ETH’s value has lately carried out like a stablecoin. 4 years in the past, when you had invested $10,000 in Ethereum (ETH), you would possibly anticipate a big return by now, given the crypto market’s status for volatility. Nonetheless, as of March 31, 2025, that funding would hover round $10,000 to $11,000, reflecting ETH’s surprisingly minimal efficiency.

The Modest Volatility of ETH Over the Previous 4 Years

Again on March 31, 2021, ETH was priced at round $1,800. Quick ahead to right this moment, and it sits between $1,700 and $1,800—a negligible change over 4 years. Whereas ETH hit an all-time excessive (ATH) of $4,878 in November 2021, it plummeted to roughly $1,000 throughout the 2022 bear market, solely to get better steadily to its present vary.

Supply: Coingecko

This rollercoaster contrasts sharply with different cryptocurrencies. Bitcoin BTC, as an illustration, surged from $58,000 in 2021 to a peak of $109,000 in 2025, although it’s now down over 30% to round $82,000. Solana SOL skyrocketed from $35 to $126 (+260%), whereas XRP XRP has seen blended outcomes however outperformed ETH in proportion good points at occasions.

Wanting forward, ETH’s value typically mirrors BTC’s developments. Traditionally, BTC drops 30-50% after hitting an ATH. For this era, after reaching the ATH of $108,786 on January 2025, BTC had decreased about 25-30%, to BTC right this moment. With this case, some analysts have predicted an extra decline to $66,000 in BTC’s value; then ETH might comply with go well with.

Nonetheless, the ETH/BTC buying and selling pair has additionally weakened considerably, with BTC/ETH roughly equal to 45, signaling ETH’s rising disconnect from BTC’s dominance. Furthermore, the current Pectra replace, not like previous upgrades comparable to The Merge, has did not spark a optimistic value response, including to the bearish outlook.

Subsequently, when you had invested $10K in ETH 4 years in the past, you’d truly be at a slight loss this yr.

Supply: Coingecko

ETH’s Worth Performs Like a Stablecoin

ETH’s lackluster efficiency might be traced to broader financial fears and market dynamics. With recession considerations mounting, conventional safe-haven belongings like gold have hit report highs. Particularly amid rising diplomatic tensions and international commerce wars since Trump took workplace earlier this yr, gold has emerged as the highest safe-haven asset for buyers, surging to $3,122 per ounce. Or another choice, BTC, has solidified its standing as “digital gold,” additionally a typical approach to reserve belongings for buyers.

In distinction, the shortage of a powerful sufficient use case for ETH is inflicting value stagnation. Traders are hesitant to pour cash into belongings perceived as much less dependable, like ETH or different digital belongings, throughout unsure occasions.

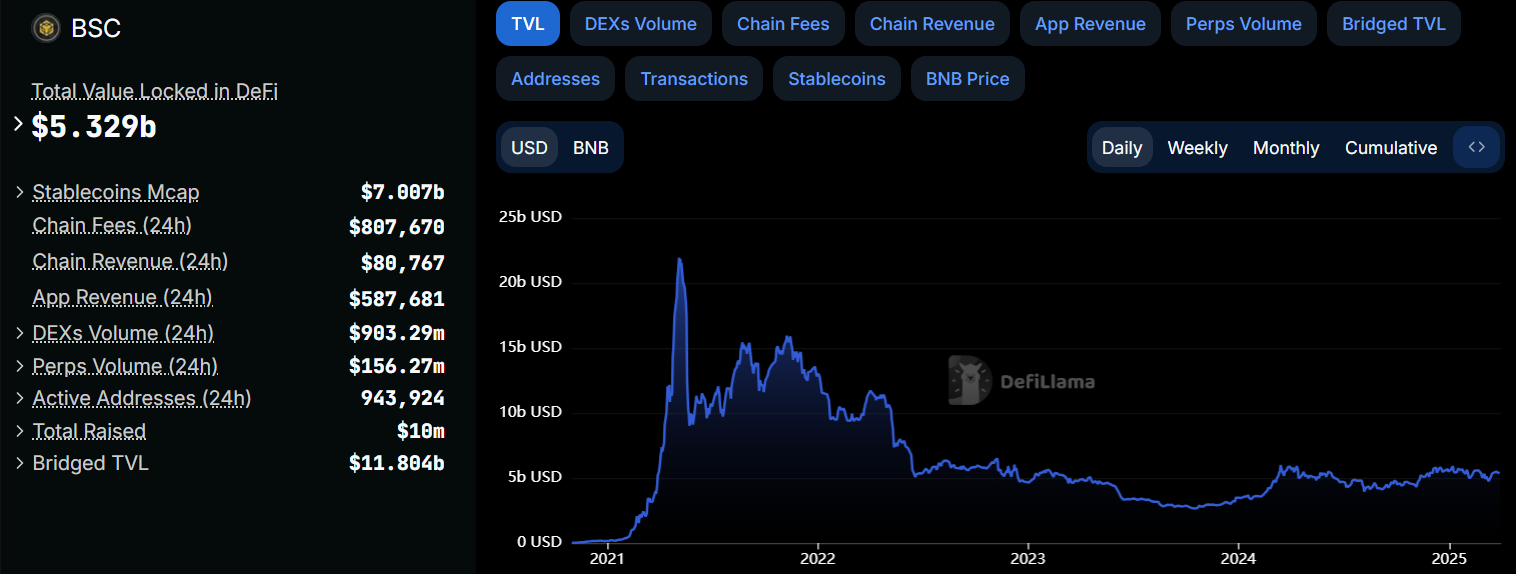

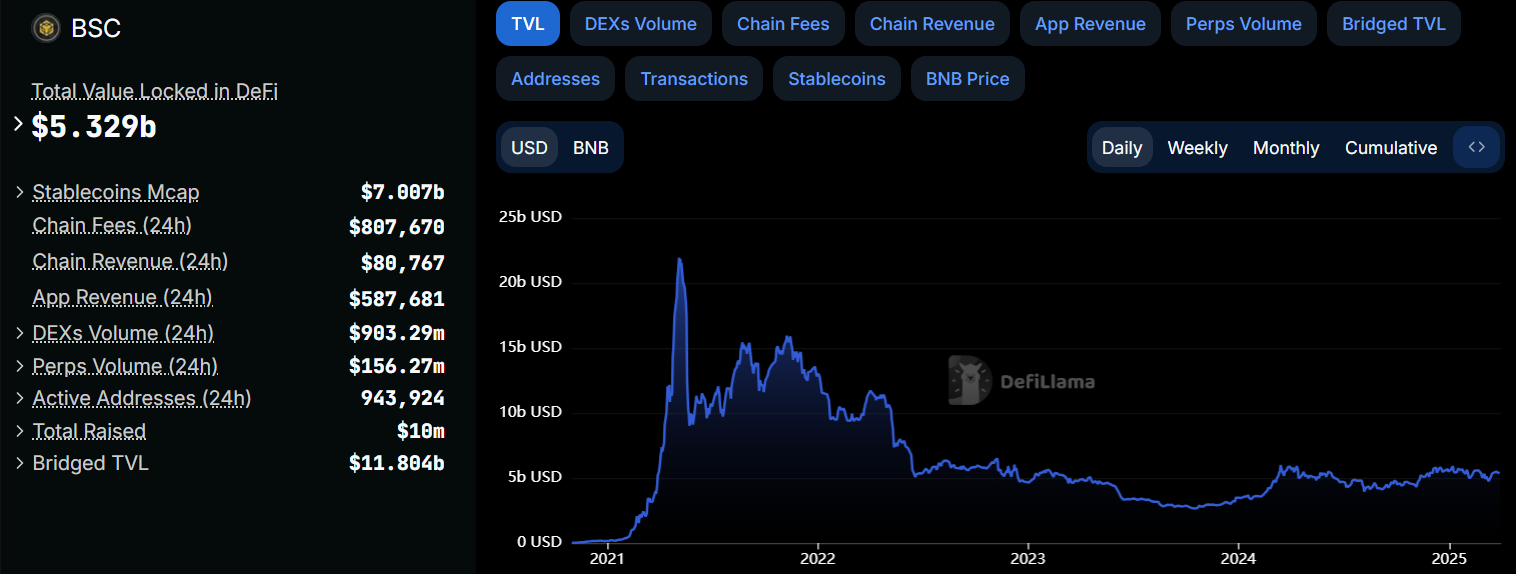

In the meantime, rivals like Binance Coin (BNB) thrive via proactive measures. BNB’s ecosystem has rolled out initiatives just like the third Liquidity Program, memecoin stimulation from CZ, and initiatives like WIO and Binance Alpha. These efforts have saved BNB’s value buoyant, climbing from $300 in 2021 to over $600 in 2025—a 100%+ acquire—whereas its chain’s complete worth locked (TVL) rivals Ethereum’s in DeFi exercise.

Supply: DefiLlama

Ethereum, in contrast, lacks such dynamic catalysts. Whereas technically spectacular, its upgrades haven’t translated into rapid market pleasure. Whereas The Merge considerably diminished power consumption, Pectra’s emphasis on scalability enhancements has not but yielded important outcomes.

With no daring push akin to BNB’s multi-pronged technique—and even Solana’s relentless advertising and marketing of its high-speed blockchain—ETH stays caught, mimicking a stablecoin’s predictability somewhat than a development asset’s volatility. This inertia highlights a broader problem: ETH’s maturity could also be stifling its capability to compete with hungrier rivals.

Learn extra: ETH All of the sudden Dropped to $1,900

Regardless of the Downsides, ETH Nonetheless Holds Immense Potential

Even with these challenges, ETH stays a cornerstone of the crypto world. As the biggest and most established Layer 1 blockchain, it boasts a sturdy neighborhood and a sprawling ecosystem, together with Layer 2 options and a wide selection of functions. Its know-how continues to guide the trade, pushed by top-tier builders and market-leading upgrades.

In addition to that, there have been a number of rumors inside the neighborhood of the rising real-world adoption of Ethereum. As an illustration, discussions round ETH’s use in funds and its rising recognition recommend a promising future. Trump’s gone large on ETH, holding 70% of his portfolio in it over BTC.

Banks at the moment are greenlit to stake ETH, and BlackRock is betting on it as their sole tokenization choose—exhibiting ETH’s quietly successful the place it counts. Whereas the market might not replicate it now, ETH’s fundamentals—its scalability, developer exercise, and ecosystem power—place it for long-term success. Endurance might but repay for ETH believers.

5/➮ Unusual that, regardless of all the pieces I discussed, we now have Trump shopping for extra ETH than BTC and holding 70% of his portfolio in it

🕷 There’s additionally the truth that banks have been allowed to make use of ETH for staking

🕷 And BlackRock, for whom ETH has turn into the one choice for…

— symbiote (@cryptosymbiiote) March 15, 2025