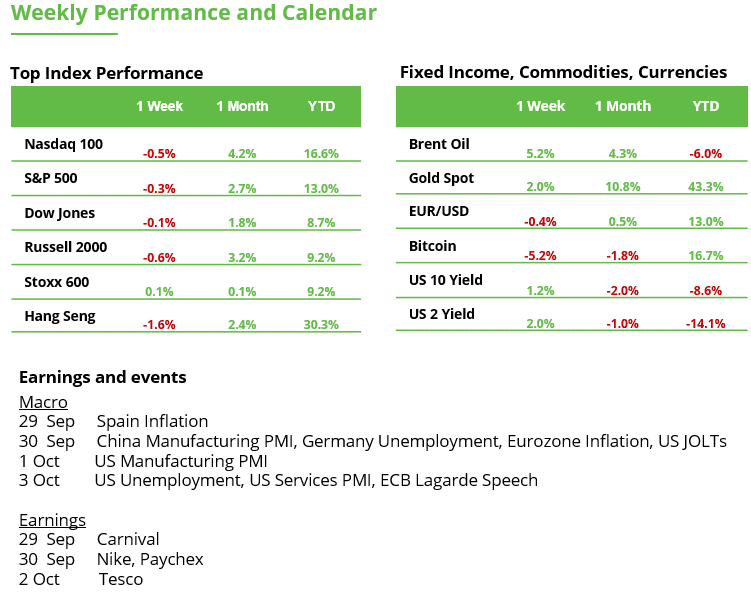

Analyst Weekly, September 29, 2025

What’s new?

The US rolled out a contemporary spherical of tariffs this week, and so they’re hitting every little thing from branded medication to furnishings and heavy vehicles. The headlines sound scary: 100% pharma tariffs, 50% cabinetry tariffs, 30% furnishings tariffs, and 25% truck tariffs beginning October 1. But, the market response has been extra muted. Why? As a result of traders are already gaming out who wins, who loses, and the place the alternatives lie.

Pharma: Large Stick, Small Carve-Outs

The most important headline: 100% tariffs on branded prescription drugs. That appears like a nightmare for drugmakers like Pfizer ($PFE), Sanofi ($SNY), and AstraZeneca ($AZN.L). However the tremendous print issues: the EU and Japan negotiated decrease charges (15% tariffs), and corporations with US manufacturing or new crops underway are exempt. Roche ($ROG.ZU), for instance, broke floor on a brand new North Carolina facility that ought to protect it from the worst.

We expect that that is the administration’s means of pushing for drug value cuts, not simply to achieve income. Pharma shares may see headline threat, however with exemptions and international diversification, the sell-off could also be shallower than the 100% headline suggests.

Cupboards, Furnishings, and Vehicles: House Depot Meets Freightliner

Tariffs aren’t nearly medication. The US additionally slapped 50% tariffs on cupboards and vanities and 30% tariffs on upholstered furnishings. That hits the housing and client discretionary house, from House Depot ($HD) and Lowe’s ($LOW) to specialty retailers like La-Z-Boy ($LZB).

In the meantime, the 25% tariff on heavy vehicles has implications for industrial names like PACCAR ($PCAR) and Navistar (owned by VW), plus ripple results for logistics and freight operators. However traders aren’t speeding for the exits: many US gamers already dominate their markets, and tariffs may tilt demand towards home manufacturing.

Tech and Semis: A Partial Move

Semiconductors have been rumored to be subsequent, however to date tariffs are more likely to be watered down. That’s a aid for Nvidia ($NVDA), AMD ($AMD), and Taiwan Semi ($TSM) traders who’ve been watching provide chain headlines like hawks. As an alternative, the US seems to be focusing tariffs on downstream merchandise (completed items) whereas avoiding upstream disruption. We expect this might assist hold inflation contained whereas nonetheless sounding powerful on commerce.

Funding Takeaway: The Large Image

Tariffs are evolving from one-off headlines right into a coverage toolkit with three clear channels: (1) pricing leverage on pharma to pressure concessions, (2) market-share safety for home producers in furnishings, cabinetry, and heavy vehicles, and (3) income assist by way of fiscal sterilization (tariff receipts offsetting weaker company tax consumption). Internet-net, that is much less about blanket de-globalization and extra about focused stress designed to shift bargaining energy and cap inflation threat from upstream provide chains.

Transmission to markets:

Earnings & margins: Sector impression is uneven. Branded pharma faces headline threat and negotiation overhang, however carve-outs (EU/Japan at decrease charges; US crops exempt) blunt worst-case margin compression. Shopper/industrials see combined results: imported inputs value extra, but home incumbents can achieve pricing energy and share.

Inflation & charges: Focus on downstream items and exemptions tempers pass-through to CPI, preserving room for the Fed’s easing path. That’s one purpose fairness volatility has stayed contained.

Positioning & flows: Vitality/industrials and US-centric producers stand to learn from import substitution; pharma requires selectivity as coverage threat is repriced stock-by-stock fairly than sector-wide.

Key uncertainties to watch:

Implementation high quality: How briskly exemptions are granted and the way “completed items” are outlined will set the true efficient charge.

Authorized path & sturdiness: IEEPA challenges and Part 232 timelines decide whether or not this regime sticks into 2026.

Second-order results: Company responses (onshoring, value pledges) might defang the headline charges quicker than anticipated.

Tesco: Earnings Preview

We anticipate Tesco to ship one other robust earnings replace, with gross sales and earnings helped by a disciplined UK grocery market, agency client demand for worth, and the corporate’s personal robust execution. A key issue is that the UK grocery market stays rational, that means rivals are avoiding harmful value wars and focusing as an alternative on disciplined pricing and profitability. This steady backdrop permits Tesco to guard its margins whereas nonetheless competing successfully. On the identical time, client habits is shifting, with many consumers buying and selling down from costlier branded merchandise to cheaper options. Tesco is properly positioned to seize this development by means of its concentrate on worth and its broad own-brand ranges, which assist retain clients who would possibly in any other case transfer to discounters.

Business meals inflation stays one other essential tailwind, feeding instantly into like-for-like gross sales development. Tesco can be gaining market share and demonstrating stronger execution than rivals Asda, Morrisons, and discounters, holding profitability on observe at the same time as competitors heats up. Asda is turning into extra aggressive on pricing, however Tesco is monitoring carefully and retains the “firepower” to reply if wanted. Crucially, the corporate’s robust money era underpins rising dividends and ongoing buybacks, which improve whole shareholder returns. Collectively, rational competitors, earnings momentum, and strong capital returns hold Tesco properly positioned for additional upside.

Technical Rebound in Copper, however China Stays the Key Driver

Copper rose 3.1% final week to $4.770 per pound, bringing the rebound from the July low to roughly 10%. After the late-July plunge, when costs dropped greater than 23% in a single week, copper is making an attempt to stabilize. The selloff halted exactly in a widely known honest worth hole ($4,343–$4,539) that was efficiently defended in April, even after an dip to $4,027. So long as this zone holds, the technical setup favors a continued restoration.

Copper, weekly chart. Supply: eToro

Traders ought to hold a detailed eye on China, the world’s largest client of copper. The nation accounts for round 50% of world demand, with copper indispensable for building, infrastructure, electronics, and e-mobility, all key sectors of China’s economic system.

Because of this, the copper value reacts strongly to China’s financial cycle. On Tuesday, the NBS Manufacturing PMI for September is due. It has remained under the vital 50 mark for 5 consecutive months, signaling continued weak spot. On the availability facet, China is quickly increasing smelting capability, which is placing processing charges beneath stress. Main smelters are subsequently urging the federal government to tighten management over capability growth.

Stress Check for Nike: Traders Await Earnings

Nike traders have been by means of loads this yr. Though the inventory has recovered greater than 30% for the reason that April low, the general image stays gloomy. In 2025, it’s nonetheless within the purple and trades greater than 60% under its report excessive.

The query now could be: does the restoration have actual substance, or is one other slide forward? A solution may come on Tuesday, when Nike stories quarterly outcomes after the U.S. market closes. A convincing outlook may present the momentum wanted to push the inventory greater.

Nike, weekly chart. Supply: eToro

Business Altering Quickly

The footwear trade is anticipated to proceed rising within the coming years, however competitors is intensifying. Area of interest life-style gamers reminiscent of On Operating or Allbirds are placing stress on established manufacturers. Decrease entry obstacles play into their arms. Outsourcing and direct-to-consumer fashions make it simpler than ever for brand spanking new gamers to enter the market. As well as, new gross sales channels are rising. Platforms like Amazon, Zalando, or JD.com give smaller manufacturers quicker entry to thousands and thousands of potential clients.

Shopper habits can be altering. Patrons are not loyal to only one model, however combine and match relying on sport, trend, or life-style traits. On the identical time, geopolitical dangers persist, making changes unavoidable. U.S. tariffs have made the selection of manufacturing websites probably the most essential strategic points. Nike produces primarily in Vietnam, Indonesia, and China, however generates greater than 40% of its income in North America.

For traders: The important thing take a look at is whether or not administration can convincingly clarify within the earnings name how the downward spiral will probably be stopped. The damaging development has lately accelerated, with declines in gross sales and earnings turning into extra pronounced quarter after quarter. And not using a sustainable turnaround technique, the restoration will stay fragile and uncertainty may shortly flip into renewed volatility.

This communication is for data and schooling functions solely and shouldn’t be taken as funding recommendation, a private advice, or a suggestion of, or solicitation to purchase or promote, any monetary devices. This materials has been ready with out making an allowance for any specific recipient’s funding aims or monetary scenario and has not been ready in accordance with the authorized and regulatory necessities to advertise impartial analysis. Any references to previous or future efficiency of a monetary instrument, index or a packaged funding product usually are not, and shouldn’t be taken as, a dependable indicator of future outcomes. eToro makes no illustration and assumes no legal responsibility as to the accuracy or completeness of the content material of this publication.