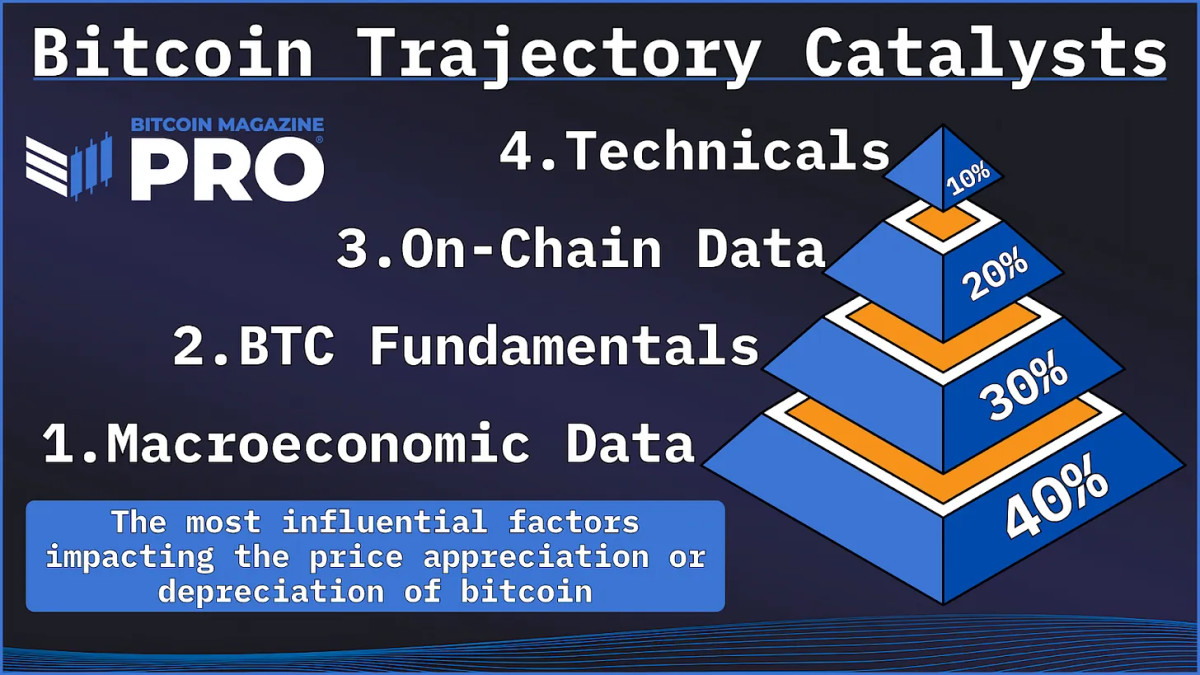

Buyers and analysts sometimes depend on varied metrics, equivalent to on-chain information, technical evaluation, and by-product charts. Nonetheless, focusing an excessive amount of on one facet can result in an incomplete understanding of Bitcoin’s worth actions. The Bitcoin All the pieces Indicator makes an attempt to resolve this by integrating key elements into one clear metric.

View Dwell Chart 🔍

The Core Elements of the Bitcoin All the pieces Indicator

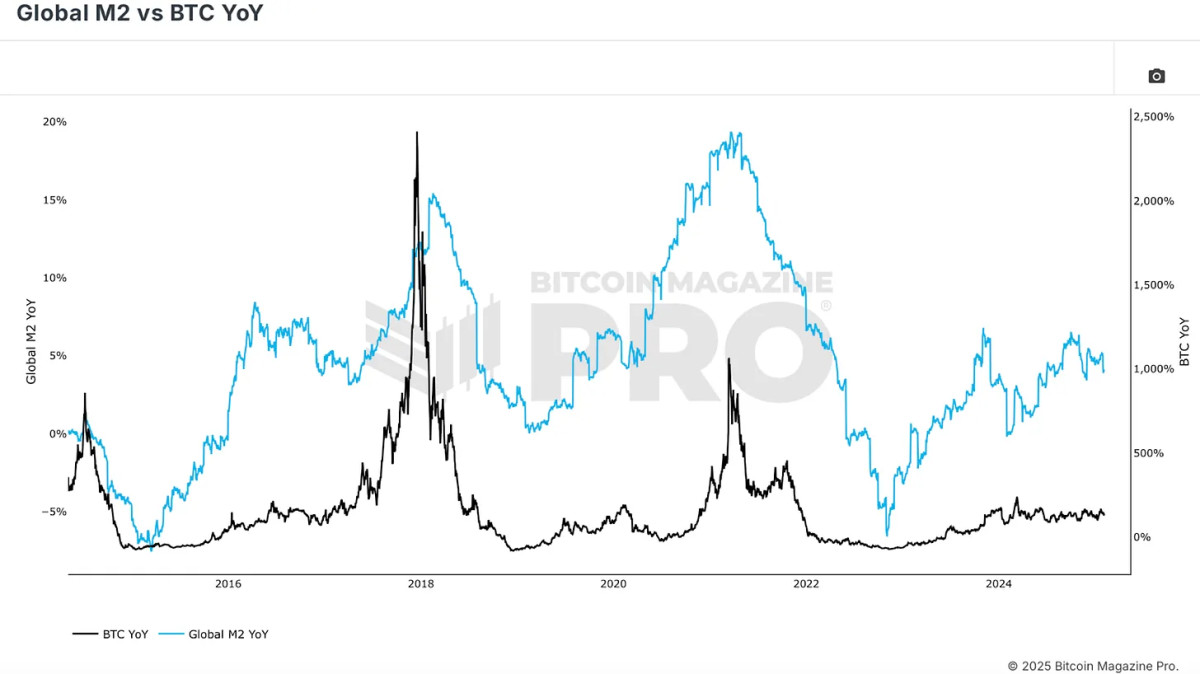

Bitcoin’s worth motion is deeply influenced by world liquidity cycles, making macroeconomic circumstances a basic pillar of this indicator. The correlation between Bitcoin and broader monetary markets, particularly by way of World M2 cash provide, is obvious. When liquidity expands, Bitcoin sometimes appreciates.

View Dwell Chart 🔍

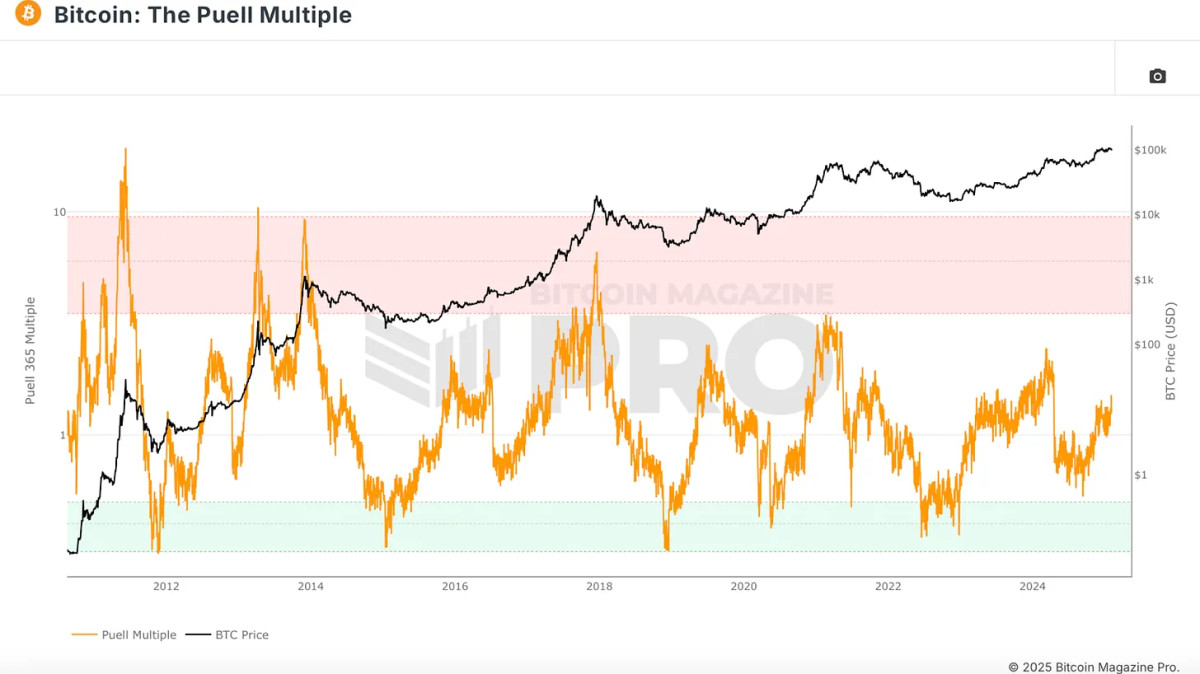

Elementary components like Bitcoin’s halving cycles and miner energy play an important function in its valuation. Whereas halvings lower new Bitcoin provide, their affect on worth appreciation has diminished as over 94% of Bitcoin’s complete provide is already in circulation. Nonetheless, miner profitability stays essential. The Puell A number of, which measures miner income relative to historic averages, offers insights into market cycles. Traditionally, when miner profitability is powerful, Bitcoin tends to be in a good place.

View Dwell Chart 🔍

On-chain indicators assist assess Bitcoin’s provide and demand dynamics. The MVRV Z-Rating, for instance, compares Bitcoin’s market cap to its realized cap (common buy worth of all cash). This metric identifies accumulation and distribution zones, highlighting when Bitcoin is overvalued or undervalued.

View Dwell Chart 🔍

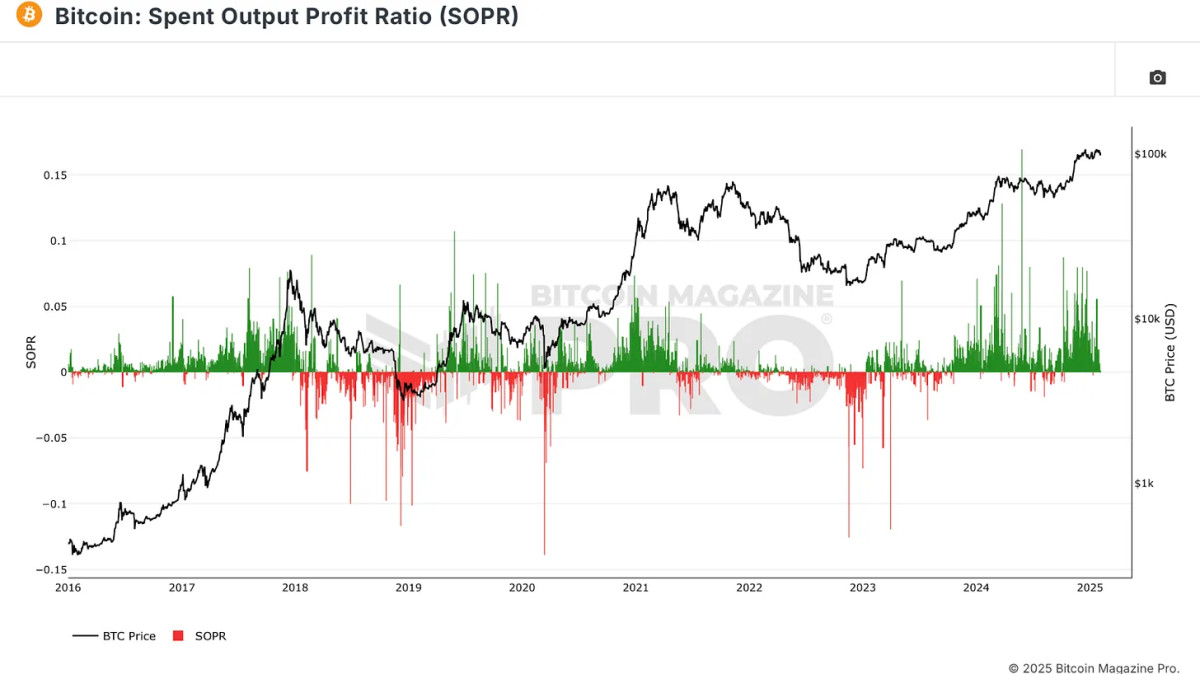

One other essential on-chain metric is the Spent Output Revenue Ratio (SOPR), which examines the profitability of cash being spent. When Bitcoin holders understand huge income, it usually indicators a market peak, whereas excessive losses point out a market backside.

View Dwell Chart 🔍

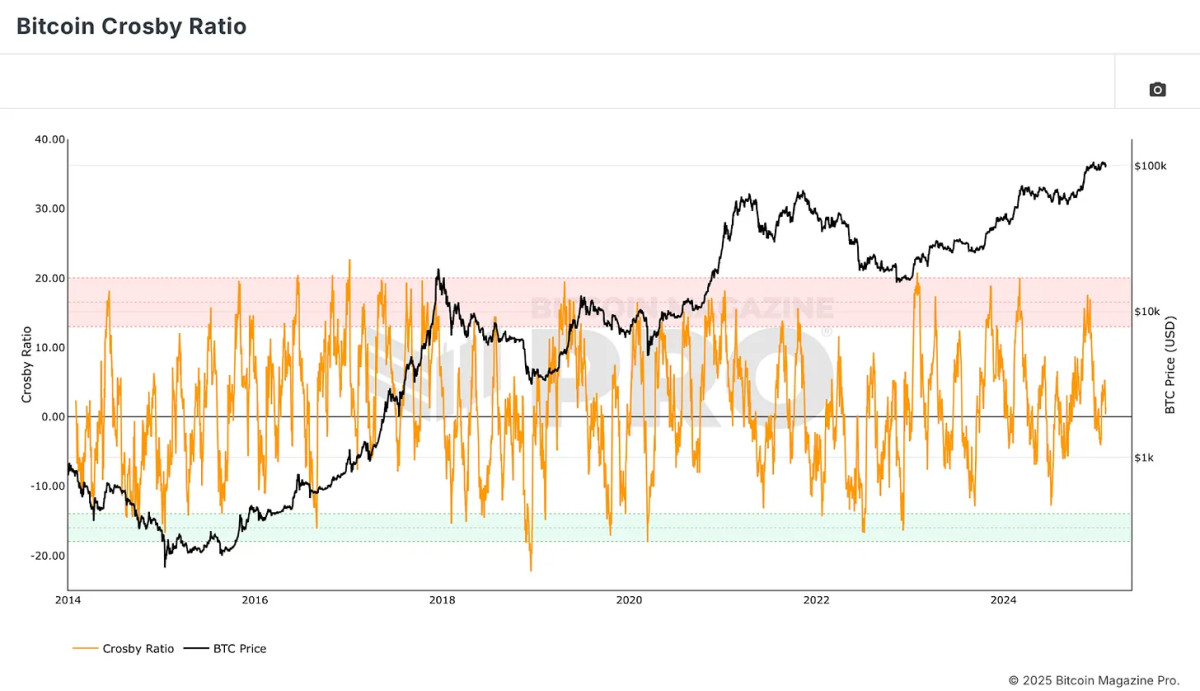

The Bitcoin Crosby Ratio is a technical metric that assesses Bitcoin’s overextended or discounted circumstances purely based mostly on worth motion. This ensures that market sentiment and momentum are additionally accounted for within the Bitcoin All the pieces Indicator.

View Dwell Chart 🔍

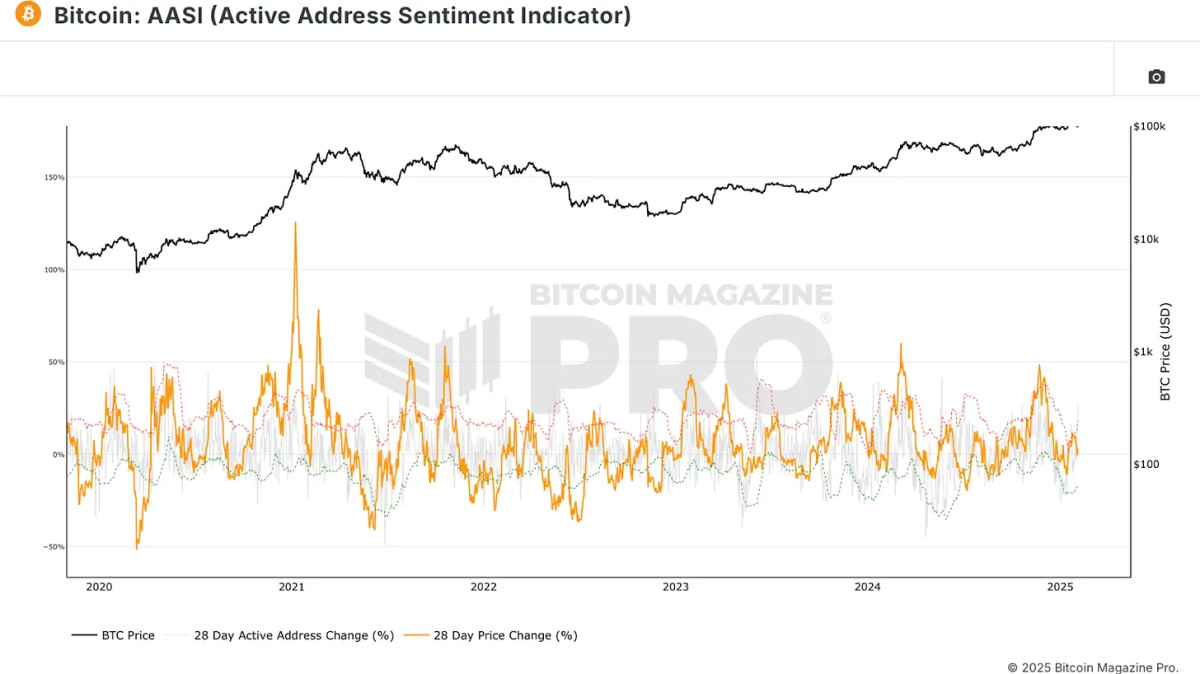

Community utilization can supply very important clues about Bitcoin’s energy. The Energetic Deal with Sentiment Indicator measures the share change in lively addresses over 28 days. An increase in lively addresses usually confirms a bullish pattern, whereas stagnation or decline could sign worth weak spot.

View Dwell Chart 🔍

How the Bitcoin All the pieces Indicator Works

By mixing these varied metrics, the Bitcoin All the pieces Indicator ensures that no single issue is given undue weight. Not like fashions that rely too closely on particular indicators, such because the MVRV Z-Rating or the Pi Cycle Prime, this indicator distributes affect equally throughout a number of classes. This prevents overfitting and permits the mannequin to adapt to altering market circumstances.

Historic Efficiency vs. Purchase-and-Maintain Technique

One of the vital putting findings is that the Bitcoin All the pieces Indicator has outperformed a easy buy-and-hold technique since Bitcoin was valued at underneath $6. Utilizing a technique of accumulating Bitcoin throughout oversold circumstances and steadily promoting in overbought zones, buyers utilizing this mannequin would have considerably elevated their portfolio’s efficiency with decrease drawdowns.

As an example, this mannequin maintains a 20% drawdown in comparison with the 60-90% declines sometimes seen in Bitcoin’s historical past. This means {that a} well-balanced, data-driven strategy may help buyers make extra knowledgeable choices with diminished draw back danger.

Conclusion

The Bitcoin All the pieces Indicator simplifies investing by merging essentially the most essential facets influencing Bitcoin’s worth motion right into a single metric. It has traditionally outperformed buy-and-hold methods whereas mitigating danger, making it a helpful device for each retail and institutional buyers.

For extra detailed Bitcoin evaluation and to entry superior options like stay charts, personalised indicator alerts, and in-depth trade studies, try Bitcoin Journal Professional.

Disclaimer: This text is for informational functions solely and shouldn’t be thought-about monetary recommendation. At all times do your individual analysis earlier than making any funding choices.