Be part of Our Telegram channel to remain updated on breaking information protection

Mastercard is in late-stage talks to purchase blockchain infrastructure agency Zero Hash for between $1.5 billion and $2 billion because the funds big strikes to increase its foothold in stablecoin settlement, Fortune reported, citing sources conversant in the matter.

It mentioned the deal would give Mastercard management of an entity that processed greater than $2 billion in tokenized fund flows this yr and raised $104 million in a funding spherical led by Interactive Brokers and Morgan Stanley in September.

Neither Mastercard nor Zero Hash has publicly commented on the report, however the transfer underscores how competitors within the stablecoin area is intensifying amongst main conventional finance companies in search of sooner, borderless settlement programs.

A possible acquisition would mark Mastercard’s most important push but into blockchain-based funds, coming as rivals together with Visa, PayPal, and Western Union speed up their very own stablecoin initiatives following new US regulation.

Mastercard Could Lose Out To Coinbase In Bid To Purchase BVNK

Fortune mentioned Mastercard could lose out to Coinbase within the bid to accumulate fintech BVNK, which makes a speciality of stablecoin and fiat-to-blockchain fee infrastructure.

Citing sources conversant in that deal, Fortune mentioned that Coinbase seems to have gained the bidding struggle and now has an unique association with the agency.

The report follows earlier information that Mastercard and crypto change Coinbase have been each holding talks to accumulate BVNK.

Extra TradFi Corporations Are Transferring Into Stablecoins

Mastercard’s transfer on Zero Hash comes as TradFi companies step up their curiosity within the crimson scorching stablecoin area.

Visa introduced within the firm’s fourth quarter earnings name that it plans to supply help for 4 stablecoins throughout 4 blockchains and in addition reported sturdy development for its current stablecoin choices, which already helps some main stablecoins and main blockchain networks.

In the meantime, PayPal has already launched its personal stablecoin, the PayPal USD (PYUSDT) token.

Legacy agency Western Union this week additionally introduced that it’s working by itself stablecoin, referred to as the US Greenback Deposit Token (USDT). In its announcement, the corporate mentioned that it’ll deploy the stablecoin on the Solana community and can difficulty the token through Anchorage Digital. The launch is scheduled for the primary half of 2026.

There isn’t a bridge forex. There are stablecoins, on Solana.

I like you. pic.twitter.com/b1TisRbEJi

— Solana (@solana) October 28, 2025

In the meantime, Citi and quite a few main banks have additionally disclosed that they’re exploring stablecoins, whereas the Trump household launched the USD1 stablecoin by means of their decentralized finance (DeFi) platform referred to as World Liberty Monetary.

Exterior of the US, Japan introduced the launch of the primary yen-backed stablecoin earlier this month referred to as JPYC. That is the primary stablecoin launched in Asia that may be issued globally.

Stablecoin Market Anticipated To Soar

The push by conventional finance companies into the stablecoins area follows the regulatory readability the trade gained when President Trump signed the GENIUS Act into legislation in July.

Stablecoins allow sooner settlement instances on the blockchain whereas additionally reducing out the intermediary. They permit person to transact with out borders with near-instant settlement instances.

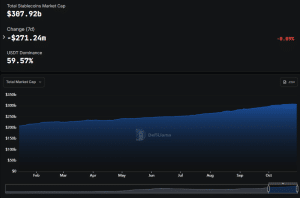

After the GENIUS Act was signed into legislation, the market capitalization of the stablecoin sector has surged greater than 20% to about $307 billion, in response to DefiLlama.

Stablecoin market cap (Supply: DefiLlama)

Bernstein Analysis predicts that the worldwide circulation of stablecoins might increase to just about $2.8 trillion by 2028, whereas Normal Chartered says stablecoins might pull in $1 trillion from banks in rising markets over the subsequent three years.

Associated Articles:

Greatest Pockets – Diversify Your Crypto Portfolio

Straightforward to Use, Function-Pushed Crypto Pockets

Get Early Entry to Upcoming Token ICOs

Multi-Chain, Multi-Pockets, Non-Custodial

Now On App Retailer, Google Play

Stake To Earn Native Token $BEST

250,000+ Month-to-month Lively Customers

Be part of Our Telegram channel to remain updated on breaking information protection