Artificial belongings are one of the intriguing improvements in DeFi. By bridging conventional finance and blockchain, they unlock entry to all kinds of monetary devices with out the constraints of legacy techniques. This text will cowl what artificial belongings are, how they work, tips on how to create artificial asset contracts, artificial belongings examples, advantages, dangers, and their broader influence on the crypto ecosystem.

What does artificial asset imply in crypto? Artificial belongings in crypto are blockchain-based devices designed to imitate the worth and worth behaviour of real-world belongings equivalent to shares, commodities, fiat currencies, or different cryptocurrencies with out the holder truly proudly owning the asset itself.

They’re referred to as artificial as a result of they replicate the financial publicity of an underlying asset by way of good contracts quite than bodily possession or custodianship.

Examples of artificial belongings embody sUSD, which mirrors the worth of the U.S. greenback; sBTC, which tracks the worth of Bitcoin; and sXAU, which displays the market worth of gold. These tokens are engineered to behave like their real-world counterparts, providing comparable worth publicity whereas present completely inside decentralized networks.

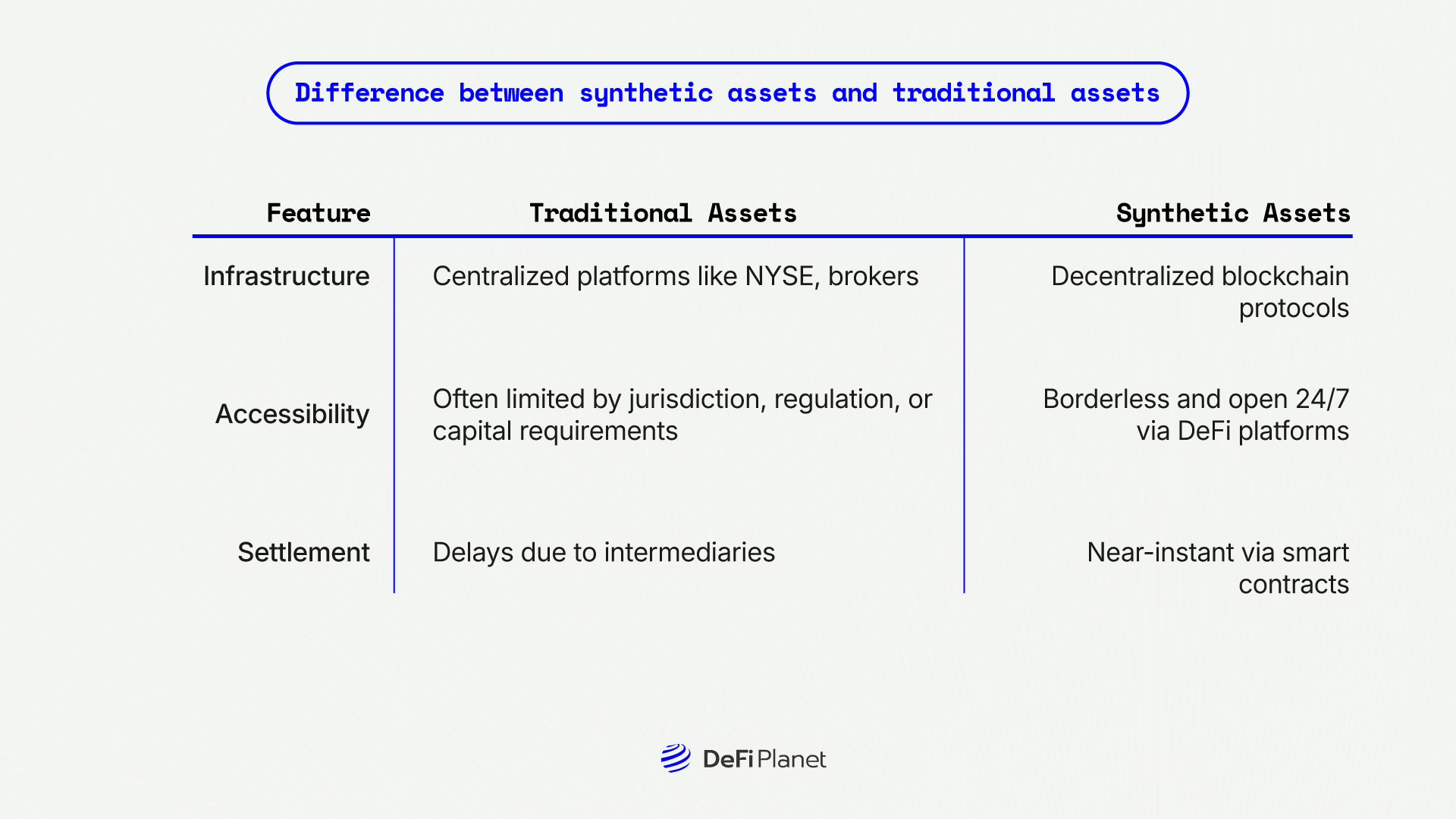

The important thing distinction between artificial and conventional belongings lies in how they’re accessed and managed. Conventional belongings typically require complicated authorized frameworks, third-party belief, and time-consuming settlement processes. In distinction, artificial belongings eradicate these frictions, providing quicker settlement, borderless accessibility, and diminished reliance on intermediaries. Consequently, they current a compelling different for customers searching for larger monetary flexibility and innovation by way of DeFi.

Artificial Belongings vs Conventional Belongings: Key variations

How Artificial Crypto Belongings Work

How Artificial Crypto Belongings Work

Artificial crypto belongings are constructed on blockchain infrastructure utilizing a mix of good contracts, collateral, and decentralized worth feeds. Right here’s tips on how to create an artificial asset under:

1. Collateralization

To create an artificial asset, customers first deposit collateral, normally a cryptocurrency like ETH, stablecoins, or a platform’s native token, into a sensible contract. This collateral acts as a monetary assure and helps the worth of the artificial asset being minted. The required collateral is usually set above the worth of the asset being replicated, making certain the system stays overcollateralized and safe in opposition to volatility.

2. Minting of artificial tokens

As soon as collateral is locked, the platform points artificial tokens that replicate the worth of a selected asset. These tokens can symbolize something with a verifiable worth—equivalent to sUSD (artificial USD), sBTC (artificial Bitcoin), or sXAU (artificial gold). The tokens are absolutely backed by the locked collateral and may be traded on decentralized exchanges that assist artificial belongings.

3. Good contract automation

Good contracts govern all the lifecycle of artificial belongings. They deal with minting and burning of tokens, preserve the required collateral ratios, and set off liquidations if the worth of the collateral drops under a preset threshold.

4. Actual-time worth feeds through oracles

To make sure artificial tokens precisely replicate the worth of the underlying asset, decentralized oracles present real-time knowledge. These oracles feed asset costs immediately into the blockchain, enabling artificial tokens to regulate dynamically in response to market actions.

Examples of Artificial Asset Platforms

Under are a few of the main platforms within the area:

1. Synthetix (Ethereum/Optimism)

Synthetix, constructed on Ethereum and Optimism, is a pioneering DeFi protocol that permits customers to mint and commerce artificial belongings referred to as “Synths.” These Synths symbolize real-world belongings such because the US greenback (sUSD), Bitcoin (sBTC), gold (sXAU), and even composite indexes, providing a various vary of market publicity with out the necessity to maintain the precise underlying belongings. To create these artificial tokens, customers stake SNX, the platform’s native token, as collateral. Buying and selling takes place by way of Synthetix’s native change interface, Kwenta, or different decentralized front-ends built-in with the protocol.

2. UMA (Common Market Entry)

UMA offers a versatile framework for creating customized artificial belongings and monetary contracts. Somewhat than providing a set catalogue of artificial tokens, UMA permits builders to construct distinctive belongings and decentralized monetary merchandise secured by a novel “optimistic oracle.”

3. Indigo Protocol (INDY)

Indigo Protocol brings artificial belongings to the Cardano blockchain by way of a system based mostly on Collateralized Debt Positions (CDPs). Customers lock ADA or different accepted collateral to mint artificial belongings referred to as iAssets, which observe the worth of exterior real-world belongings equivalent to USD or inventory indices.

These iAssets are overcollateralized to cut back threat and are actively monitored by liquidators who guarantee positions stay solvent. Indigo is likely one of the main DeFi initiatives on Cardano and presents customers publicity to international monetary markets in a decentralized and chain-native approach.

4. Cryptex Finance (CTX)

Cryptex Finance focuses on constructing artificial crypto-native indices and belongings. Considered one of its notable merchandise is TCAP (Complete Crypto Market Cap), an artificial asset that tracks all the market capitalization of all cryptocurrencies. The platform depends on trusted oracle options from Chainlink and Pyth to supply real-time market knowledge.

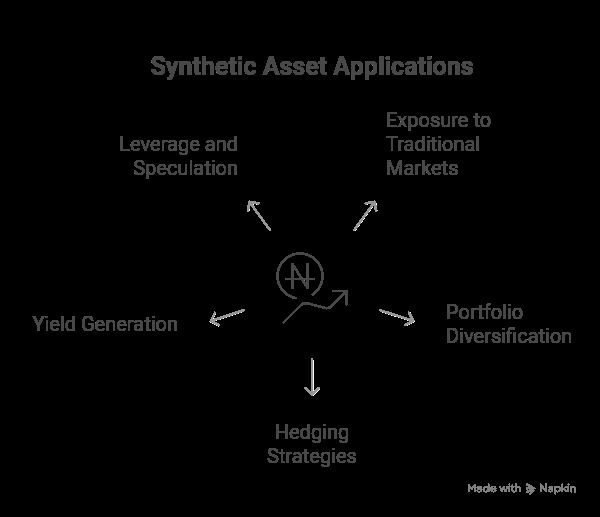

Functions of Artificial Belongings: What Are They Used For?

Artificial belongings are versatile instruments with purposes spanning funding, threat administration, entry, and innovation. Right here’s how they’re getting used immediately:

1. Publicity to conventional markets

Artificial belongings enable crypto customers to reflect the worth of conventional monetary devices—like U.S. shares, gold, oil, or fiat currencies—immediately from a blockchain platform.

2. Portfolio diversification

As an alternative of holding simply crypto-native belongings, customers can add artificial representations of shares, commodities, or fiat to their DeFi portfolios. This cross-asset diversification helps unfold threat and cut back publicity to volatility in any single asset class.

3. Hedging methods

With artificial inverse tokens, customers can shield themselves in opposition to market downturns by gaining from an asset’s decline in worth. That is akin to quick promoting however executed by way of good contracts. It permits for on-chain threat administration with out borrowing or margin necessities from centralized exchanges.

4. Yield technology

Artificial belongings may be staked or deposited in liquidity swimming pools on DeFi platforms, permitting customers to earn passive revenue. Yields can come within the type of curiosity, swap charges, or incentives like governance tokens. This makes artificial belongings each speculative instruments and income-generating devices.

5. Leverage and hypothesis

Artificial leveraged tokens allow merchants to amplify their publicity to cost actions with out utilizing conventional margin buying and selling. For instance, a 2x or 3x artificial token can multiply positive aspects (and losses) from the underlying asset’s efficiency. This appeals to high-risk merchants trying to maximize short-term earnings.

Advantages of Artificial Belongings

1. Entry to conventional markets

Artificial belongings enable international customers to achieve publicity to conventional monetary devices like shares, commodities, and foreign exchange with no need a dealer or checking account. This removes the standard geographic, authorized, or financial entry boundaries.

2. Decentralization

By working on blockchain-based platforms, artificial belongings eradicate the necessity for central monetary authorities equivalent to custodians, clearinghouses, or banks. This decentralization reduces systemic dangers and will increase person management. Individuals maintain their very own belongings and work together immediately with good contracts, not middlemen.

3. 24/7 buying and selling

In contrast to conventional markets with mounted opening hours and weekend closures, artificial belongings are accessible 24/7. This implies customers can reply to international occasions in actual time, with out ready for markets to open. It additionally presents flexibility for folks in numerous time zones or with non-traditional schedules.

4. Innovation and programmability

Artificial belongings are programmable, which means they are often tailor-made for particular use instances—equivalent to leveraged tokens, inverse publicity, yield-bearing devices, or time-locked investments. This flexibility helps artistic, automated methods. Builders and merchants can construct and deploy completely new monetary merchandise with no need regulatory approval or financial institution partnerships.

5. Integration into the DeFi ecosystem

Artificial belongings are extremely interoperable and might serve a number of roles in decentralized finance (DeFi). They can be utilized as collateral for loans, staked for rewards, or added to liquidity swimming pools for buying and selling. This composability permits customers to stack advantages and take part in varied yield-generating actions inside a single ecosystem.

Dangers of Artificial Belongings

Regardless of their promise, artificial belongings include vital dangers:

1. Good contract vulnerabilities

Artificial belongings depend on good contracts, that are solely as safe as their code. A single vulnerability or bug may be exploited by malicious actors, resulting in huge monetary losses. Since many DeFi platforms are nonetheless evolving, even audited contracts can fail below surprising situations.

2. Collateral volatility

Many artificial belongings are backed by crypto belongings like ETH or stablecoins, which may be extremely unstable. If the worth of the collateral drops too shortly, it could end in compelled liquidations or lack of peg. This could shake investor confidence and trigger cascading sell-offs throughout the ecosystem.

3. Oracle manipulation

Artificial belongings depend upon oracles for real-world knowledge like asset costs. If an oracle is compromised or manipulated, it may possibly feed false knowledge into good contracts. This might trigger mispricing, unfair liquidations, or open the door to arbitrage exploits that drain liquidity.

4. Liquidity points

Some artificial belongings, particularly newer or area of interest ones, might endure from low buying and selling quantity and weak market participation. This could make it tough for customers to enter or exit positions with out vital slippage. Lack of liquidity additionally will increase the danger of worth manipulation.

The Potential Influence on Conventional Finance and DeFi Integration

Artificial belongings symbolize a paradigm shift in monetary accessibility and infrastructure.

Blurring traces between TradFi and DeFi

Platforms providing artificial publicity to shares or commodities problem the monopoly of conventional finance. They provide entry with out the necessity for regulated exchanges, brokers, or KYC boundaries.

For retail buyers in rising markets, this may very well be revolutionary, permitting them to put money into U.S. equities or gold with only a crypto pockets.

DeFi as a world monetary layer

By enabling artificial asset creation, DeFi platforms replicate complete monetary techniques onchain—from derivatives and insurance coverage to indices and ETFs. This modular, permissionless design may outperform gradual, centralized monetary establishments.

Disruption or collaboration?

Whereas some see artificial belongings as a menace to conventional finance, others see a chance for integration. Ahead-thinking establishments would possibly construct or associate with DeFi protocols to problem compliant artificial devices.

Nonetheless, it will require a fragile steadiness—respecting regulatory frameworks whereas preserving the open nature of DeFi.

Conclusion

Artificial belongings in crypto are reshaping entry, possession, and participation in international monetary markets. By leveraging blockchain, good contracts, and oracles, they provide a brand new technique to interact with monetary devices—decentralized, borderless, and programmable.

But, they’re not a silver bullet. With innovation comes complexity, and with decentralization comes threat. Because the area matures, customers should strategy artificial belongings with each curiosity and warning.

If managed properly, artificial belongings may very well be the bridge that connects the fragmented worlds of conventional finance and decentralized ecosystems—ushering in a brand new period of inclusive and open finance.

Disclaimer: This text is meant solely for informational functions and shouldn’t be thought of buying and selling or funding recommendation. Nothing herein must be construed as monetary, authorized, or tax recommendation. Buying and selling or investing in cryptocurrencies carries a substantial threat of monetary loss. At all times conduct due diligence.

If you wish to learn extra market analyses like this one, go to DeFi Planet and comply with us on Twitter, LinkedIn, Fb, Instagram, and CoinMarketCap Neighborhood.

Take management of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics instruments.”

The put up Artificial Belongings and How They Differ from Conventional Belongings appeared first on DeFi Planet.