When Stablecoin L1 Plasma goes dwell, billions in liquidity observe, placing new stress on XPL’s first-month buying and selling vary.

Plasma, a Bitfinex-backed Layer 1 blockchain constructed for stablecoins, launched its mainnet beta and native token XPL on Sept. 25. The rollout included integrations with main DeFi protocols and rapid listings on main exchanges, signaling a robust market entry.

The brand new world monetary system is right here. pic.twitter.com/pkpXia30FS

— Plasma (@PlasmaFDN) September 25, 2025

At launch, XPL traded simply above $1, however value motion confirmed sharp swings as early consumers examined liquidity.

(Supply: Coingecko)

Stablecoin inflows on the chain picked up shortly, spreading exercise throughout Uniswap, PancakeSwap, and centralized exchanges equivalent to Binance, OKX, Bitget, and Bitfinex.

Plasma’s positioning is exact: it desires to be a high-throughput, low-cost “cash chain” designed to host stablecoin exercise at scale. By securing each DeFi and centralized trade companions on day one, the mission set the stage for fast adoption.

Why Are Merchants Linking Plasma to Tether’s Progress Story?

Plasma’s mainnet debut got here with heavy backing from the stablecoin sector. The mission says billions in liquidity are already dedicated via companions like Aave, Ethena, Fluid, and Euler.

On the similar time, tokenomics set a transparent framework: There’s a complete provide of 10 billion XPL, with about 1.8 billion circulating at launch. Public-sale consumers who paid $0.05 earlier this yr briefly noticed 20x paper beneficial properties as buying and selling opened.

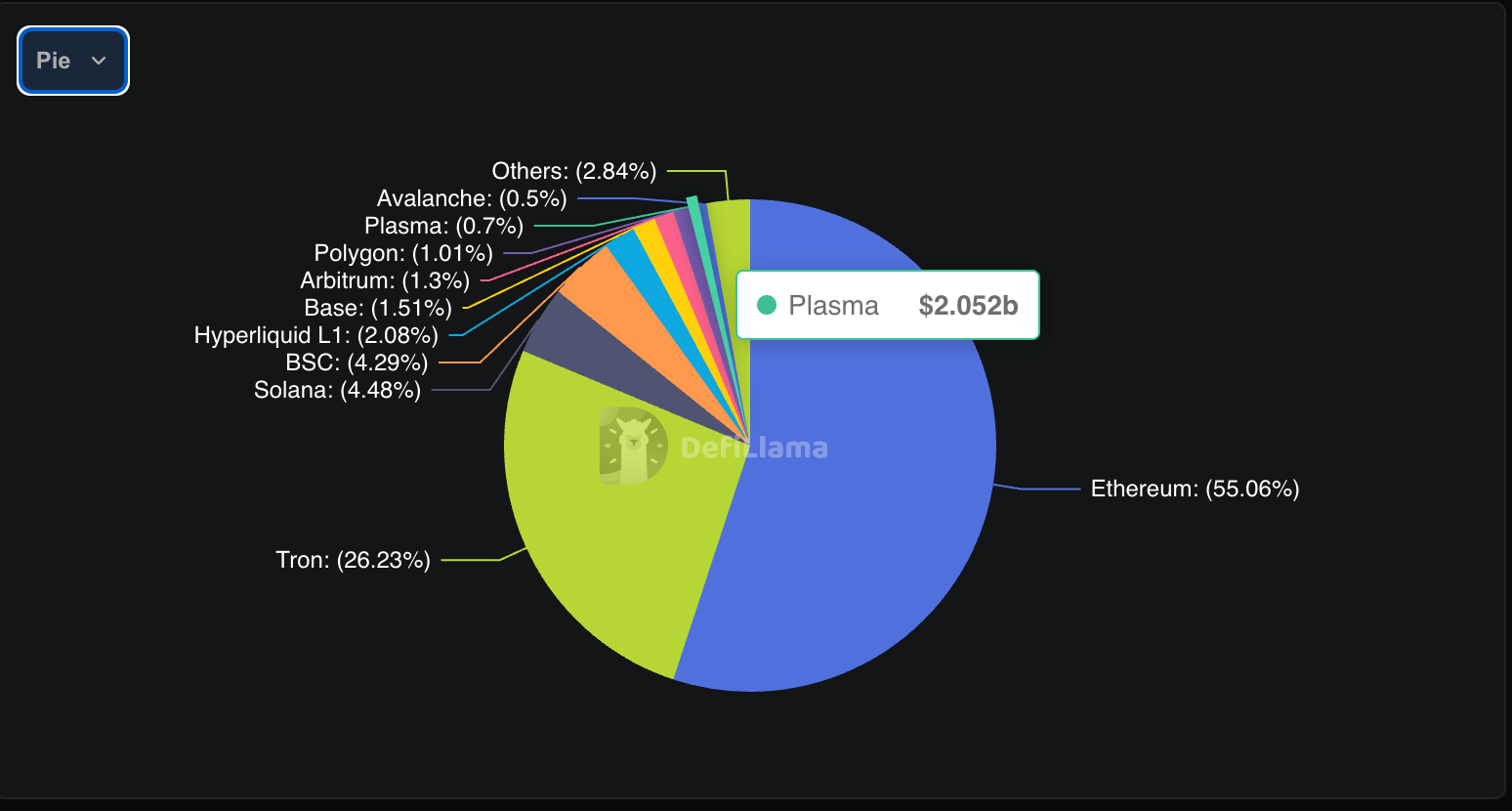

On-chain information highlights how Plasma is leaning right into a “liquidity first” technique. DefiLlama reveals roughly $2.05Bn in stablecoins lively on the community, whereas decentralized trade exercise stays gentle.

(Supply: DeFiLlama)

Each day charges have been modest, round $4,200, underscoring that utilization past stablecoin rails will take time to develop.

To widen its attraction, the ecosystem launched merchandise designed to create demand. Swarm, a regulated DeFi platform, plans to listing 9 tokenized equities, together with Apple, Microsoft, Tesla, and MicroStrategy, for twenty-four/7 buying and selling towards stablecoins.

Plasma additionally launched Plasma One, a “stablecoin-native neobank” concentrating on areas such because the Center East, the place dollar-backed digital property already see heavy use.

Introducing Plasma One: the one app to your cash. pic.twitter.com/5IgcCon5g8

— Plasma (@PlasmaFDN) September 22, 2025

Nonetheless, valuation and float stay key factors of debate. The launch implied a $10Bn absolutely diluted worth, however not all reported circulating tokens might be accessible instantly.

US sale individuals, for instance, gained’t obtain allocations till July 2026, which means the near-term float is tighter than headline figures counsel.

Analysts say the mission’s concentrate on stablecoins positions it as a proxy for broader market traits.

“Giant crypto alternatives like stablecoins at all times draw consideration,” one Delphi Digital researcher famous, including that merchants view Plasma as a strategy to faucet into Tether’s rising function in digital finance.

Tomorrow $XPL goes dwell with virtually poetic timing

(Tether elevating $20B at a $500B valuation, a lot of onchain runners, and speculative capital apeing into new launches regardless of a shaky broader market.)

I believe Plasma has an opportunity to be a large prepare dinner.

Let me break down why I…

— Simon (@simononchain) September 24, 2025

XPL Worth Prediction: Can XPL Realistically Attain $3–$5 as Some Analysts Predict?

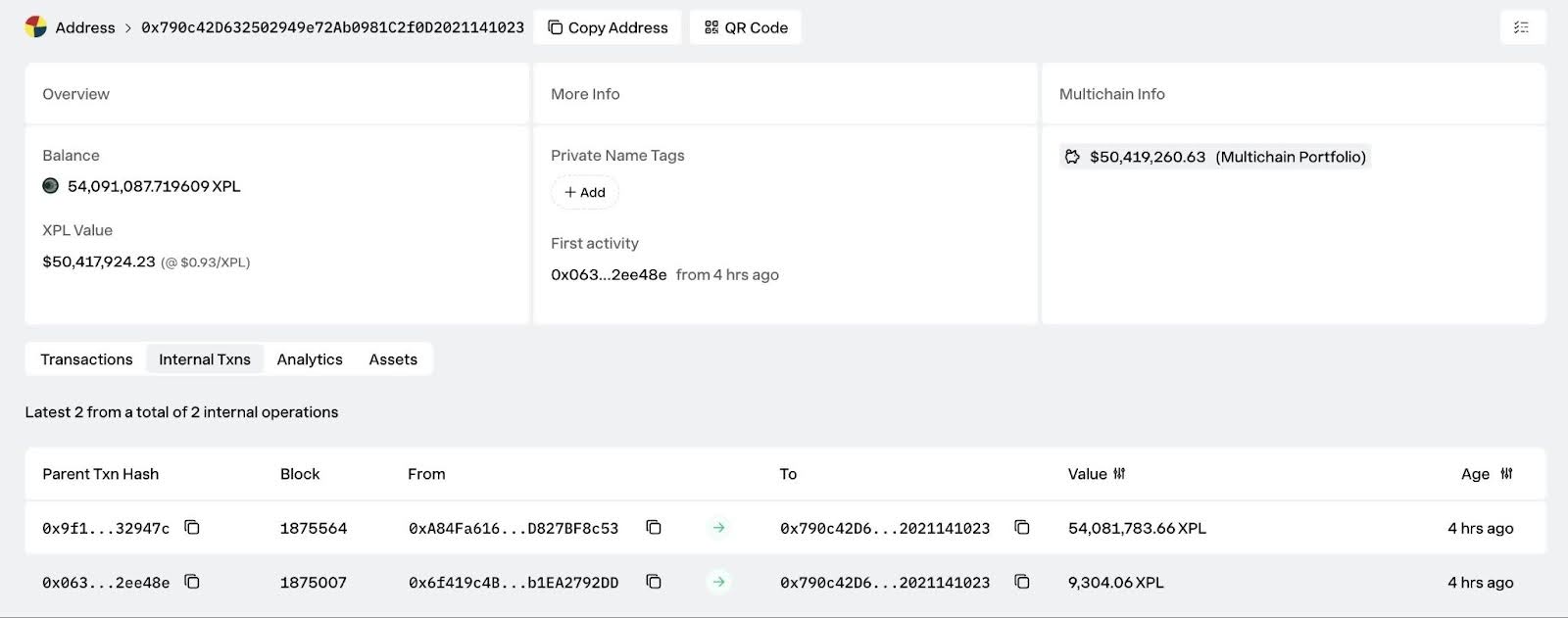

A crypto whale has booked one of many quickest beneficial properties of the yr on Plasma’s debut. On-chain information from Lookonchain reveals that pockets 0x790c deposited $50M in USDT through the mission’s public sale, securing a $2.7M allocation at $0.05 per token.

Whale 0x790c deposited 50M $USDT into #Plasma and secured a $2.7M public sale allocation.

He purchased 54.09M $XPL($50.4M now) at $0.05 and is now sitting on an unrealized revenue of over $47.7M!

Handle:0x790c42D632502949e72Ab0981C2f0D2021141023 pic.twitter.com/PHV45xKpKs

— Lookonchain (@lookonchain) September 25, 2025

The investor obtained 54.09M XPL, now value about $50.4M with the token buying and selling between $0.93 and $1.14, an unrealized revenue of $47.7M inside hours of launch.

The windfall highlights the surge of capital into Plasma as stablecoin liquidity flows into the community. Analysts say whale-sized entries can drive sharp value swings and replicate early institutional curiosity within the chain.

(Supply: X)

XPL’s perpetual contract chart reveals why merchants are paying consideration. Worth broke out from the $0.70 zone to $1.16 in a single session, with consumers stepping in round $0.75–$0.80.

R4ped by my different longs. Rescued by $XPL. Due to this I believe $3-5 $XPL appears truthful. https://t.co/BEuFgYi7GE pic.twitter.com/Y5H7iP54kz

— VikingXBT (@VikingXBT) September 25, 2025

Every resistance degree at $0.90 and $1.00 gave approach after quick consolidations, a textbook signal of bullish momentum. Quantity spikes close to the $0.90 breakout counsel massive gamers have been concerned, echoing the sooner $50M whale deposit.

The transfer above $1.00 carried weight as a psychological barrier, confirming development energy. If momentum continues, chart targets are $1.50 and $2.00, with speculative speak of $3–$5 within the medium time period. Dealer VikingXBT wrote on X: “Rescued by $XPL… I believe $3–$5 appears truthful.”

(Supply: X)

Nonetheless, vertical rallies hardly ever run unchecked. Revenue-taking may spark pullbacks, with rapid help at $1.00 after which $0.90. Holding these zones would maintain bulls in management.

For now, XPL’s breakout displays a mixture of whale backing, contemporary liquidity, and speculative hype round Plasma’s mainnet launch. Volatility is anticipated, however the broader development stays firmly upward.

DISCOVER: Greatest Meme Coin ICOs to Spend money on 2025

Be a part of The 99Bitcoins Information Discord Right here For The Newest Market Updates

The publish Plasma TVL Erupts After Mainnet: XPL Worth Prediction For October? appeared first on 99Bitcoins.