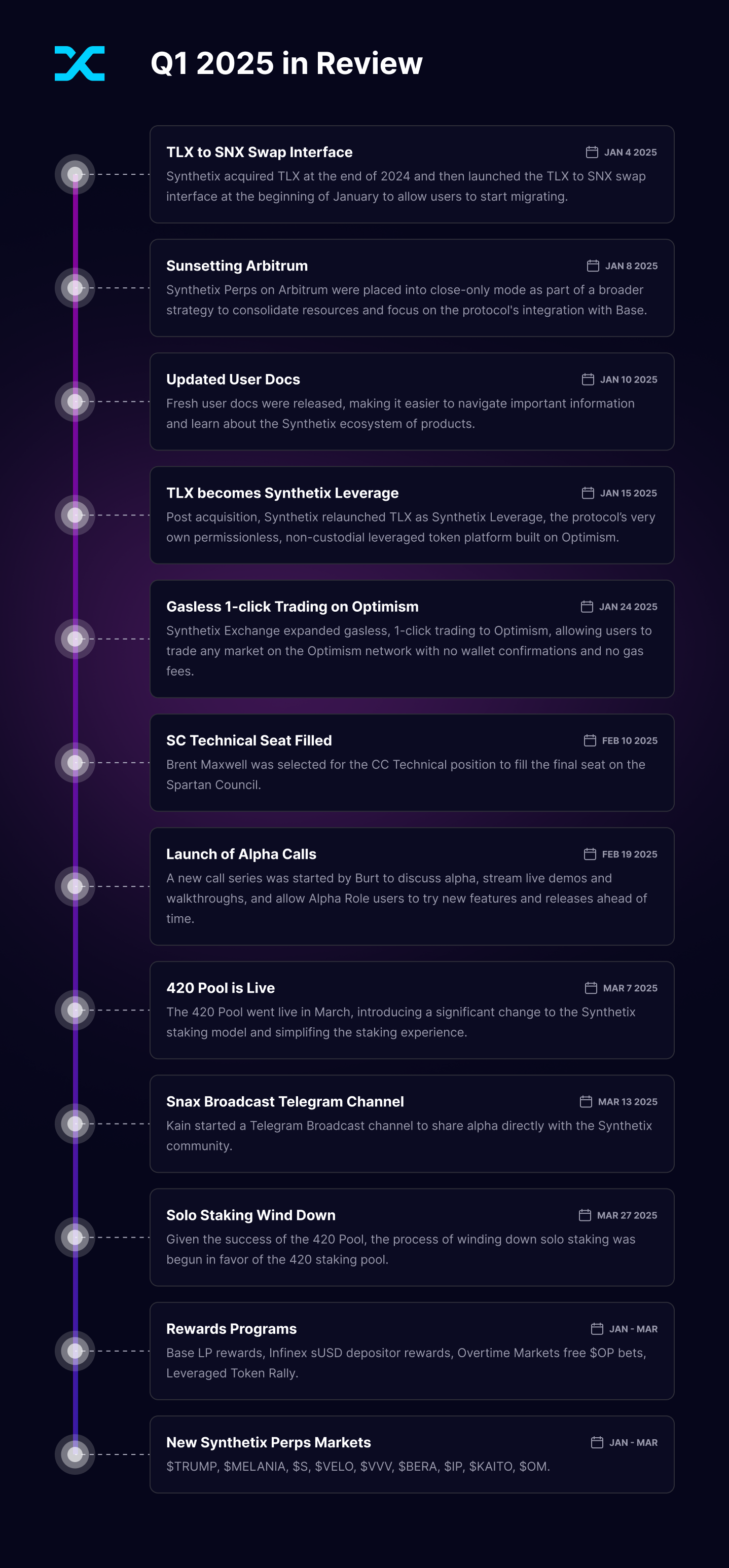

Quarterly Report for Synthetix, Quarter 1 of 2025: January — March.

Q1 Highlights

Spartan Council/CCs: 420 Pool, Alpha Calls

Spartan Council/CCs: 420 Pool, Alpha Calls

We’ve seen some main momentum shifts and significant progress at Synthetix in simply the primary quarter of 2025! From record-breaking migrations and the launch of the 420 Pool, to expanded Perps choices, platform upgrades, and protocol acquisitions, indicators of progress are seen on almost each entrance. The strategic imaginative and prescient is on full show — largely fueled by final yr’s governance shake-up referendum — and there’s a renewed dedication to enhancing accessibility, scalability, and consumer expertise. Collectively, these developments mark a transformative begin to the yr and lay a powerful basis for what’s forward.

Among the many most impactful milestones was the fast adoption of the 420 Pool, which noticed over 137 million SNX (greater than 40% of the overall provide) migrated inside simply two weeks of launching. This outstanding uptake displays sturdy group alignment with the protocol’s transition to a delegated staking mannequin. The 420 Pool eliminates liquidation threat and affords debt forgiveness over a 12-month interval, making staking easier and extra interesting to a wider vary of customers. For the protocol, this shift brings enhanced capital effectivity, extra predictable system debt administration, and tighter alignment between incentives, governance, and consumer participation.

This transition has additionally paved the best way for the deprecation of solo staking — a key step in reinforcing the protocol’s transfer towards a extra unified and scalable structure. With nearly all of SNX now concentrated within the 420 Pool, the necessity to incentivize customers to handle protocol debt responsibly is now not needed. This enables Synthetix to streamline its operations and deal with refining a single, sturdy capital allocation mannequin. The sunsetting of solo staking displays the success of this transition and clears the trail for a extra constant consumer expertise and a stronger basis for future product enlargement.

This quarter, Synthetix additionally launched a brand new initiative referred to as Alpha Calls — weekly group periods designed to showcase upcoming options, collect real-time suggestions, and foster higher transparency between core contributors and customers. Held on Discord, these calls created an area for early previews of UX updates, product experiments, and strategic discussions, giving the group a extra energetic position in shaping the protocol’s improvement. By establishing an everyday suggestions loop with engaged customers, Alpha Calls have helped the workforce shortly determine ache factors, prioritize enhancements, and take a look at concepts in a collaborative setting. This initiative not solely strengthens the protocol’s relationship with its group, but additionally reinforces a extra agile, user-driven strategy to constructing DeFi infrastructure.

Challenges

As Synthetix continues to push ahead with bold upgrades and new product launches, a number of underlying challenges have surfaced — significantly round capital retention, incentive design, and consumer expectations. Whereas the protocol has seen sturdy engagement from its core group, points with non-stablecoin LP liquidation rewards, declining TVL, and fluctuating buying and selling exercise have come into sharper focus. Because the protocol matures, addressing these challenges head-on shall be important to solidifying its position in a aggressive and fast-evolving DeFi panorama.

One rising problem this quarter has been the inconsistency in LP returns on account of liquidation rewards being distributed in risky property. Whereas incentive applications have efficiently attracted liquidity suppliers, precise returns have different broadly relying on the efficiency of the reward tokens — significantly ETH. Throughout bullish market situations, it was a simple promote to obtain LP rewards in an appreciating asset. However because the pattern shifted, some LPs discovered that their rewards misplaced worth, which negatively impacted their realized APR. This led to confusion, because the APR that many LPs skilled differed considerably from the printed determine, which had been calculated on the time of distribution. In response, the protocol is planning to launch an auto-compounding vault within the coming weeks that may convert all rewards to USDC, serving to to alleviate the burden of managing risky liquidation rewards.

Whereas adoption of the 420 Pool was sturdy and buying and selling volumes mirrored elevated product demand, it hasn’t fairly begun to usher in vital quantities of exterior capital. This implies that whereas current SNX holders are actively participating with new options, exterior liquidity could also be extra reactive to broader market sentiment. An enormous a part of the 420 push was designed to consolidate new capital round extra compelling yield methods and enhance onboarding for non-SNX-native customers. As Synthetix continues to evolve, attracting and retaining exterior capital shall be essential for deepening liquidity and scaling the protocol’s affect throughout DeFi.

Lastly, day by day buying and selling quantity averaged round $10 million in Q1, with main spikes in February and March as merchants flocked to futures markets in periods of volatility. By the tip of the quarter, nevertheless, buying and selling exercise had cooled. Whereas a few of that is attributable to broader market situations, it’s additionally clear that merchants are naturally following incentives. These applications have confirmed efficient in producing quick bursts of quantity, however the fluctuations spotlight the problem of sustaining constant buying and selling exercise with out steady exterior motivation. Convincing merchants to depart the consolation and familiarity of centralized exchanges stays a key hurdle, particularly when confronted with the sometimes advanced UX of on-chain buying and selling. Thankfully, Ethereum’s upcoming Pectra improve, scheduled for Might 7, guarantees to unlock a variety of enhancements on the UX entrance, doubtlessly making on-chain buying and selling extra seamless and accessible.

Protocol Stats

Overview of Synthetix Q1 Stats: January 2025 — March 2025.

Spartan Council

Q1 2025 Spartan Councilors: Benjamin Celermajer (Fenway), Brent Maxwell, Cavalier, coKaiynne, Jordan Momtazi, Kain Warwick, SpartanGlory

Whereas the primary quarter of the yr introduced a number of transitions, the Synthetix ecosystem stayed centered on tightening its core choices and setting the stage for a extra environment friendly, accessible, and unified future. From main system upgrades to protocol acquisitions and the launch of game-changing options, let’s get into precisely what went down this previous quarter.

Kwenta & TLX Be a part of the Synthetix Household

Kwenta & TLX Be a part of the Synthetix Household

One of many greatest strikes from final quarter carried into Q1 with the official rollout of Synthetix’s acquisition of Kwenta. The merger wasn’t nearly branding — it marked the start of a extra cohesive DeFi ecosystem. However Synthetix didn’t cease at simply buying Kwenta and creating Synthetix Change, as a result of the protocol wrapped up its acquisition of TLX in January and relaunched it as Synthetix Leverage — a permissionless leveraged token platform constructed on Optimism. With over 70 property and as much as 10x leverage, this new product line has been simplifying publicity to Perps whereas leveraging all of the composability Synthetix has to supply.

420 Pool Lights Up a New Period of Staking

420 Pool Lights Up a New Period of Staking

By far essentially the most transformative protocol replace in Q1 was the launch of the 420 Pool, a redesigned SNX staking mannequin that eliminates widespread dangers and complexities (SIP-420).

On day one, the pool noticed 100 million SNX in deposits and kicked off a 12-month computerized debt forgiveness schedule:

50% forgiven at 6 months100% forgiven at 12 months

As soon as migrated, stakers:

Now not face liquidation riskDon’t have to handle c-ratios or debtReceive yields from exterior methods like Ethena, Aave, and Morpho

And the protocol advantages too! Decrease c-ratios (200%) imply deeper sUSD liquidity and extra environment friendly capital deployment for brand spanking new merchandise.

Synthetix Focuses on Base: Sunsetting Arbitrum

Synthetix Focuses on Base: Sunsetting Arbitrum

This quarter, Synthetix additionally started the method of winding down its Arbitrum deployment, inserting all Perps markets into close-only mode on January 8. Whereas the choice wasn’t taken evenly, it mirrored a broader strategic shift towards vertical integration and community consolidation following the Synthetix Reboot.

Sustaining a number of deployments calls for vital liquidity and help overhead. By specializing in Base, the biggest and fastest-growing Ethereum L2, Synthetix can focus improvement and sources into delivering a unified, streamlined buying and selling expertise. With the rollout of V3 options like gasless 1-click buying and selling, multicollateral margin, and the launch of Synthetix Leverage, Base has grow to be the perfect house for the following period of Synthetix.

All current positions on Arbitrum stay open and will be closed at any time, however no new positions will be opened. All markets at the moment are obtainable on Base, and customers can bridge immediately from almost any EVM chain utilizing the Socket-powered swap interface, making migration quick and easy.

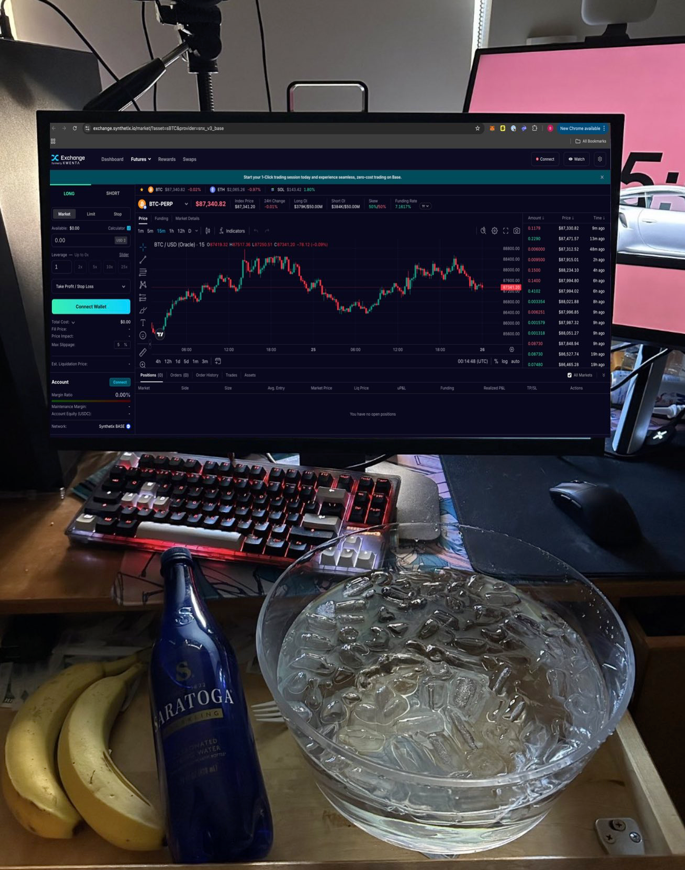

Gasless 1-Click on Buying and selling Involves Optimism

Gasless 1-Click on Buying and selling Involves Optimism

Talking of UX wins, gasless 1-click buying and selling was made obtainable on Optimism this quarter along with Base. No pockets pop-ups, no fuel charges, no delays. Simply click on and commerce. Alongside this launch got here efficiency enhancements and response-time fixes on Base.

V3 Migration: Solo Staking Winds Down

V3 Migration: Solo Staking Winds Down

On the finish of Q1, solo staking deprecation formally kicked off because the migration to V3 continued. In case you’re nonetheless staked on V2X, don’t panic — your SNX is secure and nonetheless viewable at liquidity.synthetix.io.

Nonetheless, c-ratios have begun growing to power liquidations under 160%, and in the event you’re liquidated above that threshold, you’ll have a 6-month window to get well your place (SNX + debt).

New Faces, Docs, and Alpha Calls

What’s Subsequent?

What’s Subsequent?

With the 420 Pool stay, Kwenta and TLX now a part of the household, and V3 rolling out quick, Synthetix is getting into Q2 with sturdy momentum — and no indicators of slowing down.

Anticipate:

Extra staking incentivesEnhanced vault productsLeveraged token expansionLiquidity boosts for sUSDContinued deal with Base and Optimism integrations

Whether or not you’re a veteran staker, a leveraged degen, or simply dipping your toes in for the primary time, there’s much more coming. Keep tuned!

Greatest Memes from Q1

Lastly, as a result of we will’t shut out the quarter with out a little humor, right here have been among the greatest memes from the Synthetix group.