The CEO at on-chain analytics agency CryptoQuant has declared the tip of the Bitcoin bull cycle, however this analyst has offered a counterpoint.

Realized Cap May Present Hints About What’s Subsequent For Bitcoin

In a put up on X, CryptoQuant founder and CEO Ki Younger Ju has defined why the bull cycle could possibly be over for Bitcoin, based mostly on the info of the Realized Cap. The “Realized Cap” refers to an on-chain capitalization mannequin that assumes the precise worth of any token in circulation is the spot value at which it was final transacted on the blockchain.

The final transaction value of any coin is nothing, however the value at which its investor bought it, so the Realized Cap measures the sum of the associated fee foundation of all cash within the circulating provide. In different phrases, the mannequin represents the quantity of capital that the holders as a complete have invested into the cryptocurrency.

The Market Cap, which merely sums up the availability on the present spot value, is in distinction to this mannequin, indicating the worth that the buyers are holding within the current.

At any time when the buyers purchase cash, the Realized Cap goes up by the precise quantity as what they purchased for. The identical, nonetheless, doesn’t maintain true for the Market Cap. Relying on numerous market situations, a rise within the Realized Cap can set off a rise within the Market Cap that’s smaller, bigger, or equal in scale.

In line with the CryptoQuant founder, which of those methods the Market Cap is reacting to modifications within the Realized Cap can present bullish or bearish indicators for BTC.

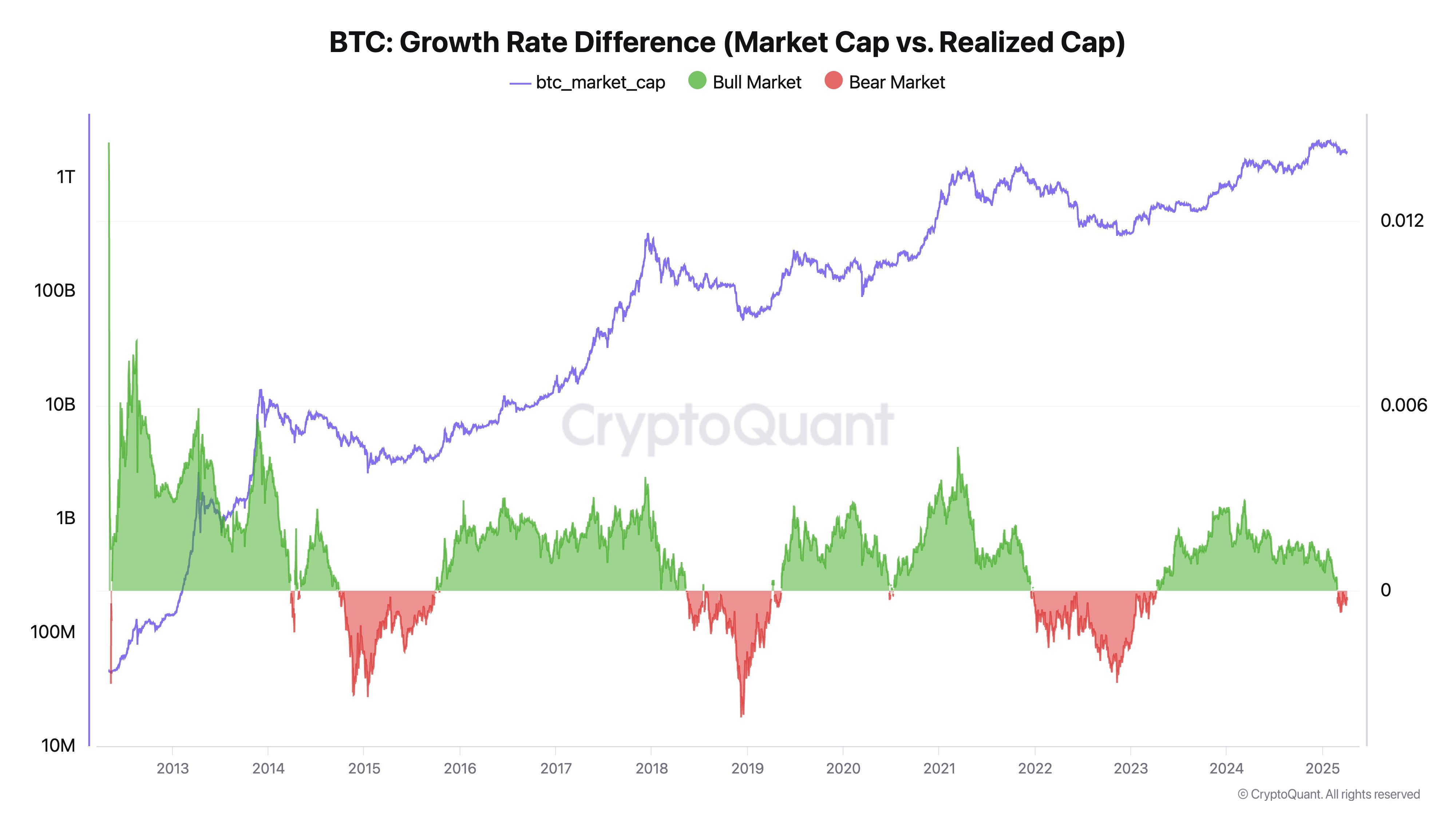

The distinction between the growths within the BTC Market Cap and Realized Cap | Supply: @ki_young_ju on X

From the above chart, it’s seen that the expansion charge distinction between the Market Cap and Realized Cap has turned damaging lately. Because of this capital inflows aren’t capable of elevate the value, which is a sign that has traditionally coincided with bearish durations for Bitcoin.

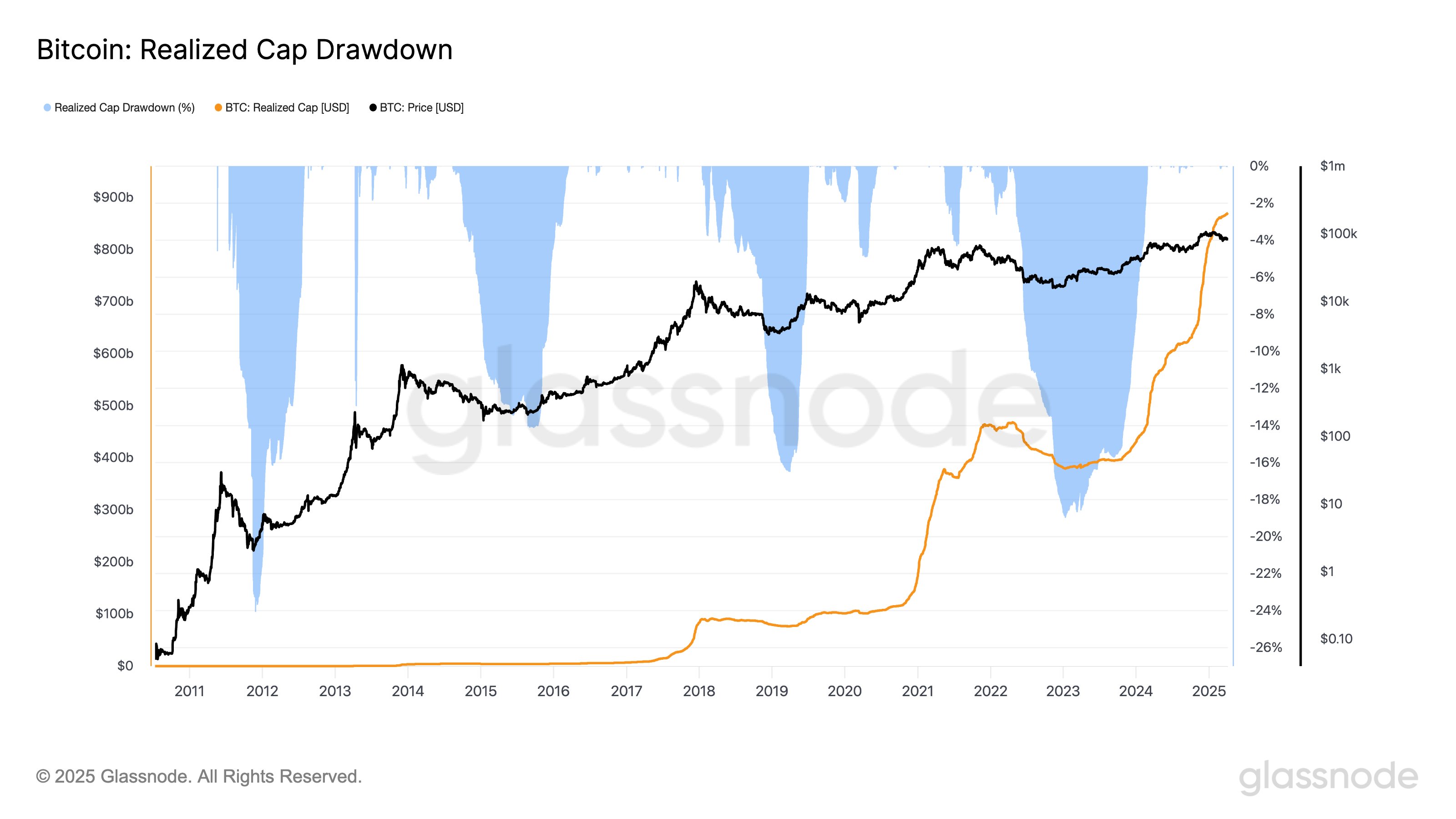

Whereas this might certainly recommend the bull market could also be over, one other analyst, James Van Straten, has offered a distinct perspective in an X put up. Right here is the chart that the analyst has shared as a counter to Younger Ju, displaying the development within the BTC Realized Cap, in addition to its drawdown proportion, over the coin’s historical past:

The Realized Cap has continued to climb up in latest days | Supply: @btcjvs on X

As is obvious from the chart, the Realized Cap has traditionally witnessed a robust drawdown throughout bear markets. This occurs because of buyers capitulating at decrease costs than they purchased at, thus repricing the availability down.

To date, the Realized Cap hasn’t seen any vital drawdowns, even supposing the value has plunged lately. This may suggest the buyers nonetheless maintain a level of confidence in Bitcoin. Not simply that, the Realized Cap has in actual fact continued its upwards trajectory lately, an indication that capital inflows haven’t let off.

“Bear markets don’t normally begin with confidence and inflows,” notes Van Straten. Solely time would have the ability to reply for certain now whether or not BTC has transitioned right into a bear or not.

BTC Worth

Bitcoin has kicked off the brand new week with a crash of virtually 7%, which has introduced its value right down to $76,500.

Appears like the value of the coin has plunged over the previous day | Supply: BTCUSDT on TradingView

Featured picture from Dall-E, CryptoQuant.com, Glassnode.com, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent overview by our staff of high know-how consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.