Alisa Davidson

Revealed: Could 30, 2025 at 7:50 am Up to date: Could 30, 2025 at 7:50 am

Edited and fact-checked:

Could 30, 2025 at 7:50 am

In Temporary

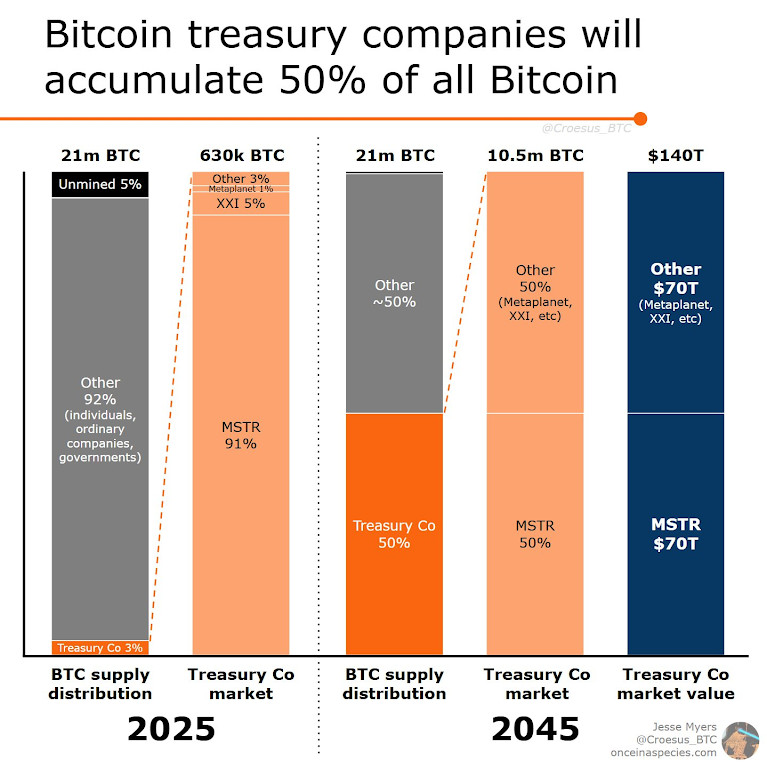

By 2045, Bitcoin Treasury Corporations are projected to carry half of all BTC, driving a $280 trillion market as institutional capital shifts from fiat to Bitcoin in quest of long-term worth preservation.

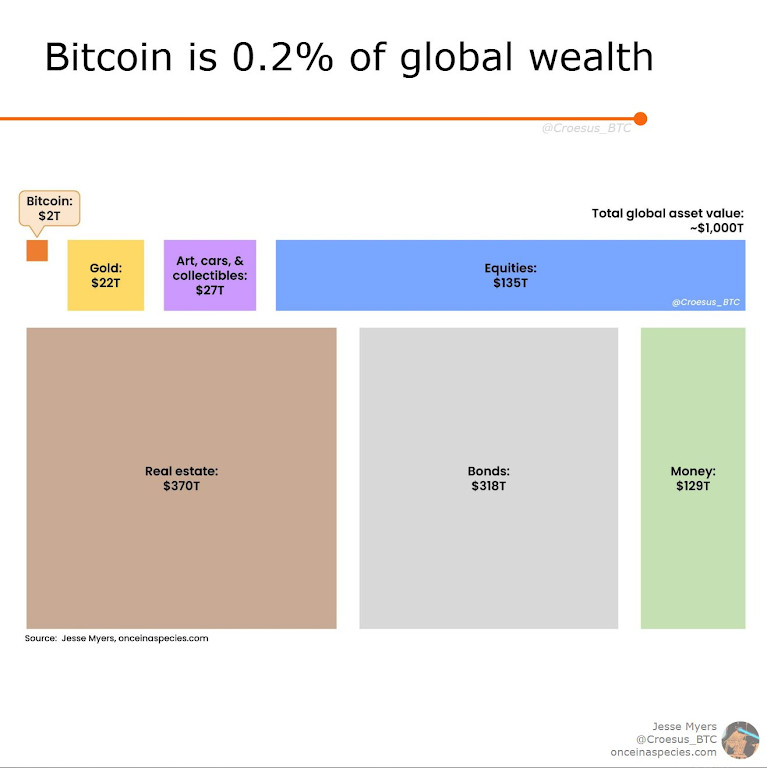

In a world with over $1,000 trillion in whole asset worth — together with bonds, shares, actual property, and gold — Bitcoin stays a tiny participant. In the present day, it represents simply 0.2% of all world wealth. However that is altering quick.

As Jesse Myers (Moon Inc.’s head of Bitcoin technique) highlights, the panorama is shifting. A brand new class of corporations is rising: Bitcoin Treasury Corporations. These are public companies whose principal mission is to purchase and maintain Bitcoin as their central technique. Their aim? To regulate an enormous share of the BTC provide and ship robust Bitcoin-based returns to their traders.

By 2045, these corporations are anticipated to personal 50% of all Bitcoin in existence — that’s 10.5 million BTC out of a most 21 million. One firm, Technique (previously MicroStrategy), might find yourself holding 5 million BTC alone. If Bitcoin hits $13 million per coin, as forecasted, that may make Technique value over $70 trillion — greater than any firm in historical past.

This text breaks down the total image: the mechanics behind the shift, the important thing gamers concerned, market forecasts, technical value evaluation, and what all of it means for the way forward for Bitcoin.

Why Is Bitcoin Attracting Trillions in Capital?

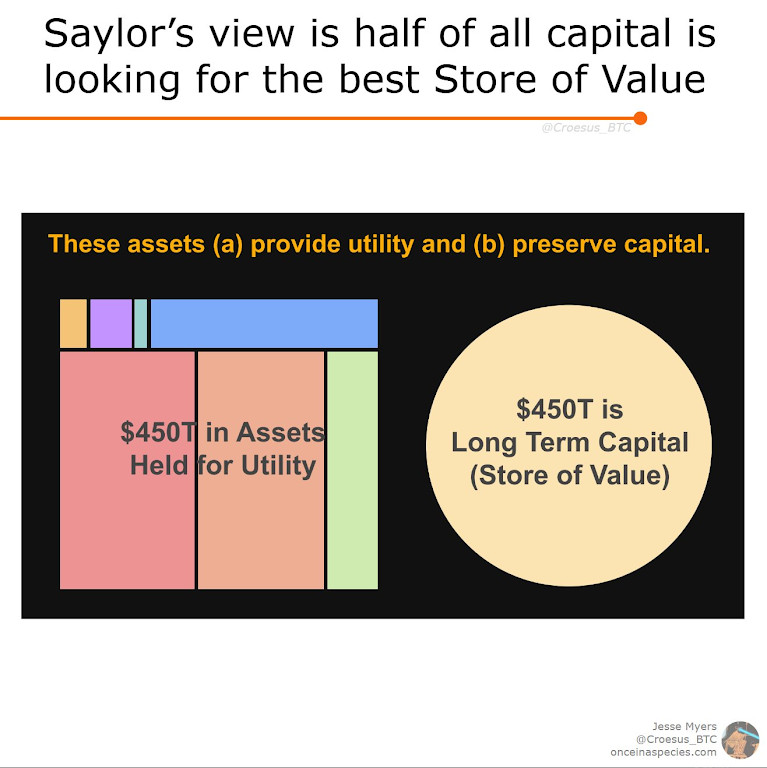

Michael Saylor, founding father of Technique, believes that half of all world capital is solely on the lookout for the very best place to guard wealth over time — referred to as a “retailer of worth.” That’s roughly $450 trillion looking for security.

In accordance with Saylor, Bitcoin is the very best retailer. It’s decentralized, has a hard and fast provide, and may’t be printed like cash. It’s extra scarce than gold and extra moveable than actual property.

Over the subsequent twenty years, capital that at the moment sits in fiat currencies, bonds, and even gold will step by step transfer into Bitcoin. However it gained’t circulation evenly. Most of will probably be absorbed by corporations purpose-built to purchase and maintain BTC. These Treasury Corporations will develop into the principle engines behind Bitcoin’s progress.

Technique’s Daring Plan: $70 Trillion and 5 Million BTC

As of Could 2025, Technique owns 580,250 BTC. It has spent round $40.6 billion to construct this place. Simply days in the past, it bought one other 4,020 BTC at $106,237 per coin, pushing its common holding value to $69,979.

This isn’t a short-term wager. Technique’s roadmap stretches to 2045, the place it goals to personal 5 million BTC. At a forecasted Bitcoin value of $13 million, that holding could be value over $70 trillion — turning Technique into essentially the most useful firm in historical past.

Present forecasts present:

By 2025: Treasury corporations will maintain 3% of all BTC (round 630,000 cash). Technique will management over 90% of that;

By 2045: Treasury corporations will maintain 50% of BTC — cut up between Technique (5M BTC) and others like Metaplanet and XXI;

The entire worth of those holdings might attain $140 trillion.

This accumulation mannequin is aggressive, nevertheless it’s backed by highly effective instruments that solely public corporations have entry to.

How Treasury Corporations Convert Capital Into BTC?

Technique does greater than merely maintain Bitcoin — it creates direct capital circulation into BTC.

Right here’s the way it works: Technique launches monetary merchandise like STRK and STRF, which supply excessive yields (8% and 10%) to bond traders who’re hungry for higher returns. This borrowed capital is then used to purchase extra BTC.

Consider Technique as a machine. On one aspect, it pulls in {dollars} from conventional markets. On the opposite, it pushes these {dollars} into Bitcoin. The corporate turns into a bridge between fiat traders and digital property. And since it’s public, it will probably elevate funds on a scale that people can’t.

This technique permits treasury corporations to construct BTC positions shortly, whereas additionally giving traders publicity to Bitcoin with added yield.

Why Treasury Corporations Have a Massive Benefit?

Bitcoin Treasury Corporations have three key strengths:

Entry to public markets. They will elevate billions by way of bonds, fairness, and monetary merchandise;

Freedom to construct methods. They will design instruments and strategies to match what the market needs;

A transparent mission. Their shareholders count on them to develop BTC holdings and returns by way of sensible risk-taking.

This mixture of capital, flexibility, and mandate makes them unstoppable BTC acquirers. Over time, they’re set to outcompete retail patrons, governments, and even conventional establishments.

The Capital Rotation Has Already Begun

From 2023 to 2025, capital has been shifting from fiat-based property like bonds and cash into laborious property like gold and Bitcoin.

Bitcoin grew by +114%;

Gold rose by +29%;

Bonds dropped by -3%;

Fiat cash fell by -2%.

This isn’t principle — it’s taking place. Buyers are leaving previous protected havens and on the lookout for higher locations to park long-term capital. With $318 trillion in world bond markets, even a small shift towards BTC might drive huge value will increase.

And the businesses greatest positioned to catch this wave are BTC Treasury Corporations.

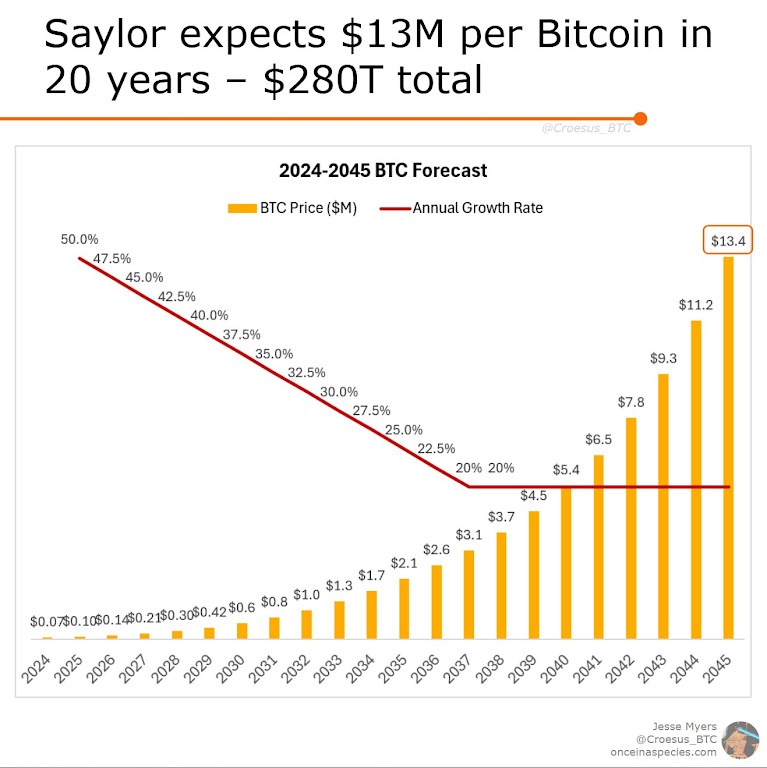

Lengthy-Time period Forecast: $280 Trillion BTC Market by 2045

Michael Saylor expects Bitcoin to achieve a complete market cap of $280 trillion by 2045. That may be 7% of worldwide wealth. Primarily based on a hard and fast provide of 21 million BTC, this suggests a value of $13.4 million per coin.

This progress shall be powered by:

A gradual however regular shift of institutional capital into Bitcoin;

A compounding BTC yield mannequin utilized by Treasury Corporations;

The collapse of confidence in fiat currencies.

Between 2023 and 2025, Bitcoin is already outperforming Saylor’s predicted progress curve, rising at 120% yearly (vs. the anticipated 29%).

Technical Evaluation: BTC Momentum, RSI, and MACD Alerts

Bitcoin’s value just lately crossed the $108,000 mark, up 59% within the final 12 months and 14% this month. However how robust is that this pattern — and may it proceed?

RSI (Relative Energy Index) is at the moment at 68.79, which suggests Bitcoin is near being “overbought.” Traditionally, ranges above 70 typically result in brief pullbacks. Nonetheless, in robust bull markets, RSI can keep excessive for lengthy intervals with out triggering main drops.

MACD (Transferring Common Convergence Divergence) reveals a robust bullish setup. The MACD line is nicely above the sign line. The histogram is rising. This implies momentum remains to be on the aspect of the bulls. Quantity can be rising, including power to the transfer.

Worth motion reveals BTC bouncing off greater lows and pushing by way of key resistance ranges. If Bitcoin holds above $100K, the subsequent goal is $120K. However with RSI nearing overbought ranges, a brief consolidation interval wouldn’t be shocking.

The general pattern stays clearly bullish — each technically and essentially.

Past Technique: Different BTC Powerhouses

Technique leads, nevertheless it’s not alone. A number of main gamers at the moment are constructing BTC treasuries at scale:

Metaplanet (public firm modeling Technique’s playbook) – Quickly shopping for BTC, positioned to guide in Asia. Seen as a rising star in company Bitcoin technique;

XXI Century Capital (non-public funding fund) – Treats Bitcoin as its core holding and a long-term safety towards inflation. Centered on silent accumulation;

Block Inc. (monetary providers, Money App) – Deep integration with BTC. Holds Bitcoin and permits user-level BTC adoption throughout merchandise;

Tesla (electrical car firm) – Holds BTC on its stability sheet. One of many first main S&P 500 corporations to embrace Bitcoin;

Coinbase (crypto alternate) – Holds BTC straight and not directly. Its infrastructure additionally permits giant institutional purchases of Bitcoin.

Collectively, these corporations symbolize the early part of company Bitcoin accumulation — and sure gained’t be the final.

What It All Means: Wanting Forward

The Bitcoin story is not about tech or hypothesis. It’s now about world capital, company construction, and long-term worth.

BTC Treasury Corporations are forming a brand new layer of economic infrastructure — one which’s constructed fully round digital gold. They are going to maintain half of all Bitcoin by 2045. Technique alone might management 5 million cash. And with BTC forecasted to achieve $13 million per coin, the stakes are monumental.

For traders, the message is obvious. The foundations are altering. Establishments are taking up BTC — not by pressure, however by incentives. And as they do, the provision will get tighter, the worth rises, and Bitcoin turns into much more useful.

Disclaimer

In step with the Belief Undertaking pointers, please observe that the knowledge supplied on this web page will not be meant to be and shouldn’t be interpreted as authorized, tax, funding, monetary, or some other type of recommendation. You will need to solely make investments what you possibly can afford to lose and to hunt unbiased monetary recommendation in case you have any doubts. For additional data, we propose referring to the phrases and circumstances in addition to the assistance and assist pages supplied by the issuer or advertiser. MetaversePost is dedicated to correct, unbiased reporting, however market circumstances are topic to vary with out discover.

About The Creator

Alisa, a devoted journalist on the MPost, focuses on cryptocurrency, zero-knowledge proofs, investments, and the expansive realm of Web3. With a eager eye for rising developments and applied sciences, she delivers complete protection to tell and interact readers within the ever-evolving panorama of digital finance.

Extra articles

Alisa Davidson

Alisa, a devoted journalist on the MPost, focuses on cryptocurrency, zero-knowledge proofs, investments, and the expansive realm of Web3. With a eager eye for rising developments and applied sciences, she delivers complete protection to tell and interact readers within the ever-evolving panorama of digital finance.