Victoria d’Este

Printed: April 14, 2025 at 1:19 pm Up to date: April 14, 2025 at 1:19 pm

Edited and fact-checked:

April 14, 2025 at 1:19 pm

In Temporary

Crypto caught a cautious breather this week, with Bitcoin charging forward on softer macro winds, Ethereum trailing in its shadow, and TON quietly constructing underneath the radar as markets weigh their subsequent transfer.

This previous week felt like crypto exhaled – not a full aid rally, however sufficient to shake off the sense of doom that’s been clinging to the charts since early April. Macro didn’t a lot flip bullish because it stopped swinging a bat. Bitcoin leads the best way, as ordinary. Ethereum tried to maintain up however didn’t fairly get there. TON stayed flat, although its ecosystem quietly saved increasing. If this week was a temper, it’d be cautious optimism with a aspect of RSI divergence. So let’s dig in: who moved, who didn’t, and why it issues.

Bitcoin

It began with a shock pause – Trump quietly shelved tariffs on sure tech imports. Nothing flashy, however sufficient to ease pressure throughout threat property.

Supply: Donald Trump

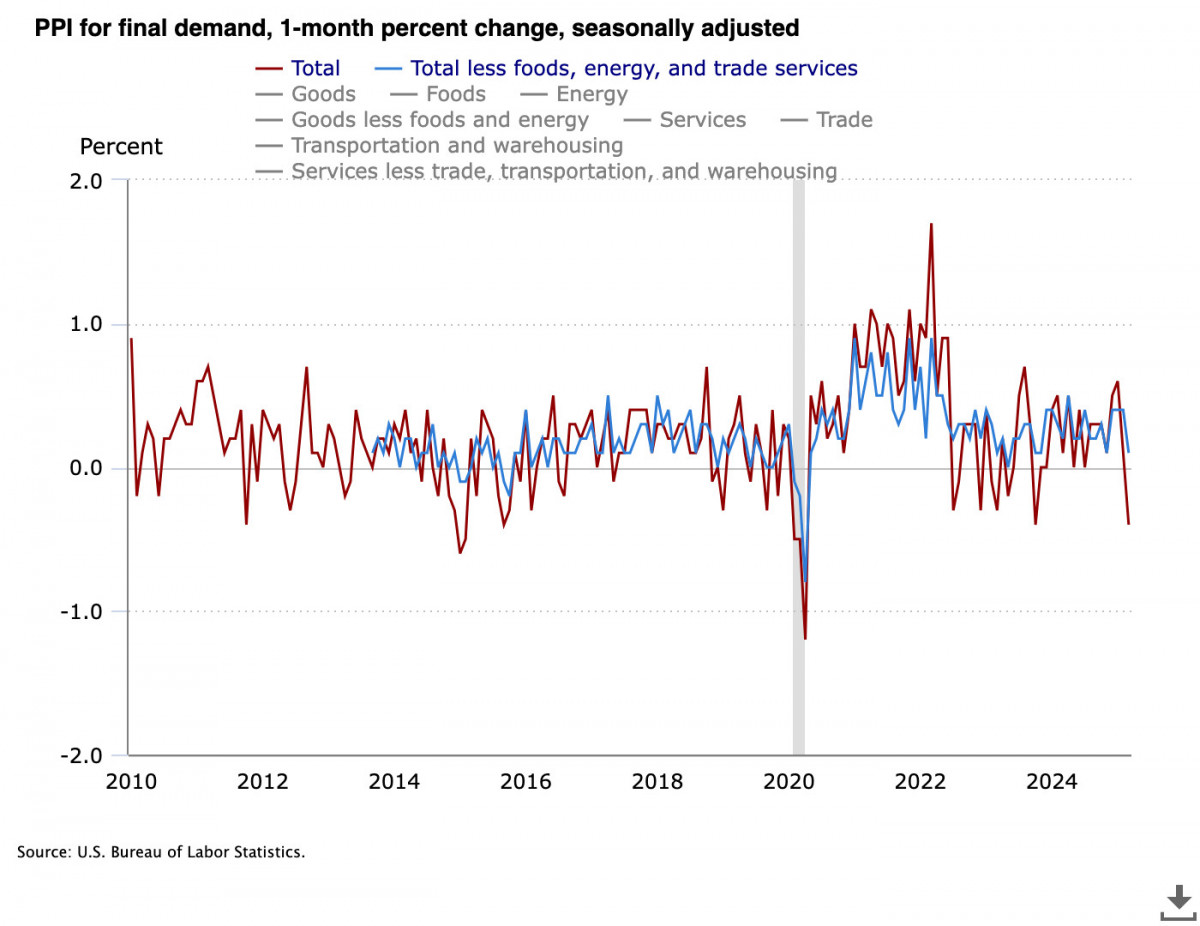

Then got here a softer PPI print, simply dovish sufficient to spook the greenback right into a three-year low. By the point markets processed each, the narrative had already shifted: possibly the Fed isn’t cornered in spite of everything. Possibly there’s nonetheless some

US PPI for ultimate demand. Supply: BLS

Bitcoin caught the scent early. It punched by $74K and saved climbing, brushing $86K earlier than cooling off close to $83,400. That wasn’t simply momentum – it was alternative assembly lowered resistance. As we all know, when the greenback journeys, Bitcoin stretches its legs.

BTC/USD 4H Chart, Coinbase. Supply: TradingView

The 4H RSI has cooled from overbought, which suggests we may chop sideways, bait just a few breakout merchants, possibly even faux a flush. However so long as macro holds regular and flows hold coming in, the trail of least resistance nonetheless factors up.

Arthur Hayes

You may virtually really feel the temper swing. ETF outflows slowed, whereas whale wallets began shopping for. In the meantime, retail sentiment was hitting peak doomscroll. Arthur Hayes chimed in together with his ordinary mixture of chaos and readability, suggesting this is likely to be the launchpad for $100K. Possibly. The technicals don’t rule it out – structurally, it’s there. However volatility has to behave, and recently, that’s been like asking a raccoon to sit down nonetheless in a bakery.

Ethereum

Meamwhile, Ethereum tried to maintain tempo, however let’s be trustworthy – it was jogging whereas Bitcoin sprinted. From a low close to $1,360 to a excessive round $1,680, ETH now sits within the $1,580s.

ETH/USD 4H Chart, Coinbase. Supply: TradingView

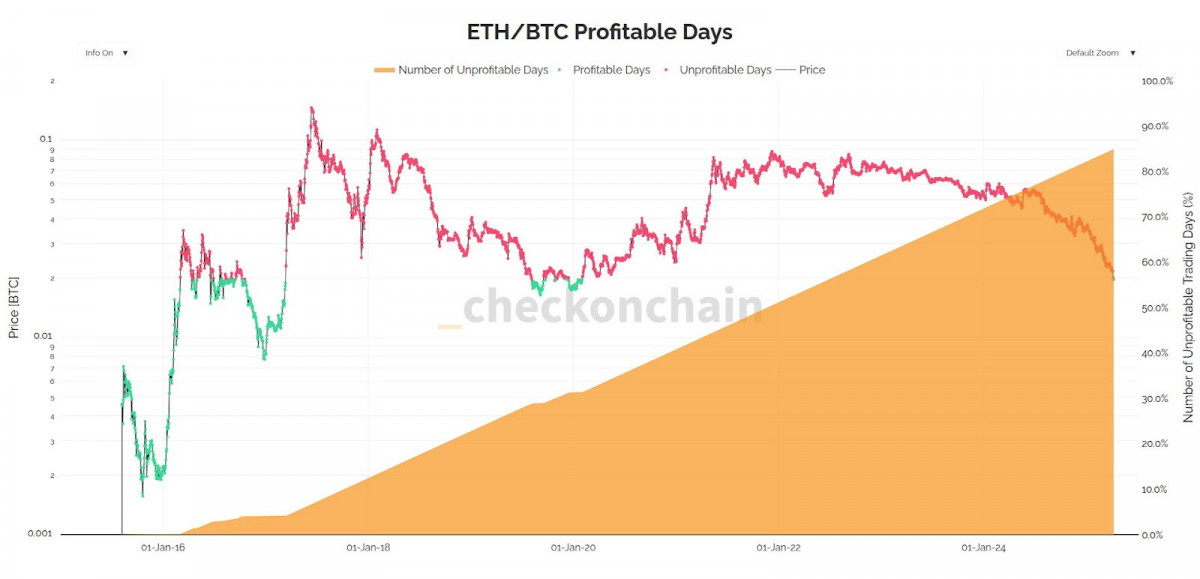

It was what merchants name a “shadow rally” – ETH rising in Bitcoin’s wake however not driving its personal narrative. The ETH/BTC ratio saved bleeding decrease, which tells you precisely the place the capital’s loyalty lies. Proper now, no one’s rotating out of BTC into majors. Why commerce the apprentice when the wizard’s casting spells?

ETH/BTC worthwhile days. Supply: James Test

SEC authorised Ether ETF choices gave ETH somewhat push, positive. Nevertheless it wasn’t the headline merchants actually needed – that will be a greenlight for staking-based ETFs, those that faucet into Ethereum’s precise economics. With out that, there’s no new capital unlock, no structural shift. Simply noise.

So, technically, ETH is drifting. It’s buying and selling close to the 50-day SMA, RSI caught within the center. Whether or not it breaks out or fades again will rely on one factor: Bitcoin.

Toncoin (TON)

TON’s been doing its finest impression of a metronome – bouncing between $2.80 and $3.20, caught in that tight sideways vary with the conviction of a coin flip. Proper now it’s hanging close to $2.82, hugging the low finish prefer it’s ready for somebody to make the primary transfer.

TON/USD 4H Chart, Coinbase. Supply: TradingView

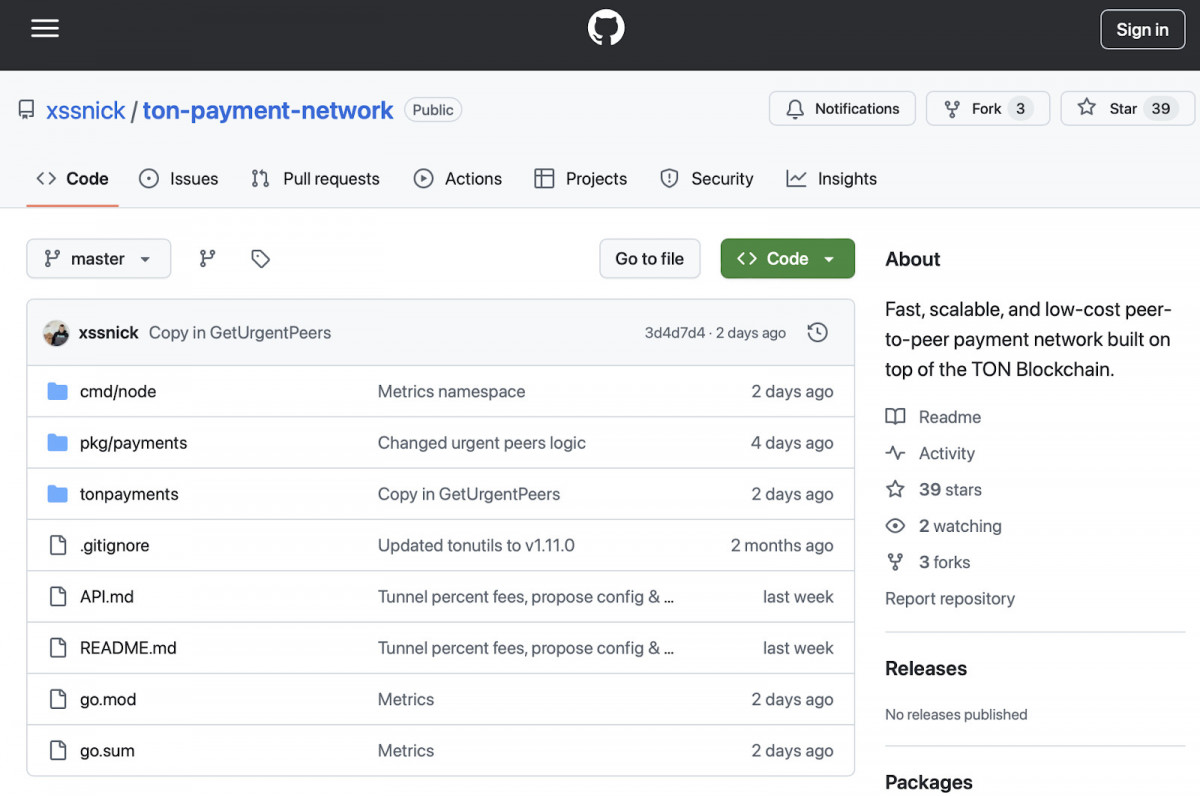

However value motion isn’t the entire story. Underneath the floor, TON’s been laying monitor. The group simply dropped a beta for the TON Cost Community – a Layer 2 constructed for immediate, low-cost funds, already operating by TON Proxy. Suppose microtransactions, reside suggestions, in-game rewards. Not the form of stuff that grabs headlines, however the sort that builds foundations.

Supply: Github

In the meantime, @pockets is preparing for its U.S. rollout, and Telegram – ever so quietly – has began tagging verified channels. It’s a gentle transfer, however one which provides a layer of legitimacy to an ecosystem that’s typically needed to function with one eye on the regulators.

However right here’s the rub: none of it’s priced in. RSI remains to be weak. The 50-SMA retains performing like a ceiling. No quantity surge, no breakout. Merchants haven’t re-rated it but, possibly as a result of they’ve seen too many flashy roadmaps with too little stickiness. Actual adoption – not simply technical releases – is what strikes the needle now.

Summing Up: What’s The Outlook This Week?

Bitcoin’s nonetheless the axis the market spins round – and this week, macro helped it flip. With tariffs paused and inflation softening, threat urge for food discovered simply sufficient respiration room. Bitcoin took the lead. Ethereum tagged alongside, however hasn’t damaged character. TON? It’s constructing a case, however the jury’s nonetheless out.

What occurs subsequent hinges on stability. If the greenback stays gentle, if the Fed doesn’t spook the herd, there’s room for capital to rotate into lagging alts. But when volatility returns – if coverage throws a curveball or macro sentiment buckles – Bitcoin doubtless tightens its grip whereas ETH and TON keep within the ready room, flipping by outdated magazines.

Disclaimer

According to the Belief Challenge pointers, please word that the knowledge supplied on this web page isn’t meant to be and shouldn’t be interpreted as authorized, tax, funding, monetary, or some other type of recommendation. You will need to solely make investments what you’ll be able to afford to lose and to hunt impartial monetary recommendation when you have any doubts. For additional info, we propose referring to the phrases and situations in addition to the assistance and assist pages supplied by the issuer or advertiser. MetaversePost is dedicated to correct, unbiased reporting, however market situations are topic to alter with out discover.

About The Creator

Victoria is a author on a wide range of expertise matters together with Web3.0, AI and cryptocurrencies. Her intensive expertise permits her to put in writing insightful articles for the broader viewers.

Extra articles

Victoria d’Este

Victoria is a author on a wide range of expertise matters together with Web3.0, AI and cryptocurrencies. Her intensive expertise permits her to put in writing insightful articles for the broader viewers.