Victoria d’Este

Printed: October 27, 2025 at 10:33 am Up to date: October 27, 2025 at 10:41 am

Edited and fact-checked:

October 27, 2025 at 10:33 am

In Temporary

Bitcoin and Ethereum rebounded in October, boosted by softer inflation and renewed market optimism. Toncoin quietly gained, supported by strategic reserves, Grayscale curiosity, and rising ecosystem momentum.

Bitcoin (BTC)

From ~105 Ok lows again towards 116 Ok, reclaiming mid-range floor after the October nuke.

BTC/USD 1H Chart, Coinbase. Supply: TradingView

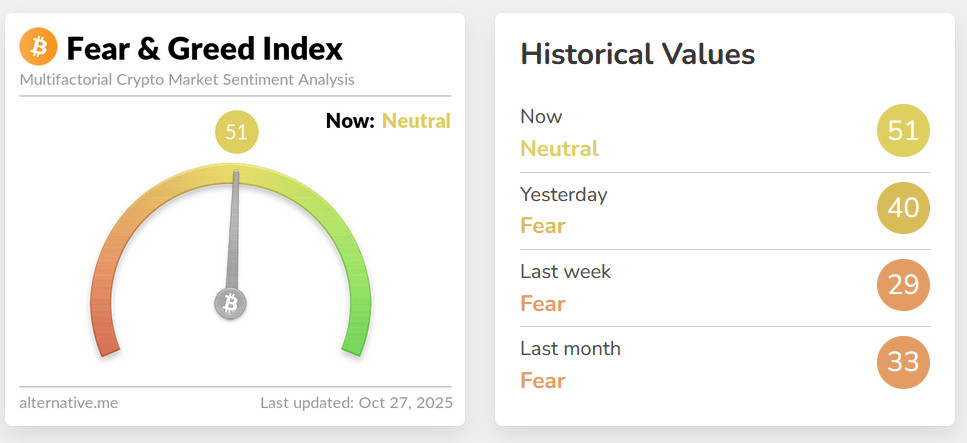

So yeah, BTC lastly determined it’s had sufficient of the post-tariff hangover and pushed a reasonably convincing native rebound. What’s humorous is that it doesn’t really feel euphoric — sentiment’s solely simply crawled out of “worry” territory, in keeping with the Crypto Concern & Greed Index. You’ll be able to virtually sense the hesitation: merchants are shopping for, certain, however with one foot nonetheless hovering over the brake pedal.

The present Crypto Concern and Greed rating. Supply: Various.me

Macro helped a bit right here. The percentages of a Fed price reduce jumped to 98%, and inflation knowledge got here in softer than anticipated. That mixture alone gave crypto a much-needed tailwind. Shares hitting report highs didn’t damage both — danger urge for food’s slowly seeping again in.

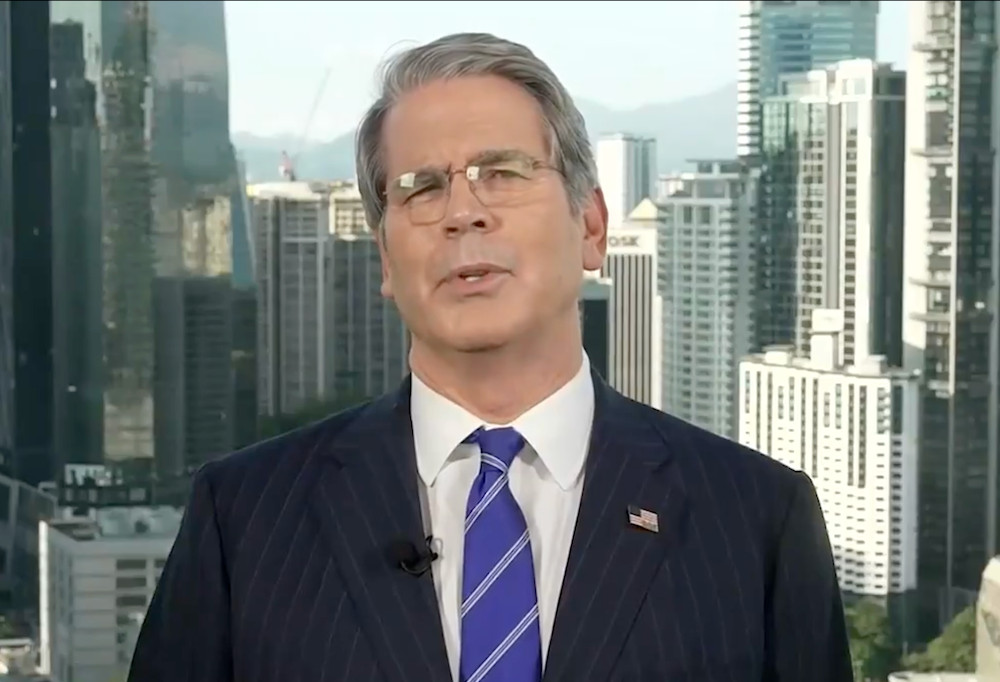

Scott Bessent breaks the information of optimistic commerce negotiations between the US and China. Supply: The White Home

And politically, Trump’s Treasury group reached what they referred to as a “substantial” commerce framework with China. That eased the tariff panic — the very one which triggered October’s crash within the first place.

US President Donald Trump solutions reporters’ questions on a number of matters, together with CZ, at Thursday’s press convention. Supply: The White Home

Then there’s the crypto-native facet of issues. CZ’s presidential pardon reignited hypothesis about Binance’s attainable U.S. return.

Ferrari 499P. Supply: Wikimedia

Even Ferrari wandered into the image, teasing a digital token public sale for its Le Mans-winning automobile. Random, certain — however form of symbolic. When outdated luxurious manufacturers hold inching towards crypto, it makes the rebound really feel a bit of extra “actual.”

So the place does that go away Bitcoin? Proper on the high of its crash-range once more, hovering close to 116 Ok. Perhaps it breaks via, perhaps it doesn’t. The vary remains to be a minefield, and the simple beneficial properties are accomplished. In case you’re buying and selling short-term, you retain your stops tight. In case you’re pondering larger image, you most likely look forward to this field to interrupt cleanly earlier than pretending the highway to new highs has reopened.

Ethereum (ETH)

Bounced from 3.7 Ok to 4.25 Ok, shadowing BTC’s restoration and poking its personal native ceiling.

BTC/USD 1H Chart, Coinbase. Supply: TradingView

Ether’s transfer this week looks like déjà vu — it’s nonetheless dancing to Bitcoin’s rhythm, simply with a barely smoother beat. Spot ETH ETFs, although, instructed a distinct story: outflows for a second straight week.

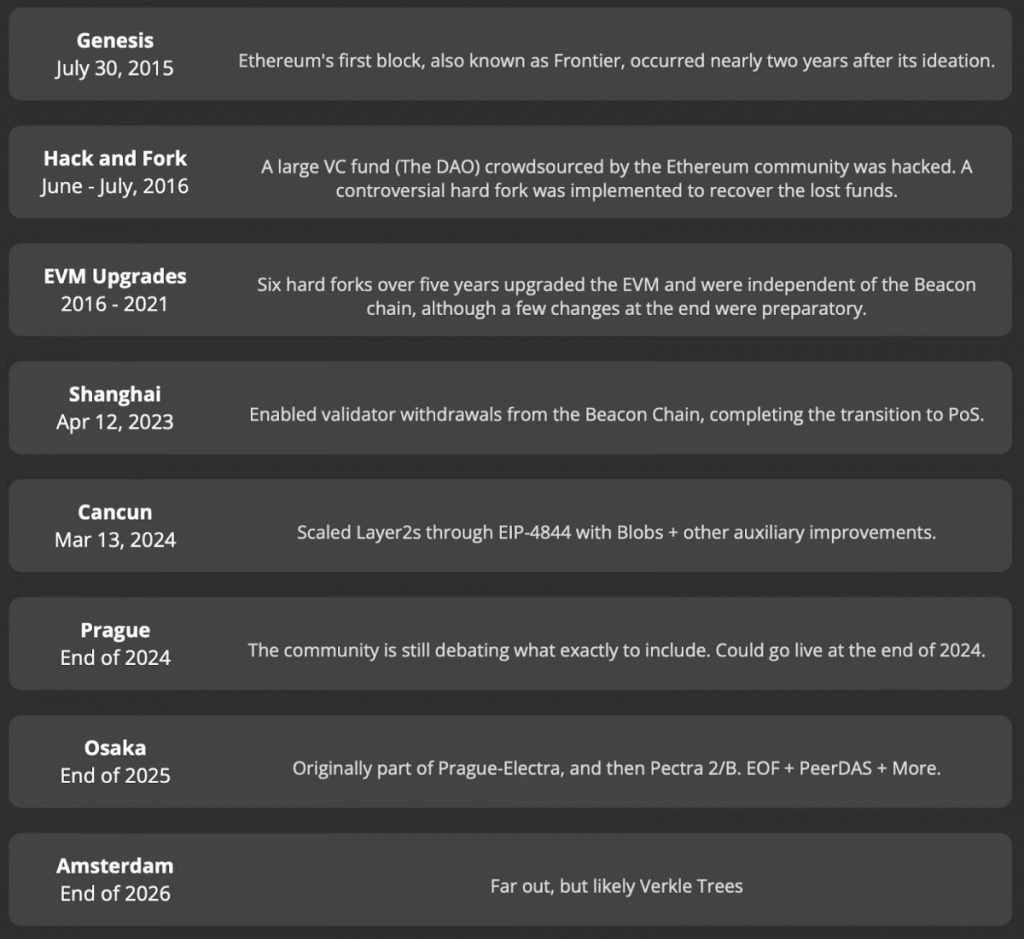

Even so, the market shrugged it off. Merchants are waiting for the December 3 Fusaka improve, now in its ultimate testnet section, which reminded everybody that, past all of the noise, Ethereum nonetheless ships code.

Ethereum Onerous Fork timeline. Supply: ethroadmap.com

Technically, ETH stays trapped under that thick 4.3 Ok resistance — the identical one which’s rejected each breakout try this month. It’s seen, it’s psychological, and it’s not breaking till Bitcoin clears its personal ceiling.

Narratively, the Ethereum camp had a loud week. ConsenSys’ Joe Lubin referred to as Ether “the highest-powered cash on the planet.”

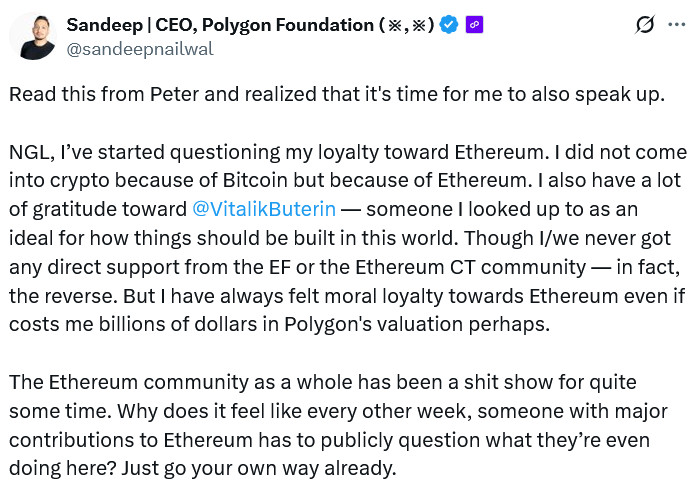

Polygon’s founder publicly questioned his “loyalty” to Ethereum, whereas Solana’s Anatoly couldn’t resist calling L2s “centralized safety liabilities.” It’s like everybody’s again to arguing theology once more — and that’s a traditional signal the cycle’s maturing.

Supply: Sandeep Nailwal

Nonetheless, correlation is king proper now. It doesn’t matter what tech milestones or philosophical debates play out, ETH received’t decouple till BTC’s route turns into clearer.

Toncoin (TON)

From ~2.06 to 2.25, late to the occasion however becoming a member of the rebound.

BTC/USD 1H Chart, Coinbase. Supply: TradingView

TON didn’t precisely rip, nevertheless it’s lastly catching a bid once more — and this time, the optimism truly has some substance behind it. The brand new TON Strategic Reserve website quietly went dwell this week, displaying that TON Technique and AlphaTON Capital collectively now maintain about 229 million TON, roughly 4.7% of complete provide.

Across the similar time, Grayscale re-added TON to its “belongings into account” checklist, which is a reasonably large nod from the TradFi facet. It’s the second time they’ve accomplished this, and the truth that it’s resurfacing a 12 months later suggests the curiosity in Telegram’s blockchain is turning into extra systematic than ‘experimental’.

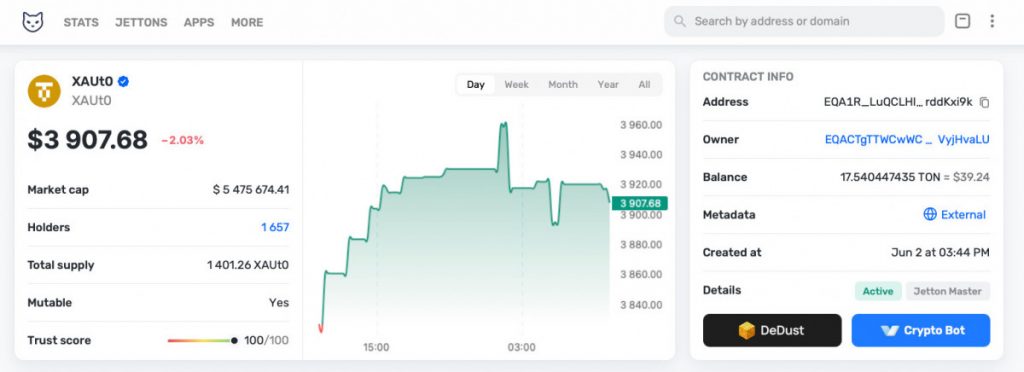

On the infrastructure entrance, TON’s nonetheless benefiting from having Tether Gold (XAUt0) as its first omnichain token — that little experiment now sits at a $10.7 million cap, with greater than half of it circulating proper on TON. It’s a small quantity within the grand scheme, however symbolically, it reveals TON’s evolving right into a critical multi-asset platform, not only a chat-app chain.

AlphaTON itself additionally made headlines this week with a brand new CFO appointment — Wes Levitt (previously of Theta Labs), who’ll be compensated half in fiat, half in TON, plus a chunky choices package deal. It’s a company transfer, however one that claims the cash round this community is getting extra skilled.

All in all, TON’s trying steadier — not precisely a breakout story, however undoubtedly reasserting its relevance after a number of quiet weeks. Its value is shifting in sync with the majors, sure, however this time there’s real ecosystem momentum underneath it. Nonetheless, if Bitcoin stumbles close to 116 Ok, TON will probably give again floor like everybody else.

Disclaimer

In step with the Belief Challenge pointers, please notice that the data supplied on this web page shouldn’t be meant to be and shouldn’t be interpreted as authorized, tax, funding, monetary, or another type of recommendation. You will need to solely make investments what you may afford to lose and to hunt unbiased monetary recommendation if in case you have any doubts. For additional data, we advise referring to the phrases and circumstances in addition to the assistance and assist pages supplied by the issuer or advertiser. MetaversePost is dedicated to correct, unbiased reporting, however market circumstances are topic to alter with out discover.

About The Creator

Victoria is a author on quite a lot of expertise matters together with Web3.0, AI and cryptocurrencies. Her in depth expertise permits her to write down insightful articles for the broader viewers.

Extra articles

Victoria d’Este

Victoria is a author on quite a lot of expertise matters together with Web3.0, AI and cryptocurrencies. Her in depth expertise permits her to write down insightful articles for the broader viewers.