Be part of Our Telegram channel to remain updated on breaking information protection

Pantera Capital is planning to lift $1.25 billion to transform a Nasdaq-listed firm into a number one SOL treasury agency that’s tentatively known as Solana Co.

That’s according to a report from The Info, which mentioned the crypto fund supervisor goals to lift an preliminary sum of $500 million, adopted by one other $750 million through warrants.

Warrants are agreements that give a capital supplier the precise to purchase firm inventory sooner or later at a value established when the warrants have been issued.

If the $1.25 billion is raised and Solana Co. is created, it will mark the most important devoted effort up to now towards making a SOL treasury agency.

Pantera Capital is making ready a large $1.25B increase to create a Solana-focused treasury agency, beginning with $500M in fairness and $750M in warrants. If profitable, this entity may maintain extra SOL than all current public company treasuries mixed.

On the identical time, companies like… pic.twitter.com/vGHv47vypK

— ApeWitch (@ape_witch) August 26, 2025

“Digital Asset Treasury firms are an ideal instance of the unimaginable demand in public markets to get publicity to this dynamic house,” mentioned founder Dan Morehead, a former Goldman Sachs and Tiger World Administration dealer, on the Wyoming Blockchain Symposium final week.

Pantera Capital Has Already Deployed $300M Into Crypto Treasury Firms

This isn’t the primary crypto treasury associated growth made by Pantera Capital, which manages about $5 billion in belongings.

Earlier this month, the fund supervisor disclosed that it deployed roughly $300 million into digital asset treasury (DAT) companies.

Within the disclosure, Pantera Capital mentioned that “proudly owning a DAT may supply a better potential in comparison with holding tokens straight by an ETF.” It’s because DATs are capable of generate yield by staking, which will increase their respective web asset worth per share.

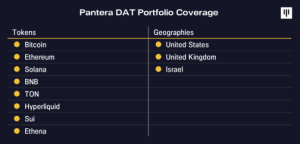

Among the firms that Pantera has added to its portfolio embrace Twenty One Capital, DeFi Improvement Corp, and SharpLink Gaming, giving it publicity to cryptos that embrace Bitcoin (BTC), Ethereum (ETH), Solana (SOL), Binance Coin (BNB), Toncoin (TON), Hyperliquid (HYPE), Sui (SUI) and Ethena (ENA).

Pantera DAT portfolio (Supply: Pantera Capital)

The primary funding by the Pantera DAT Fund was in BitMine, which it mentioned has “a transparent strategic roadmap and the management to execute it.”

This week, Pantera additionally joined ParaFi Capital in backing Sharps Know-how, one other SOL-focused treasury agency focusing on greater than $400 million in capital.

A number of Nasdaq-Listed Firms Creating Their Personal SOL Treasuries

Pantera’s transfer is the most recent in a rising variety of Nasdaq-listed companies which might be turning their consideration to Solana with plans to construct their very own treasuries across the crypto.

Firms reminiscent of Upexi, DeFi Improvement Corp and BitMining have all been accumulating SOL in latest months.

Information from CoinGecko exhibits that there are at the moment 5 firms throughout two international locations that collectively maintain 3,715,814 SOL valued at greater than $700 million. This equates to round 0.69% of SOL’s complete provide.

Upexi is the most important of those Solana treasuries, with its holdings of two,000,518 SOL. This complete is after the corporate purchased one other 98,709 SOL within the final 30 days.

DeFi Improvement is the subsequent greatest company SOL holder, with its holdings of 1,270,259 tokens. Much like Upexi, it additionally purchased extra SOL within the final 30 days, including one other 291,769 tokens to its reserves.

The one different firm to purchase extra SOL previously month is Exodus Motion, which is at the moment ranked because the fifth-biggest SOL treasury after its first buy of 34,578 SOL, in line with CoinGecko.

Regardless of the continued shopping for strain from public firms, the worth of SOL has dropped barely over the previous month.

Whereas an increasing number of firms are beginning to create their very own SOL treasuries, the variety of these firms continues to be low in comparison with the 305 entities that at the moment maintain Bitcoin (BTC) on their stability sheets.

It’s additionally lower than the 70 firms that at the moment have an Ethereum (ETH) treasury and collectively maintain round 4.3 million tokens valued at over $19.12 billion.

Pantera Not The Solely Firm Wanting To Make A $1B SOL Treasury Wager

Pantera’s $1.25 billion SOL Treasury play additionally follows on the heels of an analogous transfer by crypto business giants Galaxy Digital, Multicoin Capital, and Soar Crypto.

In response to Bloomberg, the three crypto business titans are in talks to lift $1 billion to construct their very own SOL treasury firm. Cantor Fitzgerald has been tapped because the lead banker, with the Solana Basis backing the deal as nicely. The deal may shut in early September.

The three firms plan to take an analogous method to Pantera, changing an already-listed public firm right into a treasury entity.

Associated Articles:

Finest Pockets – Diversify Your Crypto Portfolio

Simple to Use, Function-Pushed Crypto Pockets

Get Early Entry to Upcoming Token ICOs

Multi-Chain, Multi-Pockets, Non-Custodial

Now On App Retailer, Google Play

Stake To Earn Native Token $BEST

250,000+ Month-to-month Energetic Customers

Be part of Our Telegram channel to remain updated on breaking information protection