In one other groundbreaking announcement for SoFi, the monetary providers firm has confirmed a strategic cope with Fortress Group valued at $3.2 billion. This plan includes a $2 billion extension for a one-year time period and a further settlement to originate $1.2 billion in loans over two years with Edge Focus, marking a major 150% enhance from earlier agreements. What’s much more thrilling is that this deal comes earlier than the prior deal of $2 billion has accomplished. That is additionally on prime of the prevailing Blue Owl deal, which was for $5 billion throughout two years. The collaboration with Fortress emphasizes the standard of loans being processed, because it illustrates their confidence in SoFi’s underwriting capabilities, showcasing progress within the monetary know-how sector, regardless of this announcement coming in a difficult macroeconomic surroundings that has influenced the inventory market negatively.

The implications of this settlement are multi-faceted, starting from an anticipated increase in mortgage origination, improved underwriting capabilities as a consequence of expanded knowledge evaluation, and cross-selling alternatives inside different SoFi merchandise. As the corporate goals to shift extra lending in direction of their mortgage platform mannequin, monetary progress prospects seem very constructive, promising larger return on fairness and the potential for a major uptick in income.

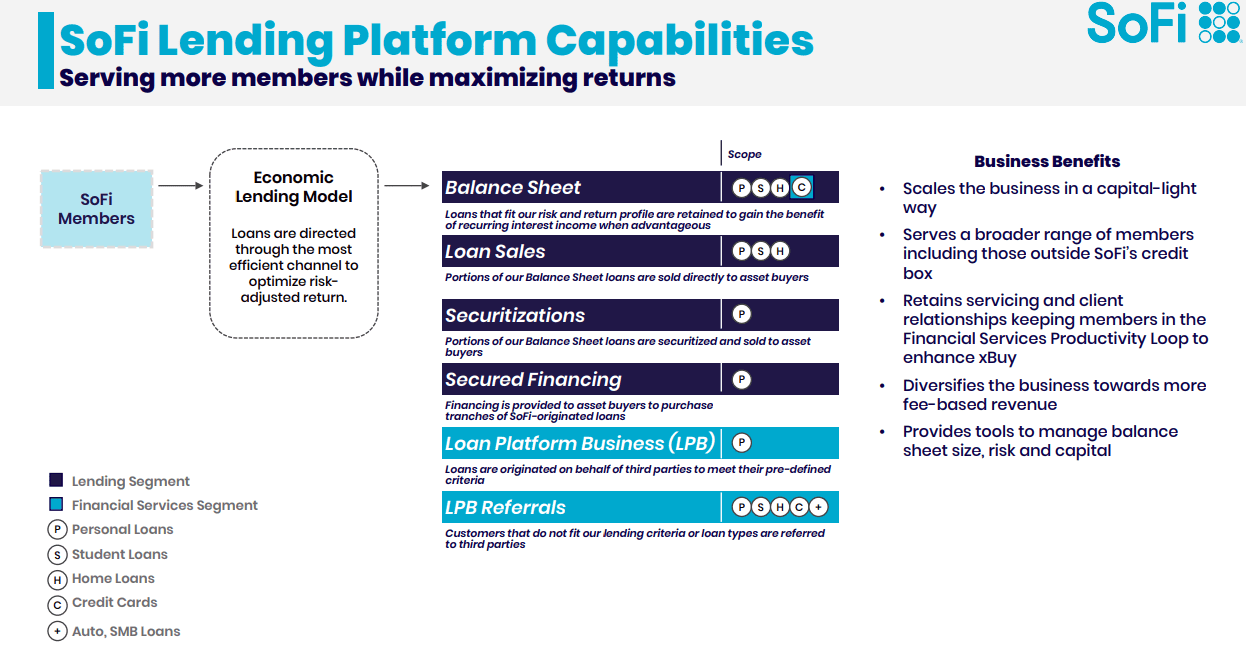

Supply: SoFi Investor Relations Web page

Highlights

🔹 Enticing Financial Mannequin: The shift in direction of a mortgage platform mannequin helps a lighter steadiness sheet, in the end enhancing return on fairness. SoFi’s technique to originate loans on behalf of third events minimizes its personal danger publicity and by performing as a facilitator, SoFi shifts the chance of mortgage defaults away from its steadiness sheet, enhancing its monetary resilience even in turbulent financial climates.

🔹 High quality Over Amount: The continuation of loans from Fortress Group signifies a important understanding of SoFi’s method to underwriting. By discovering a renewed partnership so quickly, it highlights that Fortress sees worth within the asset high quality of loans being processed. This implies that SoFi’s rigorous danger evaluation permits them to faucet into high-quality mortgage origination, thus enhancing their repute inside the business.

🔹 Information-Pushed Enhancements: With larger volumes of loans being processed, SoFi will collect extra knowledge to refine its danger fashions. This steady evaluation will improve their capability to precisely consider creditworthiness, thus solidifying their underwriting requirements. The training from enhanced knowledge analytics results in smarter enterprise choices, tabling SoFi as a data-driven group.

🔹 Cross-Promoting of Companies: SoFi’s construction facilitates the cross-selling of different monetary merchandise, similar to bank cards and banking providers, to prospects making use of for loans. This creates a extra built-in shopper expertise, permitting the corporate to capitalize on shopper pockets share by encouraging utilization of a number of merchandise, drastically enhancing common income per consumer.

🔹 Projected Monetary Progress: The cope with Fortress Group considerably boosts SoFi’s mortgage origination and income potential. With projections indicating that non-public mortgage gross sales might attain upwards of $4 billion, these figures help the argument for a valuation shift towards SoFi. Elevated origination leads to elevated liquidity, solidifying SoFi’s standing as a aggressive participant within the monetary know-how area.

🔹 Lengthy-Time period Income Constructing: SoFi’s technique, aiming to shift its lending construction to a mortgage platform mannequin, is critical. This mannequin helps constant quarterly income streams by specializing in mortgage agreements over time, slightly than one-off initiatives, which inherently creates a extra secure monetary future and reduces income volatility. This shift holds long-term potential, as profitability metrics might enhance considerably over years of gathered studying and enterprise refinement.

🔹 Aggressive Edge: SoFi’s deal with their mortgage platform over different segments like brokerage providers positions them extra competitively inside the business. By leveraging their financial institution constitution’s benefits, they’ll effectively faucet into demand and pursue progress avenues that different rivals could not be capable to exploit successfully, and in contrast to rivals which will solely deal with mortgage merchandise, SoFi is innovatively positioned to not solely present monetary merchandise but in addition faucet into a mix of inexpensive financing options and monetary planning providers. This holistic method enhances buyer retention, presenting SoFi as an all-encompassing monetary accomplice within the shoppers’ lives, giving it a novel edge over extra conventional monetary establishments.

🔹 Market Demand: Regardless of macroeconomic uncertainties, there stays a powerful demand for private loans, validating SoFi’s operational stability and progress. The rate of those offers reveals demand is excessive and implies the expectation of sustained enterprise efficiency.

🔹 Investor Attraction: Given the constructive reception and analysis of SoFi’s mortgage high quality, it’s doubtless that analysts will revise their projections for the corporate favourably. Coupling a sturdy deal pipeline with investor confidence in earnings high quality might enhance market sentiment and result in a extra beneficial valuation of SoFi’s inventory.

Mortgage Platform Progress

SoFi has traditionally expanded cautiously within the mortgage sector however in simply 12-15 months, SoFi has engaged in roughly $12 billion price of offers by its mortgage platform. The projected progress in mortgage origination quantity implies that SoFi could quickly expertise a major surge in income. Assuming their estimate of a 4% take price holds, projected revenues might attain round $470 million from the current $12 billion in whole mortgage originations, translating to an ongoing earnings stream that helps enterprise growth. If SoFi can scale this successfully, they may considerably drive their steadiness sheet progress, while decreasing danger.

Supply: Newest SoFi earnings deck

Valuation

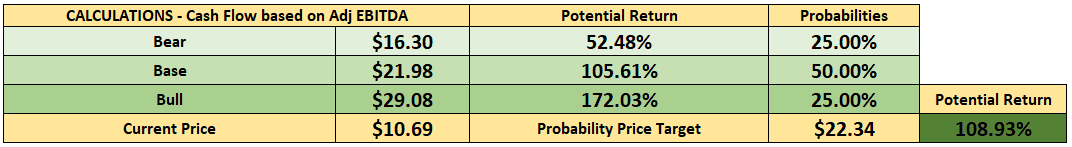

SoFi’s steering for 2025 doubtless doesn’t absolutely account for the extra income anticipated from these current offers and even for the anticipated reintroduction of cryptocurrency, representing a major shock issue for potential traders and analysts alike. This underestimation of potential earnings energy creates a strategic shopping for alternative on the present market value.

Regardless of vital enterprise advances, SoFi’s inventory doesn’t appear to replicate the robust fundamentals. Market costs replicate substantial discrepancies associated to the corporate’s progress methods in opposition to macroeconomic components similar to tariffs and hypothesis about recessions. These discrepancies might current a useful alternative for savvy traders, as enhanced progress avenues may take time to be acknowledged by the market.

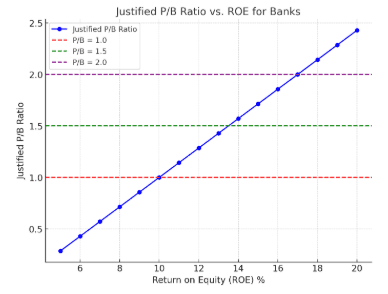

Presently, if we value SoFi as a financial institution utilizing P/B, SoFi seems to be a little bit on the costly facet at 1.8x. Nonetheless, ROE might see some appreciable strikes to the upside with these new offers.

Extra importantly, this implies we aren’t giving SoFi a hybrid a number of, which continues to be a scorching matter with traders.

We will tweak a DCF calculation utilizing adjusted EBITDA, much less Capex, and including again the ebook worth in lieu of money movement, which might be extra applicable for this kind of hybrid firm. We’re additionally utilizing a variable progress price, ranging from the 25% SoFi is guiding with and dropping all the way down to a terminal price of 4% over a 10-year interval.

Dangers:

SoFi (Social Finance Inc.) operates a diversified fintech enterprise, and whereas it’s been rising quickly, a number of dangers might materially influence its efficiency. Right here’s a breakdown of key enterprise, monetary, regulatory, aggressive, and macroeconomic dangers:

🔹 Regulatory and Compliance Danger – Publicity to altering monetary rules and banking oversight as a consequence of its financial institution constitution and fintech operations, though one might argue that is much less impactful since monetary regulation is about to ease. That is mirrored partially within the rest of crypto buying and selling for SoFi.

🔹 Credit score Danger – Potential for rising mortgage defaults, particularly in private and scholar mortgage portfolios, throughout financial downturns. SoFi does goal larger credit score scores, so one thing to remember concerning this level.

🔹 Curiosity Fee Danger – Sensitivity to price modifications, which may have an effect on mortgage demand, deposit prices, and internet curiosity margins.

🔹 Aggressive Danger – Strain from each conventional banks and fintech rivals providing comparable or higher monetary merchandise.

🔹 Execution Danger – Challenges in scaling new enterprise strains or integrating acquisitions like Galileo and Technisys successfully. Not like the mortgage platform enterprise, these merchandise have had progress issues.

In conclusion:

The developments surrounding SoFi’s current partnership with Fortress Group point out a paradigm shift in direction of a extra strong, data-informed, and customer-centric monetary service mannequin. As they solidify their market presence by mortgage origination and improved underwriting accuracy, SoFi is making a aggressive hierarchy that positions them favourably for long-term progress and success.

It’s a capital-light, high-margin progress engine that’s scaling sooner than anybody anticipated and it’s solely simply getting began. With cross-sell potential, improved underwriting intelligence, and the power to draw new institutional capital, SoFi is not only optimizing its present enterprise, it’s redefining the way forward for shopper lending. That is one more instance of how SoFi can pivot into new enterprise segments with ease, indicating a change that’s too vital to be missed in at the moment’s monetary panorama. Finally, this partnership serves as a stepping stone to even larger achievements for SoFi within the coming years.

Given the robust demand for private loans, the longer term seems brilliant for SoFi’s progress trajectory, even in unsure financial situations. May SoFi transfer all their lending into the mortgage platform enterprise over time? The steadiness sheet can be lighter and who would complain a few larger return on fairness?

This communication is for info and schooling functions solely and shouldn’t be taken as funding recommendation, a private advice, or a proposal of, or solicitation to purchase or promote, any monetary devices. This materials has been ready with out bearing in mind any specific recipient’s funding goals or monetary state of affairs and has not been ready in accordance with the authorized and regulatory necessities to advertise unbiased analysis. Any references to previous or future efficiency of a monetary instrument, index or a packaged funding product are usually not, and shouldn’t be taken as, a dependable indicator of future outcomes. eToro makes no illustration and assumes no legal responsibility as to the accuracy or completeness of the content material of this publication.