As the brand new 12 months begins with optimism throughout the crypto market, Bitcoin is as soon as once more taking the lead with a bullish outlook. The world’s largest cryptocurrency has began 2025 on a powerful be aware, setting the tone for what traders anticipate to be a pivotal 12 months for the asset. With value motion holding above essential ranges, the sentiment surrounding BTC and the broader market stays optimistic, fueled by hopes of additional development and adoption.

CryptoQuant analyst Axel Adler not too long ago launched a novel metric, the Bitcoin Enter Output Ratio, providing contemporary insights into the present market dynamics. In keeping with Adler, the ratio presently signifies market equilibrium, suggesting that Bitcoin’s value displays a balanced state between shopping for and promoting pressures. This new perspective gives a clearer lens for understanding BTC’s current actions and hints at potential shifts within the weeks forward.

With a powerful begin to the 12 months and a bullish sentiment dominating investor conversations, the following few weeks will likely be important for Bitcoin’s trajectory. Because the market appears poised for vital developments, many consider 2025 may mark one other milestone 12 months for BTC and the broader cryptocurrency area. All eyes at the moment are on the information and value motion as BTC charts its course for the months forward.

Bitcoin Enter Output Ratio: What This Metric Reveals

CryptoQuant analyst Axel Adler has offered useful insights into Bitcoin’s present market dynamics by means of on-chain metrics. On X, Adler not too long ago launched the Bitcoin Enter Output Ratio (IOR), explaining its significance and the way it displays the state of the market. This metric affords a granular take a look at pockets exercise, serving to analysts and traders interpret shifts in market sentiment.

The IOR measures the exercise of BTC wallets by evaluating the variety of addresses spending or transferring funds (inputs) to these receiving funds (outputs). A rise within the ratio signifies larger spending exercise, doubtlessly signaling promoting strain or motion towards exchanges. Conversely, a lower within the ratio suggests diminished spending exercise, which can point out accumulation or hodling habits.

When the ratio drops beneath 1, it displays a better variety of wallets receiving BTC than these spending it—a possible bullish signal, as it could suggest accumulation. For the present Bitcoin bullish cycle, the common IOR worth has been 1.05. Presently, the metric sits at 1.04, signaling a state of equilibrium out there.

Adler emphasizes that whereas the IOR gives useful info, it ought to be analyzed alongside different on-chain metrics and broader market situations to type a whole image of BTC’s trajectory. This equilibrium part suggests a balanced market, leaving room for potential shifts in both path based mostly on exterior catalysts.

BTC Holding Sturdy: Time For A Rally?

Bitcoin continues to indicate resilience because it holds above the important $95,000 mark, a key stage for sustaining bullish momentum. This value stage has turn out to be a focus for each bulls and bears, because it serves as the muse for a possible breakout above the extremely anticipated $100K mark.

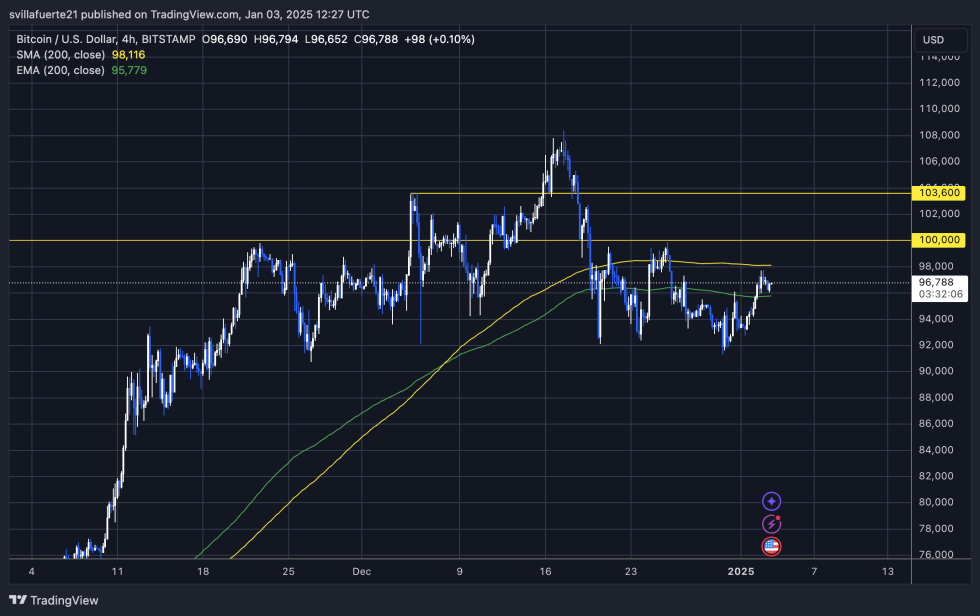

Presently, BTC is buying and selling inside a good vary, with the 4-hour 200 EMA beneath at $95,779 and the 200 MA above at $98,116. This vary highlights a interval of consolidation, with merchants eagerly looking ahead to a clear breakout in both path. A decisive transfer above the 200 MA and a profitable retest to determine it as assist would set the stage for a brand new rally into uncharted territory and potential all-time highs.

Alternatively, failure to carry these ranges may sign brewing bearish momentum. Shedding the $95,000 mark, specifically, might result in a deeper correction because the market searches for the following vital demand zone.

Because the market stays in a state of equilibrium, Bitcoin’s subsequent transfer will doubtless set the tone for the broader crypto market. All eyes are on whether or not bulls can collect the power wanted to take BTC to new heights.

Featured picture from Dall-E, chart from TradingView