9 of Europe’s greatest banks—together with ING, UniCredit, Danske Financial institution, SEB, KBC, DekaBank, Banca Sella, and Raiffeisen Financial institution Worldwide—have determined to collaborate on a euro-backed stablecoin. Beneath the European Union’s (EU) Markets in Crypto-Belongings Regulation (MiCA) framework, the collaborating banks will roll out the stablecoin within the second half of 2026. Will this be a game-changer for European crypto funds? Will the euro-backed stablecoin cut back Europe’s reliance on US dollar-denominated stablecoins?

On 25 September 2025, ING launched the joint assertion confirming that “the initiative will present an actual European different to the US-dominated stablecoin market, contributing to Europe’s strategic autonomy in funds.”

In response to the banking giants, the stablecoin will present near-instant, low-cost funds and settlements. Moreover, it would allow 24/7 entry to environment friendly cross-border funds, programmable funds, and enhancements in provide chain administration and digital asset settlements, which may differ from securities to cryptocurrencies.

BREAKING

NINE EUROPEAN BANKS ARE TEAMING UP TO LAUNCH A MICA COMPLIANT EURO STABLECOIN, WITH A TARGET DEBUT IN 2026.

TRADITIONAL FINANCE IS LOCKING IN ON DIGITAL MONEY FOR THE EUROZONE.

pic.twitter.com/W967MJW3gR

— DustyBC Crypto (@TheDustyBC) September 25, 2025

DISCOVER: 20+ Subsequent Crypto to Explode in 2025

“Digital funds are key for brand spanking new euro-denominated funds and monetary market infrastructure”

The member banks made it clear – they’re open to new members. Therefore, extra banks are anticipated to affix the unique 9.

“This digital fee instrument, leveraging blockchain know-how, goals to change into a trusted European fee commonplace within the digital ecosystem,” the joint assertion mentioned.

The undertaking is curiously spearheaded by a newly shaped firm based mostly in Netherlands. It’s going to search licensing and oversight from the Dutch Central financial institution, positioning itself as an “e-money establishment.”

Floris Lugt, Digital Belongings lead at ING and joint public consultant of the initiative mentioned, “Digital funds are key for brand spanking new euro-denominated funds and monetary market infrastructure. They provide vital effectivity and transparency, because of blockchain know-how’s programmability options and 24/7 immediate cross-currency settlement.”

“We imagine this improvement requires an industry-wide method, and it’s crucial that banks undertake the identical requirements,” he added.

DISCOVER: Subsequent 1000X Crypto: 10+ Crypto Tokens That Can Hit 1000x in 2025

New European Tips Boosted Demand For Euro-backed Stablecoins

A 2024 evaluation by Kaiko Analysis revealed that whereas Europe has historically lagged the US and APAC on the subject of crypto buying and selling, Euro-backed stablecoin’s have constantly grown in quantity for the reason that starting of the 12 months. This concretely means that demand for stablecoin is lastly choosing up in European markets.

Significantly, Circle’s USDC stablecoin is predicted to achieve substantial market share from its bigger rival, Tether’s USDT, discovered Kaiko. Anastasia Melachrinos, an analyst at Kaiko Analysis, highlighted that USDC may probably profit probably the most from the brand new European pointers.

EXPLORE: 9+ Greatest Excessive-Danger, Excessive-Reward Crypto to Purchase in 2025

Key Takeaways

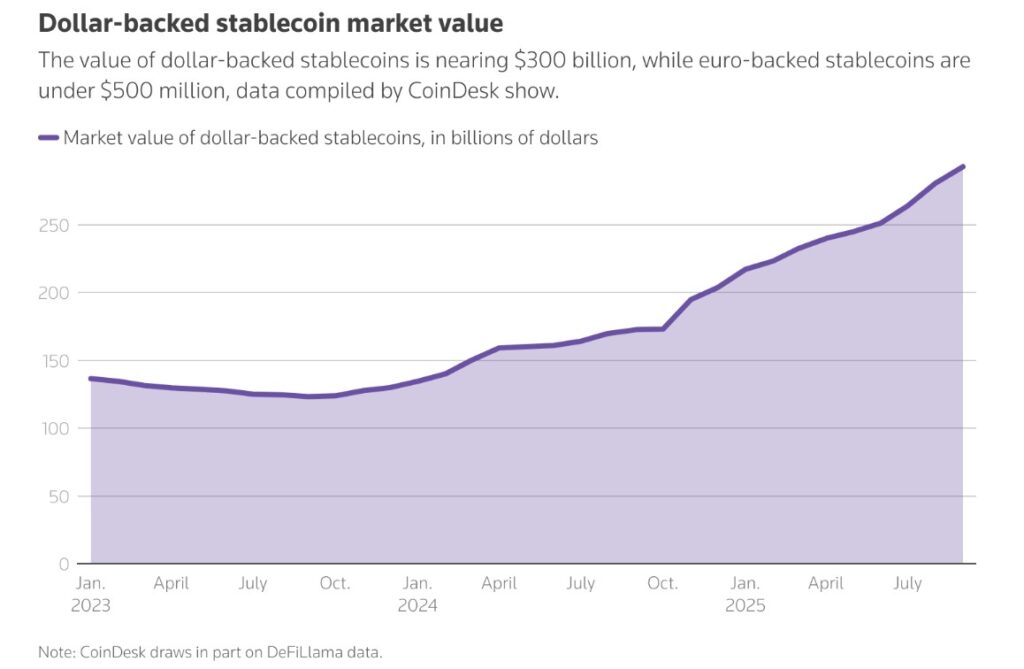

The euro-backed stablecoin is predicted to scale back Europe’s reliance on US dollar-denominated stablecoins – which at present dominate the worldwide market.

The euro stablecoin goals to allow near-instant, low-fee funds and settlements throughout borders, obtainable 24/7.

The put up Launch Of Euro-Backed Stablecoin In H2 2026? 9 European Banking Giants Be part of Forces appeared first on 99Bitcoins.