Alisa Davidson

Printed: October 13, 2025 at 5:00 am Up to date: October 13, 2025 at 4:32 am

Edited and fact-checked:

October 13, 2025 at 5:00 am

In Transient

A sudden US–China commerce shock triggered huge crypto liquidations final week, sending Bitcoin, Ethereum, and Toncoin sharply down earlier than institutional demand and ecosystem exercise helped all three rebound, highlighting market resilience amid excessive volatility.

There’s a rhythm to each bull cycle, and by the primary week of October it felt like we had been again in that acquainted groove. Bitcoin was hovering close to $120K, merchants had been posting “Uptober” memes once more, and funding charges had crept to ranges that solely ever make sense proper earlier than a shake-out. It was the basic calm — that misleading, weightless stretch of optimism that all the time comes earlier than one thing snaps.

After which it did.

Bitcoin (BTC)

Late on Friday, October 10, Donald Trump reignited trade-war fears by saying a 100% tariff on Chinese language imports.

Inside seconds, markets throughout the board recoiled. Bitcoin fell almost $15K in a single breath, slicing via technical helps like they weren’t there.

Screens started to stutter, Binance briefly misprinted costs at zero, and panic rippled via each nook of the derivatives market. Funding charges flipped detrimental, liquidations piled up by the billions, and even Ethena’s USDe — a stablecoin that had been uneventful for months — slipped off its peg.

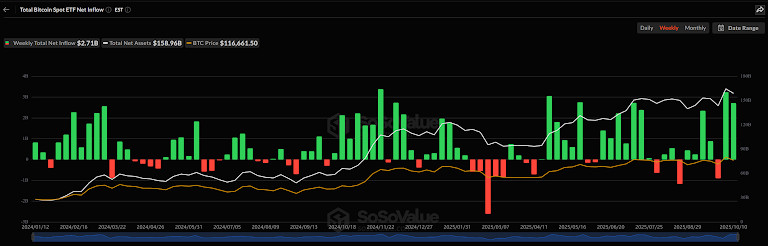

For a couple of hours, it actually did really feel like the ground was gone. But beneath all of the noise, there was nonetheless a quieter story unfolding. Spot ETF inflows — the structural demand that had supported Bitcoin all 12 months — by no means stopped.

Whilst merchants had been compelled out of leveraged longs, establishments had been nonetheless shopping for the underlying asset. By Sunday, the US–China rhetoric had cooled barely, sentiment steadied, and Bitcoin started clawing its method again towards the mid-$110Ks. It wasn’t a heroic rebound a lot as a deep exhale after a collective panic assault. However nonetheless — the market was standing.

Ethereum (ETH)

Ethereum, predictably, made the transfer look much more dramatic. It dropped nearly 25%, plunging to round $3.5K on the lows, and for a quick second your entire staking narrative appeared in danger.

But as funding normalized and futures unwound, ETH confirmed its resilience. Treasury desks quietly began accumulating, validator exits had been matched by recent deposits, and by Monday morning ETH was already again above $4K.

Toncoin (TON)

TON, nonetheless, was in a special league altogether. Its chart appeared just about like a coronary heart monitor — we noticed a vertical plunge to roughly $0.56 adopted by an equally vertical rebound previous $2. That’s about 80% down and 250% again up inside the span of a single hour. The drop was so excessive that many assumed it was a knowledge glitch. However no. It was actual.

And but, as quickly because the mud settled, the move of stories continued.

Simply earlier than the crash, AlphaTON Capital had filed to boost $15.6 million via a inventory sale explicitly earmarked for TON purchases and investments into the Telegram ecosystem. Two days later, the agency filed once more, this time for a $47-million share sale, and publicly confirmed that its TON reserves had not been liquidated in the course of the chaos. How about that?

Then, to cap the week, AlphaTON disclosed an extra 300,000 TON purchase on the open market — including to the 1.1 million cash it had already accrued the earlier week. Thus, whereas everybody else was attempting to get well from the wick, one of many largest holders was utilizing it to develop publicity.

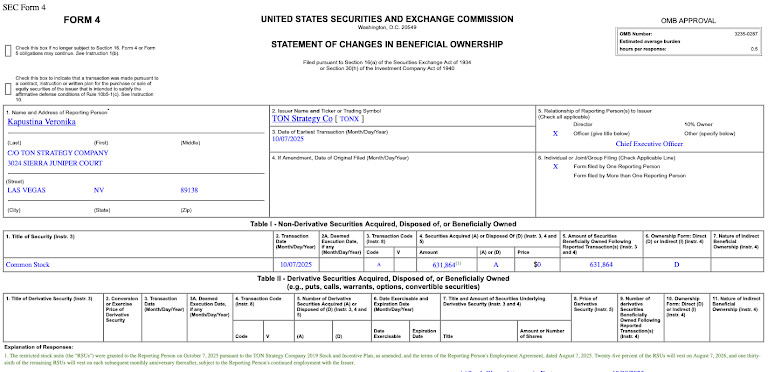

In the meantime, TON Technique — one other main participant within the ecosystem — transferred $3.9 million in fairness to its CFO and COO as a part of an worker incentive program. CEO Manuel Stotz had lately elevated his personal stake as nicely, underscoring administration’s long-term dedication. It was exhausting to overlook the distinction: whereas retail merchants had been nonetheless nursing losses, insiders had been leaning in.

Additionally, on October 10 OpenSea launched its official Telegram channel, which is a significant bridge between the most important NFT market and Telegram’s crypto-native consumer base.

By the beginning of the brand new week, the general image appeared surprisingly steady. Bitcoin had re-anchored, Ethereum had regained its footing, and TON — regardless of every part — was buying and selling again above $2 with recent institutional assist and increasing ecosystem momentum. What started as a flash crash ended up as an unintentional stress check that TON one way or the other handed.

Wanting forward, if international rhetoric cools and no recent tariff shocks arrive, Bitcoin appears poised to grind sideways between $110K and $120K whereas Ethereum follows its lead. TON will doubtless stay extra risky — that’s simply a part of its DNA — however after this week, it’s exhausting to disclaim that the venture has earned a re-assessment.

Disclaimer

In keeping with the Belief Challenge tips, please be aware that the knowledge supplied on this web page just isn’t supposed to be and shouldn’t be interpreted as authorized, tax, funding, monetary, or another type of recommendation. It is very important solely make investments what you possibly can afford to lose and to hunt impartial monetary recommendation when you have any doubts. For additional info, we recommend referring to the phrases and circumstances in addition to the assistance and assist pages supplied by the issuer or advertiser. MetaversePost is dedicated to correct, unbiased reporting, however market circumstances are topic to alter with out discover.

About The Writer

Alisa, a devoted journalist on the MPost, makes a speciality of cryptocurrency, zero-knowledge proofs, investments, and the expansive realm of Web3. With a eager eye for rising tendencies and applied sciences, she delivers complete protection to tell and have interaction readers within the ever-evolving panorama of digital finance.

Extra articles

Alisa, a devoted journalist on the MPost, makes a speciality of cryptocurrency, zero-knowledge proofs, investments, and the expansive realm of Web3. With a eager eye for rising tendencies and applied sciences, she delivers complete protection to tell and have interaction readers within the ever-evolving panorama of digital finance.