Motive to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade consultants and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

Solana (SOL) has been beneath intense promoting strain, with the worth failing to reclaim key resistance ranges after weeks of fear-driven market situations. Bulls misplaced management when SOL dropped beneath $180, a vital assist degree that beforehand held agency. Since then, bearish sentiment has dominated, with hypothesis rising a few potential bear marketplace for SOL and the broader altcoin sector.

Associated Studying

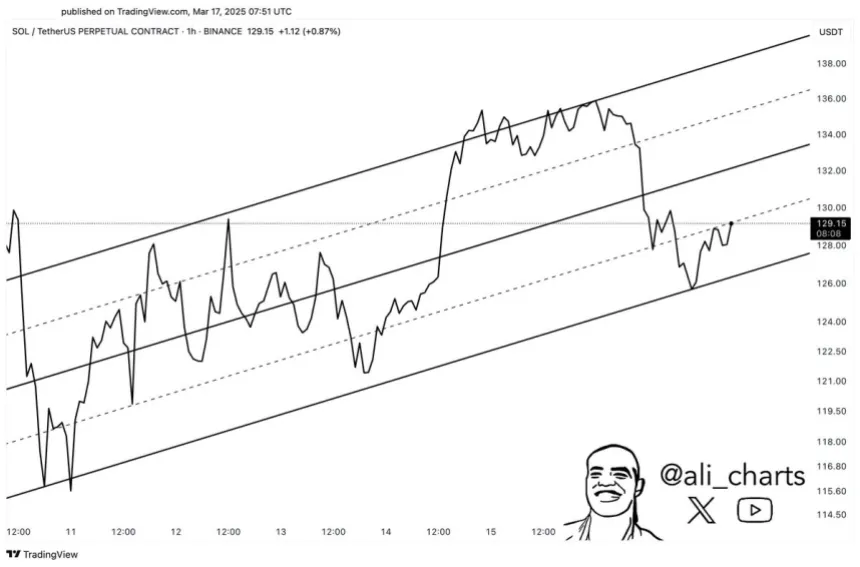

Regardless of this detrimental outlook, there could also be a glimmer of hope for Solana bulls. Prime analyst Ali Martinez shared a technical evaluation on X, revealing that SOL is forming a bullish channel within the short-term time-frame. This sample means that if Solana holds inside this formation, a surge to increased value ranges might observe.

For this bullish situation to play out, SOL should maintain the decrease trendline of the channel and push towards increased resistances. A breakout from this sample might sign a robust restoration, doubtlessly reversing the downtrend that has dominated the marketplace for weeks. Nonetheless, if Solana fails to keep up this construction, the chance of additional draw back stays excessive. The subsequent few days will likely be essential in figuring out SOL’s short-term course.

Solana Faces Dangers Amid Volatility

Solana has confronted relentless promoting strain since hitting its all-time excessive of $261 in January, now down 61% from that peak. As hopes for a large bull run fade, hypothesis round a possible bear market continues to develop. The broader macroeconomic atmosphere stays unfavorable, with commerce conflict fears and financial uncertainty pushing down not simply the crypto market but additionally the U.S. inventory market.

Buyers are actually on the lookout for indicators of a reversal, and technical indicators recommend a possible short-term restoration. Martinez’s evaluation on X reveals that Solana is forming a bullish channel and is eyeing a climb from the channel’s base to the higher resistance at $140. If this sample holds, SOL might push towards $140 and even increased ranges, signaling a aid rally.

For this bullish outlook to materialize, Solana should preserve its present trendline assist and break by means of key resistance ranges. If SOL fails to carry this channel, it might face additional draw back, reinforcing fears of a protracted bear market. The subsequent few days will likely be essential in figuring out whether or not Solana can reclaim momentum or proceed its downward trajectory.

Associated Studying

Solana Struggles As Bulls Struggle to Regain Momentum

Solana (SOL) is at the moment buying and selling at $129, following days of consolidation between $136 and $111. The value motion stays unsure, with bulls struggling to regain management after weeks of promoting strain.

For a possible reversal, SOL should break above the $140 resistance degree and push towards $160, a key degree that will sign a shift in market construction. If bulls efficiently reclaim these value factors, a stronger restoration section might start, doubtlessly attracting new consumers again into the market.

Nonetheless, if Solana fails to carry the $125 assist, it might set off a wave of promoting strain, sending the worth towards decrease demand zones. A break beneath this degree might expose SOL to a drop towards $110 and even decrease, reinforcing issues that the present downtrend is much from over.

Associated Studying

The subsequent few buying and selling classes will likely be essential in figuring out whether or not Solana can reclaim momentum or if additional declines are forward.

Featured picture from Dall-E, chart from TradingView