Japanese startup JPYC has launched the primary stablecoin pegged to the yen, backed by home financial savings and Japanese authorities bonds.

JPYC Is The First Yen-Backed Stablecoin In The World

JPYC introduced on Monday the launch of its yen-backed stablecoin, additionally known as “JPYC.” A stablecoin is a cryptocurrency pegged to a fiat foreign money, and at current, the sector is closely dominated by tokens tied to the US Greenback, with USDT and USDC alone accounting for almost all of the market.

Japan is now additionally dipping into the area with this new stablecoin. In response to JPYC, the token will probably be backed 1:1 by home deposits and Japanese authorities bonds (JGBs). Customers should buy or promote the asset via JPYC EX, the Japanese startup’s official platform. The corporate is providing zero price on issuance and redemption for now, as a substitute turning to the curiosity from the JGBs as a supply of earnings.

The token is initially changing into obtainable on Ethereum, Avalanche, and Polygon, with help for added blockchains deliberate. In response to Reuters, JPY is aiming to situation 10 trillion yen price of the stablecoin over the subsequent three years. On the present price, this goal is equal to about $65.5 billion.

USDC, the second-largest fiat-tied token within the sector, has a market cap of about $76.3 billion proper now. Thus, if JPYC meets its bold goal, it might doubtlessly rival the USD-ruled stablecoin market. The JPYC launch isn’t the one stable-related improvement that has occurred in Japan lately. As reported by Bitcoinist, three Japanese megabanks are planning to situation a yen-backed token by the tip of 2025.

The banks in query are Mitsubishi UFJ Monetary Group (MUFG) Financial institution, Sumitomo Mitsui Banking Corp., and Mizuho Financial institution. Collectively, they serve over 300,000 purchasers.

Institutional curiosity in cryptocurrencies has been rising within the East Asian nation lately as the federal government is contemplating a regulatory rule change that might permit banks to carry Bitcoin and different digital property for funding functions, and register themselves as “crypto alternate operators,” changing into capable of supply buying and selling companies to clients.

Whereas Japan has been shifting in a crypto-positive course, China has remained cautious, providing impediments to stablecoin plans in Hong Kong, in accordance with Monetary Occasions.

The Chinese language metropolis launched its stablecoin laws earlier within the yr and acquired enquiries from a number of tech giants for an issuer license. Mainland regulators, nevertheless, have urged the businesses to halt their plans, elevating considerations concerning the progress of currencies managed by the personal sector.

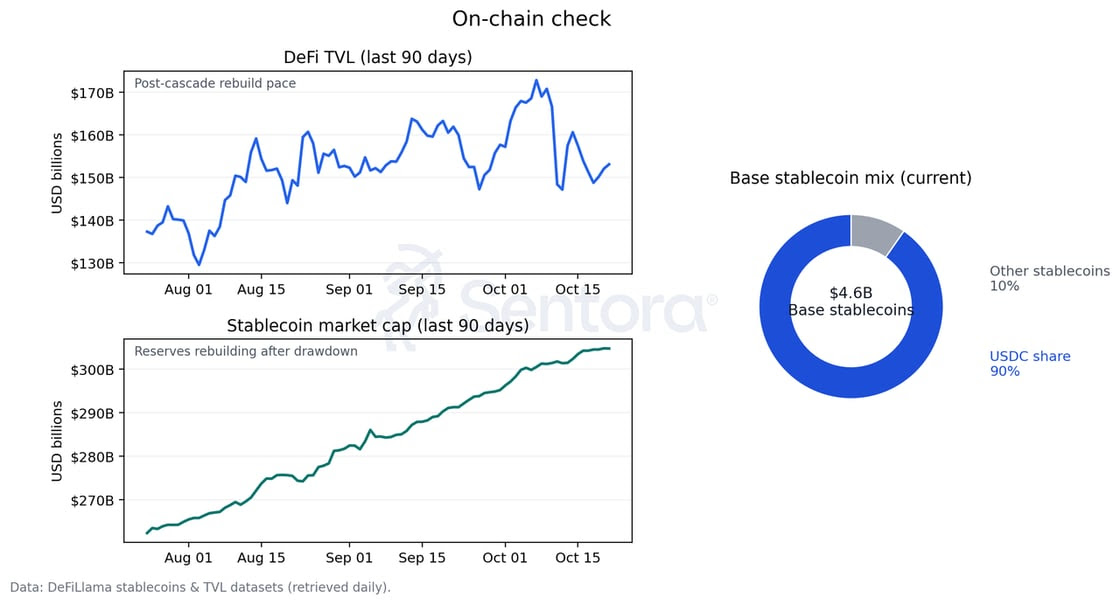

Globally, digital property pegged to fiat currencies have continued to take pleasure in capital inflows lately regardless of Bitcoin and altcoins going through volatility. Because the chart shared by institutional DeFi options supplier Sentora reveals, the sector has seen its market cap break a file of $308 billion.

The pattern out there cap of stables | Supply: Sentora on X

Bitcoin Worth

On the time of writing, Bitcoin is buying and selling round $115,200, up practically 4% during the last week.

The worth of the coin appears to have been going up | Supply: BTCUSDT on TradingView

Featured picture from Dall-E, Sentora.com, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluation by our crew of prime expertise specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.