February 5, 2025

The next put up accommodates a recap of reports, initiatives, and necessary updates from the Spartan Council and Core Contributors from final week.

👉TLDR

SIP-420: Protocol Owned SNAX — That is in its remaining audit stage. See under for a refresher on the contents of this proposal.Synthetix Leveraged Token Rally rewards program: Week 3 of 5 has simply begun, with one other 15,000 $OP and 30,000 $USDC up for grabs. See final week’s leaderboard under.Discord alpha about free $OP bets from Additional time: Synthetix struck a deal (thanks Burt!) final week with Additional time Markets in order that the primary 250 addresses to commerce on Synthetix Leverage for the remainder of the week (ended February 3), would earn a free 10 $OP guess on Additional time.Cease Loss and Take Revenue order varieties have been added to Synthetix Exchange1-click buying and selling and account abstraction is in remaining testing stagesArbitrum deprecation is close to completionFenway updates: Synthetix is transitioning from being solely a liquidity service to taking cost of the product improvement (frontend UX developments are off the charts, Synthetix vaults as a brand new product is bringing many constructive modifications).V4 is coming: Synthetix V4 will ship a buying and selling expertise that’s aggressive with different on-chain DEX’s with out making a number of the centralization tradeoffs that opponents have needed to make. Buying and selling and LP exercise on V3 on Base will proceed. See extra particulars under.Synthetix Alternate new instruments and docs: Now there’s a better solution to modify your positions with restrict orders on Optimism. The brand new pencil icons on Synthetix Alternate enable modification by means of market, restrict, and cease orders.New Perps markets are stay: $VELO, by Velodrome, and $VVV, by Venice.Rewards for sUSD depositors on Infinex nonetheless ongoing: Rewards had been simply DOUBLED to 10,000 OP and 10,000 SNX being distributed weekly. See outcomes from final week’s Patron NFT drawing under.Synthetix efficiency comparability thread on X: 🥇SOLBULL 3X Leveraged Tokens vs. 🥈SOL Perps vs. 🥉SOL Spot. See full outcomes of efficiency comparability under.

Spartan Council and SIP updates

Throughout final week’s sync the Council mentioned some product updates, together with SIP-420 which is in its remaining audit stage. Massive issues are cooking with this implementation and we’ll be maintaining with its development, so keep tuned for updates. However simply as a refresher:

This SIP was proposed by Kain to introduce a delegated staking system the place SNX holders can contribute their current debt positions to a protocol-owned pool, permitting the protocol to handle debt and generate yield, whereas providing stakers higher incentives.That is imagined to make staking a lot simpler and extra accessible by providing decrease dangers, larger returns, and long-term rewards, like liquidity incentives and treasury collateral redistribution (it was proposed that 10 million SNX from the treasury be used as staking incentives).Burt Rock additionally posted a fantastic thread about this SIP on X, so remember to test that out as properly!

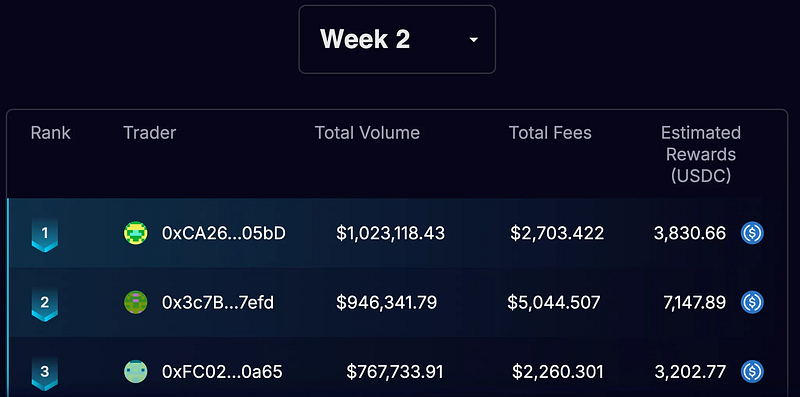

Subsequent up, as we talked about final week, the Synthetix Leveraged Token Rally rewards program is ongoing and is presently in its remaining swing. Now we have simply entered week 3 of 5, so in case you missed out on the final couple of weeks it’s not too late to affix! This week one other 15,000 $OP and 30,000 $USDC are up for grabs — simply mint Leveraged Tokens at http://leverage.synthetix.io and climb the leaderboard. Right here’s a take a look at final week’s prime merchants and the rewards they took dwelling:

Weekly rewards accumulate all through the occasion, and contributors can declare them of their dashboard after Week 5. Don’t miss out!

Talking of lacking out, did you catch the Discord alpha about free $OP bets from Additional time?? Synthetix struck a deal final week with Additional time Markets in order that the primary 250 addresses to commerce on Synthetix Leverage for the remainder of the week (up till this previous Monday morning), would earn a free 10 $OP guess on Additional time. Shout out to our buddies at Additional time! Simply in time for the Tremendous Bowl within the states.

However getting again to final week’s Spartan Council sync, the group additionally mentioned how Cease Loss and Take Revenue order varieties have been added to Synthetix Alternate, and 1-click buying and selling and account abstraction is in remaining testing phases. The Arbitrum deprecation can also be close to completion (all LPs and merchants are being suggested to withdraw and exit the system forward of anticipated liquidation ratio will increase to speed up the wind down).

Fenway additionally introduced up how Synthetix is at an fascinating level within the protocol’s improvement, because the core mission is altering from being solely a liquidity service to taking cost of the product improvement. The frontend (Synthetix Alternate) has seen lots of UX enhancements, and there are extra to return over the subsequent couple of months. He added that Synthetix vaults as a brand new product will allow customers to execute funding charge arbitrage and foundation commerce seize methods, and the plan is to construct person pleasant UIs for this product to make it extra accessible for typical merchants.

Additionally, Fenway introduced that incentives for customers holding sUSD on Infinex could be doubling final week — the APY growing from 25% to 50%.

AND…V4 is coming! Synthetix V4 will ship a buying and selling expertise that’s aggressive with different on-chain DEX’s with out making a number of the centralization tradeoffs that some opponents have needed to make. V4 will probably be deployed on SNAX Chain, and SIP-420 will unlock some liquidity to assist get this going (through a diminished c-ratio) and help extra OI proper from the launch. Buying and selling and LP exercise on V3 on Base will proceed, however count on extra particulars about all of this within the coming weeks.

Subsequent, the Synthetix Alternate group has been exhausting at work on some sizzling new instruments and docs. They’ve listened to your suggestions and have applied a better solution to modify your positions with restrict orders on Optimism. The brand new pencil icons on Synthetix Alternate enable modification by means of market, restrict, and cease orders. You possibly can scale in or out of trades simply, utilizing market or conditional orders — all with out depositing any further margin.

Talking of Synthetix Alternate, a few new Perps markets at the moment are stay: $VELO, by Velodrome, and $VVV, by Venice.

And don’t overlook — Infinex sUSD depositor rewards are nonetheless occurring! Rewards had been really simply DOUBLED to 10,000 OP and 10,000 SNX being distributed weekly. Final week there have been 334 customers who deposited $1,000 or extra sUSD and certified for the week 2 random Patron NFT drawing — and the winner was Cyberdruid! However everyone seems to be profitable with these rewards. 😉

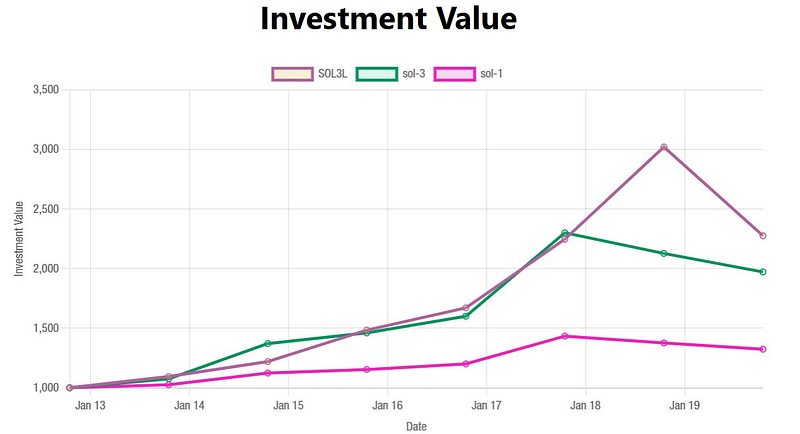

Lastly, Synthetix not too long ago posted a thread on X that goes by means of a efficiency comparability of SOLBULL 3X Leveraged Tokens, SOL Perps, and SOL Spot. These 3 other ways to lengthy SOL had been backtested over a 7-day span (January 13 — January 20) to see which carried out finest and assist customers higher evaluate buying and selling choices.

🥉Third place: SOL Spot, with a $1,000 spot purchase of SOL being price roughly $1,324 for a worth enhance of +32.4%.🥈Second place: the 3x SOL Perp lengthy with $1,000, ending at $1,972 with a +97.2% worth enhance.🥇First place: the SOLBULL 3x Leveraged Token, ending at $2,276 with a +127.6% worth enhance.

Take into accout, nonetheless, that this comparability doesn’t account for Perps funding or account for charges (which might range from platform to platform). However, with all charges being equal on this take a look at, the Leveraged Token was the strongest performer over this time interval because it robotically rebalances, taking unrealized PnL to extend the place whereas sustaining the leverage issue of 3x.