Bitcoin treasury corporations have seen a record-breaking 2025 to this point, however CryptoQuant knowledge reveals momentum has began to decelerate.

Bitcoin Treasuries Could Be Observing A Slowdown

In a brand new publish on X, on-chain analytics agency CryptoQuant has mentioned how the newest development is trying with regards to Bitcoin company treasuries. Popularized by Michael Saylor’s Technique (previously Microstrategy), the treasury playbook refers to a mannequin the place a publicly listed entity buys and retains BTC as a reserve asset on its stability sheet.

The earlier cycle noticed this treasury technique achieve some steam, however issues have gone up a notch this cycle because the success of Technique has inspired corporations to go bolder.

Because the beneath chart reveals, 2023 peaked at simply 15 new treasury patrons of Bitcoin, however the quantity greater than doubled to 38 in 2024.

The variety of new treasuries appears to have been accelerating | Supply: CryptoQuant on X

2025 has solely continued this development of acceleration, with 89 corporations already having added BTC to their stability sheets, when there are just a few months left to go for the yr.

That mentioned, whereas 2025 has actually been spectacular to this point, granular knowledge may present early indicators {that a} shift could also be underway.

The brand new treasury corporations established within the varied months of 2025 | Supply: CryptoQuant on X

As is seen within the above graph, the Bitcoin treasury technique hype noticed a rise over the yr, peaking at 21 new corporations in July. In August, nonetheless, the quantity dropped to fifteen, and within the first half of September, to this point, only one new firm has employed this mannequin. Primarily based on the information, CryptoQuant concludes, “the slowdown has begun.”

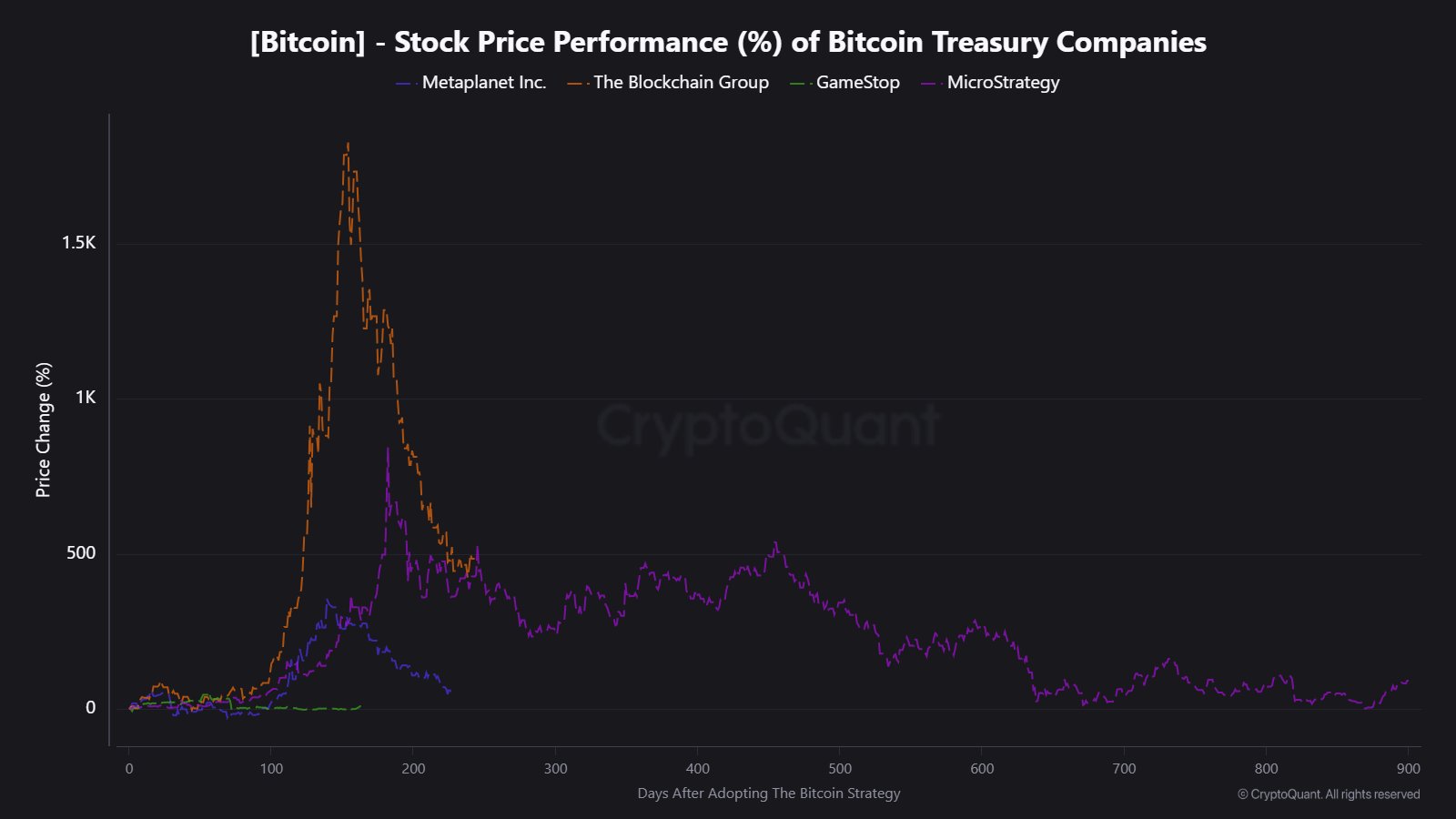

The cooldown in momentum can also be evident within the inventory charts of a few of these corporations.

Appears to be like like these corporations all noticed a notable peak of their inventory earlier than seeing a pointy decline | Supply: CryptoQuant on X

Examples of this embody The Blockchain Group, which was sitting at +1,820% at its peak earlier than seeing a decline to +443%, and Metaplanet, all the way down to +55% from its +355% high. “Indicators the hype is deflating as actuality units in,” notes the analytics agency.

Although whereas indicators have been there for a slowdown, the large patrons haven’t regarded finished accumulating Bitcoin but. Technique has repeatedly been shopping for and has added $19.3 billion to its reserves year-to-date. Equally, Metaplanet has expanded its treasury by $1.92 billion.

The cumulative USD quantity invested by Technique for every year | Supply: CryptoQuant on X

At this time, Bitcoin treasury corporations as an entire management greater than 1 million tokens, equal to five% of your complete BTC provide in circulation. Technique alone makes up for 66% of this stack.

BTC Worth

Bitcoin has furthered its restoration over the previous day as its value has surged to $116,600.

The development within the value of the coin during the last 5 days | Supply: BTCUSDT on TradingView

Featured picture from Dall-E, CryptoQuant.com, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent overview by our workforce of high know-how consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.