It solutions billions of searches each day, powers the world’s largest video platform, dominates internet marketing, and is making a large push into AI and even self-driving vehicles; Google is all over the place. With over $90 billion in money and annual income exceeding $100 billion, Alphabet, Google’s mother or father firm, is among the world’s most influential corporations. However with regulatory threats looming and fierce competitors in cloud and AI, can Google hold delivering for traders? Let’s discover out.

Google is a money-making machine. It continues to develop its promoting enterprise whereas innovating in cloud and AI. In 2024, it raked in over $100 billion in revenue and ended the 12 months with $90 billion in money.

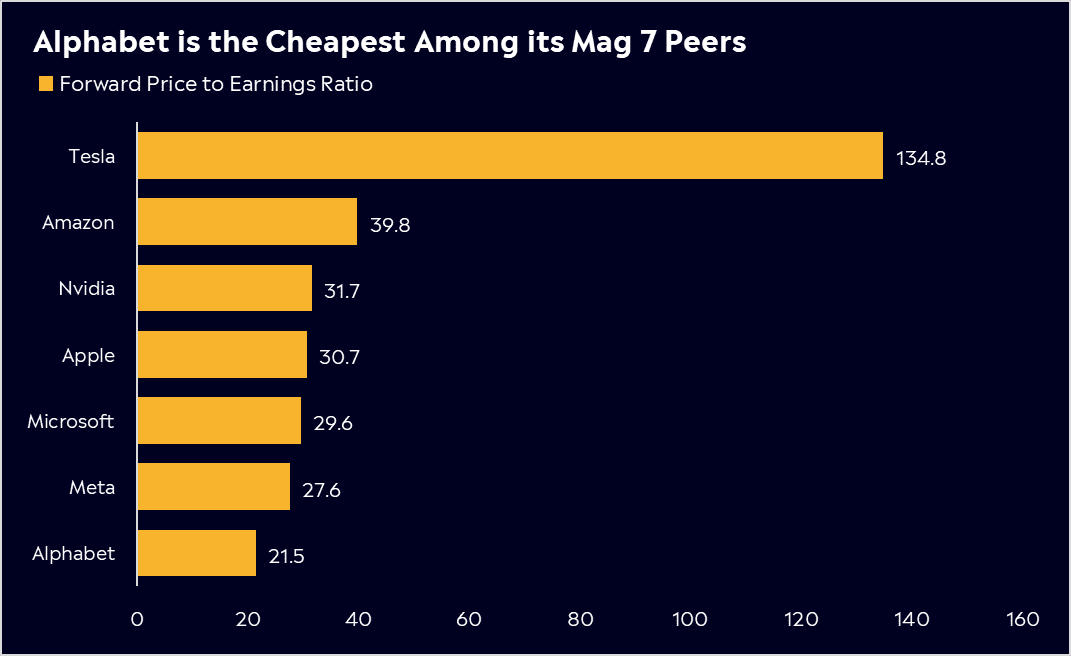

Alphabet at the moment trades at 21.5x ahead earnings, a compelling valuation given its buying and selling at a reduction to the S&P500 which is at the moment 23x value to earnings.

Wall Road likes it – Alphabet has 59 Purchase rankings, 15 Holds, and 0 Sells. From these rankings it has a mean value goal of $218.60.signalling a possible 14% upside.

The Fundamentals

Google was based in 1998 by associates Sergey Brin and Larry Web page, ranging from a rented storage in California. At present, it’s some of the dominant companies on this planet, renaming itself Alphabet in 2015. This was as a result of Google turned extra than simply Google. Though Google generates most of its income from digital promoting, a large $265 billion in 2024, its attain extends far past search.

The enterprise generates its income from three key income segments:

Google Providers (87% of income) That is the moneymaker. Google’s dominance in search, video, and electronic mail makes it the world’s largest digital promoting enterprise.

Search – The spine of Google, dealing with over 8.5 billion searches per day and producing billions in advert income.

YouTube – The world’s second-largest search engine (behind Google itself) and the largest video platform, monetised via advertisements.

Android & Google Play—With over 3 billion gadgets, Android is the most-used cell working system on this planet, with a 72% market share, in line with Statista. Sure, greater than iPhone’s iOS, which has simply 27.5% market share. Android generates income from app gross sales, subscriptions, and Play Retailer charges.

Chrome, Gmail and Maps – Whereas free for customers, these providers hold folks in Google’s ecosystem, feeding knowledge into its advert enterprise.

Google Cloud (12% of income)

Google Cloud powers companies, AI fashions, and digital providers worldwide. It competes with Amazon Net Providers (AWS) and Microsoft Azure, serving to corporations retailer knowledge, run purposes, and construct AI instruments. This section additionally encompasses Google Workspace: Google Meet, Drive and Docs. Google Cloud has been Alphabet’s fastest-growing section as demand for AI and enterprise cloud providers continues to soar. However it’s nonetheless enjoying catch-up to AWS and Microsoft.

Different Bets (Underneath 1% of income)That is the place Alphabet desires massive. A few of these initiatives may form the longer term, whereas others would possibly by no means make a cent.

Waymo – Self-driving vehicles that would change transport ceaselessly.

DeepMind – Reducing-edge AI analysis.

Nest – Google’s sensible house division division. Sure, it’s these little doorbell cameras!

Alphabet’s long-term development story has rewarded traders within the final decade. Shares have risen by greater than 670%, giving an annualised return of twenty-two%. To maintain the inventory engaging for retail traders, Alphabet has break up its inventory 3 times, now buying and selling at round $205.

Enjoyable Truth: Alphabet acquired YouTube for $1.65 billion in 2006. Alphabet makes round $1.65 billion in income from YouTube each 2.5 weeks. YouTube additionally has 2.5 billion month-to-month energetic customers and is Australia’s 2nd most visited web site, behind… Google. Dominance.

Previous efficiency just isn’t a sign of future outcomes.*Supply: International Stats StatCounter

Competitor Analysis

Alphabet faces fairly stiff competitors throughout all of its key enterprise areas. In promoting, it’s keeping off Meta with its suite of social apps, and TikTok continues to be a brand new formidable power up towards YouTube. Google stays the dominant search engine however faces challenges. AI-powered search continues to be evolving, however corporations like Perplexity AI wish to disrupt conventional search fashions. In the meantime, Microsoft’s deep partnership with OpenAI provides it an edge, integrating AI instantly into Bing and enterprise instruments via Copilot.

One in every of Google’s important aggressive benefits is its long-standing relationship with Apple. In 2005, the pair signed an settlement to make Google the default search engine for Safari, which nonetheless stands immediately. Given the huge iPhone person base, being the default search engine on Safari is essential for Google, because it drives important search site visitors and advert income.

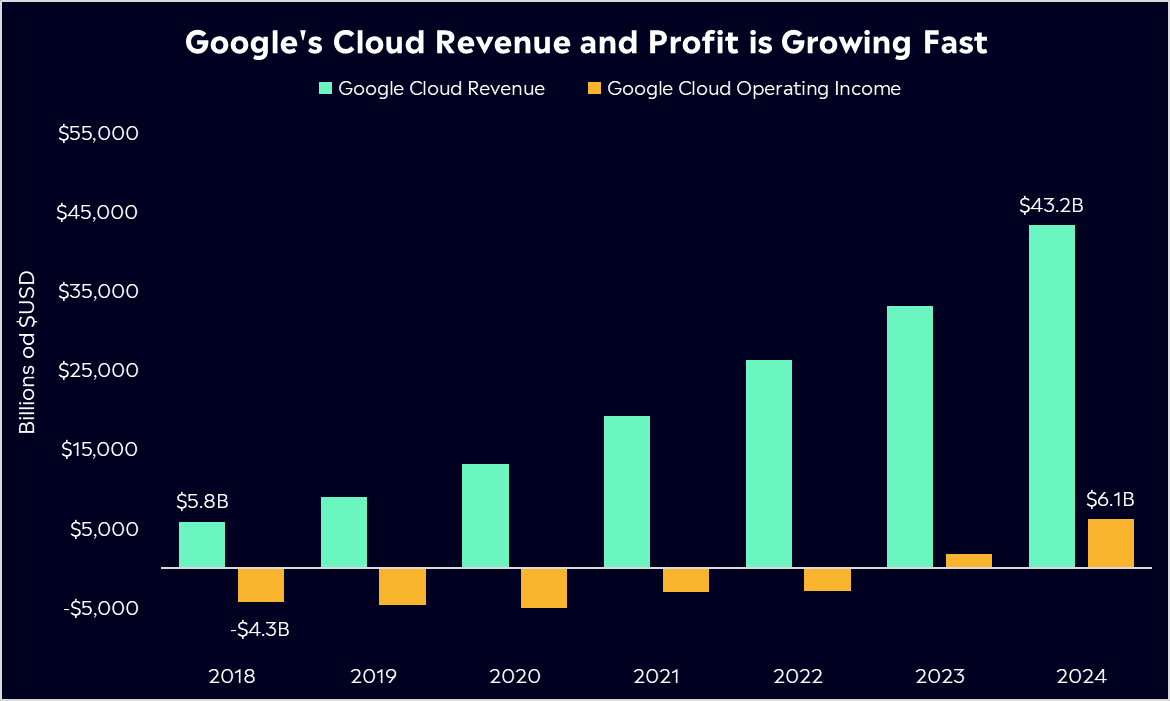

Amazon (AWS) and Microsoft (Azure) are the dominant gamers in cloud computing, whereas Google Cloud is doing what it may possibly to achieve market share. Whereas it’s nonetheless enjoying catch-up, Google Cloud’s profitability turned optimistic for the primary time in 2023, a key milestone in its enlargement.

An enormous problem to contemplate is the crackdown from US regulators. The Division of Justice has stated that Google unfairly maintains a monopoly in search and internet marketing. The DOJ may power Google to interrupt up, probably separating its search, promoting, or cloud companies. This may basically reshape the corporate. A Trump Presidency might be excellent news right here, significantly together with his stance on much less regulation. CEO Sundar Pichai attended Trump’s inauguration as he seems to be to do what he can to cease any crackdowns. Trump’s relationship with massive tech hasn’t all the time been a technique; he has beforehand accused Google of bias in search outcomes. Nevertheless, a extra business-friendly administration may ease regulatory pressures.

Alphabet’s give attention to integrating AI and cloud expertise into its enterprise is positioning it to remain aggressive whereas its huge person base retains its promoting machine rolling.

Monetary Well being Verify

Alphabet reported its earnings earlier within the week, and the This autumn outcome was fairly uninspiring. Income missed estimates, and Google Cloud, its key development section, didn’t dwell as much as expectations. There have been brilliant spots. Google’s search, promoting, and YouTube revenues have been forward of estimates, however the focus has been on Cloud.

General This autumn Income $96.47 billion +12% y/y, estimate $96.62 billion

Google promoting income $72.46 billion +11% y/y, estimate $71.73 billion

YouTube advertisements income $10.47 billion +14% y/y, estimate $10.22 billion

Google Cloud income $11.96 billion +30% y/y, estimate $12.19 billion

Google’s promoting income is its bread and butter via its search enterprise however that is now a mature enterprise with income set to develop within the single digits subsequent 12 months. For traders, the main focus is on cloud, the place the corporate is seeing speedy development, with working earnings up over 250% in 2024. Importantly, Google’s search advert income retains rising regardless of the rise of AI search. The miss on income in its cloud enterprise is essential as a result of it did not reassure Wall Road that its heavy investments in AI are translating into better-than-expected development. That concern is extra related than ever with the emergence of DeepSeek and the truth that Alphabet additionally stated they see capital expenditures at round USD$75 billion in 2025, nearly USD$20 billion greater than analysts had anticipated. This reveals their dedication to rising knowledge centres, AI infrastructure, and different applied sciences. Which will appear to be a giant quantity, however Alphabet’s web revenue rose to $100 billion in 2024.

Nevertheless, this was one quarter. Google Cloud’s margin development has been strong since 2018, rising at a outstanding tempo. For the total 12 months 2024, its EBIT margin reached 14%, leaping to as excessive as 17.5% in the newest outcome. For some context, this was -74% in 2018. That development has helped increase Alphabet’s general revenue margins for the 12 months. It’s additionally price noting that the enterprise has a critical money pile. Free money circulate remained robust at practically $25 billion for the quarter. For the total 12 months 2024, Alphabet had USD$95 billion in money, which is about to develop to USD$153 billion in 2025. All in all, its This autumn report was okay; it definitely wasn’t magnificent. Whenever you’re spending as a lot as they’re, traders need constant development and can develop into impatient in the event that they don’t get that. Alphabet might want to justify its AI spending all through 2025, and if it may possibly’t, shares will undoubtedly face some strain.

* Previous efficiency just isn’t a sign of future outcomes.

Purchase, Maintain or Promote?

In its most up-to-date earnings name, administration famous that demand was outpacing capability for its AI merchandise, simply one of many causes it plans to spend $75 billion in 2025, serving to to ease capability constraints as AI demand grows. Its AI positioning is a large optimistic for the corporate, but it surely should hold making market share positive aspects in cloud to please Wall Road even when its extra conventional promoting enterprise retains delivering.

Alphabet at the moment trades at 21.5x ahead earnings. It is a fairly compelling valuation given the corporate’s robust place and the actual fact it trades at a reduction to the S&P500, which is at the moment 23x value to earnings and it’s personal 10-year common of twenty-two.2x earnings.

Analysts nonetheless imagine there may be additional upside for Alphabet shares. In keeping with Bloomberg’s Analyst Suggestions, it boasts 59 purchase rankings, 15 maintain rankings, and 0 promote rankings. With a mean value goal of USD$218.60, that suggests a possible 14% upside.With its dominant advert enterprise, robust AI positioning, and discounted valuation, Alphabet stays a inventory for traders to look at. Whereas regulatory dangers and AI competitors shouldn’t be ignored, its management in search, cloud, and AI innovation positions it nicely for long-term development.

* Previous efficiency just isn’t a sign of future outcomes.

*Knowledge Correct as of 06/02/2025

eToro Service ARSN 637 489 466 promoted by eToro AUS Capital Restricted ACN 612 791 803 AFSL 491139. Capital in danger. See PDS and TMD. This communication is basic info and schooling functions solely and shouldn’t be taken as monetary product recommendation, a private advice, or a suggestion of, or solicitation to purchase or promote, any monetary product. It has been ready with out taking your aims, monetary scenario or wants under consideration. Any references to previous efficiency and future indications will not be, and shouldn’t be taken as, a dependable indicator of future outcomes. eToro makes no illustration and assumes no legal responsibility as to the accuracy or completeness of the content material of this publication.