The stablecoin market recorded its strongest quarterly enlargement since 2021, with $41 billion in internet inflows throughout the third quarter of 2025.

In accordance to Orbital’s Stablecoin Retail Funds Index, retail adoption of stablecoins has entered a brand new section of stability after a yr of intense development, owing to the truth that the crypto trade is transferring from speculative buying and selling to sensible, on a regular basis use in rising economies.

Retail Exercise Settles As Crypto Market Finds Its Stability

Stablecoin exercise has begun to stage out following a 69% enhance in consumer adoption between mid-2024 and mid-2025. In line with the most recent report knowledge from Orbital, there have been about 3.6 million day by day lively customers in Q3, indicating that the market is stabilizing following the joy of earlier months.

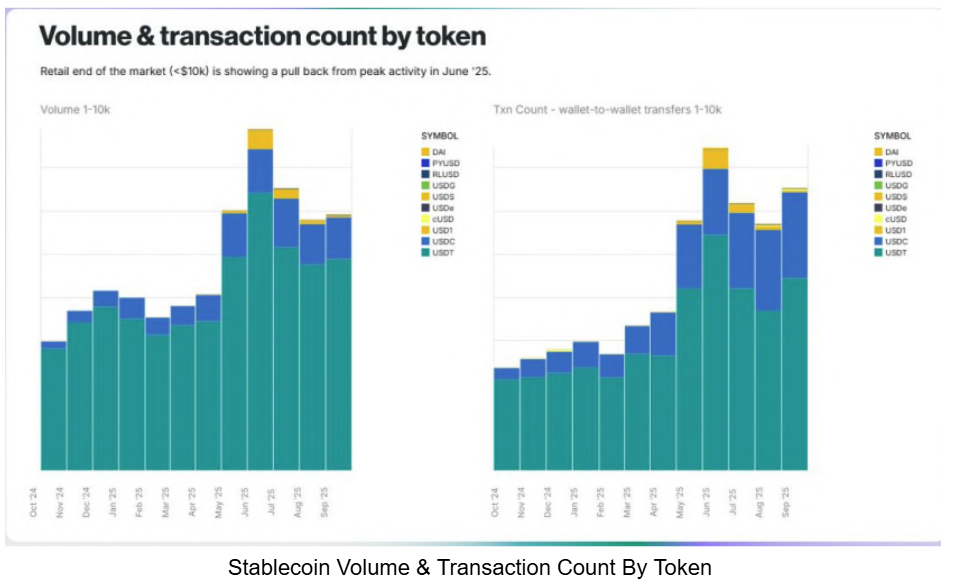

Nevertheless, the vital factor is that retail cost volumes nonetheless climbed considerably, up 4% to $1.77 trillion, even because the variety of transactions declined barely from 1.33 billion to 1.21 billion. This development factors to bigger, extra vital transfers changing the smaller ones under $10,000 that prevailed in earlier quarters.

Tether’s flagship token, USDT, continues to dominate the retail trade, accounting for 83% of complete transactions. Alternatively, USDC is the favourite token amongst DeFi customers, accounting for greater than 50% of the DeFi market. When it comes to crypto trade, Binance performs the main function of controlling a lot of the liquidity for each tokens and offering the rails for retail funds throughout rising markets.

Rising Markets Lean On Stablecoins To Battle Inflation

Stablecoins are more and more getting used as lifelines in struggling economies. This development has been acknowledged by monetary specialists, with Ark Make investments CEO Cathie Wooden just lately revising her $1.5 million Bitcoin prediction because of the rising reputation of stablecoins.

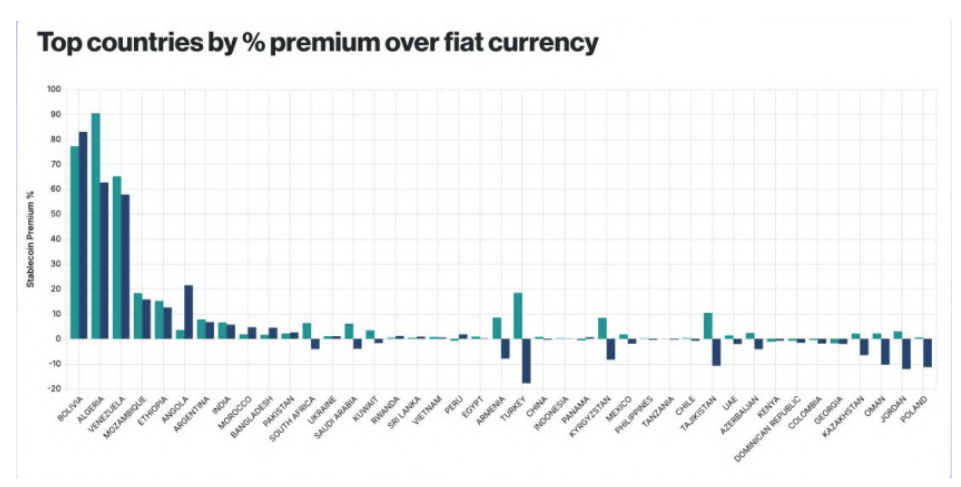

Orbital’s report reveals that customers in Algeria, Bolivia, and Venezuela are paying staggering premiums of 90%, 77%, and 63%, respectively, to entry dollar-pegged tokens. It is a signal that stablecoins have gotten digital variations of the US greenback in these areas. Mid-tier premier ranges between 8% and 18% in international locations like Türkiye, Ethiopia, and Argentina.

Alternatively, markets akin to India, Saudi Arabia, and South Africa present decrease premiums, as improved monetary infrastructure makes it simpler to purchase and promote stablecoins at near-market charges. Some international locations, together with Colombia and Peru, even commerce under parity, an indication of stronger liquidity and rising market maturity.

Prime international locations by stablecoin premium.

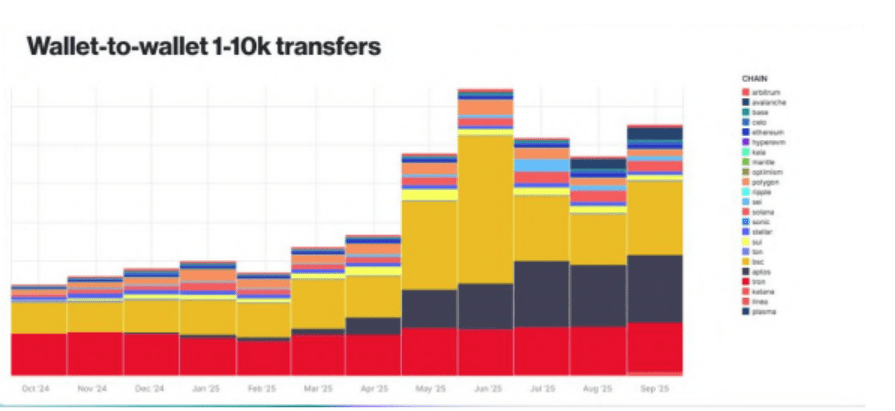

Notably, a brand new era of blockchains is competing for a share of stablecoin site visitors. Binance Good Chain nonetheless leads in retail transfers however noticed development gradual by half in Q3.

Aptos has now stabilized after its huge breakout earlier within the yr, whereas Plasma, the latest entrant, set a document of $7 billion in deposits inside days of launching its native token, XPL.

Tron additionally continued its regular climb as a result of its heavy USDT utilization, and Ethereum noticed its complete stablecoin provide develop by $35 billion.

Stablecoin Pockets-to-wallet Transfers

In line with knowledge from CoinGecko, the stablecoin market cap at present is round $311 billion.

Featured picture from Unsplash, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluation by our workforce of high know-how specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.